A lot has been written about the Treasury Department and FinCEN's "midnight rulemaking" efforts regarding cryptocurrency recently. As in very recently. The reason for this is the proposed rules published for public review less than 15 days ago and the comment period ends on January 4, 2021 (normally comment periods last at least 30 days, 60 days if the rule is complex). If you would like to read more about what has happened and why, you can get a good start here and here.

The goal of this post isn't to explain why these proposed rules are being put forth in an underhanded and shady manner, or to lay out why they are horrible for the industry, terrible for privacy rights, and generally anti-innovation. Despite the title of this post, we aren't going to discuss why these rules could amount to a de facto ban on cryptocurrency in the USA. There are many luminaries in the field who have written quite eloquently on these things.

This was written to reduce friction for the average person to get involved in the comment process, to provide an avenue for democratic action that is supposed to be guaranteed by the Administrative Procedure Act ("APA"). The process being used is, by its nature, an undemocratic and largely unaccountable activity through which an unelected bureaucracy, exercising broad delegated powers, enacts a law that is binding on individuals with little – if any – oversight. "The essential purpose of notice and comment opportunities is to reintroduce public participation and fairness to affected parties after governmental authority has been delegated to unrepresentative agencies."1 "Robust notice and comment is therefore what underpins the legitimacy of an otherwise undemocratic and unaccountable process."2

The three important things to remember here are:

-

These rules have not been well thought out and have will have significant negative consequences, both intended and unintended.

-

The APA requires every comment to be read before rules can take effect.

-

If enough comments are submitted and the rule-making process is delayed long enough, there is a real chance that these rules will not go into effect because the new administration takes office on January 20th, 2021 and the political impetus for enacting these particular rules will be gone and with the individuals responsible for pushing them will be removed from power.

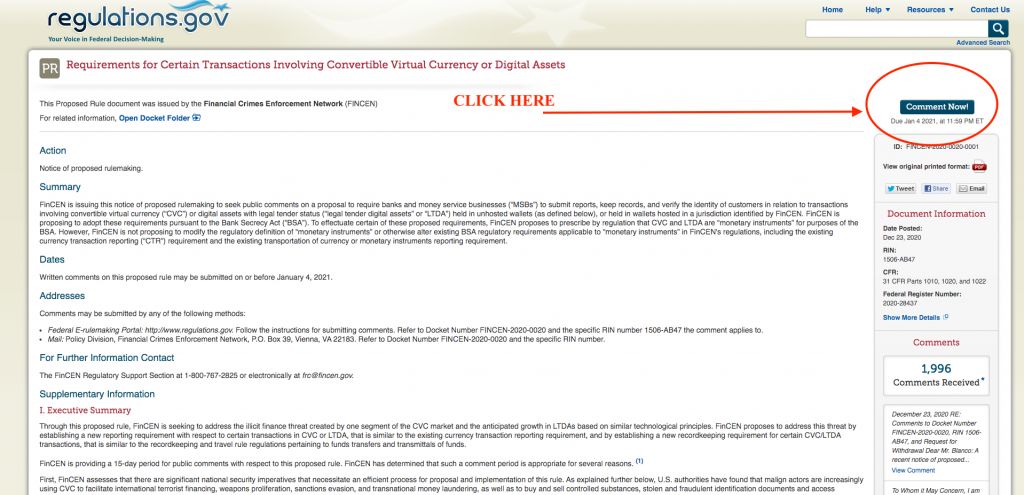

Putting that all together, literally every comment counts, so if you care about privacy, if you care about cryptocurrency, if you care about sound money, if you care about technological innovation, or if you care about limiting governmental overreach, you should make your voice heard. Go here to tender your comment. Share this with your friends!

Click on the "Comment Now" box and follow the instructions

If you write your own comment follow the great tips that Jake Chervinsky shared on his Twitter feed.

If you don't want to write your own comment, please feel free to cut and copy the following and submit it as your own (we suggest that you modify the text at least a little bit to personalize it).

Text for Comment:

I am writing to vehemently oppose FinCEN's notice of proposed rule-making that would dramatically expand financial surveillance of American citizens by requiring cryptocurrency companies to collect sensitive information from personal wallet users. FinCEN refers to these as "unhosted" wallets, which appears to be an intentional negative reframing of the definition of cryptocurrency wallets, as most wallets are not "hosted" and FinCEN seems to have added "unhosted" as a technically unnecessary and derogatory modifier.

The changes would require banks, exchanges, and other custodians to record and report the name and physical address of personal wallet owners who transact with their customers, which would unacceptably undermine my financial privacy and the financial privacy of others around the world.

Financial data reveals some of our most sensitive personal information, including our personal interests, the causes we support, and our plans for the future. FinCEN's total failure to consider my and my fellow Americans' privacy rights in the proposal's cost-benefit analysis is especially concerning given that the proposed rule would dramatically expand the financial surveillance dragnet by mandating-for the first time ever-that financial institutions start collecting and reporting sensitive personal data not needed in the normal course of business.

I'm also worried that the companies I use for cryptocurrency services won't be able to figure out how to comply with the proposed changes. If that happens, I might not be able to take custody of the assets that these companies are holding for me. My assets, whether digital or fiat, are just that-mine. A rule proposed by the United States government that denies me my right to take control of what I own is antithetical to this nation's foundational principles.

I'm even more disappointed that FinCEN decided to bypass the standard notice-and-comment period by providing only 15 days over Christmas and New Year's for the public to provide feedback on this proposal. It seems like FinCEN has little intention of considering the feedback it receives from this unprecedentedly short comment period, given that the agency actually claims within the proposal that it has no obligation to solicit feedback from the public on this rule-making.

It is important to remember that the single most popular currency used to finance terrorism, criminal enterprises, and corruption is the US Dollar. Cryptocurrency doesn't even come close to cash for such uses and given the immutable nature of blockchains, it likely never will. Any argument to the contrary is at best meritless and at worst an intentional misrepresentation of reality that utilizes straight-up fear tactics to secure unneeded and unconstitutional surveillance abilities.

Make no mistake, the proposed rules have not been well thought out and the public nature of blockchains has not been considered because these rules if enacted as written will likely lead us directly to a dystopian surveillance state where all financial transactions are tracked and recorded.

In short, FinCEN must not adopt these proposed changes. The intentional consequences of these rules will cause a "brain drain" in crypto talent from the US causing America to fall further behind in this booming and novel sector. The unintentional consequences will likely dramatically reduce our freedom and our right to privacy.

Footnotes

1. Batterton v. Marshall, 648 F.2d 694, 703 (D.C. Cir. 1980).

2. Nina A. Mendelson, "Rulemaking, Democracy, and Torrents of E-Mail," 79 Geo. Wash. L. Rev. 1343, 1348 - 50 (2011).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.