WELCOME

Welcome to our second quarterly newsletter for HR and In-house employment lawyers in financial services. In this edition we look at the implications for the sector of the Government's latest proposals for employment law reform. We also focus on latest bonus news, equality issues and summarise a couple of recent relevant cases. We hope you find this informative and would be very interested to receive your feedback on the topics and format.

Reform

September has seen the publication of two consultation papers, Ending the Employment Relationship and Underhill's Review of the Employment Tribunal Rules, and two responses to calls for evidence on TUPE and compensated no-fault dismissals for small employers. We look at the proposals most likely to have an impact on the financial services sector.

Settlement Agreements

The most interesting proposal is the detail on settlement agreements in the consultation on Ending the Employment Relationship. The Government wants to make it easier for employers to dismiss employees without the risks, fear and cost of litigation and is now consulting on ways of increasing the use of settlement agreements and making offers of settlement.

The current "without prejudice" regime only applies if there is a "dispute" in existence. This makes it difficult for employers to initiate conversations about ending employment without the risk of constructive dismissal claims and of any offer or discussions being referred to as part of any subsequent claim if agreement is not reached. The concept proposed would allow employers to have such conversations. However, crucially the protection will only be available in the context of potential unfair dismissal liability and will not cover discrimination or whistleblowing claims.

However, crucially the protection will only be available in the context of potential unfair dismissal liability and will not cover discrimination or whistleblowing claims.

The Government is asking ACAS to draw up a statutory code and guidance to ensure employers handle settlement correctly. This will also make it clear that "improper" behaviour will not be protected with specific examples. It is also consulting on template letters and a model agreement, whether there should be a guideline tariff to inform negotiations and if so, how this should be approached; i.e. as a set figure or formula or a list of issues for the employer to consider in deciding the amount.

Likely practical impact

This, no doubt, sounds like an attractive way of dealing with problem employees with apparently minimal risk and is welcome news for employers. However, the danger is that managers could rush into making settlement offers and, without proper training and awareness, get it wrong resulting in claims of discrimination and/or constructive dismissal. Although the Government is trying to reduce the burden on businesses, this could end up backfiring.

Unfair dismissal compensation

The other main proposal concerns changing the level of the unfair dismissal compensatory award: by reducing the overall statutory cap, currently £72,300 to between 1 and 3 times average earnings (currently £25,882 and £77, 646) and setting a cap on individual awards of 12 months pay where this is less than the overall cap. This is to address unrealistic perceptions and expectations about the likely level of compensation whereas in fact the average award for unfair dismissal last year was less than £5,000.

Likely practical impact

Although again this is ostensibly good news for employers it may lead to high earning employees trying to find some form of discrimination to hook onto any claim to get over the reduced cap.

Whistleblowing loophole to be closed

An unintended consequence of the whistleblowing legislation is that employees have been able to use a breach of their own contracts to make a claim. Whistleblowing claims are not subject to any limit on compensation and claims are often used by opportunist employees/their lawyers as extra leverage in settlement negotiations. The Enterprise and Regulatory Reform Bill proposes an amendment to the legislation so that a qualifying disclosure must be in the public interest as well as in the reasonable belief of the worker. The closure of this loophole will be welcomed by employers, particularly those in the sector, given the proliferation of such claims, often with little or no foundation. This is expected to come into force in spring 2013.

The closure of this loophole will be welcomed by employers, particularly those in the sector, given the proliferation of such claims, often with little or no foundation.

Bonus news

European Parliament plans to cap bankers' bonuses

The European Parliament is considering a new limit on bankers' bonuses set at 100% of fixed pay although the European Commission opposes the plans. Negotiations between representatives of parliament and member states are continuing. We will update you on further developments.

Claw-back of bonuses

It has been reported that Deutsche Bank is introducing a mechanism to claw back bonuses earned by employees at former employers. This will apply to unvested share awards from previous employers that have been converted into DB shares. Whilst it is, of course, not completely clear exactly how Deutsche Bank rules are to operate, this does raise some interesting points deriving from the FSA remuneration code.

In the circumstances, where an institution is "making whole" a new joiner in relation to forfeited remuneration, principle 12C of the Code requires the new employer to take reasonable steps to ensure that remuneration is not more generous than that which was forfeited, and is also subject to appropriate performance adjustment requirements.

The potential policy problem is that individuals may be able to effectively walk away from risks which may materialise if replacement awards do not remain linked to performance with their previous employer. The previous employer may be reluctant, however, to alert the new employer regarding risks that have materialised in its business. New employers may also want to ensure that awards tie to and incentivise performance with them rather than previous employers. In short, here one of the key policy aims of the Code does not fully align with the interests of individual banks.

Cap on bonuses

UBS is also reportedly considering placing a cap on executive bonuses. This will be either in relation to fixed salary or the bank's net profit. There are also proposals to increase deferral periods to five years and align the bank's absolute remuneration level with the average of a peer group. Another option being considered is to restrict the bonus pool of top managers to a specified amount of net profit. It is understood that, following discussions at board level, a final plan is to be presented before the annual meeting in May 2013.

Further application for leave to appeal Attrill decision

An application for leave to appeal to the Court of Appeal in the case of Attrill v Dresdner Kleinwort and Commerzbank (see our last newsletter for an analysis of this decision) was refused in August. A further application for leave to appeal has been made and is due to be heard on 5/6 November.

Equality issues

Compulsory equal pay audits

The Government Equalities Office has published its response to the consultation on equal pay audits. It is proceeding with the proposal to give employment tribunals power to order pay audits where an employer is found guilty of gender discrimination in relation to contractual or non-contractual pay matters. However tribunals will not order audits where one has been completed in the last three years, the employer has transparent pay practices or can show a good reason why it would not be useful.

Although intended to address the long-running problem of the gender pay gap, this proposal may result in unintended consequences. For example, employers will inevitably find themselves under increased pressure to settle equal pay claims, whether merited or not, and the threat of an audit may be used by employees as leverage to obtain a higher settlement. Greater clarification is also needed on aspects such as the scope for publication of an audit; e.g. will it be available to other employees, trade union representatives or to the public generally?

A second consultation will take place on the exact contents of equal pay audits, publication requirements and "other issues raised by the consultation". We will update you on this. Given the potential impact of these measures, you may want to feed into this consultation either directly or through industry bodies.

Gender equality in the workplace

The EU Justice Commissioner is considering legislation which would require companies with more than 250 employees, or with revenue in excess of 50 million euros, to report annually on the gender composition of their boards. Those that fail to meet the mandatory quota of 40% women on their boards will be fined or barred from state aid and contracts.

A BIS select committee is inquiring into women in the workplace. It is examining pay, job segregation inequalities, the impact of the current economic crisis on female employment, gender stereotyping in particular occupations (including banking) and the promotion of part-time working.

USEFUL LINKS

Please click here for further details on gender diversity.

Case update

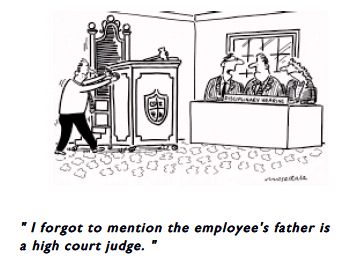

Legal representation at disciplinary hearings Employers will be relieved that the recent Court of Appeal decision in Mattu v University Hospitals of Coventry and Warwickshire NHS Trust means employees will find it difficult to argue they are entitled to legal representation at disciplinary proceedings which could result in a career-ending dismissal. There have been a number of cases based on whether Article 6 (the right to a fair trial) applies to allow legal representation in these circumstances. The Court of Appeal, in Kulkarni v Milton Keynes NHS Hospital Trust, commented that Article 6 would apply where the effect of the disciplinary proceedings could deprive the employee of their civil right to practise his or her profession.

Although rights under the European Convention on Human Rights are only directly enforceable against public sector employers, these decisions are relevant for the private sector because the courts and tribunals, as public bodies themselves, are required to interpret legislation (including unfair dismissal legislation) in line with the Human Rights Act. This means any refusal could make a dismissal procedurally unfair. This issue has been of particular concern to financial services employers due to the potential relevance for employees subject to the FSA approved person regime where disciplinary hearings could ultimately result in the withdrawal of their approved person status.

The good news is that in Mattu the Court confirmed that where an employer is considering dismissing an employee, it is not determining a civil right, but exercising a contractual power. The employee's civil rights are subsequently determined by a tribunal or court or by any other regulatory or professional body with the power to bar the individual from practising their profession. It also confirmed it considered the comments in Kulkarni were incorrect.

This almost closes the door on arguments for legal representation. The only circumstance remaining is that outlined by the Supreme Court in R v Governing Body of X School which is where the employer's decision has a substantial influence on or determines the outcome of any later proceedings. However, there has yet to be a case where this has been established as most professional bodies make their own independent decisions.

KEY POINT TO TAKE AWAY

As the FSA makes its own decision on approved person status, and the employer's disciplinary process does not determine the outcome, the Mattu decision effectively ends the argument for legal representation at a disciplinary hearing in this sector.

LLP members are not "workers"

The Court of Appeal has just confirmed in Clyde and Co and anor v Bates Van Winkelhof that members of an LLP are not workers for the purposes of whistleblowing legislation or any other legislation which gives rights to workers who are not employees. This decision has major implications for members of LLPs and is particularly good news for those hedge funds, asset management companies and other entities set up as an LLP. However, it is understood that leave to appeal the decision to the Supreme Court is being sought.

FSA News

Libor The FSA has recently published its report into the Libor rate-rigging scandal:

http://www.bbc.co.uk/news/business-19748613

We have produced a summary of useful lessons regarding the FSA approach to risk management and the role of compliance from its final notice to Barclays. Please click on the link below.

FSA guidance consultation on risks to customers from financial incentives

The FSA has published a guidance consultation on the risks to customers from financial incentives paid to sales staff. This follows the FSA's review into the incentivisation of sales staff. Please click on the link below for our summary of the findings and what firms are expected to do.

Useful links

In-House Employment Lawyers Academy (IHEL)

Our next financial services IHEL is due to be held on 20 November, see Date for the Diary. We will, with assistance from Jane McCafferty and Simon Forshaw of 11 Kings Bench Walk, be covering managing regulatory risk in employment litigation, the impact of employment law reform in the sector and latest themes from the FSA on remuneration including the review of incentivisation of sales staff, issues on claw-back and an update on the latest EU proposals

Financial services round-table event

We held our first FS roundtable on 11 September. Subjects for discussion were compulsory equal pay audits and the role of mediation, the practical implications of Attrill and lessons deriving from the Barclays Libor findings. The consensus of views seemed to be that:

- whilst Attrill was a decision on fairly extreme facts, it does highlight the need for caution when giving comfort about the size of bonus pools/potential bonuses and may well encourage claims (see our previous newsletter for more on this case);

- the provision for compulsory equal pay audits is likely to have a real impact on the sector and to be used by claimants/their lawyers to push for significant payments;

- the issue of publicity of audits is a significant issue to be considered in the up and coming consultation exercise;

- there is unlikely at least, in the short term, to be a significant appetite amongst many financial institutions for trying to pre-empt the likelihood of compulsory equal pay audits through completing voluntary audits with a view to utilising the proposed exception;

- the Barclays LIBOR final notice does contain a useful steer as to the FSA's approach on systems and controls issues and how it expects compliance to seek to identify and respond to risk (see link above).

- the FSA document Risks to Customers from Financial Incentives (see link above) should be considered by all institutions whose bonus arrangements are geared to the performance of employees who service financial sector consumers.

DATE FOR THE DIARY

Topic: Financial Services In-House Employment Lawyers Academy

Date: 20 November 2012

Time: 10.00 - 13.30

Contact: Please contact events@charlesrussell.co.uk and we will send you a invitation together with a full programme.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.