The SEC has proposed a long-awaited set of rules that provides its own contribution to the running debate over how US rules should apply to cross-border activity in derivatives. In a single release, the SEC's proposed rules (the "Proposed Rules"),1 issued on May 1, 2013, take a comprehensive approach to addressing the application of Title VII of the Dodd-Frank Act ("Dodd-Frank" or "DFA") to cross-border activity in security-based swaps ("SBS") in a number of areas, including dealer registration and regulation, clearing, exchange trading and reporting. The SEC's Proposed Rules come in the midst of significant discussion, and criticism, of the approach taken by the Commodity Futures Trading Commission (the "CFTC") in its own proposed guidance on cross-border issues (issued approximately 10 months ago) by market participants and non-US regulators.

Introduction and Executive Summary

If adopted, the Proposed Rules would address several key registration and regulatory requirements in the cross-border context:

- Registration. Non-US persons would have to count only transactions with US persons and transactions conducted in the United States toward the de minimis threshold for security-based swap dealer ("SBSD") registration.

- Dealer Regulatory Requirements. Non-US persons that are registered security-based swap dealers would need to comply with entity-level regulatory requirements and, in connection with transactions with US persons and transactions conducted in the United States, transaction-level regulatory requirements. Substituted compliance would, however, potentially be available for both sets of requirements, even for transactions with US persons.

- Mandatory Clearing and Exchange Trading. When implemented, mandatory clearing and exchange trading requirements would apply to cross-border transactions (whether or not involving registered SBSDs) where one of the counterparties to a transaction is a US person (or a non-US person guaranteed by a US person) or the transaction is conducted in the United States, with certain exceptions. Substituted compliance may be available for those requirements.

- Reporting. Regulatory reporting and public dissemination requirements would apply to transactions with a US person counterparty or guarantor, transactions conducted in the United States, transactions involving a registered SBSD or major security-based swap participant ("MSBSP") and transactions cleared through US clearing organizations. Substituted compliance may be available in some circumstances.

In broad outlines, the SEC's Proposed Rules take a generally similar approach to the regulation of cross-border activity to that proposed by the CFTC, with some important differences.

- Broader Use of Substituted Compliance (Potentially). The SEC's approach contemplates potentially broader use of substituted compliance for transactions between non-US persons and US persons, where the CFTC had generally proposed that US requirements would apply in those cases.

- Focus on US Activity. In addition to examining whether a market participant is a "US person," the SEC's approach focuses on whether relevant activity, including solicitation, negotiation, or execution of a transaction, takes place in the United States. The CFTC's proposal, by contrast, focuses principally on the location of the parties, rather than the location of related conduct. As a result, the SEC's approach may result in a broader range of activities and market participants being potentially subject to US jurisdiction, or require changes in the way business is conducted in order to avoid such jurisdiction.

- Approach to Cross-Border Clearing, Execution and Reporting. The Proposed Rules provide specific guidance as to the application of US rules to clearing, execution and reporting requirements, whether or not registered dealers are involved in such transactions. The Proposed Rules also would set out a framework for potential application of substituted compliance to such requirements.

If adopted, the Proposed Rules will address a number of questions left open by the CFTC proposal. At the same time, several key issues would remain to be addressed, including how the restrictions on US activities would be implemented in practice and the manner in which the SEC would permit substituted compliance. The effectiveness of substituted compliance as a means of limiting the risk of conflicting or overlapping regulation will, of course, depend on the timing and scope of any substituted compliance determinations by the SEC. Significantly, most of the major substantive SEC rulemakings on SBS remain to be finalized, and the ultimate regulatory framework for SBS will depend as much on those final rules as on the cross-border approach proposed by the SEC.2

This client alert summarizes the Proposed Rules as they relate to (1) registration and regulatory requirements for dealers and major market participants, (2) clearing, reporting and trade execution requirements, and (3) the procedures for substituted compliance.

Scope of US Regulatory Requirements: US Persons and US Conduct

The application of various requirements of the Securities Exchange Act of 1934 (the "Exchange Act") to cross-border transactions in SBS under the Proposed Rules depends to a great extent on two principal factors: (1) whether a party to the transaction is a "US person" and (2) whether the transaction is a "transaction conducted within the United States."

US Person Definition

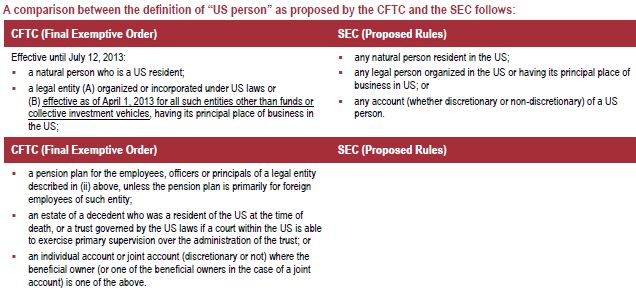

A "US person" is defined in the Proposed Rules as:

- any natural person who is a United States resident;3

- any legal person organized in the United States or having its principal place of business in the United States; or

- any account (whether discretionary or non-discretionary) of a US person.

The proposed definition excludes certain international organizations, such as the International Monetary Fund, the International Bank for Reconstruction and Development, the United Nations and their respective agencies and pension plans. This proposed definition is a narrower definition than the definition proposed by the CFTC in the CFTC Cross-Border Guidance, and is somewhat simpler than the definition used by the CFTC in its current exemptive order.4 The SEC also declined to use its Regulation S definition of "US person," which has a number of other exemptions (including for US fiduciaries of foreign accounts), as not appropriate for the SBS rules.

The SEC's "US person" definition does not contain an exclusion for foreign branch offices of a US person. Under the Proposed Rules, an entity's status as a US person is proposed to be determined at the legal entity level and to apply to the entire entity, including any foreign operations that are not separately organized.5

An entity whose principal place of business is located in the United States cannot avoid US person status by organizing under foreign laws. Significantly, the "principal place of business" prong of the SEC definition, unlike the CFTC exemptive order definition, potentially applies to collective investment vehicles and fund entities. (Such entities may also be captured by the "transaction conducted within the United States" prong, as discussed below.)

Finally, accounts, regardless of their location, will bear the status of their owner, and not that of the fiduciary or manager holding or maintaining the account. Under this prong of the definition, client accounts will not be attributed to the asset manager or investment adviser, but rather the beneficial owners.6

Transactions Conducted Within the United States

A transaction will be considered a "transaction conducted within the United States" under the Proposed Rules if it is solicited, negotiated, executed or booked within the United States, by or on behalf of either counterparty, regardless of the location, domicile or residence status of either counterparty.7 Accordingly, the involvement of a US branch or associated person (including any US affiliate or US third-party agent) of either counterparty in the transaction may bring the transaction within US jurisdiction. Submission for clearing, reporting a transaction to a SB SDR, or the use of collateral management services in the United States, however, would not on its own constitute conduct within the United States.

As a result of these two concepts, under the Proposed Rules, a transaction between two non-US persons that is conducted outside the United States will generally be outside US jurisdiction (with certain exceptions where a party is guaranteed by a US person). Where a transaction involves a US person, or is conducted within the United States, consideration will have to be given to whether US rules apply and whether substituted compliance may be available, as discussed below.

Substituted Compliance

The SEC is proposing to consider making substituted compliance determinations with respect to four distinct categories of requirements:8

- Requirements applicable to registered SBSDs in Section 15F of the Exchange Act and related rules (e.g., capital, margin, risk management, recordkeeping and reporting, and diligent supervision requirements);

- Requirements relating to regulatory reporting and public dissemination of information on SBS;

- Requirements relating to clearing of SBS; and

- Requirements relating to trade execution of SBS.

With respect to each of these categories, the Commission is proposing a "comparability" standard as the basis for making a substituted compliance determination. The SEC states that it would endeavor to take a "holistic approach" in making substituted compliance determinations by focusing on regulatory outcomes as a whole for the requirements within a category, rather than a rule-by-rule comparison.

Accordingly, the SEC does not envision making a comparability determination by looking to whether a foreign jurisdiction has implemented specific rules and regulations that correspond to rules and regulations adopted by the Commission. Rather, the SEC would determine whether the foreign regulatory system in a particular area achieves regulatory outcomes that are comparable to the regulatory outcomes of the relevant provisions of the Exchange Act, taking into consideration any relevant principles, regulations, or rules in other areas of the foreign regulatory system to the extent they are relevant to the analysis. As part of this review, the SEC would consider the ways in which a foreign regulatory system achieves its overall goals and purposes, including those undertaken in response to the G20 commitments relating to derivatives.

Although neither the SEC nor the CFTC is proposing to make its comparability determination by looking at the foreign regulatory regime as a whole,9 the CFTC has proposed a more restrictive approach that would involve on an individual requirement basis.10 Under its approach, the CFTC may permit substituted compliance with regulations of the non-US person's home jurisdiction to the extent that the comparability standard is met for certain requirements, but require compliance with certain CFTC rules where comparable home country regulations are lacking.

The SEC would likely make a substituted compliance determination on a class or jurisdiction basis, depending on the foreign regulator and the particular regime, rather than on a firm-by-firm basis.

The proposals with respect to substituted compliance for particular categories of requirements are discussed in further detail below.

To read this article in full, please click here.

Footnotes

1 Cross-Border Security-Based Swap Activities; Re-Proposal of Regulation SBSR and Certain Rules and Forms Relating to the Registration of Security-Based Swap Dealers and Major Security-Based Swap Participants; SEC Proposed Rule (May 23, 2013), 78 FR 30967, available at http://www.gpo.gov/fdsys/pkg/FR-2013-05-23/pdf/2013-10835.pdf.

2 The SEC has reopened the comment period for the major substantive regulations. See Reopening of Comment Periods for Certain Rulemaking Releases and Policy Statement Applicable to Security-Based Swaps Proposed Pursuant to the Securities Exchange Act of 1934 and the Dodd-Frank Wall Street Reform and Consumer Protection Act, Release No. 34-69491(May 1, 2013), available at http://www.sec.gov/rules/proposed/2013/34-69491.pdf.

3 Proposed Rules, 78 FR at 30996. US citizens who are resident abroad would not be considered a US person under the proposed definition.

4 Final Exemptive Order Regarding Compliance With Certain Swap Regulations, 78 FR 858 (January 7, 2013) ("Final Exemptive Order"). The definition of "US person" in the Final Exemptive Order expires on July 12, 2013.

5 In contrast, Regulation S looks to the physical location of a branch office rather than the jurisdiction of an entity's organization. Proposed Rules, fn. 289, 78 FR at 30997.

6 This is consistent with the approach to managed accounts adopted by the CFTC and the SEC in their joint rules further defining certain registrant categories. Further Definition of "Swap Dealer," "Security-Based Swap Dealer," "Major Swap Participant," "Major Security-Based Swap Participant" and "Eligible Contract Participant," Exchange Act Release No. 66868 (Apr. 27, 2012), 77 FR 30596, at 30690 (May 23, 2012) ("Intermediary Definitions Adopting Release").

7 In the context of mandatory clearing, the SEC requested comment on whether a transaction in which the only conduct occurring in the United States is limited to negotiating or soliciting the transaction would carry risk into the US financial system and therefore should be subject to US regulation. Proposed Rules, 78 FR at 31080.

8 Applications for substituted compliance must be filed in accordance with a new proposed rule 17 CFR § 240.0-3.

9 The SEC states that making a comparability determination by looking at the entire set of SBS requirements on a regime-wide basis with respect to regimes that have implemented regulations consistent with the overall objectives of the G20 commitments would be unworkable in light of the SEC's responsibility to implement the specific statutory provisions of the Exchange Act added by Title VII of the DFA. Proposed Rules, 78 FR at 31086.

10 CFTC Cross Border Guidance, 77 FR at 41232.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.