The Summer Finance Bill 2017 passed its second reading in the House of Commons on 12 September 2017 and is now at Committee stage in the Commons. It contains a significant set of welcome reforms that broaden the scope of an important tax exemption for UK companies. This is the so-called "Substantial Shareholder Exemption" or "SSE", which exempts from UK corporation tax the capital gains realised by UK holding companies from the sale of subsidiary companies.

THE REFORMS

There are several pending reforms to the SSE, of which the most important are listed below:

UK holding companies: trading status requirement for SSE to be abolished

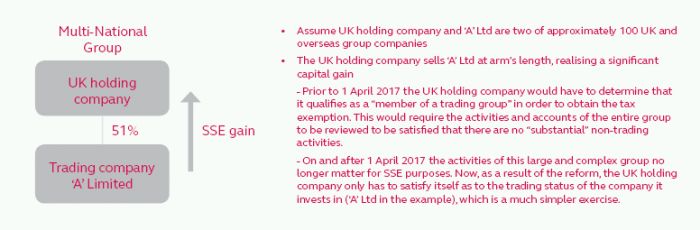

With effect from 1 April 2017 a UK holding company will no longer have to have any trading status to qualify for the SSE. This will therefore take away the need for the UK company to demonstrate that it is either a sole trading company or a member of a trading group in order to benefit from the SSE. This is a welcome simplification for international groups.

Relaxation of temporal conditions around the 10% minimum shareholding requirement

The SSE requires that the UK company (the "investing company") must hold not less than 10% of the ordinary share capital of the subsidiary company ("the company invested in") for a period of at least 12 months. Previously therefore, a UK company would have had one year from a part-disposal resulting in its shareholding falling below the 10% threshold to sell the remaining shares subject to SSE. This one year window on part-disposals will be increased to 5 years.

Furthermore, the new legislation will extend the period a UK company will be treated as holding a substantial shareholding so as to include the period when it was held by any non-resident group company.

Trading conditions surrounding the company invested in

Whilst the legislation continues to require the company invested in to have trading status (it must either be a trading company or a holding company of a trading group or trading sub-group), the new legislation no longer requires the company invested in to maintain its trading status immediately after its disposal, provided that the disposal is to a third party unconnected with the UK investing company.

These welcome changes will apply to disposals of a substantial shareholding that occur on or after 1 April 2017. An illustration of the potential advantages of the reforms described is provided below:

SSE: INSTITUTIONAL INVESTORS

A new SSE regime will be introduced to apply to UK holding companies owned by "qualifying institutional investors" or "QIIs".

In short, neither the UK holding company ("the investing company") nor the company invested in need to meet any trading status requirements provided at least 80% of the UK company's ordinary share capital is owned by a QII or QIIs. Full exemption from UK corporation tax can therefore be obtained by such UK holding companies where the company invested in owns purely investment assets (e.g. property).

A partial exemption is given where the interest of QIIs in the ordinary share capital of the UK company making the disposal is between 25% and 80%. In this scenario, a proportionate part of the gain will be subject to SSE.

QIIs

Under the scheme of the legislation, a QII is:

(i) a registered pension scheme (but not an investment regulated pension scheme)

(ii) a company carrying on Life Assurance business if the UK holding company is held as part of the Life Assurance company's long-term fixed capital

(iii) sovereign wealth funds

(iv) charities

(v) investment trusts

(vi) authorised investment funds (must be diversely held)

(vii) exempt authorised unit trusts (must be diversely held)

Qualifying Real Estate Investment Trusts (REITs)

REITs will receive these new SSE advantages, but only if they are "qualifying REITs". These are REITs that are not close companies by virtue of having an institutional investor as a participant (as defined in s528 CTA 2010).

Alternative "substantial shareholding" test

If a UK holding company, at least 25% of whose ordinary shares are owned by a QII, owns less than 10% of the company invested in, then such a sub-10% shareholding will still be treated as a "substantial shareholding" and will qualify for SSE provided that the cost of the investment is not less than £20,000,000.

QIIs – indirect ownership of UK company

QIIs can hold their shareholdings in the UK investing company directly, or indirectly. Where the shareholding is indirect via other companies, the intermediate company may be another QII, but cannot be via a "disqualified listed investor" ("DLI"). A DLI is a listed company that is not a QII.

JORDANS SERVICES SURROUNDING SSE

Jordans can offer a broad range of services around the SSE legislation:

- Formation of UK holding companies

- Provision of company secretarial, tax and director services for UK holding companies

- Accounting services for UK holding companies

- Similar services for the company invested in (where the companies invested in are non-UK registered, the Vistra international office network can assist in providing incorporation, or company administration and management services to such companies)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.