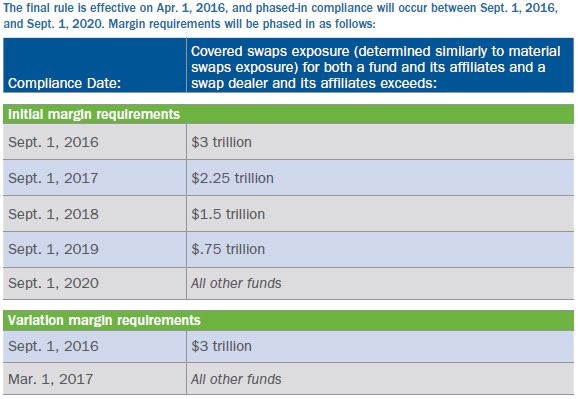

On Oct. 22, 2015, the Board of Directors of the Federal Deposit Insurance Corporation approved a joint final rule (the "final rule") establishing minimum initial and variation margin requirements for non-cleared swaps. The rules have been approved by the Office of the Comptroller of the Currency and are expected to also be adopted by the other prudential regulators (the Federal Reserve Board, the Farm Credit Administration, and the Federal Housing Finance Agency). Investment funds trading non-cleared swaps with registered swap dealers supervised by these prudential regulators ("covered swap dealers") will be indirectly impacted by these final rules.

The final rule essentially requires covered swap dealers to collect and, in some instances, post initial and variation margin with respect to non-cleared swaps with their counterparties. With respect to investment funds, the obligations of the swap dealer will depend upon whether the fund has material swaps exposure.

A fund has material swaps exposure if it and its affiliates have an average daily aggregate notional amount of non-cleared swaps, foreign exchange forwards, and foreign exchange swaps for March, April, and May of the previous calendar year (calculated only for business days and counting affiliate trades only once) exceeding $8 billion. Affiliate determinations are largely based on the consolidation of financial statements as opposed to a "control" standard, which will likely save fund complexes from more onerous requirements under the final rule. However, fund complexes may need to consider how they structure seed accounts for purposes of aggregating affiliate exposures.

With respect to initial margin and a fund with material swaps exposure, a covered swap dealer must both collect and post margin on a daily basis (in amounts not less than the amount specified by table or an approved margin model) with respect to any non-cleared swap, and qualified segregation is required for both parties (but not necessarily under tri-party documentation) with one or more third-party independent custodians.

With respect to initial margin and any other fund, a covered swap dealer must collect (with no requirement to post) initial margin at times and in the forms/amounts (if any) that the covered swap dealer determines appropriately address the credit risk posed by the fund and the risks of the relevant non-cleared swaps. Segregation for margin (if any) posted by the swap dealer is also required.

In each case, initial margin must be posted on or before the first business day following the day of execution, and a threshold of up to a $50 million may be applied to the aggregate credit exposures resulting from all non-cleared swaps between the fund and a covered swap dealer (and their respective affiliates). In that respect, the final rule explicitly notes that separate accounts having multiple managers will not receive a separate threshold for each manager of a sleeve of that account despite operational issues that are likely to result.

With respect to variation margin, regardless of whether a fund has material swaps exposure, a covered swap dealer must both collect and post mark-to-market margin on each business day, for a period beginning on or before the business day following the day of execution and ending on the date of termination/expiry. Variation margin is not required to be segregated, and no threshold applies. Accordingly, for any fund without material swaps exposure, the final rule should not significantly change current practice with respect to its margin posting obligations.

A minimum transfer amount will apply such that a covered swap dealer will not be required to collect or post margin from or to a fund unless the combined initial and variation margin that would otherwise be required to be delivered by a party exceeds $500,000 (or such lesser amount agreed by the parties). Eligible collateral for these purposes includes (i) any G11 currency, (ii) the currency of settlement for the non-cleared swap, and (iii) certain liquid U.S. or foreign government or corporate debt securities, certain listed equity securities, shares in certain pooled investment vehicles and gold. Non-cash collateral will be subject to haircuts specified (by table) in the final rule. An additive 8% cross-currency haircut applies whenever collateral is denominated in a currency other than the currency of settlement or (with respect to initial margin only) a currency other than an agreed termination currency under the relevant "eligible master netting agreement," except where cash variation margin is in a major currency.

In determining exposures, a covered swap dealer may net initial margin requirements on a portfolio basis in certain circumstances and net variation margin requirements on an aggregate, net basis for swaps covered by an eligible master netting agreement. The parties may elect to margin pre-compliance and post-compliance date swaps under one eligible master netting agreement but separate credit support annexes, with the effect of excluding pre-compliance date swaps from the requirements of the final rule.

When facing a fund, a covered swap dealer must execute documentation specifying methods, procedures, rules, and inputs for (i) determining the value of each non-cleared swap for purposes of calculating variation margin requirements, and (ii) calculating the amount of initial margin required for each non-cleared swap. The procedures for disputes of valuation of non-cleared swaps or valuation of assets posted as margin must be specified. Affected market participants will need to amend their non-cleared swaps documentation before the rule becomes effective to comply with these requirements and those described above.

Once the final rule is effective for a fund, if a fund becomes subject to more strict margin requirements (e.g., a fund exceeds the material swaps exposure threshold), then the more strict margin requirements will apply only for trades entered into after the change is effective, and if a fund becomes subject to less strict margin requirements (e.g., a fund no longer has material swaps exposure), then the less strict margin requirements will apply for trades entered into after the change as well as for any outstanding trades.

The joint final rule was developed in consultation with the U.S. Commodity Futures and Trading Commission and the U.S. Securities and Exchange Commission, which have yet to release their respective final rules establishing minimum margin requirements for swap dealers not supervised by a prudential regulator (including non-bank subsidiaries of a bank holding company).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.