Washington's Department of Labor and Industries just decided to substantially raise the state's salary threshold to meet the salary basis test for "white collar" overtime exemptions. As set out more specifically below, starting July 1, 2020, the state's salary threshold will be determined by both an employer's size and a multiple of the state's then-current minimum wage for a 40-hour workweek.

The first major impact of the new state law will begin January 2021, when Washington's required minimum salary will exceed even the new amount under the federal FLSA rules ($684 per week, or $35,568 per year). Smaller employers (with 50 or fewer employees) will see the minimum salary level rise to $827 per week (or $43,004 per year), while all other employers will face an increase to $965 per week (or $50,180 per year). Washington's new rule, announced on December 11, also seeks to bring the duties tests for the white-collar exemptions (executive, administrative, professional, and outside sales) more in line with the FLSA duties tests. However, you should still work with your legal counsel to ensure all parts of the relevant duties test are met.

New Salary Threshold For Executive, Professional, And Administrative Exemption

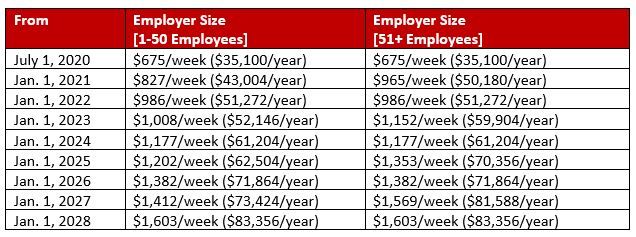

The first step in meeting am overtime exemption under federal or state law is meeting the requisite "salary basis." On July 1, 2020, Washington's salary threshold will depend on the employer's size and be based on a multiple of minimum wage for a 40-hour workweek. An employer's size will be determined by the total number of Washington-based employees regardless if they are full or part time.

The law then dictates the correct multiple of the state's minimum wage for a 40-hour workweek to reach the weekly minimum salary. For example, in 2020, for employers with fewer than 50 employees, the multiple of the state's minimum wage of $13.50 for a 40-hour workweek will be 1.25, making the salary threshold $675 per week ($35,100 per year). However, beginning January 1, 2020 and throughout 2020, Washington employers should still follow the new federal salary threshold for the overtime exemptions at $684 per week ($35,568 per year) because you must follow the law that is more favorable to the employee.

From 2020 to 2028, Washington's minimum salary threshold will increase incrementally at the start of each year as shown below. For employers with 50 or fewer employees, the increase is slower than that for those with more than 50 employees. By 2028, the threshold will be the same for all employers regardless of size, and all salaried employees exempted from overtime will earn 2.5 times the minimum wage. After 2028, the salary threshold will increase if minimum wage is adjusted for inflation. In sum:

Computer Professionals

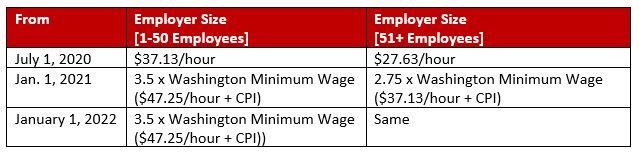

The minimum hourly pay rate for to meet the computer professional exemption has also been revised. These new minimum hourly rates are:

Outside Salespeople

Washington's outside sales exemption retains key features different than federal law. Currently, Washington's new rule keeps the current requirement that the outside salesperson's nonexempt work must not exceed 20% of a normal nonexempt workweek (typically eight hours per week), although it was initially deleted in the draft rule. This may change. Employers must also continue to advise employees under this exemption of their status as an outside salesperson as well as meet other requirements of the test.

Regarding pay rates, Washington's law still does not require a minimum pay rate for this exemption. It does, however, continue to require that employers pay outside salespeople on a guaranteed salary, commission or fee basis.

Some Other Differences

Washington still does not recognize an overtime exemption for "highly compensated" individuals. This is consistent with existing law. So-called highly compensated individuals must still meet the duties tests for one of Washington's overtime exemptions.

The teachers' professional exemption for teachers will now require payment on a salary or fee basis, although there is no required minimum pay rate. For academic administrators, the exemption now permits a salary that is at least equal to any teacher's entrance salary at the same educational establishment where they work.

Planning Ahead

Washington employers should begin planning to avoid legal liability for misclassification and to ameliorate significant financial impacts of these changes. Some steps to consider:

- Take this opportunity to make sure that each employee is classified properly. Make a list of all employees, noting each employee's classification as either "exempt" or "non-exempt." This will involve analysis of both the weekly salary paid as well as whether the employee meets the duties test for the relevant exemption.

- Identify employees who will need to be reclassified from "exempt" to "non-exempt," because they are or will be are paid less than the requisite amount or no longer meet the relevant "duties test."

- Calculate the financial feasibility and costs of raising these employees' pay to the new threshold level to make them "exempt" versus reclassifying them as "non-exempt" and paying overtime.

- If a reclassification is necessary, prepare meaningful employee communications. This includes management training, sharing necessary changes in company policies, presenting a unified message on how and why changes are going to be implemented, and positive individual communications to reclassified employees who will now need to keep track of their hours worked, take required breaks, and may have a change to their benefits.

- Seek legal advice. The new rules are complex, and employers who do not adhere to them strictly may be liable for serious financial penalties, including an unpaid overtime claim under Washington law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.