In one of the more ironic turnarounds in modern business times, large retailers benefitted enormously from the COVID-19 pandemic, a most stressful period that encompassed months of rolling lockdowns, business shutdowns, and stay-at-home living conditions across much of the country followed by a slow and staggered resumption of normal life. What was a painful episode in so many ways for millions of Americans became an inadvertent windfall for retail chains able to rise to the moment during the pandemic, and many have continued to enjoy improved prosperity even as COVID-induced lifestyle restrictions have mostly disappeared.

Prior to COVID-19, much of the U.S. retail sector struggled with persistently weak sales growth and modest or meager profitability, as consumers came to expect deals galore and other perks (such as rewards programs and free shipping and returns) from retailers before they would step up their spending. This dynamic tended to benefit the largest general merchandisers, who could accommodate such demands, at the expense of smaller chains. During the prior decade, the retail sector, particularly specialty retailers, was perennially near the top of the leaderboard in bankruptcy filings among industry sectors. But COVID-19 changed all of that, as huge amounts of financial relief provided to most households in 2020 and 2021 coupled with a redirection of spending away from services, such as travel and leisure, towards consumer goods was hugely beneficial for most large retailers. Retail sales growth hit unprecedented highs from mid-2020 through early 2022, and operating margins expanded as well. Large retail-related bankruptcy filings have plummeted since COVID-19 hit and remain depressed more than two years later. All the while there has been speculation about how long these good times would last for the retail sector. Lately, there is mounting evidence that this period of unexpected prosperity may be fading.

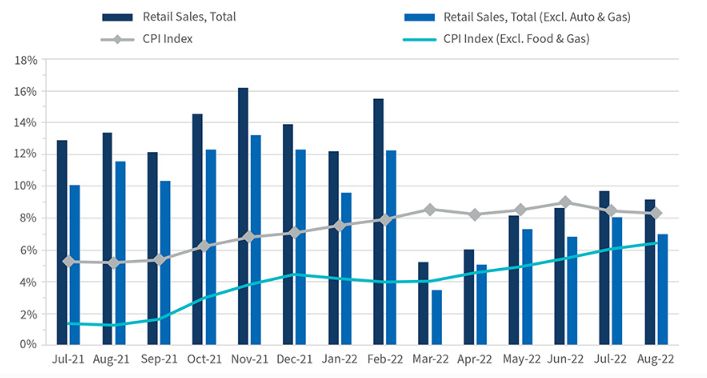

Foremost, inflation is eroding nominal (i.e., non-inflation-adjusted) sales gains for most retailers. Nominal retail sales growth (YOY) has slowed in recent months, but this reduced growth would still be considered robust in any normal business environment. However, with inflation accelerating in 2022 and now running at mid-to-high single digit rates at the consumer and wholesale levels, recent monthly sales gains are almost entirely inflation-driven (Exhibit 1), meaning that real (i.e., inflation-adjusted) sales growth for most retailers is modest or negligible, while operating margins are pressured despite still-above-average nominal sales growth, as operating costs increase at faster rates than most retailers are willing or able to pass on to customers. Consequently, monthly nominal retail sales growth has become a somewhat misleading indicator of consumer spending activity. Increasingly, most shoppers are not buying more merchandise these days; rather, they are just paying more for the same baskets of goods. High inflation is hurting shoppers but is not benefitting retailers, who themselves are contending with rising costs across the board. Moreover, for big-ticket purchases that need to be financed, such as automobiles and furniture, the double whammy of higher sticker prices and rising financing rates is an affordability killer for most shoppers, as CarMax's recent earnings-miss and downbeat outlook attest.1

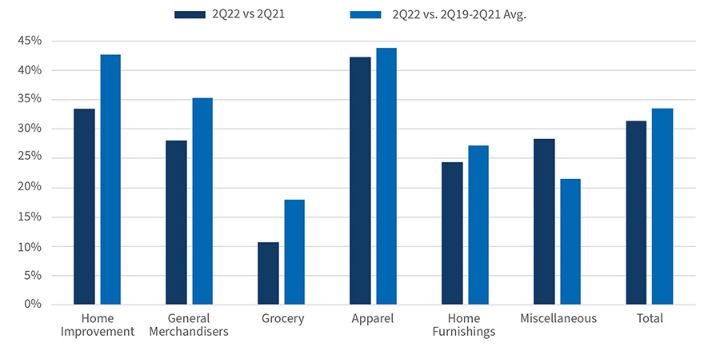

Perhaps the most troubling sign that the tide may be turning against the retail sector is the pronounced inventory buildup that has developed across the sector in recent months. Inventory levels at the end of 2Q22 were appreciably higher across retail segments, increasing by 31% (YoY) overall compared to 2Q21, with apparel retailers showing the largest increases (Exhibit 2). (It is too soon to know whether high inventory levels were worked off during the third quarter.) Some retailers have made a point of saying that inventory builds are deliberate and intended to ensure that shelves are stocked at a time when supply chain strains have made product sourcing and timely delivery more difficult and less reliable. That may be true in some instances, but we are not buying it entirely; many retailers' inventory builds far exceed levels needed, according to current trends, to accommodate customer demand and are more likely to reflect over-ordering amid a weakening sales environment.2

Exhibit 1 - Monthly Nominal Retail Sales Growth (YOY)

Source: U.S. Census Bureau, Advance Monthly Retail Trade Report, August 2022

Moreover, the over-storing of America was a prevalent theme in U.S. retailing for years prior to COVID-19 and there's little reason to believe that issue has abated at all since the pandemic, which has made consumers more reliant on shopping online. Retail square footage per capita in the U.S. is a multiple of that for comparable nations-it has been for decades. Much of this phenomenon is attributable to the large size of our country and the wide dispersion of its population but a lot of it is attributable to over-building. Remember the many conversations about "zombie malls" prior to 2020? Not much has really changed on the front. Eventually the retail sector will resume its fundamental debate about why so many stores and shopping centers are needed, as online sales continue to take the lion's share of retail sales growth while online market share tops 30% in several major product categories.

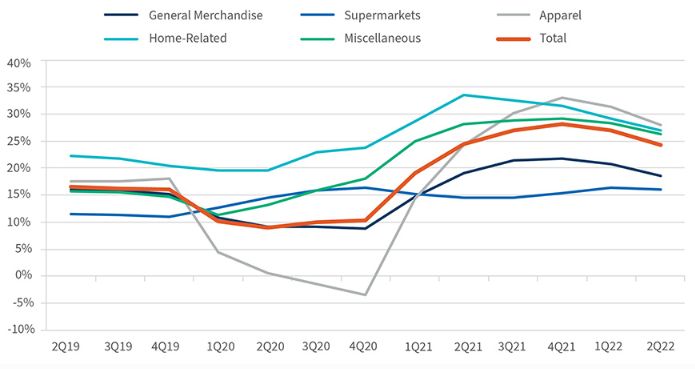

We are not suggesting that an unraveling is underway for the retail sector. However, operating performance and metrics have peaked and are subsiding currently while remaining ahead of where they were in pre-COVID times (Exhibit 3). Whether these metrics stabilize and stay above pre-COVID levels or eventually revert to pre-pandemic readings remains to be seen. What is evident with more certainty is that outsized performance by retailers attributable to COVID-19 is waning, as seen in Exhibit 3.

With a U.S. recession looking more likely and the Federal Reserve giving every indication that it will continue to tighten monetary policy until inflation is tamed, the domestic economy looks like it's in for a stretch of pain, especially in the upcoming months when the effects of higher rates are felt before inflation recedes. Consumer spending momentum is weakening just as the retail sector enters the all-important holiday season. Amazon jumpstarted the season with a surprising second Prime Day promotion event in mid-October, the first time it has scheduled two distinct Prime Day events in the same year. Not to be outdone, Target announced a similar promotion dated to front-run Amazon's Prime Day event by a week. Such promotional events by these retail giants do more than pull forward the holiday season; they siphon sales from other retailers that depend on the traditional holiday shopping season.

Exhibit 2 - Percentage Increase in Inventory (YOY)

Source: S&P Capital IQ and FTI Consulting analysis

Exhibit 3 - Return on Invested Capital

Source: S&P Capital IQ and FTI Consulting analysis

More importantly, most Americans are contending with the combined impacts of high inflation, rising interest rates, and the wealth loss effect of reeling financial markets just as the holiday season approaches-and they recognize that a difficult year lies ahead for the U.S. economy, recession or not. With financial markets now back in bear market territory, no group -not even more affluent households relatively unscathed by inflation - can claim immunity from these economic headwinds. Unlike last year, far fewer Americans appear to be in the mood to splurge this upcoming holiday season, and the prospects for a continuation of the COVID-driven retail revival seemingly weaken with each passing month.

Overall, the retail sector is on more solid footing than it was in 2019, but those who made pivotal business decisions or strategic investments riding on the assumption that pandemic-driven performance trends would persist indefinitely are in for a rude awakening next year.

Footnotes:

1: https://finance.yahoo.com/news/carmax-huge-earnings-miss-sends-143640081.html

2: Forbes, Retail Inventory Glut is About to Get Ugly, Oct. 7, 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.