I. Background

On October 30, 2020, the Federal Reserve Board adjusted various terms of three facilities under the Main Street Lending Program ("MSLP") to reduce minimum loan sizes available for borrowers and alter the fee structures.1

II. Minimum Loan Sizes

The minimum loan sizes offered under three of the MSLP's facilities originating loans, namely the Main Street New Loan Facility ("New Loan Facility"), the Main Street Priority Loan Facility ("Priority Loan Facility"), and the Nonprofit Organization New Loan Facility ("Nonprofit New Loan Facility"), have each been reduced to $100,000 from the original $250,000 requirement. The Federal Reserve Board indicated in its press release that this change was instituted to better target support to smaller business. The revised Term Sheets relating to the New Loan Facility, the Priority Loan Facility, and the Nonprofit New Loan Facility are attached to this memorandum as Annexes A, B, and C.

III. Fee Structures

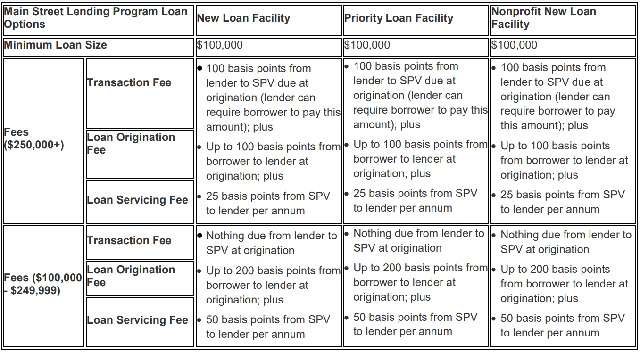

The fees tied to the borrowing and making of loans under the New Loan Facility, Priority Loan Facility, and Nonprofit New Loan Facility have also been changed. Under the original Term Sheets, (i) lenders paid a transaction fee of up to 100 basis points to the MSLP's special purpose vehicle ("SPV") at the time of loan origination, which they could require borrowers pay instead, (ii) borrowers paid lenders an origination fee of up to 100 basis points at the time loans are made, and (iii) the SPV would pay the lender a loan servicing fee of 25 basis points of the principal amount of its participation in the loan annually

The new iterations of the Term Sheets maintain this fee structure for all loans extended under the facilities where the principal amounts are $250,000 or greater. However, for loans of less than $250,000, there will be no transaction fees payable to the SPV at the time of origination, borrowers now will pay lenders an origination fee of up to 200 basis points for loan origination, and the SPV will pay lenders an annual servicing fee of 50 basis points on the principal amount of its participation in the loan.

A summary of the updated terms of the three facilities under the MSLP is set forth below:

Per the Federal Reserve Board's press release, the MSLP has made almost 400 loans totaling $3.7 billion to date, and the reduction in minimum loan size, coupled with the lower fees paid to the SPV and higher fees paid to lenders, are meant to encourage the provision of these loans to smaller businesses.

Footnotes

1 The Federal Reserve press release announcing the adjustments to the Main Street Lending Program can be found here. We previously discussed the initial terms of the MSLP in our memo dated April 14, 2020, which can be accessed here, and the subsequent expansions and revisions thereof in our memos dated May 13, 2020, June 26, 2020, and August 14, 2020, which can be accessed here, here, and here.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.