Alternative project finance continues to remain a popular route to commercial fundraising, particularly in the UK commercial property development industry. Businesses continue to diversify their funding arrangements by considering alternative finance structures. These structures can take a number of different forms, with the most common being equity and debt based alternative investments, with UK resident and domiciled, sophisticated high net worth investors being the main target groups.

How Can Dixcart Assist with the Organisation of these Arrangements?

Dixcart establishes workable structures to enable clients to raise the funds they require, from both direct high net worth sophisticated investors and via Self Invested Personal Pensions (SIPPs) and Small Self Administered Schemes (SSAS), whilst also ensuring that the structures are compliant with UK Financial Conduct Authority legislation.

Dixcart works with specialist corporate lawyers who provide advice on the most appropriate alternative structures to comply with the complex array of UK financial services legislation and the associated rules and regulations established by the Guernsey Financial Conduct Authority where applicable.

How Does a Dixcart Security Trust Arrangement Work?

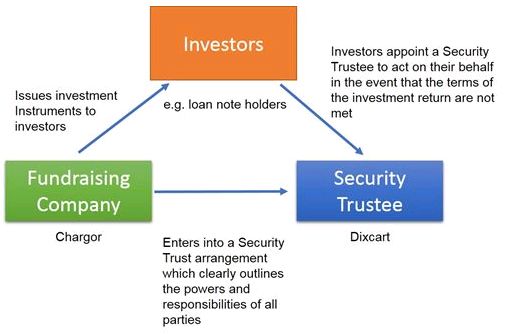

The Dixcart Security Trust Arrangement (STA) is generally introduced by the fundraising party via a Security Trust Deed. The security trustee holds a charge over the investment assets and is empowered to act on behalf of the investors should the terms of the investment return not be fulfilled.

The parties to the agreement are:

- The company seeking to raise funds

- The investors

- The security trustee

What are the Benefits of using Dixcart as the Security Trustee?

-

Costs

- Use of a Security Trust Arrangement can be a less expensive on-going alternative to using a standard fundraising model.

- A Security Trust Arrangement offers flexibility in terms of the potential to add extra levels of fundraising through the issue of additional equity or debt instruments.

-

Experience

- Dixcart already has a number of active arrangements in place in the £5m to £15m fundraising range.

- The Dixcart role of security trustee includes: due diligence audits, coordinating banking operations, liaising with architects and RICS (Royal Institution of Chartered Surveyors) professionals to monitor project development, UK site visits, review of reports detailing the schedule of stage payments and arranging payment release against professional reports.

-

Expertise

- The Dixcart Group was established in 1972 and has in excess of 40 years' experience acting as a professional, independent trustee on a wide range of corporate and private matters.

- Dixcart Trust Corporation Limited is a licensed fiduciary and is regulated by the Guernsey Financial Services Commission.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.