The first quarter 2020 PwC/CB Insights MoneyTree Report for the first quarter of 2020 provides insights on the level of venture funding.

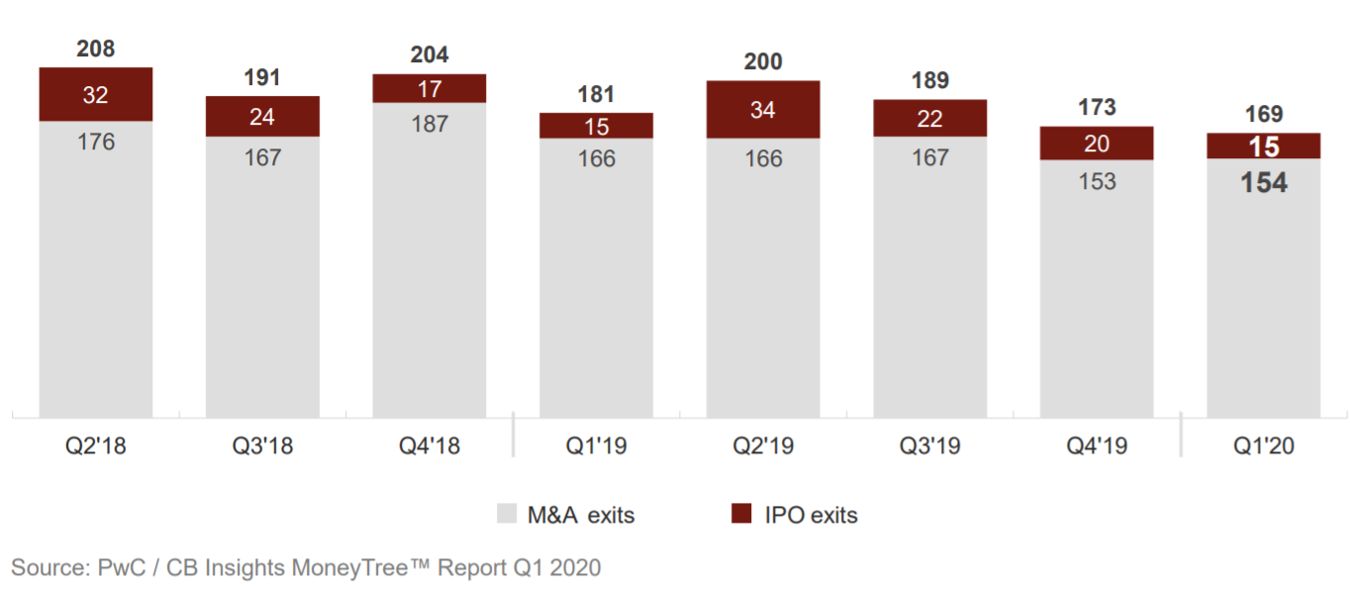

US venture capital deal activity has declined for three straight quarters, with 1,533 deals raising $28.6 billion, 1,399 deals raising $23.3 billion, and 1,271 deals raising $26.4 billion raised, respectively, in each of the last three quarters ended with first quarter 2020. Deal activity in 2020 was off to its slowest start since first quarter of 2013. However, despite these declines, VC funding is still above quarterly averages compared to prior periods in the last five years. Seed deals saw the sharpest declines, while later stage growth deals (Series E and above) increased slightly during the first quarter 2020. Mega-rounds increased during the first quarter 2020, with 58 deals completed raising $12 billion. [CHART, P 10] The five largest deals in the United States in the first quarter 2020 (each raising more than $450 million) included JUUL Labs, Joby Aviation, Impossible Foods, Lyell Immunopharma, and Snowflake Computing. Internet SaaS and healthcare companies attracted the most capital. Nearly half of all US funding during the first quarter 2020 came from mega-rounds. Unicorn births declined during the first quarter 2020, with only 12 newly minted unicorns. The top valued US unicorns remain unchanged from late 2019 and include JUUL Labs, Stripe, Airbnb, SpaceX, and Palantir Technologies. The number of M&A exits remained flat in the first quarter 2020 compared to fourth quarter 2020, with 154 exits, and exits occurring on average seven years from inception. As we have previously reported, the number of IPOs fell in the first quarter 2020 to 15—so while there were fewer IPOs in Q1 2020, the number of M&A exits remained virtually flat.

Globally deal activity and funding both declined year over year, with the largest decline occurring in Asia.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.