This Jones Day Global Merger Control Update highlights significant changes in merger control regimes in 2020. In this Update, we review: (i) changes in Australia, Belgium, Botswana, Bulgaria, Ecuador, France, Germany, Ireland, Kenya, Nigeria, Peru, Turkey, the United Kingdom, Uruguay, and Vietnam; (ii) adjustments to the current notification thresholds in Argentina, Italy, and the Philippines; and (iii) proposed changes to merger control rules in China, the European Commission, Finland, France, India, the United Kingdom, and the United States.

KEY CHANGES TO EXISTING MERGER CONTROL REGIMES

Australian Competition Authority Will No Longer List Completed Merger Investigations on the Public Register

In August 2020, the Australian Competition & Consumer Commission ("ACCC") announced that it will no longer list on the public register its merger investigations involving transactions that closed prior to a merger notification or before the ACCC reached an enforcement decision.

Merger notification is not mandatory in Australia prior to consummating a transaction. However, Australia features an informal notification procedure that allows parties to seek ACCC's views, prior to closing, about whether the agency is likely to challenge the transaction. Under the ACCC's new approach, an ACCC investigation into a closed merger that the parties did not voluntarily file with the ACCC will not become public unless the ACCC conducts an enforcement investigation or files an action to block the transaction in court.

The ACCC now will only issue a public statement prior to an investigation into a closed merger if it is warranted on public interest grounds. The ACCC considers the following factors in deciding whether to issue a public statement: (i) whether information about a merger investigation is already in the public domain; (ii) whether third-party comments are necessary for the ACCC's investigation; or (iii) whether a public announcement is necessary to encourage witnesses to make statements to assist the ACCC.

Belgium Adopts New Rules Regarding Expedited Merger Review

In January 2020, the Belgian Competition Authority ("BCA") expanded the list of mergers that qualify for its expedited review, i.e., "simplified procedure." The list now includes additional scenarios covering transactions in which:

- The merging parties' combined market share is less than 50%, and the increase in market concentration?according to the Herfindahl-Hirschman Index, calculated as the difference in the pre- and post-transaction sum of the square of each competitor's market share?is less than 150;

- The combined market share is less than 50%, and the incremental combined market share resulting from the proposed transaction is less than 2%;

- The transaction does not raise any significant competition concerns, no one opposes the merger, and the transaction satisfies one of the following two conditions: (i) two or more of the merging parties are active in the same relevant market, and the combined market share is more than 25% but less than 40% (horizontal mergers); or (ii) at least one of the merging parties operates in an upstream or downstream market from the relevant product market in which another merging party is active, and the market share of any party in the upstream or downstream market is more than 25% but less than 40% (vertical mergers).

Under the existing rules, transactions with the following characteristics qualify for the simplified procedure:

- Joint ventures that do not carry out significant activities in the Belgian market, i.e., Belgian turnover of the joint venture or the total value of assets transferred to it are less than €40 million (approximately US$48 million);

- Mergers or acquisitions of sole or joint control that do not involve any horizontal or vertical overlaps;

- Mergers or acquisitions of sole or joint control involving horizontal overlaps provided that the parties' combined market share is less than 25%;

- Mergers or acquisitions of sole or joint control involving vertical overlaps provided that the parties' individual or combined market share is less than 25%; and

- Acquisitions of sole control over a company by a party which already has joint control.

Botswana Amends Competition Law

The Botswanan Competition Act 17 of 2018 went into effect in December 2019, amending the Competition Act of 2009. The amendments introduced fines of up to 10% of the deal in consideration or the combined turnover of the parties (whichever is higher) for any party that implements a reportable merger prior to Competition and Consumer Authority's ("CCA") approval of a notifiable transaction.

In addition, the amendments introduce a reconsideration procedure in the event that the CCA rejects a transaction. To take advantage of the procedure, the parties must submit an application for reconsideration to the CCA within 14 days of the CCA's decision.

Bulgaria Adopts New Merger Filing Guidelines

Bulgaria's new filing guidelines took effect in January 2020. The guidelines introduced an expedited review for transactions that do not raise competition concerns (the "simplified procedure"), but also render a more burdensome filing procedure for mergers involving significant horizontal overlaps.

The simplified procedure applies if:

- In a horizontal merger, the parties' combined market shares do not exceed 15%; or

- In vertically related markets, the parties' market shares do not exceed 25%.

If the merging parties' market shares exceed these thresholds, the parties must submit a full filing form, and the Bulgarian Commission on Protection of Competition ("CPC") will conduct a lengthier review involving more extensive information requests compared to its prior procedures.

The guidelines now allow notifying parties to request a pre-notification meeting with the CPC (as is the case in the European Union). The notifying party also can now offer remedies within the CPC's first phase procedure, whereas remedies could only be officially proposed during second phase investigations under the old procedure.

Ecuador Introduces Simplified Merger Control Procedure

In April 2020, the Ecuadorian Competition Authority, Superintendencia de Control de Poder de Mercado ("SCPM"), introduced an expedited review procedure ("simplified merger procedure") for transactions that have no appreciable adverse effects on competition. Transactions qualify for the simplified procedure if they meet at least one of the following requirements:

- The acquirer does not directly or indirectly conduct economic activities in Ecuador.

- The parties' combined market share is less than 30% in each relevant market.

- The HHI index (described in "Belgium Adopts New Rules Regarding Expedited Merger Review") is less than 2,000, and the change in HHI as a result of the transaction is less than 250 in each of the relevant market.

- One or both parties to the transaction are at risk of failing. In its assessment, the SCPM will consider whether: (i) the parties are able to meet their financial obligations in the near future; (ii) there is an alternative acquisition that would have a less restrictive effect on competition; and (iii) the failing company would exit the market in the absence of the transaction.

France Publishes New Merger Control Guidelines

In July 2020, the French Competition Authority ("FCA") published merger control guidelines that introduce new procedural rules and update the FCA's analytical framework for merger reviews. The guidelines, which went into effect in the same month, incorporate recent case law and the FCA's recent decision-making practice.

The guidelines introduce the following procedural changes, among others:

- A period of 10 working days from notification for the FCA to confirm whether the file: (i) is complete and (ii) qualifies for the simplified procedure.

- The right to request appointment of a case handler within five working days for pre-notification consultation.

- Guidance on permissible, pre-closing conduct as well as guidance on conduct likely to lead to gun-jumping.

- Requirement that the FCA provide an anticipated review timeline if it plans to conduct an in-depth, Phase II review.

- Procedure for parties to request an amendment to existing remedies.

- Increased control of compliance with commitments.

The FCA also adopted the following changes to its substantive review standards:

- An updated description of the FCA's competitive analysis, broken down by types of competitive effects rather than by types of mergers.

- Examples of the use of and limits of certain economic tools applied to assess the unilateral effects of a concentration.

- A clarification of the FCA's approach to merger remedies, including updated standard commitments and mandates regarding trustees.

- A description of the FCA's methodology employed for transactions in the retail sector, such as the assessment of the effects of transactions on local markets or the assessment of the competitive effects of online sales.

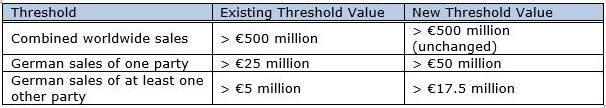

Germany Substantially Increases Merger Control Thresholds

German law requires a merger control filing if the transacting parties meet a combined global sales threshold in addition to domestic sales thresholds for at least two parties to a transaction, and there is no European Union filing. In recent years, low domestic sales thresholds in Germany led to a number of global transactions having to file in Germany, despite little local effect. As shown in the table below, the 10th Amendment to the German Act against Restraints of Competition ("ARC") increased the two domestic sales thresholds, which should lead to fewer merger control filings in Germany.

The latest amendments did not substantially alter the alternative value-based threshold introduced in 2017, which was intended to capture high-value acquisitions of targets that have little German revenue. The oft-cited exemplar is Facebook's acquisition of WhatsApp. Under this test, parties must make a German filing if one party has German sales of (now €50 million), the transaction consideration exceeds €400 million, and the other party is "substantially active" in Germany, even if it does not meet the lower sales threshold (now, €17.5 million).

The ARC Amendments also changed the de minimis markets rule threshold under which the Federal Cartel Office ("FCO") cannot block a transaction, with some exceptions, even if the deal would otherwise harm competition. The de minimis markets rule applies if a market has existed for at least five years and has a total annual value of less than €20 million, up from €15 million.

The ARC Amendments also introduced a new rule that permits the FCO to request a merger control notification from parties to successive acquisitions by a large market player of small companies largely operating in Germany. The FCO may now issue such orders to companies that have worldwide revenues of more than €250 million (approximately US$279 million) to notify mergers in "concentrated" sectors in which the company has revenues of more than €2 million (approximately US$2.2 million), two-thirds of which the company generated in Germany. The FCO's individual orders would be valid for three years, and a company receiving such an order could appeal its issuance to the FCO in the German courts.

The ARC Amendments also include special competition rules for digital platform companies, as detailed in our January 2021 Commentary[MAG1] .

Ireland Introduces Simplified Merger Notification Procedure

Ireland introduced an expedited review for transactions that do not raise competition concerns (the "simplified procedure") in July 2020. The simplified procedure is available in the following three scenar

- The merging companies are not active or potentially active in the same product or geographic market, or in any upstream or downstream market in which another party to the transaction is active or potentially active;

- The parties to the transaction are: (i) active in the same product or geographic market, but their combined market share is less than 15%; or (ii) active in markets that are upstream or downstream to one another, but the market share of each party is less than 25%; or

- One party acquires sole control over a company over which it already has joint control.

The rules require that the Irish Competition and Consumer Protection Commission ("CCPC") inform the merging parties about whether the simplified procedure applies within 10 working days of the parties submitting their notification to the CCPC.

Kenya Introduces Revised Merger Control

In December 2019, Kenya amended the Competition Act of 2010, introducing new notification thresholds. The new notification thresholds went into effect in January 2020. Parties must submit a merger control filing to the Competition Authority of Kenya ("CAK") if a transaction meets any of the following thresholds:

- The parties' combined turnover or asset value in Kenya (whichever is higher) is at least KES 1 billion (approximately US$10 million or €8.9 million), and the turnover or asset value of the target in Kenya is more than KES 500 million (approximately US$5 million or €4.4 million).

- The acquirer's turnover or asset value in Kenya exceeds KES 10 billion (approximately US$100 million or €89.3 million), and the parties are in the same market or could be vertically integrated, unless the transaction meets the merger control thresholds of the Common Market for Eastern and Southern Africa ("COMESA").

- The transaction is in the carbon-based mineral sector, and the value of the reserves, the rights, and the associated assets exceed KES 10 billion (approximately US$100 million or €89.3 million) as a result of the merger.

- The COMESA merger control thresholds are met, and two-thirds of the parties' turnover or value of assets is generated or located in Kenya (even if the combined turnover or asset value of the merging parties does not exceed KES 500 million, approximately US$5 million or €4.4 million).

COMESA is a free-trade area covering east and southern Africa, consisting of 21 member states. Until now, Kenya had not fully accepted that COMESA review takes precedence over its national laws. The wording of the new thresholds are subject to further CAK interpretation.

Finally, Kenya's amendments establish two new notification exemptions:

- The combined turnover or asset value (whichever is higher) of the merging parties in Kenya is between KES 500 million and KES 1 billion; or

- The parties are engaged in prospecting in the carbon-based mineral sector, irrespective of their asset value.

Parties must apply for the exemption to the CAK, which then has 14 days to determine whether the exemption applies.

Nigeria Issues Guidelines on Expedited Review for Foreign-to-Foreign Mergers With a Nigerian Component

Nigeria introduced guidelines on an expedited review procedure for foreign-to-foreign mergers with a Nigerian component. The guidelines, issued in November 2019, reduce the documentation burdens on parties to foreign-to-foreign mergers and cut the Nigerian Competition Authority's review period to 15 business days.

Peru Launches New Merger Control Regulation

In May 2020, the Peruvian government issued Decree No. 1510, which modifies and supplements the Peruvian Merger Control Act of 2019. The Peruvian government plans to implement the changes in March 2021, not August 2020 as originally scheduled.

As detailed in our previous Update, the new mandatory merger control rules require that all transactions that meet certain thresholds have to be notified to the Competition Commission at Instituto Nacional de Defensa de la Competencia y de la Protección de la Propiedad Intelectual ("INDECOPI"). The act requires parties to submit mandatory notifications to INDECOPI if the following thresholds are met:

- The parties' aggregate turnover in Peru exceeds PEN 495.6 million (approximately US$147 million or €132.5 million); and

- Each of at least two parties' turnover in Peru exceeds PEN 75.6 million (approximately US$22.4 million or €20.2 million).

A party that fails to properly notify a transaction or closes a transaction prior to obtaining the required clearance from INDECOPI is subject to a fine of up to 12% of its total annual turnover. INDECOPI also has authority to unwind any unauthorized transaction.

The new decree also implements an expedited notification procedure for transactions that are unlikely to raise anticompetitive effects. Transactions qualify for the expedited procedure if:

- The parties do not engage in economic activities in the same product or geographic market or do not participate in the same production line or value chain; or

- The merger results in a party obtaining exclusive control of another party in which it already holds joint control.

Nevertheless, INDECOPI has discretion to open an ordinary investigation within 10 days of notification.

Turkey Amends Competition Law

In June 2020, the Turkish Parliament passed the Competition "Amendment Law," modifying the Act on the Protection of Competition of 1994. The new rules went into effect in the same month. The key changes for merger control are:

- Significant Impediment of Effective Competition ("SIEC") test. Under existing rules, the Turkish Competition Authority ("TCA") can prohibit a transaction if it creates or strengthens an existing dominant position. The amendment adds the SIEC criterion, used by the European Commission, as a ground for prohibiting notified transactions.

- Gun-jumping remedies. The TCA may now impose any behavioral or structural remedies for anticompetitive conduct when parties fail to notify a transaction that would result in an SIEC.

United Kingdom Adds Sectors Falling Under Special Thresholds

In June 2020, the United Kingdom amended the Enterprise Act 2002 to add new economic sectors to its lower merger control notification thresholds. The new amendment went into effect in July.

As detailed in our June 2018 Commentary, the United Kingdom introduced lower merger control thresholds for transactions in certain industries that could raise public interest or national security issues, including deals involving products for military or dual military and civilian use, intellectual property for computing processing chips, or quantum technology. The amendments add deals in three new categories:

- Artificial intelligence. This includes businesses that produce, develop, and design artificial intelligence technologies, including components and service providers and all relevant intellectual property.

- Advanced materials. This includes businesses that develop products whose primary function is authentication using cryptographic means, including IT systems in critical infrastructure sectors.

- Cryptographic authentication. This includes businesses engaged in the research, production, exploitation, or supply of: (i) materials capable of modifying the detectability or identification of any object within specific wavelength ranges; (ii) alloys formed by chemical or electrochemical reduction of feed stocks in a solid state; (iii) any manufacturing processes involved in the solid state formation of alloys into crude or semi-fabricated forms, or powders for additive manufacturing to make parts from three-dimensional model data; and (iv) certain metamaterials.

The UK merger notification regime remains voluntary. A filing for a deal involving any of the above industries can be made (or requested by the Competition & Markets Authority ("CMA")) if:

- The acquired business has annual UK turnover of more than £1 million (approximately US$1.2 million or €1.1 million), (the standard threshold is £70 million); and

- The target alone (or combined with the buyer) has a "share of supply" of 25% or more.

Uruguay Reforms Merger Control Rules

In April 2020, Act No. 19.833 amending Uruguay's Competition Law went into effect. Most importantly, the amendments lowered the notification threshold from 750 million index units to 600 million index units. Translated to a revenue threshold, parties now must notify transactions to the Uruguayan Comisión de Promoción y Defensa de la Competencia ("CPDC") if their combined turnover in Uruguay in any of the three previous fiscal years to the transaction was US$76 million (€67 million) in 2017 and 2018 and US$71 million (€63 million) in 2019. The alternative combined market share threshold (50% or more) remained unchanged.

The CPDC has 60 days to issue a decision.

In addition, transactions are exempted from notification when:

- The acquirer already holds 50% shares of the acquiring company.

- The transaction involves the acquisition of bonds, debentures, obligations, any other debt security of the company, or non-voting shares.

- The transaction involves the acquisition of a single entity by a foreign entity that did not previously own assets or shares of other companies in Uruguay.

- The transaction involves the acquisition of companies declared bankrupt and offered in an insolvency tender, provided that only one bidder has participated in the bidding process.

Vietnam Issues Guidance on Mergers

Vietnam issued new guidelines on the implementation of the Law of Competition that clarify, inter alia, its merger control procedures. The new guidelines took effect in May 2020.

The guidelines now define an "acquisition of control." A party acquires control in Vietnam if, as a result of the transaction, the acquiring party holds more than 50% of the capital, voting rights, or assets of the acquired party, or where it obtains power to decide on material matters.

The merger notification thresholds are now set as follows:

- The combined market share in the relevant market in Vietnam is 20% or more;

- The total turnover or assets of one of the parties in Vietnam exceeds VND 3,000 billion (approximately US$130 million or €116 million); or

- For local transactions, the value of the transaction exceeds VND 1,000 billion (approximately US$40 million or €35 million).

In addition, transactions in the insurance, securities, or credit sectors have specific thresholds.

If one of the thresholds is met, the guidelines now set out a preliminary review period of 30 days by the Vietnam Competition and Consumers Protection Authority, while an official review will take 90 days, extendable for another 60 days.

ADJUSTMENTS TO NOTIFICATION THRESHOLDS

Argentina Updates Merger Control Thresholds

As indicated in a previous Update, Argentina is conducting a comprehensive overhaul of its antitrust laws, including merger control. The most notable proposed change is the introduction of a suspensive, pre-merger regime to replace the existing post-closing review. The draft bill is under consideration by the Argentinian Congress and might become applicable as early as April 2021.

In addition, in January 2020, the Argentinian Office of Foreign Trade updated its merger control thresholds. A merger control filing is required in Argentina if the combined aggregate turnover of the merging parties for the preceding fiscal year exceeds 100 million adjustable units (AR$4,061 million, or approximately US$55 million or €49 million).

Transactions are exempt from notification if the value of the transaction, or the value of assets to be merged, acquired, transferred, or controlled in Argentina each do not individually exceed AR$812.2 million (approximately US$11 million or €9 million). This exemption does not apply if, within the same relevant market: (i) there had been economic operations that jointly exceed AR$812.2 million during the preceding 12 months; or (ii) there had been economic operations that jointly exceed AR$2,436 million (approximately US$33 million or €29 million) during the preceding 36 months.

Italy Updates Merger Control Turnover Thresholds

In March 2020, the Italian Competition Authority ("ICA") revised it merger control turnover thresholds. The new thresholds, which entered into force immediately, require notification of all mergers that satisfy the following conditions:

- The aggregate turnover in Italy of all the businesses involved is more 504 million euros (approximately US$610 million); and

- The individual turnover in Italy of at least two of the transacting partings is more than 31 million euros (approximately US$37 million).

Philippines Adjusts Notification Thresholds

In September 2020, the Philippine Competition Commission ("PCC") adjusted the mandatory notification thresholds in line with the government's COVID-19 economic stimulus response. Effective until September 15, 2022, parties must notify the PCC if they satisfy both the size-of-party and the size-of-transaction tests.

- The size-of-party threshold increased from PHP 6 billion to PHP 50 billion (approximately US$ 1 billion or €883 million). The size of party is the aggregate value of the assets in the Philippines and revenues from sales in, into, or from the Philippines of the filing ultimate parent entity, including all entities that it controls directly or indirectly.

- The size-of-transaction threshold increased from PHP 2.4 billion to PHP 50 billion (approximately US$ 1 billion or €883 million). The size of transaction is the total value of the acquired assets and/or gross revenues in the Philippines that the acquired assets generate, or the total value of the acquired entity and any entities it controls.

CONSIDERED CHANGES

China Received Comments on Anti-Monopoly Law Amendments

In January 2020, the State Administration for Market Regulation ("SAMR") released draft amendments to the Anti-Monopoly Law for public comments.

The draft amendments would allow SAMR to adjust the notification thresholds according to the level of economic development and the size of the industry concerned. Additionally, transactions that do not meet the turnover notification thresholds could still be reviewed if they have or are likely to have a restricting effect on competition.

The draft amendments also introduce a procedure that would temporarily pause SAMR's merger review period in the following circumstances: (i) the notifying party applies for a suspension or agrees to suspend the review procedure; (ii) SAMR requests that one of the parties provides additional documents or information; or (iii) the parties are negotiating remedies with SAMR. The draft amendments also establish new authority for SAMR to reexamine the transaction if the materials provided by the parties prove false or inaccurate.

In addition, the proposed amendments would increase the fines for merger control violation up to 10% of the parties' revenues in the prior year in cases such as failures to notify, gun-jumping, or breach of the remedies imposed. SAMR's existing maximum fine for such violations is just CN¥500,000 (approximately US$76,500 or €63,000).

SAMR has not yet set a specific date for the adoption of these amendments.

European Commission Considers Sweeping Proposals to Regulate Digital Sector

As detailed in our January 2021 Commentary, the European Commission ("EC") recently released two legislative proposals, the Digital Services Act and Digital Markets Act, that would significantly increase the EC's regulatory oversight of online platform companies. Although these rules largely relate to conduct rather than merger control, they would require any company determined to be a "gatekeeper" to notify the EC of proposed acquisitions in the digital sector, including small acquisitions that would otherwise fall below the EC's merger review thresholds.

Finland Considers Amending the Turnover Thresholds for Mergers and Extending the Powers of the Competition Authority

The Finnish Ministry of Economic Affairs and Employment announced that it will examine whether the turnover thresholds for mergers should be amended and whether the Finnish Competition Authority should be granted the power to examine mergers falling below the minimum turnover thresholds that might nonetheless have negative effects on competition.

France Considers Redefining Its Merger Control Tools for the Digital Economy

In February 2020, the French Competition Authority ("FCA") published a paper on the adaptation of merger control rules to the digitalization of the economy. The FCA document argues that competitive analyses of mergers in the digital sector should be more focused on potential anticompetitive effects unrelated to price. The FCA also indicated that EU competition authorities should make more frequent use of behavioral remedies.

The FCA urges EU competition authorities to adopt the following practices:

- Mandatory merger control notification for all acquisitions by global digital platforms, either to the national competition authorities or to the European Commission. This proposal is already in a draft bill in discussions before the French Parliament.

- Adopt rules whereby competition authorities have authority to require any company to notify a merger before or after closing, any time within a 12-month period after the transaction closed, provided that a combined €150 million worldwide turnover threshold is met, that the transaction raises substantial competition concerns in a relevant market, and that the transaction does not fall within the jurisdiction of the European Commission; and

- Allow companies to voluntarily notify all mergers which satisfy the conditions discussed in the second bullet above. Voluntary notification and clearance would immunize the transaction from any further challenge from EU Member State national competition authorities.

India Calls for Feedback on Competition Amendment Bill

In February 2020, the Indian Government launched a public consultation process with the publication of the Competition Amendment Bill 2020, amending the Competition Act 2002. Although the consultation process is complete, the Parliament has not yet enacted the amendment.

If enacted, the amendment will clarify what it means to acquire "control," as well as how India defines companies within the same corporate "group." The amendment also will introduce the following key changes:

- The Competition Commission of India ("CCI") will have 150 calendar days to review a notified transaction, down from the current 250 calendar-day period. Nonetheless, CCI will have discretion to extend the 150-day period up to 30 days if it requires the parties to provide additional materials.

- The amendment would enshrine a fast-track approval, known as the "Green Channel," in Indian law. The Green Channel permits the CCI to issue on-the-spot approval for combinations that have no appreciable adverse effects on competition. Examples include transactions without horizontal overlaps, vertical relationships, or complimentary products or services.

- In Green Channel reviews, the CCI will have to inform the parties of its prima facie opinion within 20 calendar days, down from the current 30 calendar days.

U.K. Competition & Markets Authority Calls for a New Merger Regime for Digital Markets

In December 2020, the Competition & Markets Authority ("CMA") issued advice to the government on a new regulatory regime to address the alleged market power of digital companies that hold a so-called "Strategic Market Status" ("SMS").

The CMA recommends implementing specific merger rules for companies with an SMS. The key features of the proposed merger control regime are the following:

- Mandatory reporting requirement for all transactions entered into by SMS companies. The existing voluntary merger reporting regime would continue for non-SMS companies. This requirement would apply only to acquisitions of control in enterprises but not to acquisitions of "bare assets."

- Acquisitions of clear-cut levels of control by SMS companies that meet clear threshold tests should be subject to mandatory notification under the SMS merger control regime.

- In addition, the CMA is proposing to impose fines where an SMS company has failed to notify a relevant transaction.

U.S. Federal Trade Commission and Department of Justice Antitrust Division Propose Changes to Hart-Scott-Rodino Act and Rules

In December 2020, the U.S. agencies published a Notice of Proposed Rulemaking ("NPRM") and an Advanced Notice of Proposed Rulemaking ("ANPRM") that could alter certain reporting pre-merger requirements under the Hart-Scott-Rodino ("HSR") Act of 1976. The NPRM includes specific proposals that would:

- Exempt acquisitions of 10% or less of a company's voting securities when the acquirer does not have a "competitively significant" relationship with the target ("De Minimis Exemption").

- Change the definition of a company's filing entity to include "associates," expanding the scope of the filing entity and capturing more information in private equity and other investment fund acquisitions ("Associates Rule").

In contrast, the ANPRM does not include specific proposals, but instead requests public comment about whether changes are necessary to a variety of HSR rules.

De Minimis Exemption

The HSR rules already include an exemption for acquisitions of 10% or less of the voting securities of a company made "solely for investment." However, the agencies interpret this exemption narrowly, and even minimal shareholder engagement may fall outside the exemption. This exemption will not change (for now).

The new rules would add an exemption for acquisitions of 10% or less of a company's voting securities when the acquirer does not have a "competitively significant" relationship with the target regardless of investment intent. The proposed rule defines a competitively significant relationship as: operating competing lines of business, owning 1% or more of a competitor, having existing vendor-vendee sales of $10 million or more, having an employee, officer, or director who is an officer or director of the target or the target's competitor.

Associates Rule

Under the HSR rules, a buyer's "Ultimate Parent Entity" ("UPE") determines the HSR filing entity, whether a filing is necessary, and the scope of the information required for the filing. The UPE is the person or entity at the top of the corporate chain, i.e., one that is not "controlled" by any other entity. For "non-corporate entities" such as limited liability companies or limited partnerships, the HSR rules evaluate control based on economic ownership. Thus, a non-corporate entity is its own UPE if no one holds the right to 50% or more of the profits or assets upon dissolution.

Investment funds and master limited partnerships sometimes utilize non-corporate entities that are their own UPE even though the funds might be part of the same family or have common management. As a result, an acquisition by an investment firm may not require an HSR filing when other acquirers might have to file. For example, if Company A acquires B's shares for $120 million, the parties likely will have to file under HSR. If Investment Firm A acquires the same share through three commonly managed funds that each is its own UPE and where each acquires $40 million in shares of B, then there is no HSR filing.

The proposed rule would address this difference by including a buyer's "associates" in the definition of the filing entity. Under the HSR rules, associates are entities that the UPE does not control (as that term is defined in the HSR rules) but that are under the same management.

Below are the two most common types of transactions affected:

- Investment Fund divides acquisition among multiple funds where each is its own UPE. Although the transaction value in total exceeds the HSR threshold ($94 million in 2020), no acquisition by any one fund exceeds the HSR threshold.

- Investment Fund establishes a new fund that has no balance sheet and no assets other than cash to complete an acquisition valued at $376 million or less (in 2020).

ANPRM

As noted above, the ANPRM does not propose specific changes, but instead calls for public comment about whether the antitrust agencies should alter various other HSR rules. The topics include:

- Calculating size of transaction (to determine whether a filing is required).

- Real estate investment trusts.

- Treatment of non-corporate entities, such as LLCs.

- Acquisitions of small amounts of voting securities.

- Influence outside the scope of voting securities.

- Transactions or "devices for avoiding" the HSR Act requirements.

- HSR filing process.

Next Steps

Public comments on the NPRM and ANPRM are due to the U.S. Federal Trade Commission by February 1, 2021. Following receipt of public comments, the agencies will consider whether changes are necessary to the proposals, including whether to adopt changes at all. There is no set timeframe for action on the proposed changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.