What is a Down Round?

A "down round" is a financing in which a company sells shares of its capital stock at a price per share that is less than the price per share it sold shares for in an earlier financing.

Why Does it Matter if a Company Does a Down Round?

Down rounds are frequently viewed much more harshly than flat or up rounds – a round at $0.05 per share lower than a prior round will carry much more negative baggage than a $0.05 up round would have carried goodwill. Public company stock prices fluctuate every day, often for reasons related to general industry or economic conditions that are not unique to a particular company, and these dips are often characterized as "buying opportunities" for investors and not reflective of the intrinsic value of the company. But private companies are different for a few reasons:

- Damaging Psychology. Venture-backed companies are typically unprofitable, risky endeavors with illiquid stock that require consistent evidence of rapid growth to continue to attract and retain capital and talent. A signal that a company needs to raise capital and is willing to do so at a declining price can be a significant blow to employee morale.

- Anti- Dilution Protection. Unlike public companies, investors in venture-backed companies typically own preferred stock, which sometimes has special rights referred to as "anti- dilution protection" that can magnify the dilution to common stockholders from the financing. More on this below. Similarly, if the prior round was at a highly negotiated price and/or the prior price was based on assumptions that have proven to be untrue, investors will sometimes look to renegotiate the price of the prior round to more closely reflect the benefit-of-hindsight value of the company at the time of the investment.

- Investor Accounting. Venture capital funds account to their limited partners based on the value of the securities in their portfolio, as suggested by the most recent pricing of those securities. When a company does a down round, existing investors may have an obligation to "write down" the value of their existing holdings in their financial statements, which can affect the fund's fundraising efforts and perhaps even the ability of the general partners to receive distributions.

What is Anti-Dilution Protection?

Anti-dilution protection refers to a provision that provides for preferred stock to be entitled to a larger percentage of the company's pre-financing equity ownership upon the occurrence of a down round. A common misconception is this "adjustment" is accomplished through the issuance of additional shares of preferred stock by the company; instead, it increases the number of shares of common stock each share of preferred stock is convertible into (i.e. instead of being convertible into 1 share of common stock, the preferred stock may be adjusted so that each share is convertible into 1.1, 1.2 or some other number of shares of common stock). This mechanism prevents the dual problems of issuing additional shares without consideration and increasing the liquidation preference of the preferred stock to a number that is greater than the amount originally negotiated, which is typically the amount of the investment. Simultaneously, it provides the holder of preferred stock the right to receive a larger percentage of proceeds at an exit where the aggregate proceeds are high enough that the preferred stock is better off converting to common stock rather than taking its liquidation preference.

There are two common types of anti-dilution protection: "full ratchet" and "broad-based weighted-average," with the latter being significantly more common than the former.

- Full Ratchet Anti-Dilution Protection gives the holder of preferred stock rights to convert her preferred stock into a number of shares of common stock equal to the amount invested by the preferred stockholder divided by the price per share in the current round. As an example, if an investor purchased 1,000 shares of preferred stock with full-ratchet anti-dilution protection for $10,000, or $10 per share, and in a future down round the company sells shares for $5 per share, the investor's preferred stock would be convertible into 2,000 shares of common stock ($10,000 ÷ $5), and each share of preferred stock would be convertible into two shares of common stock. In essence, the existing investor gets the benefit of the new, lower per share price for her prior investment.

- Broad-Based Weighted-Average Anti-Dilution Protection also results in shares of preferred stock being convertible into additional shares of common stock, but the size of the adjustment is much smaller and depends on the magnitude of both the size and price of the down round relative to the size of the company's outstanding capitalization. In other words, a down round in which $1.0 million of capital is raised will result in a significantly smaller increase in the conversion rate of the preferred stock than a down round at the same price in which $10.0 million worth of shares are sold. For those who are interested in seeing how the math works, I have included a sample broad-based weighted-average adjustment formula below.

What Happens When There is an Anti-Dilution Adjustment?

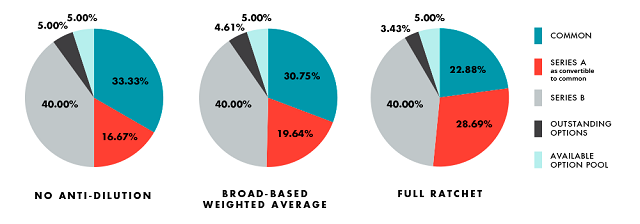

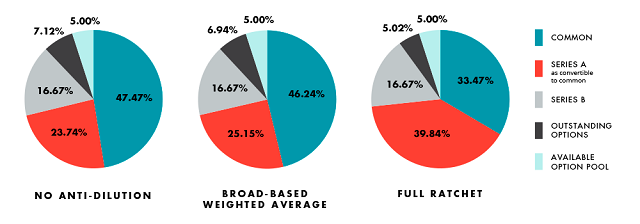

Below are a couple of examples that demonstrate the effect of full ratchet and broad-based weighted-average anti-dilution protection. Notice how the percentage ownership of the Series B and Available Option Pool remains fixed, while the Series A increases at the expense of the common and outstanding options. Also note how much more significant the Series A adjustment is in Example 2

Example 1: $25M Series A Post-Money after a $7,171,150 investment at $3.03 per share; $15M Series B Pre-Money; $10M investment; no options or shares granted in the interim; 5% unallocated option pool included in the pre-money valuation. Note the same amount of money at the same valuation is being invested in each of the examples below – the only difference is the type of anti-dilution adjustment. (For an explanation of pre-/ post-money valuations, check out Calculating Share Price With Outstanding Convertible Notes. For option pools, see Option Grants: Fully Diluted or Issued and Outstanding.)

Example 2: Same as Example 1, except here we assume a $3M Series B investment instead of a $10M Series B investment. Note the same amount of money at the same valuation is being invested in each of the examples below – the only difference is the type of anti-dilution adjustment.

Alternatives to Down Rounds That Trigger Anti-Dilution Adjustments.

Down rounds that result in anti-dilution adjustments are not the only option for companies raising money that are not able to support their prior valuations. A few alternatives are listed below:

- Waive or Negotiate. Just because the terms negotiated in a prior financing round would result in an antidilution adjustment does not mean these provisions can't be renegotiated in connection with the next round. Founders regularly negotiate with investors to waive or partially reduce anti-dilution adjustments. A key factor is whether management, which are often the main common stockholders, will be adequately incentivized by their post-financing equity stake to continue to spend their time operating the business.

- Bridge Financing. Sometimes companies simply need a short term cash infusion to get them out of a soft patch and back on an upward trajectory, or just enough to get to another inflection point. A simple solution in this situation is a convertible note financing where the notes convert into the next round, commonly at a discount to the price of the next round. While this option may simply delay rather than solve a valuation problem, it can work well in many situations.

- Other Investor-Friendly Terms. Investors can increase their upside protection and mitigate their downside risk by negotiating more favorable than usual economic terms other than the price per share. Some examples of these include providing for a greater than 1x liquidation preference, accruing dividends, "participating" preferred and warrant coverage. Entrepreneurs should tread carefully as providing these rights could result in the holders of common stock being worse off than they would have been in a down round scenario. The key, as always, is to make sure you have competent counsel and consider the consequences of given options.

Broad-Based Weighted Average Formula Footnote:

The number of shares of common stock that each share of preferred stock is convertible into is equal to the original price per share paid by the investor divided by the conversion price, which is initially equal to the original price per share (resulting in a one-to-one conversion rate). When there is anti-dilution protection, the conversion price is adjusted when a down round occurs. The following formula is used to calculate the new "conversion price" of the existing preferred stock upon the issuance of the new preferred stock in the down round when the investor has broad-based anti-dilution protection.

CP2 = CP1* (A + B) ÷ (A + C).

"CP2" means the conversion price in effect immediately after such issue of the additional shares;

"CP1" means the conversion price in effect immediately prior to such issue of the additional shares;

"A" means the number of shares of common stock outstanding immediately prior to such issue of additional shares (treating for this purpose as all outstanding shares of capital stock issuable upon exercise of options or warrants outstanding immediately prior to such issue or upon conversion or exchange of preferred stock and any other securities convertible into capital stock);

"B" means the number of shares of common stock that would have been issued if such additional shares had been issued at a price per share equal to CP1 (determined by dividing the aggregate consideration received by the company in respect of such issuance by CP1); and

"C" means the number of such additional shares issued in such transaction.

More colloquially, think of "A" as the size of the company's capitaliation before the new round, "B" as the number of shares that "should have been issued", and "C" as the number of shares actually issued.

Originally published 04 August, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.