Issues affecting all schemes

- Lifetime allowance – abolition

The Finance Bill has been laid before Parliament. Its pensions-related provisions include :

- Abolition of the lifetime allowance (LTA).

- Changes to the taxation of lump sums and lump sum death benefits.

- Changes to the taxation of lump sums paid by overseas pension schemes.

- Changes to the overseas transfer charge.

- Changes to the rules governing LTA protections.

- Changes to scheme reporting obligations.

- Transitional provisions, in particular in relation to the treatment of benefits taken before 6 April 2024.

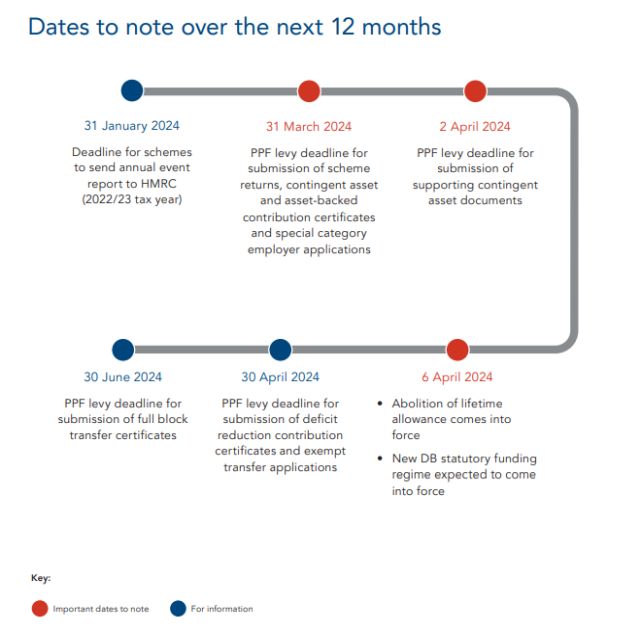

The provisions will come into force on 6 April 2024. Accompanying explanatory notes and an HMRC policy paper have also been published.

The new regime in summary

The legislation remains broadly as set out in HMRC's consultation on the draft legislation. From 6 April 2024 the concept of the LTA will be removed from legislation and a new regime for the tax treatment of lump sums and lump sum death benefits will be introduced. A new "lump sum allowance" of £268,275 (i.e. 25% of the current LTA) and a new "lump sum and death benefit allowance" of £1,073,000 (i.e. the current LTA) will be created. Individuals will not pay tax where the non-taxable element of lump sums they receive does not take them above these levels. To the extent that the otherwise nontaxable element of a lump sum exceeds these levels, it will be taxed at the recipient's marginal rate (except where protections apply). The allowances will be personal rather than scheme limits and will not take into consideration the payment of regular pension income.

Post-consultation changes

Some changes have been made following the consultation, including:

- The tax-free element of a trivial commutation lump sum, winding-up lump sum or small lump sum will not now count towards the new lump sum allowance. However an individual must have available lump sum allowance to be able to take those lump sums.

- A new type of lump sum, the pension commencement excess lump sum (PCELS), will be introduced. It is intended to be similar to the current LTA excess lump sum. However, it can only be paid in connection with the individual becoming entitled to the associated pension and if the individual has exhausted their lump sum allowance. There is a cap on the maximum PCELS that can be taken. A PCELS will be taxed at an individual's marginal rate.

Action

Trustees and administrators should consider what changes they will need to make to their scheme's administration processes and member communications in light of the changes. They should also consider whether a standalone member communication on the changes should be issued, in particular to those approaching retirement.

Action

Trustees and employers should consider whether any elements of their scheme's benefit design should be amended in light of the changes. They should also consider whether any current scheme projects, e.g. GMP conversion, may be affected by the changes.

Action

Employers should consider whether any changes are required to their employee communications on pensions. They should also consider whether any special arrangements put in place in light of the LTA, e.g. for employees whose benefits have reached the LTA, should be revisited.

Overpayments – recoupment

If trustees wish to recover an overpayment by equitable recoupment (i.e. by deducting the overpayment from future pension instalments), and the member disputes the amount to be recouped, either in total or from each pension instalment, the trustees must obtain an order of a competent court to enforce the recoupment. The Court of Appeal has upheld the High Court's decision that the Pensions Ombudsman is not a competent court for these purposes.

Action

Trustees and administrators should note the decision and ensure that their scheme's procedures for recovering overpayments are consistent with it.

Autumn Statement – pensions aspects

The Autumn Statement contained various pensions-related announcements, including:

- The government will launch a call for evidence on a lifetime provider model which would allow individuals to have contributions paid into their existing pension scheme when they change employer.

- The Financial Conduct Authority will consult on new value for money (VFM) rules for contract-based schemes in spring 2024. It will work closely with the government and the Pensions Regulator (TPR) for consistency with the development of legislative requirements for trust-based schemes. In the meantime, actions from TPR will strengthen their existing supervisory approach.

- The authorised surplus payments charge will be reduced from 35% to 25% from 6 April 2024.

- The government will commit £250 million to two successful bidders in the Long-term Investment for Technology and Science (LIFTS) initiative, subject to final agreement. It will also establish a new Growth Fund within the British Business Bank to give pension schemes access to opportunities in the UK's most promising businesses.

The Statement also announced responses to the various consultations launched in July 2023 as part of the Mansion House Reforms – these are discussed separately below. For more information, please see our legal update.

Action

Trustees, employers and administrators should monitor implementation of the announcements.

Trustee skills and capability – call for evidence response

The government has responded to its call for evidence on how trustee skills and capability could be improved and barriers to effective investment decision-making removed. The response concludes that while trustees would benefit from more support, guidance and training, one of the key barriers to achieving better long-term outcomes for members is a damaging and continual focus on cost and minimising all risks. There are several areas where immediate action will be taken, including:

- TPR will put in place a trustee register.

- TPR's General Code will set accreditation for professional trustees as an expectation.

- TPR will update its investment guidance, including providing additional guidance on investment decisions and alternative assets.

- TPR will provide further information for employers on what factors should be assessed when they are selecting a pension scheme.

To view the full article, click here.

click here© Copyright 2023. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.