A sale to private equity can be a great option for a Seller. For example, a private equity ("PE") firm may provide additional management, proven processes, best practices, and additional capital to take a company to another level. A PE firm may permit the Seller to retain a portion of its equity during this next phase of growth, giving the Seller "another bite at the apple" when the PE firm executes the next liquidity event. Most importantly, a PE firm is often the highest bidder for the target Company. I have helped clients of every description sell to PE firms, and the overwhelming majority of these Sellers are happy they did.

All that said, I have seen some PE firms be very aggressive in their deal documentation, so I'm always careful and looking to protect a Seller's interests. In 2020, I saw PE firms attempt to use the same unfair structure in two separate sale transactions, and I wondered whether the structure was a mistake or an intentional effort to extract more value away from the Seller.

The unfair structure becomes an issue in transactions with two characteristics:

- Partial Sale / Rollover – Seller sells less than 100% of its ownership interests, or otherwise receives rollover equity as part of the transaction.

- Post-Closing Payments – The transaction has a post-closing purchase price adjustment (often called a "true-up"), or other post-closing payment.

To illustrate the issue, let's start by looking at the following typical provision for payment of a post-closing purchase price adjustment:

(d) Payment of Adjustment Amount.

(i) If the Final Closing Cash Purchase Price is greater than the Estimated Closing Cash Purchase Price, then, .....

(ii) If the Final Closing Cash Purchase Price is less than the Estimated Closing Cash Purchase Price (the "Adjustment Amount"), then, within five days after such determination, the Seller shall pay or cause to be paid to the Buyer an aggregate amount equal to the Adjustment Amount. Such payment shall be made first from the Adjustment Escrow Fund and then from the Seller should the Adjustment Escrow Fund be insufficient.

As the bolded wording indicates, when the Seller is required to pay the purchase price "Adjustment Amount," the Seller pays it to the Buyer. Or, in some cases, the wording requires Seller to pay the Adjustment Amount to the target Company. When the Buyer purchases 100% of the target Company, it doesn't matter if this amount is paid to the Buyer or the target Company, because the benefit goes entirely to the Buyer, either directly or through Buyer's 100% ownership in the target Company.

However, let's now consider a couple typical post-closing structures where the target Company does not become wholly owned by the Buyer.

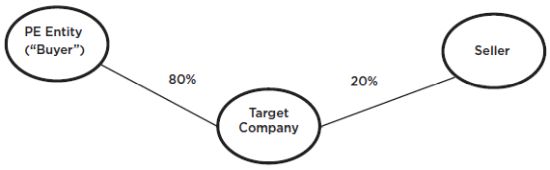

Post-Closing Structure #1 ("Partial Sale")

Structure #1 is the simplest structure. Here, the PE firm entity purchases 80% of the equity in the target Company from the Seller, and the Seller retains the remaining 20% interest.

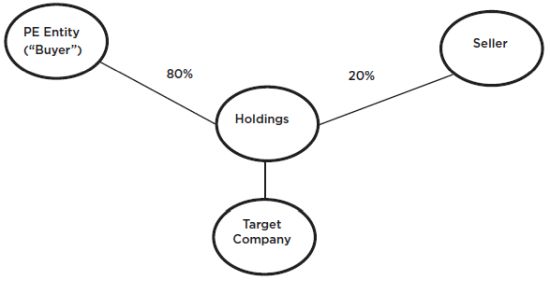

Post-Closing Structure #2 ("Rollover")

In Structure #2, which is more common, the PE firm forms a new entity, defined above as "Holdings," and Holdings purchases the target Company, with the Seller rolling a portion of its equity in the target Company up into equity of Holdings. As a result of the sale transaction, the PE firm entity and the Seller become the owners of "Holdings," and Holdings owns the target Company.

Under these structures, I have seen the purchase price adjustment provision result in value potentially being taken away from the Seller. If the acquisition agreement is drafted with the customary purchase price adjustment language provided above, then the Buyer will receive 100% of the "Adjustment Amount," even though the Buyer only purchased 80% of the target Company. Instead, the language in the sample should be adjusted to require the Adjustment Amount to be paid either to the target Company or to Holdings, both of which are beneficially owned 80% by Buyer and 20% by the Seller. For a modest $100,000 post-closing Adjustment Amount, the mistaken wording could result in a difference of $20,000 in sale proceeds to the Seller.

Upon reflection, it appears the unfair proposal made in two of my 2020 sell-side transactions was the result of using customary purchase price adjustment language without fully considering the ramifications. Bottom line, I don't think the two PE firms were intentionally using a structure to extract more value, to the detriment of the Seller. It was a drafting mistake that we caught and corrected through careful review and revision. Regardless, it is an issue we will continue to monitor.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.