On June 29, 2012, the Commodity Futures Trading Commission (the "CFTC" or the "Commission") approved two notices addressing the application of certain swap provisions under The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act")1 to U.S. and non-U.S.2 swap dealers ("SDs"), major swap participants ("MSPs") and their foreign affiliates, and other related issues. One notice contains proposed interpretive guidance on the cross-border application of certain swaps provisions of the Dodd-Frank Act. See 77 Fed. Reg. 41214 (July 12, 2012). Comments are due on or before August 27, 2012. The other notice contains a proposed exemptive order setting forth a phased compliance program for swap dealing by non-U.S. SDs and MSPs, U.S. SDs and MSPs, and foreign branches of U.S. SDs and MSPs. See 77 Fed. Reg. 41110 (July 12, 2012). Comments on this proposal are due on or before August 13, 2012.

Cross-Border Application of Certain Swaps Provisions of the Dodd-Frank Act

The CFTC's proposed interpretive guidance with respect to the cross-border application of certain swaps provisions of the Dodd-Frank Act focuses on Section 2(i) of the Commodity Exchange Act (the "CEA"). This provision, which was added to the CEA by Section 722(d) of the Dodd-Frank Act, states that the swaps provisions of the CEA that were enacted by Title VII of the Dodd-Frank Act

"shall not apply to activities outside the United States unless those activities (1) have a direct and significant connection with activities in, or effect on, commerce of the United States; or (2) contravene such rules or regulations as the Commission may prescribe or promulgate as are necessary and appropriate to prevent the evasion of any provision of [the CEA] that was enacted by [Title VII of the Dodd-Frank Act]."

Definition of "U.S. Person"

For purposes of the interpretive guidance, the Commission is proposing to interpret the term "U.S. person". In this regard, the Commission explains that its interpretation of the term "U.S. person" for this purpose is designed to reflect the extent to which swap activities or transactions involving one or more such persons have the relevant effect on U.S. commerce.

Under this interpretation, the term "U.S. person" would include, but not be limited to: (1) any natural person who is a resident of the U.S.; (2) any corporation, partnership, limited liability company, business or other trust, association, joint-stock company, fund, or any form of enterprise similar to any of the foregoing, in each case either (A) organized or incorporated under the laws of the U.S. or having its principal place of business in the U.S. ("legal entity") or (B) in which the direct or indirect owners thereof are responsible for the liabilities of such entity and one or more of such owners is a U.S. person; (3) any individual account (discretionary or not) where the beneficial owner is a U.S. person; (4) any commodity pool, pooled account, or collective investment vehicle (whether or not it is organized or incorporated in the U.S.) of which a majority ownership or equity interest is held, directly or indirectly, by a U.S. person(s); (5) any commodity pool, pooled account, or collective investment vehicle the operator of which would be required to register as a commodity pool operator under the CEA; (6) a pension plan for the employees, officers, or principals of a legal entity with its principal place of business inside the U.S.; and (7) an estate or trust, the income of which is subject to U.S. income tax regardless of source. The Commission is requesting comment on whether the term "U.S. person" should also include foreign affiliates and subsidiaries guaranteed by U.S. persons and/or non-U.S. persons controlled by, or under common control with, a U.S. person.

Among other things, it is unclear whether having a managing member or general partner who is a U.S. person would result in an entity being deemed a U.S. person even if all the other participants in such entity are non-U.S. persons. Additionally, although it would appear that an offshore commodity pool, pooled account or collective investment vehicle operated by a registered commodity pool operator that is required to be registered as such in respect of other commodity pools should not be considered a U.S. person solely as a result of having a registered commodity pool operator, it would be helpful for the Commission to confirm this point.

Registration Thresholds

The Commission is proposing that a non-U.S. person must register as an SD with the CFTC if the aggregate notional value of its swap dealing activities with U.S. persons as counterparties, or of its swap dealing activities with non-U.S. persons where the dealing non-U.S. person's obligations are guaranteed by a U.S. person, exceed the de minimis threshold of swap dealing ($8 billion of swaps constituting swap dealing activity during the prior 12 months (regardless of whether such swaps are collateralized or not) during an initial phase-in period not to exceed five years, and $3 billion thereafter).3 When calculating its swap dealing activity, a non-U.S. person would include the aggregate notional value of (i) any swap dealing transactions between U.S. persons and any of its non-U.S. affiliates under common control and (ii) any swap dealing transactions of any of its non-U.S. affiliates under common control where the obligations of such non-U.S. affiliates are guaranteed by U.S. persons. However, a non-U.S. person would not include the notional value of swap dealing transactions (i) in which its U.S. affiliates engage, (ii) between such non-U.S. person and its U.S. affiliates or (iii) between two affiliated non-U.S. persons. Further, a non-U.S. person would also not include the notional value of dealing transactions with foreign branches of registered U.S. swap dealers.

Note that the aforementioned thresholds apply only to swap dealing activity and not to swap trading that is not part of "a regular business" – a person who is not engaged in swap dealing as part of "a regular business" is not required to apply the de minimis test and is not a swap dealer under the CEA. Therefore, a non-U.S. person (without a guarantee from a U.S. person) who is not engaged in swap dealing as part of a regular business with respect to U.S. persons as counterparties is not required to apply the de minimis test or to register as an SD. The Commission notes that this would be true even if the non-U.S. person is engaged in swap dealing as part of a regular business with respect to non-U.S. persons as counterparties.

Similarly, the Commission is proposing that a non-U.S. person must register as an MSP if its swap trading activity with U.S. persons as counterparties (plus any swap positions between another non-U.S. person and a U.S. person that it guarantees on behalf of the non-U.S. person) exceeds the thresholds delineated in the CFTC's final rules defining the terms SD and MSP4. Note, however, that any swap positions that are guaranteed by a U.S. person generally would be attributed to that U.S. person and not included in a non-U.S. person's MSP threshold determination. Swap trading activity with non-U.S. persons as counterparties also would not be included for the purpose of such calculations. Further, for purposes of Section 2(i) of the CEA, the CFTC intends to evaluate whether such swaps with U.S. persons, in the aggregate, have a direct and significant connection with activities in, or effect on, U.S. commerce, rather than evaluating whether each particular swap has such a connection or effect.

Entity-Level and Transaction-Level Requirements

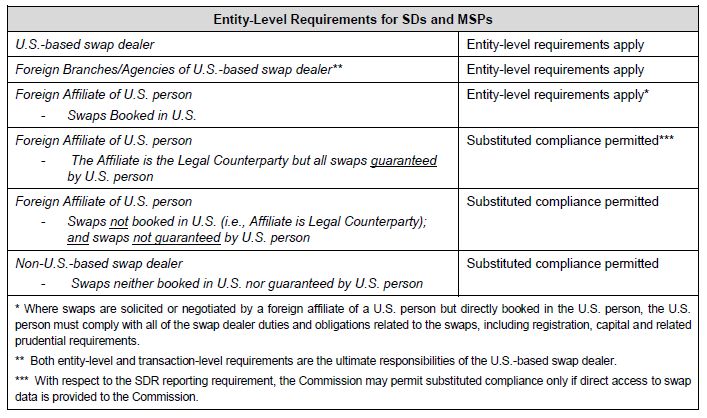

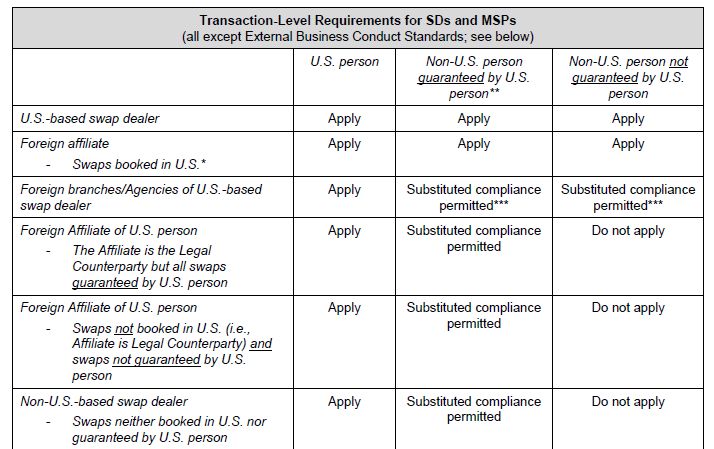

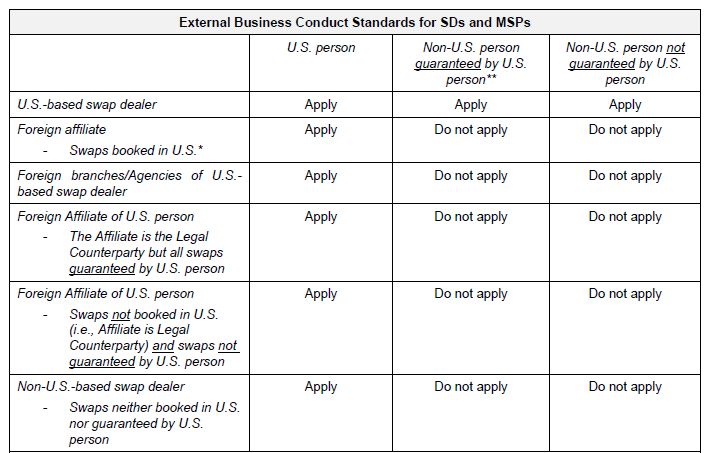

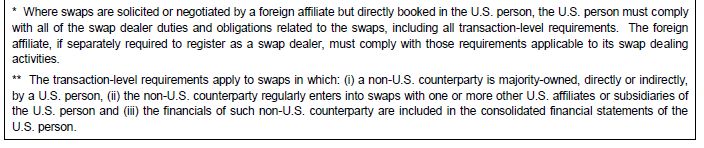

In general, the Commission is proposing to bifurcate the swap-related requirements under the Dodd-Frank Act into two categories: entity-level requirements and transaction-level requirements. Entity-level requirements would apply on a firm-wide basis, inclusive of all swaps and irrespective of whether the counterparty is a U.S. person or where the transactions are executed. The entity-level requirements relate to capital adequacy, the entity's chief compliance officer, risk management, swap data recordkeeping, swap data repository ("SDR") reporting and physical commodity swaps reporting (i.e., large swap trader reporting). Conversely, transaction-level requirements would be applied on a transaction-by-transaction basis and relate to clearing and swap processing, margining and segregation for uncleared swaps, trade execution, swap trading relationship documentation, portfolio reconciliation and compression, real-time public reporting, trade confirmation, daily trading records and external business conduct standards.

Substituted Compliance

Generally, the Commission is proposing to interpret CEA Section 2(i) to require registered non-U.S. SDs and MSPs to comply with the capital adequacy, chief compliance officer, risk management, swap data recordkeeping and SDR reporting entity-level requirements with respect to all of their swaps; non-U.S. SDs would also need to comply with large-trader reporting under Part 20 of the CFTC's rules. Similarly, non-U.S. SDs and MSPs would be required to comply with all of the transaction-level requirements for all of their swaps with U.S. persons; such entities would also need to comply with the transaction-level requirements (except external business conduct standards) for swaps with non-U.S. persons if the obligations of such non-U.S. persons are guaranteed by (or otherwise supported by) U.S. persons. Swaps between a non-U.S. SD or MSP and a non-U.S. counterparty that are not guaranteed by a U.S. person would not be subject to any of the transaction-level requirements. However, the transaction-level requirements (except external business conduct standards) would also apply to swaps in which (i) a non- U.S. counterparty is majority-owned, directly or indirectly, by a U.S. person, (ii) the non-U.S. counterparty regularly enters into swaps with one or more other U.S. affiliates or subsidiaries of the U.S. person and (iii) the financials of such non-U.S. counterparty are included in the consolidated financial statements of the U.S. person. This particular element of the Commission's proposal is intended to address swaps effected through so-called non-U.S. "conduits" of U.S. persons.

Notwithstanding the foregoing, the Commission is proposing to allow non-U.S. SDs and MSPs, once registered with the Commission, to substitute compliance with the requirements of such entity's relevant home jurisdiction's law and regulations in lieu of the CEA and the CFTC's regulations, provided that the CFTC finds such requirements comprehensive and comparable to analogous requirements under the CEA and the CFTC's regulations. Note that the Commission is proposing to make comparability determinations on an individual requirement basis, rather than based on the foreign regime as a whole (a non-U.S. SD or non-U.S. MSP may be permitted to comply with regulations in its home jurisdiction where the comparability standard is met, but may also be required to comply with certain of the Dodd-Frank Act requirements where the relevant home regulations are inadequate). This type of itemized approach differs from the broad analysis of foreign regulatory regimes undertaken by the Commission when making comparability determinations under Part 30 of the CFTC's rules, which govern the offer and sale of foreign futures and options contracts in the United States. The Commission expects to enter into memoranda of understanding or similar arrangements with foreign supervisors with respect to substituted compliance and comparability determinations.

With respect to entity-level requirements, the Commission would permit substituted compliance where a non-U.S. SD or MSP is subject to comparable requirements in its home jurisdiction. However, such entities would still need to comply with SDR reporting requirements for all swaps unless (i) the swaps are with non-U.S. counterparties (regardless of whether or not they are guaranteed by U.S. persons) and (ii) the Commission has direct access to the swap data for such non-U.S. SD or MSP that is stored at a foreign trade repository.

With respect to transaction-level requirements, substituted compliance would generally not be permitted for transactions directly between a non-U.S. SD or MSP and a U.S. person. Instead, the Commission would only permit substituted compliance for (i) swaps between a non-U.S. SD or MSP and a non-U.S. person whose obligations are guaranteed by a U.S. person, (ii) swaps with non-U.S. affiliate conduits and (iii) swaps between a foreign branch of a U.S. person and a non-U.S. person (regardless of whether any of the obligations are guaranteed by U.S. persons or not).

Please refer to the charts below for a summary of the proposed requirements for SDs and MSPs.

Transactions Involving Non-SDs and Non-MSPs

Non-SDs and non-MSPs may nevertheless be subject to certain swap-related provisions of the Dodd-Frank Act, which have been added to the CEA (e.g., clearing, trade execution, real-time public reporting, large trader reporting and swap data reporting/recordkeeping). See the chart below. In interpreting Section 2(i) of the CEA, the Commission is proposing that (i) the clearing, trade execution and real-time public reporting requirements would apply to any swaps where one of the counterparties is a U.S. person (irrespective of the location of the transaction), without permitting substituted compliance; (ii) non-U.S. clearing members would be required to report all reportable positions under the Part 20 rules and traders with reportable positions would be subject to the relevant recordkeeping obligations, without permitting substituted compliance; and (iii) substituted compliance would be permitted with respect to transactions between a U.S. person and a non-U.S. person that are subject to SDR reporting and swap data recordkeeping requirements, provided that the Commission has direct access to the swap data for these transactions that is stored at the foreign trade repository. Note, however, that where a non-U.S. person enters into a swap with another non-U.S. person and neither counterparty is required to register as an SD or MSP, the requirements of the Dodd-Frank Act would not apply. Similarly, these requirements would not be applicable to non-U.S. affiliates and subsidiaries. As noted, the Commission, however, is considering whether to propose additional measures to address a non-U.S. affiliate acting as a conduit for a U.S. person under these circumstances.

Phased Compliance Proposal for Certain Swap Regulations

To ensure an orderly transition to the Dodd-Frank Act's regulatory regime and to provide greater certainty to market participants, the Commission is proposing temporary exemptive relief pursuant to Section 4(c) of the CEA. Under the proposed relief, non-U.S. SDs and MSPs would be permitted to delay their compliance with most of the aforementioned entity-level and, to a more limited extent, transaction-level requirements. Also, U.S. SDs and MSPs would be given some additional time to transition to the new regulatory regime with respect to certain entity-level requirements.

One notable exception is that non-U.S. SDs and MSPs would be required to comply with the SDR reporting requirement and the large-trader reporting requirement with respect to all swaps with U.S. counterparties, upon the applicable compliance date(s). However, non-U.S. SDs and MSPs that are not affiliates or subsidiaries of an SD would be permitted to delay compliance with the SDR and large-trader reporting requirements for swaps with non-U.S. counterparties. Under the proposal, U.S. SDs and MSPs would not be afforded any relief with respect to swap data recordkeeping, SDR reporting, or large-trader reporting requirements.

The Commission is proposing a phased compliance period which would become effective on the initial compliance date for registration of SDs and MSPs and which would expire (i) 12 months after the publication of the proposal in the Federal Register for non-U.S. SDs and MSPs and for foreign branches of U.S. SDs and MSPs5 and (ii) on January 1, 2013 for U.S. SDs and MSPs6. During the phased compliance period (i) U.S. and non-U.S. SDs and MSPs would be afforded additional time to prepare for certain entity-level requirements and (ii) with respect to swaps with non-U.S. counterparties only, non-U.S. SDs and MSPs and foreign branches of U.S. SDs and MSPs would be permitted to comply with the regulations of the home jurisdiction or location of the relevant entity, rather than U.S. regulations, with respect to the transaction-level requirements. Note, however, that non-U.S. SDs, MSPs, and foreign branches of U.S. SDs and MSPs would need to comply with the transaction-level requirements with respect to swaps with U.S. counterparties.

In order to avail themselves of the phased compliance program with respect to entity-level requirements, non-U.S. SDs and MSPs would be required to (i) file an application to register as an SD or as an MSP, as applicable, with the National Futures Association (the "NFA") and (ii) within 60 days of such application, submit to the NFA a compliance plan addressing how it plans to comply with the applicable entity-level and transaction-level requirements under the CEA and the related rules and regulations upon the effective date of the cross-border interpretive guidance discussed above. At a minimum, such plan should provide, for each requirement, a description of (i) whether the non-U.S. SD or MSP plans to comply with each of the requirements that are in effect at such time or plans to seek a comparability determination and rely on compliance with one or more of the requirements of the home jurisdiction, as applicable and (ii) to the extent that the non-U.S. SD or MSP would seek to comply with one or more of the requirements of the home jurisdiction, a description of such requirements. Similarly, a foreign branch of a U.S. SD or MSP that seeks to rely on the phased compliance program with respect to swaps with non-U.S. counterparties must submit a compliance plan addressing how it plans to comply, in good faith, with all applicable transaction-level requirements under the CEA upon the expiration of the proposed exemptive order.

We will continue to monitor and report on developments in this area.

Footnotes

1 See Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. 111-203, 124 Stat. 1376 (2010).

2 Note that the terms "non-U.S. swap dealer" and "non-U.S. major swap participant" refer to entities that are non-U.S. based, as well as those that are foreign affiliates of a U.S. person.

3 See 77 Fed. Reg. 39626 (May 23, 2012) (setting forth the final definitions of the terms "Swap Dealer", "Security-Based Swap Dealer", "Major Swap Participant", "Major Security-Based Swap Participant" and "Eligible Contract Participant").

4 Id.

5 Note that the Commission proposes to deem a foreign branch or agency of a U.S. person to be part of that U.S. person. Therefore, swaps entered between a foreign branch of a U.S. person and another foreign branch of a U.S. person would be subject to most of the transaction-level requirements of the Dodd-Frank Act; the U.S person would also be legally responsible for complying with all of the entity-level requirements. By contrast, a foreign affiliate or subsidiary of a U.S. person would be considered a non-U.S. person. However, if a non-U.S. person is the booking entity (the legal counterparty) to swaps, the requirements of the Dodd-Frank Act would apply to such non-U.S. person, even where a U.S. branch, agency, affiliate or subsidiary of such non-U.S. person engages in the respective solicitation or negotiation of such swaps.

6 Therefore, U.S. SDs and MSPs would be permitted to delay compliance with the entity-level requirements until January 1, 2013 (except with respect to the swap data recordkeeping, SDR reporting and large-trader reporting requirements).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.