If you supply construction services in the UK, the VAT reverse charge could affect you. From 1 March 2021, HMRC are changing the way they collect VAT from construction businesses meaning your cash flow might be affected. Failing to properly plan for this change could push some subcontractors into a cash flow crisis.

How will the VAT reverse charge work?

The VAT reverse charge is a new procedure for accounting for VAT that applies to transactions between VAT-registered businesses reported under the Construction Industry Scheme (CIS). Under this new mechanism, VAT cash will no longer flow between businesses as the customer receiving the supply of construction services will charge themselves VAT, rather than the supplier charging them VAT. The reverse charge will apply throughout the supply chain up until the end user (businesses that are VAT and CIS registered but do not make onward supplies of the construction services supplied to them); at this point, the normal VAT rules will apply.

From 1 March 2021, you must use the new reverse charge process if you are VAT-registered in the UK, supply building and construction industry services and:

- your customer is registered for VAT in the UK

- payment for the supply is reported within the CIS

- the services you supply are standard or reduced rated

- you're not an employment business supplying either staff or workers, or both; and

- your customer has not given written confirmation that they are an end user or intermediary supplier.

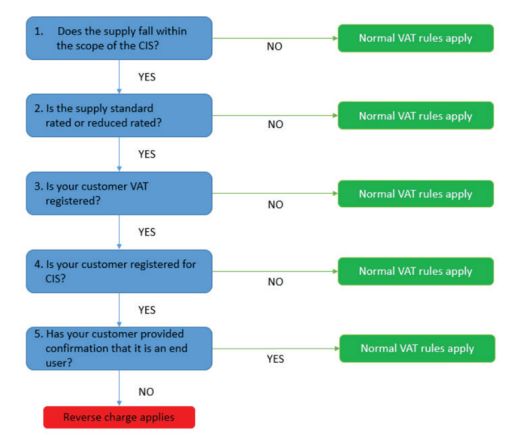

If you supply construction services and are still unsure if the reverse charge affects you, take a look at the flowchart below:

How will invoicing work once the new rules are in play?

If the conditions above are met, you should issue a VAT invoice stating the construction supplies are subject to the reverse charge and the customer is expected to account for the VAT themselves (rather than you charging them). The invoice should still state how much VAT is due or, if the amount cannot be shown, the rate of VAT.

Why is this change happening?

The Government are clamping down on VAT fraud in the building and construction sector, specifically on a crime called 'missing trader fraud'. This typically occurs when the supplier of construction services charges their customer for VAT but then fails to account for that VAT to HMRC. Instead, the VAT is pocketed and the supplier disappears. This scam has been seen across several industries but is now popping up in construction supply chains. The new reverse charge makes it the customer's responsibility to account for VAT meaning there is no opportunity for the supplier to disappear before paying their VAT bill to HMRC.

Could this affect your cash flow?

Under the current system it is common for suppliers to use the VAT they are paid by their customers to pay their suppliers until they are required to pay it to HMRC. If your business is affected by the reverse charge, you need to prepare to receive payments net of VAT from 1 March 2021. Failing to prepare for the change could leave you struggling to pay suppliers. As well as considering whether the change will impact your cash flow, it is also important for you to ensure your business' accounting systems and software can deal with the reverse charge.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.