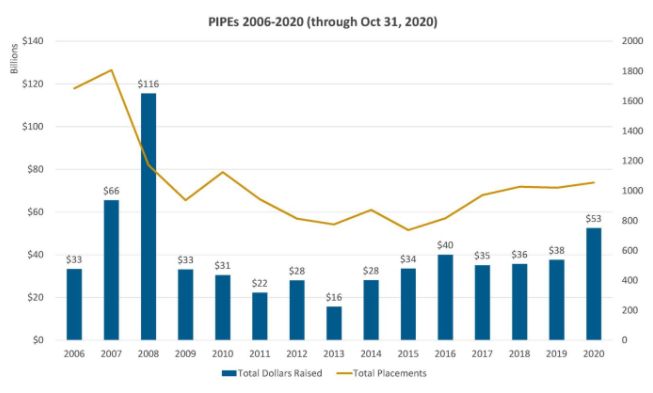

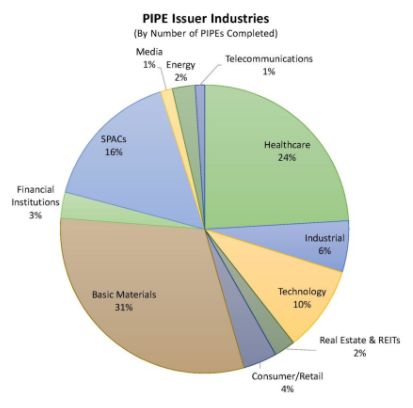

Private investment in public equity ("PIPE") transactions completed in 2020* have raised over $53.0 billion, in aggregate, in 1055 transactions. This is the largest sum of capital raised in PIPE transactions since 2008. While industrials companies (chemicals, metals, mining and paper-focused companies) lead the market by number of PIPEs completed, the 323 deals in this sector raised only $2.8 billion in aggregate. By comparison, healthcare and life sciences companies completed 254 PIPEs and raised $15.2 billion in aggregate.

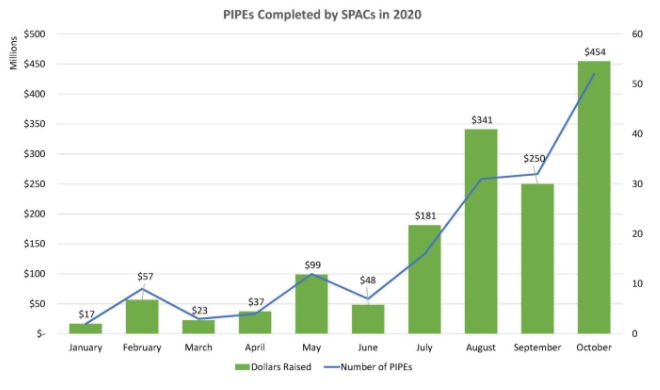

As more SPACs go public and seek out targets, SPACs have also relied on PIPE transactions in order to raise capital in connection with their initial business combinations. In 2020, SPACs have raised $1.5 billion in 168 PIPE transactions. As the year comes to a close, we expect to see more companies, including SPACs, complete PIPE transactions in order to raise capital amidst market volatility relating to the US Presidential Election, the COVID-19 pandemic, and other geopolitical factors.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.