The Federal Trade Commission ("FTC") announced its annual revision to the thresholds for premerger reporting of proposed acquisitions to the United States antitrust authorities under the Hart-ScottRodino Antitrust Improvements Act of 1976, as amended (the "HSR Act").1 Effective March 4, 2021, the minimum size-of-transaction threshold will decrease to $92 million.2 The FTC and the U.S. Department of Justice ("DOJ" and, together with the FTC, the "agencies") also announced that the agencies will temporarily suspend their practice of granting early termination of the waiting period under the HSR Act due to the transition to the new Administration, the COVID-19 pandemic, and the "unprecedented" volume of HSR filings received in the start of the fiscal year.3

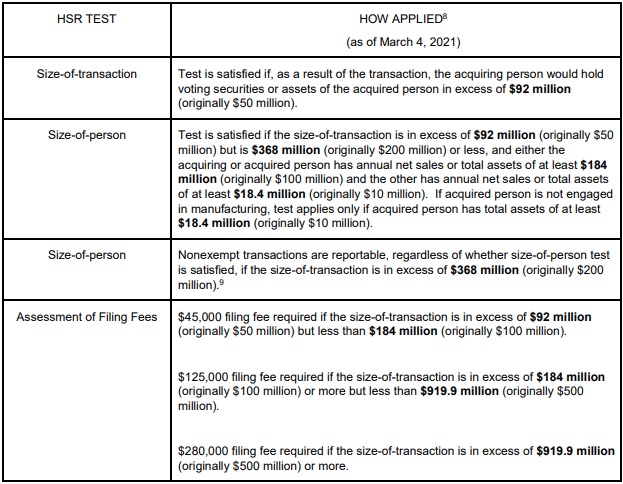

The HSR thresholds are adjusted annually, based on the change in gross national product, and had not been lowered since 2010. Under the new thresholds, transactions that will result in one person holding more than $92 million (originally $50 million) of another person's assets, voting securities or non-corporate interests may be subject to the HSR Act's premerger reporting requirements.4

The HSR Act requires all persons contemplating mergers or acquisitions of voting securities or assets that satisfy the size-of-transaction and size-of-person thresholds to notify the FTC and DOJ, pay a filing fee of $45,000 to $280,000 (depending on the size of the transaction) and observe a waiting period before completing the transaction. Once the agencies receive the required HSR forms and the filing fee, a 30-day waiting period commences (in most cases) and the transaction cannot close until the expiration or early termination of the waiting period—or, in the event the waiting period is extended by issuance of a "Second Request" for additional materials because significant antitrust concerns exist—expiration of an additional 30-day waiting period or a negotiated schedule following substantial compliance with the Second Request.

The HSR rules are complex. They include many exemptions and exceptions and at times require the aggregation of pre-acquisition holdings and reporting of various transactions, including (i) acquisitions of minority holdings of voting securities, (ii) subsequent acquisitions when a secondary threshold is crossed, and (iii) acquisitions of additional voting securities from the same issuer after more than five years, among other scenarios. The antitrust agencies may impose fines for failure to make required notifications, and the rules should be carefully reviewed with respect to any particular transaction.5

The FTC also revised thresholds for restrictions on interlocking directorates under Section 8 of the Clayton Antitrust Act of 1914, as amended, which prohibits the same person from serving as a director or officer of two competing corporations whose combined sales exceed certain thresholds. Competing corporations are covered if each one has capital, surplus, and undivided profits in aggregate of more than $37,382,000 (originally $10,000,000), with the exception that no corporation is covered if the competitive sales of either corporation are less than $3,738,200 (originally $1,000,000).6

The agencies' temporary suspension of early termination was announced shortly after the FTC released its revised thresholds. Under the HSR Premerger Notification program, filing parties may request and receive early termination of the 30-day waiting period for transactions that do not raise competitive concerns. The suspension was enacted due to the transition to the new Administration, the COVID-19 pandemic, and the "unprecedented" volume of HSR filings the agencies have received in the start of the fiscal year. The agencies, who will be "reviewing the processes and procedures used to grant early termination to filings," anticipate that the suspension will be brief. Republican-appointed FTC Commissioners Christine Wilson and Noah Phillips dissented from this decision.7

Appendix A

Footntoes

1 15 U.S.C. § 18a.

2 Revised Jurisdictional Thresholds for Section 7A of the Clayton Act, 86 Fed. Reg. 7870 (Feb. 2, 2021), available at https://www.federalregister.gov/documents/2021/02/02/2021-02110/revised-jurisdictional-thresholds-for-section-7a-of-theclayton-act.

3 FTC, DOJ Temporarily Suspend Discretionary Practice of Early Termination (Feb. 4, 2021), available at https://www.ftc.gov/newsevents/press-releases/2021/02/ftc-doj-temporarily-suspend-discretionary-practice-early.

4 Attached as Appendix A to this memorandum is a table indicating the adjusted filing thresholds and related filing fees.

5 The civil penalties for premerger filing notification violations under the HSR Act are now $43,792 per day. Adjustments to Civil Penalty Amounts, 86 Fed. Reg. 2539 (Jan. 13, 2021), available at https://www.federalregister.gov/documents/2021/01/13/2021-00483/adjustments-to-civil-penalty-amounts. The FTC must adjust these penalties for inflation annually each January. Id.

6 Revised Jurisdictional Thresholds for Section 8 of the Clayton Act, 86 Fed. Reg. 6330 (Jan. 21, 2021), available at https://www.federalregister.gov/documents/2021/01/21/2021-01172/revised-jurisdictional-thresholds-for-section-8-of-the-claytonact.

7 Statement of Commissioners Noah Joshua Phillips and Christine S. Wilson (February 4, 2021), available at https://www.ftc.gov/system/files/documents/public_statements/1587047/phillipswilsonetstatement.pdf.

8 Original thresholds shown for reference. As adjusted thresholds will apply to all transactions closing on or after March 4, 2021.

9 Nonexempt transactions valued at or less than $368 million (originally $200 million), but more than $92 million (originally $50 million) are reportable if both the size-of-person and the size-of-transaction tests are satisfied.

To subscribe to Cahill Publications Click Here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.