The FTC took action against Intuit, Inc., the maker of TurboTax tax filing software, for advertising that its software was "free," when in reality millions of consumers were ineligible to use the "free" version. The FTC's Chief Administrative Law Judge (ALJ) issued an initial decision that Intuit violated Section 5 of the FTC Act by engaging in deceptive advertising practices when they advertised "free" tax services and products that millions of consumers could not use.

TurboTax offers several products that help consumers prepare and file their taxes. The products are categorized by the level of assistance provided: Do-It-Yourself ("DIY"), Live Assisted, and Live Full Service. The DIY products come in four different categories differentiated by the complexity of the consumer's tax situation: TurboTax Free Edition, TurboTax Deluxe, TurboTax Premier, and TurboTax Self-Employed. TurboTax Free Edition is available to taxpayers with "simple tax returns," as defined by Intuit. This definition has changed over time to reflect changes to tax forms and schedules made by the IRS. Approximately 100 million taxpayers are not eligible to file for free using the TurboTax Free Edition.

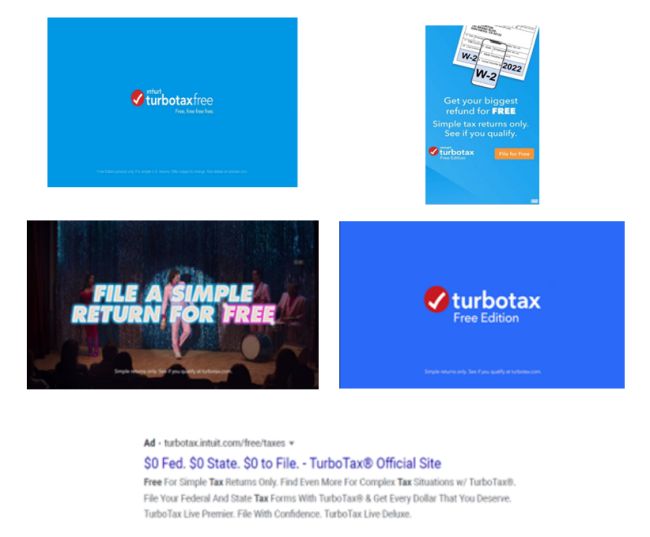

Intuit's advertising campaigns at issue emphasized that TurboTax is "free" and included a disclosure indicating that the offer is limited to consumers with "simple tax returns." Many of these ads also featured a voiceover stating "That's right. TurboTax Free is free. Free, free free free." Examples of the TurboTax ads at issue include:

To determine whether the ads were deceptive, the ALJ analyzed the claims conveyed in the ads, whether those claims were false or misleading, and whether those claims were material to consumers' purchasing decisions.

When analyzing the claims conveyed, the ALJ determined that at least a significant minority of reasonable consumers would believe that TurboTax online tax filing was free for them to use. Intuit argued that reasonable consumers understand that free offers, including free tax preparation offers, have limitations, even if the limitations are not stated in the advertisements. The ALJ rejected this argument because, even if some consumers understood that the free tax filing offer has some qualifications and/or did not apply to them, at least a significant minority of reasonable consumers do not understand the "simple returns" limitation, including how it applies to their own tax situation. The ALJ concluded that at least a significant minority of consumers would come away with the impression that TurboTax's online tax filing would be free for them.

The ALJ next analyzed whether Intuit's "free" claims were false and/or misleading. Because only about one-third of taxpayers qualify for the free version of TurboTax, the ALJ found Intuit's claim that consumers can file for free to be false for approximately 100 million taxpayers. Intuit argued that its ads were not false because the free version of TurboTax is in fact free for those who qualify. The ALJ rejected this argument because the ads were written in a way that falsely conveys to a significant minority of consumers that they can file their taxes for free with TurboTax when they cannot.

Finally, the ALJ analyzed whether Intuit's ad claims were material, i.e., likely to affect a consumer's choice of a product. The ALJ found that misrepresentation of the product's cost was material because cost is an important factor in consumers purchasing decisions. Intuit argued against materiality because any alleged misrepresentation was about the qualifications to use the product, rather than the cost of it. The ALJ rejected this argument because product efficacy is also material, and a product has no efficacy for a consumer who is ineligible to use it.

The ALJ therefore concluded that Intuit engaged in deceptive advertising in violation Section 5 of the FTC Act. As a result, Intuit was prohibited from representing that a good or service is "free" unless it is free for all consumers or all terms and conditions for receiving the free good or service are clearly and conspicuously set forth at the outset of the offer. The ALJ's order also required that "if the goods or services are not [f]ree for a majority of U.S. taxpayers" that fact is clearly and conspicuously disclosed at the outset of the offer. Intuit was also prohibited from misrepresenting any material fact in its advertising, including (1) the cost of its goods or services; (2) that consumers can only file their taxes online accurately if they use a paid TurboTax product; (3) that consumers can only claim a tax credit or deduction of they use a paid TurboTax product; and (4) any other fact material to consumers, such as total costs, refund policies, and product performance and efficacy. The ALJ's decision is subject to automatic review by the full FTC, and appeal briefing is currently underway.

Case citation: In re Intuit, Inc., FTC Docket No. 9408 (Sept. 6, 2023).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.