As required by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the "DoddFrank Act"), the Securities and Exchange Commission (the "SEC") has adopted final rules requiring most public companies to present executive pay versus performance ("PVP") disclosures, which are intended to help investors more clearly understand the relationship between executive compensation and company financial performance in prior years, and make such information readily comparable across public companies.

Affected companies (excluding emerging growth companies, registered investment companies, and foreign private issuers) are required to include significant new executive compensationrelated disclosures in their proxy statements and information statements, beginning with 2023 proxy statements and information statements for companies with fiscal years ending on or after December 16, 2022.

Affected companies should begin preparing their PVP disclosures for their 2023 proxy statements, as the required elements, many of which are based on historical compensation and may involve departed executives, require novel calculations and analysis above and beyond what the executive compensation disclosure rules previously required. Further, the new PVP disclosures are not strictly quantitative or tabular in nature. Accordingly, each affected company will also need to analyze and present new narrative and/or graphic disclosures describing the relationship between paid executive compensation and company performance across multiple fiscal years

INTRODUCTION

On August 25, 2022, the SEC adopted final rules implementing PVP disclosure requirements as mandated by the Dodd-Frank Act. Precursor rules were first proposed in 2015 but were never finalized and remained dormant until the SEC reopened the comment period in January 2022 to revise and finalize the PVP disclosure rules.

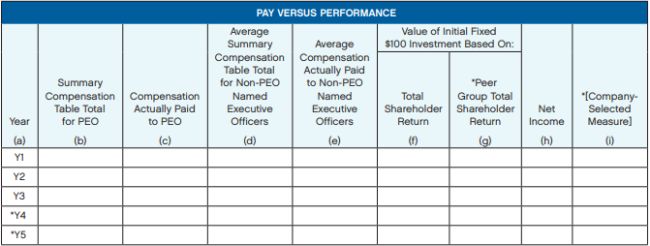

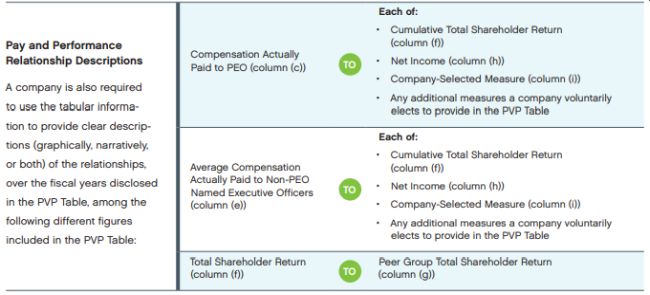

The new rules require most companies to provide tabular, quantitative disclosure in proxy statements or information statements of specified executive compensation and financial performance measures, together with clear descriptions (graphically, narratively, or both) of the relationships between certain of the figures included in the table. The new PVP disclosures are not required to be included in other filings where disclosure under Item 402 of Regulation S-K is otherwise required, including Form 10-K and registration statements. The new PVP disclosure requirements do not PAY VERSUS PERFORMANCE Year (a) Summary Compensation Table Total for PEO (b) Compensation Actually Paid to PEO (c) Average Summary Compensation Table Total for Non-PEO Named Executive Officers (d) Average Compensation Actually Paid to Non-PEO Named Executive Officers (e) Value of Initial Fixed $100 Investment Based On: Net Income (h) *[CompanySelected Measure] (i) Total Shareholder Return (f) *Peer Group Total Shareholder Return (g) Y1 Y2 Y3 *Y4 *Y5 apply to emerging growth companies, registered investment companies, or foreign private issuers, including Canadian filers using the multijurisdictional disclosure system, and smaller reporting companies ("SRCs") are permitted to provide scaled disclosures.

REQUIRED DISCLOSURES

Pay Versus Performance Table

New Item 402(v) of Regulation S-K requires a company to disclose specified executive compensation amounts and financial performance measure results for its five most recently completed fiscal years in substantially the following tabular format (the "PVP Table"), subject to a phase-in period (a company may provide three years of data (two years for SRCs) in the first filing in which it provides this disclosure, and expand the table by an additional year in each subsequent annual filing until the phase-in period is exhausted):

For each amount disclosed in columns (c) and (e) of the PVP Table, the name of each person included as a principal executive officer ("PEO") or in the calculation of the average compensation of the non-PEO named executive officers ("Other NEOs"), and the fiscal years in which such persons are included, must be disclosed in footnotes to the PVP Table. If more than one person served as a company's PEO during any fiscal year, columns (b) and (c) must be duplicated in the PVP Table to provide disclosure for each such additional person (consistent with the approach the SEC requires for the Summary Compensation Table (the "SCT") and related compensation tables, though different from the combined approach the SEC permits for Pay Ratio disclosure). SRCs are exempt from disclosing the information in the columns and rows marked with an asterisk in the above table example.

We assume a company will be required to provide the relationship disclosure described above with respect to all PEOs disclosed in the PVP Table, including multiple PEOs serving during any one fiscal year, but further clarifying guidance from the SEC on this topic is likely needed. Also, SRCs will not be required to provide the relationship description between Total Shareholder Return (column (f)) and Peer Group Total Shareholder Return (column (g)).

Tabular List of Financial Performance Measures

The new rules also require that a company (other than an SRC) provide an unranked tabular list of at least three, and up to seven, financial performance measures that, in a company's assessment, represent the most important financial performance measures it used to link compensation actually paid to its named executive officers for the most recently completed fiscal year to company performance (the "Tabular List"). If a company uses fewer than three financial performance measures for these purposes, it is permitted to include in its Tabular List just the financial performance measures it used (or to provide no Tabular List if a company did not use any financial performance measures for such purposes).

A company may also include nonfinancial performance measures (e.g., a safety-related metric tied to fatality count, or other individual or operational measures) as part of its Tabular List, provided that it has also disclosed its most important three (or fewer, as described above) financial performance measures, and there are no more than seven total measures disclosed in the Tabular List. Further, a company may disclose two or more separate Tabular Lists if it chooses to identify differences in the performance measures used for a company's PEO, the Other NEOs as a group, or each Other NEO individually.

DISCLOSURE METHODOLOGIES

"Actually Paid" Compensation

To calculate compensation "actually paid," a company satisfying the new rules must make a number of adjustments to total compensation as otherwise reported in the SCT for the same fiscal years disclosed in the PVP Table. Specifically, a company must, for each PEO and Other NEO for each fiscal year:

- Deduct the aggregate change (if positive) in the actuarial present value of the person's accumulated benefit under defined benefit and actuarial pension plans (SRCs are not required to comply with this deduction requirement);

- Add back the aggregate of: (i) the actuarial present value of the person's benefits under such defined benefit and actuarial pension plans attributable to services rendered during the fiscal year (service cost); and (ii) the entire cost of benefits granted to (or credit for benefits reduced for) the person in a plan amendment (or initiation) during the fiscal year that are attributed by the benefit formula to service rendered in periods prior to the amendment (or initiation) (prior service cost), in each case calculated using the same methodology as used for a company's financial statements under generally accepted accounting principles ("GAAP") (SRCs are not required to comply with this add-back requirement);

- Deduct the SCT "Stock Awards" and "Option Awards" values (including any modification fair value);

- Add back for equity awards:

- the fiscal year-end fair value of stock awards and option awards granted during the fiscal year that remain outstanding and unvested at fiscal year-end;

- the fiscal year-over-year change, as of fiscal year-end, in the fair value of stock awards and option awards granted in prior fiscal years that remain outstanding and unvested at fiscal year-end (whether the change is positive or negative, and including any modification fair value);

- for stock awards and option awards granted and vested in the same fiscal year, the fair value of such awards as of the vesting date;

- - for stock awards and option awards granted in prior fiscal years and vested in the applicable fiscal year, the change in fair value from the prior fiscal year-end to the vesting date (whether the change is positive or negative, and including any modification fair value); and

- the dollar value of dividends or other earnings paid on stock awards and option awards in the applicable fiscal year prior to the vesting date that are not otherwise reflected in the fair-value determinations or any other component of total compensation for the applicable fiscal year; and

- Deduct for any stock award or option award granted in prior fiscal years that is determined to have failed to meet applicable vesting conditions in the applicable fiscal year, such award's fair value at the prior fiscal year-end.

Each of the amounts deducted or added back as noted above must be disclosed in footnotes to the PVP Table (disclosing such deductions and additions for the Other NEOs as averages), together with a footnote describing any assumptions made in the related valuations for equity awards that differ materially from those disclosed as of the grant date of such equity awards. Fair-value amounts must be computed consistent with the fair-value methodology used for share-based payments in a company's financial statements under GAAP. For equity awards subject to performance-based conditions, the change in fair value as of the end of an applicable fiscal year must be calculated based on the probable outcome of such conditions as of the last day of the applicable fiscal year.

Total Shareholder Return

To calculate Total Shareholder Return ("TSR") (column (f)) and Peer Group Total Shareholder Return (column (g)), companies must use essentially the same methodology used to calculate TSR for purposes of the Regulation S-K Item 201(e) performance graph required to be included in annual reports (the "Performance Graph"). For the peer group TSR, companies (other than SRCs) may use either: (i) the same index or entities they use for the Performance Graph or (ii) the entities they use as a peer group for named executive officer compensation comparison purposes (the "peer group"), as described in each company's Compensation Discussion and Analysis disclosure. Footnote disclosure of (or cross-reference within the applicable document to) the constituent entities in the peer group is required if the peer group is not a published industry or lineof-business index, and the TSR of each peer group entity must be weighted based on the entity's market capitalization as of the beginning of each period for which a return is indicated.

If changes are made to the peer group from one fiscal year to the next, the reason for such changes, plus a comparison of a company's cumulative TSR to the cumulative TSR of both the prior peer group and the new peer group, must be provided in a footnote. Practically speaking, to reduce or avoid additional disclosures related to year-over-year changes, companies may find it most efficient to use the same index or entities used for the Performance Graph for the peer group TSR, as such peer group is generally less variable from year to year compared to the peer group used for named executive officer compensation comparison purposes

Company-Selected Measure

A company (other than an SRC) must use as the CompanySelected Measure what it believes represents the most important financial performance measure from the Tabular List (not otherwise required to be disclosed in the PVP Table) it uses to link named executive officer compensation actually paid to company performance, in each case for the most recently completed fiscal year. If a company's most important financial performance measure is already included in the PVP Table, then a company would select its next-most-important financial performance measure from the Tabular List.

For purposes of the rules, "financial performance measures" means only measures that are determined and presented in accordance with the accounting principles used in preparing a company's financial statements, any measures that are derived wholly or in part from such measures, and stock price and TSR. It is not necessary for the Company-Selected Measure to actually be presented within a company's financial statements or SEC filings. Disclosure of a Company-Selected Measure that is not presented in accordance with GAAP will not be subject to Regulation G or Item 10(e) of Regulation S-K, but a company will be required to disclose in plain English how results under such Company-Selected Measure are calculated from its audited financial statements.

Companies may, under certain conditions, provide additional voluntary disclosure about important nonfinancial performance measures in connection with the required tabular and relationship disclosure, but such voluntary disclosure may not be misleading or obscure the required information, and it may not be presented with greater prominence than the required disclosure. The Company-Selected Measure may be changed from filing to filing; however, absent contrary guidance from the SEC, year-over-year changes to the Company-Selected Measure will necessitate revisiting and revising prior-year disclosures, as the new rules indicate that the Company-Selected Measure for the most recent fiscal year must also be disclosed for the other fiscal years included in the PVP Table.

PLACEMENT

The new rules provide companies flexibility in determining where in the proxy statement or information statement to provide the new required disclosures. The new disclosures are clearly not required to be included in a company's Compensation Discussion and Analysis disclosure but should appear together with a company's other executive compensation disclosures in the applicable proxy statement or information statement.

XBRL TAGGING

Companies are required to use Inline XBRL to tag their new PVP disclosures, with SRCs obligated to comply with this requirement by their third filing (regardless of when such filing occurs) under these new rules

EFFECTIVENESS

Companies with fiscal years ending on or after December 16, 2022, will first be required to comply with these new rules in their 2023 proxy statement and information statements.

CONSIDERATIONS AND PREPARING FOR COMPLIANCE

Significant Preparation Work

Although the new rules provide for a phase-in period, companies are still required to provide three years (two years for SRCs) of data in their initial filing that includes the new PVP disclosures. Companies will have to revisit compensation data back to at least 2020 (including for departed officers) and perform significant new analyses and adjustments on such historical information. This process is expected to be even more challenging and time-consuming for companies that have had named executive officer turnover (especially within the PEO position) over the past three years because those companies will need to analyze different sets of current and departed executives.

Further, the new rules do not just require a new table and footnotes but also significant additional relationships disclosure regarding paid compensation and financial performance measures (including TSR) results over multiple years. The content of and format for this required relationships disclosure (including potentially new graphical disclosures) may take significant time for companies to prepare and review with management and directors ahead of filing. The new rules may also require companies to perform significant additional work to determine TSR results for peer companies. This work likely was not conducted in past years. Finally, the Inline XBRL requirements for the new disclosures create yet an additional cost and could impact timing of preparing the applicable filings.

Novel and Complex Calculations

The calculations and adjustments required for determining "actually paid" compensation are complex and significantly different from those that have historically been required as part of executive compensation disclosures, including preparation of the SCT and related compensation tables. Preparing the PVP Table will not be simply a matter of inserting readily available or previously calculated numbers into a new format. Instead, the PVP Table will require revisiting historical information and making new calculations and adjustments, particularly with respect to pension benefits and equity awards. For equity awards, companies may need to examine precisely when persons covered by the PVP Table vest in (or have an unconditional right to) their equity awards, including under accelerated or continued vesting provisions of such equity awards, as well as when such awards fail to vest, in order to make the new calculations. While the equity-related calculations may be something that can be handled in-house, companies may need to outsource certain of the pension-related calculations and engage third-party actuarial services at additional cost.

Consistent Use of Financial Performance Measures

Companies will need to consider how their existing disclosures around key performance indicators and current and historical executive compensation programs fit together with the Company-Selected Measure and the financial performance measures included on the Tabular List. Metrics selected for companies' annually implemented incentive programs arguably should be related, in whole or in part, to the financial performance measure results if they were selected specifically to link named executive officer compensation to company performance for the applicable year. In that case, companies may find that their Tabular Lists largely align with annual incentive program metrics (both financial and nonfinancial) and performance-based long-term incentive program metrics. However, this will be a good time for companies to re-evaluate their disclosures and the degree to which they pay for performance, and consider any adjustments to incentive program design that may be needed ahead of granting future years' incentive awards.

Investor and Other Stakeholder Scrutiny Anticipated

The disclosures required by the new rules are expected to lead to increased investor and other stakeholder scrutiny of executive compensation changes over time and the particular performance metrics (including the calculation of such metrics) that comprise companies' executive compensation programs, including any adjustments to such metrics that differ from GAAP-determined financial measures, such as Net Income. The requirement to provide these disclosures may drive companies to shape their future executive compensation programs differently, including by selecting metrics that they believe will be more favorably viewed by investors and other stakeholders (e.g., environmental, social, and governance metrics) or that are likely to have results that more closely track anticipated changes in executive pay (rather than those metrics that they truly believe are the most important drivers of financial, operational, and individual performance).

The full release detailing the new rules can be found on the SEC's website.

KEY TAKEAWAYS

- Management teams should advise their boards regarding the new disclosure requirements and the potential future impacts of the disclosure.

- . Companies should start preparing disclosure now for 2023 proxy statements, as the required disclosures are novel and complex, and may require significant internal socialization before filing.

- Companies should be cognizant of how the disclosure requirements and their compensation programs will (or will not) fit together to present a consistent and logical snapshot of what is driving financial performance and executive compensation decisions. Incentive program design changes may be needed ahead of granting 2023 (and future years') incentive awards.

- Companies should anticipate increased scrutiny of executive compensation changes over time and executive compensation program metrics, particularly components of the Tabular List, as well as possible pressure from investors to select different metrics if actual pay is not viewed as commensurate with performance over multiple years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.