Overcall limitations ("Overcall Limitations"), in their most simple form, limit the ability of a private equity fund (each, a "Fund") to overcall capital (each, an "Overcall") from its limited partners (each, an "Investor") to make up for shortfalls created by other Investors' failure to fund an original capital call ("Capital Call") as a result of a default or excuse. Because lenders' (each, a "Lender") underwriting expectation is that each Investor is jointly and severally obligated to fund up to the full amount of its unfunded capital commitment ("Unfunded Commitment"), both established players and new entrants in the subscription facility (each, a "Facility") market continue to wrestle with the various forms of Overcall Limitations found in Fund partnership agreements ("Partnership Agreements").

Any Overcall Limitation is a credit exception that must be addressed. And their presence is meaningful: a full 38% of the 252 Facilities that Cadwalader, Wickersham & Taft's United States Fund Finance team worked on in 2017–2018 included some form of Overcall Limitation. In this chapter, we describe the various forms of Overcall Limitations that are most prevalent in Partnership Agreements and discuss their underwriting implications. We also describe the steps Lenders are taking in the market to mitigate the increased risks created by their presence as applied to a particular Facility. Finally, we provide some market color around the treatment of Overcall Limitations in practice, including their actual prevalence, impact on Facility pricing and likely future evolutions.

Percentage of Prior Call Overcall Limitations

Formulation. Historically, the most prevalent form of Overcall Limitation limits the amount a Fund can overcall from its non-defaulting Investors as a percentage of their original Capital Call. With brilliant creativity, we call this a "Percentage of Prior Call Overcall Limitation". Here is an example of a typical formulation:

"In the event that an Investor defaults on a Capital Call, the GP may require all of the nonDefaulting Investors to increase their Capital Contributions by an aggregate amount equal to the shortfall; provided that no Investor will be required to contribute an amount in excess of 50% of the amount specified in the original Capital Call."

This means, if an Investor defaults or is excused from funding a Capital Call, the Fund is authorized to overcall to make up the shortfall, but no Investor has to fund more than 50% of the amount it originally funded. In our 2017–2018 portfolio, nearly 20% of the Fund borrowers had a Percentage of Prior Call Overcall Limitation in their Partnership Agreement. While the 50% in the above example is a common percentage limit threshold, 35% is also seen with frequency, and we have recently seen a Partnership Agreement where the threshold was set at 20%.

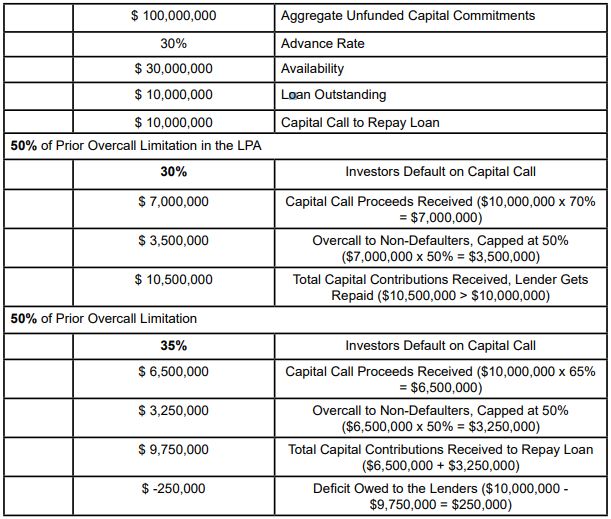

Default Inflection Point. To properly underwrite a Percentage of Prior Call Overcall Limitation, the Lender should determine what percentage of Investors must default to leave the Lender's loans uncovered by Unfunded Commitments. We call this threshold the "Default Inflection Point". Below, we illustrate a simple example. We hypothetically assume a 50% Percentage of Prior Call Overcall Limitation and then simulate scenarios where 30% and then 35% of the Investors default. As you can see, the example illustrates that the Default Inflection Point is 33.33% with a 50% Percentage of Prior Call Overcall Limitation.

Assumptions

The Investor Default Inflection Point is 33.33% with a 50% Percentage of Prior Call Overcall Limitation

Remember, it is essential to note that the borrowing base does not protect the Lender; Overcall Limitations apply to all Investors, even those that are excluded from the borrowing base. So what happens when the percentage limit threshold is set lower? The model figure below assumes a 20% Percentage of Prior Call Overcall Limitation. As you can see, the Default Inflection Point drops to slightly under 17% of Investors.

To view the full article, please click here.

Originally Published by GLI

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.