Do the policy changes announced by the UK Government in September mean that it is rowing back on its commitment Net Zero? Anyone wanting to understand the UK's Net Zero ambitions may ask how many plans it takes to switch on a light bulb. Distilling current policy from a multitude of current Government policies (see the Net Zero Growth Plan, the Energy Security Strategy, the Energy Security Plan, the Green Finance Strategy, and others) over recent years is no mean feat.

However, the recent high point in terms of ambition was perhaps the 2021 'Net Zero Strategy' - tellingly, released in the months preceding the UK hosting COP26 – which listed a number of policies and proposals aimed at demonstrating the UK's world leading climate ambition in line with its international commitments on emissions. As we approach COP28 UAE it seems an appropriate time to reassess that ambition and its implications for energy and infrastructure development. We also highlight the key changes in the September policy announcement.

1. The 2023 Statement: a shift in mindset?

Two years on from COP26, as the impact of global events, including the Ukraine War, on energy prices and the wider cost of living crisis continues, the UK's 'world-leading' ambition is less evident. The Government's September announcement that the UK's "over-delivery" on reducing emissions meant a revised plan could not only be considered but was justified to avoid loss of public support for transition, reflects a shift in mindset from 'acceleration' to 'stability'. In keeping with this, the Government confirmed that various carbon-focused policies are to be scrapped or delayed – ranging from bans on new petrol and diesel cars through to gas boilers and domestic energy efficiency targets (set out in further detail below). All the while there are mixed policy signals around renewable energy, with the emphasis on stability in transition leading to (for example) firmer support for domestic oil and gas exploration.

Will the change of course lead to higher costs in the long run?

Those policy changes which directly impact and purport to reduce financial cost to consumers / homeowners may have an eye on the upcoming election. The conservative party's surprise by-election win in Uxbridge - where the cost to motorists of the labour mayor's low emission policies was a prominent election issue – is regarded as (possibly disproportionately) influential on the current policy stance. However, there is already commentary (including from the body set up to advise the Government and hold it to account on its emissions targets, the Climate Change Committee ("CCC")) suggesting that the impact of these changes may instead act to push back both costs and savings for consumers. The announcements made on short notice and without consultation have also triggered criticism from industry that the inconsistent approach and messaging undermines business's attempts to plan and invest in cost-effective, market-based solutions. Whilst businesses tend to vary in their policy stances, they are more unified in a desire for certainty.

An assessment by the CCC also casts doubt on the Government's assertion that a revised plan can be justified in carbon budgetary terms based on emissions reductions progress to date. In its response to the Government's announcements, the CCC raised concerns around the likelihood of the UK being able to achieve its Paris Agreement aligned 2030 'Nationally Determined Contribution' (NDC) goal of a 68% reduction in terrestrial emissions from 1990 levels. The CCC also noted that "around a fifth of the required emissions reductions to 2030 are covered by plans that we assess as insufficient. Recent policy announcements were not accompanied by estimates...nor evidence...We urge the Government to adopt greater transparency in updating its analysis at the time of major announcements."

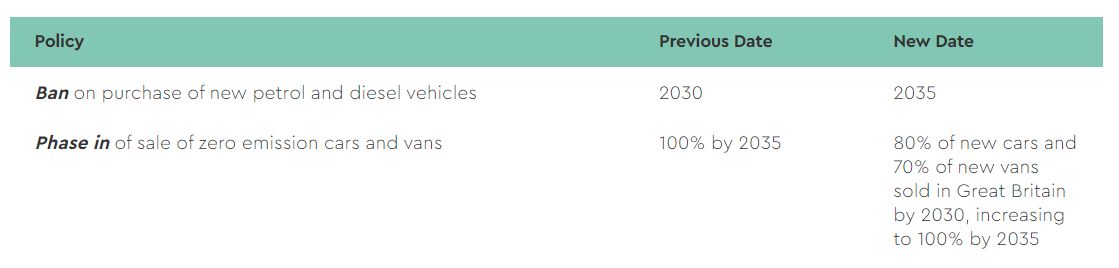

2. Proposed ban on sale of new petrol and diesel cars moved back from 2030 to 2035

In November 2020 the Government had announced:

- a phase out of the sale of new petrol and diesel cars and vans by 2030, and

- a requirement that all new cars and vans be fully zero emission from 2035.

Phase one has now been pushed back to 2035, which brings the UK into line with the EU's proposed ban timeframe. Phase two remains in place, with the Government recently publishing its Zero Emissions Vehicle (ZEV) Mandate to require 80% of new cars and 70% of new vans sold in Great Britain set to be zero emission by 2030, increasing to 100% by 2035.

Industry reaction

While the impact on future emissions may (as recognised by the CCC) be limited in practice, the motor industry has criticised the wider impact of this part of the Government's announcements for confusing consumers who "want to make the switch, which requires from Government a clear, consistent message, attractive incentives and charging infrastructure that gives confidence rather than anxiety. Confusion and uncertainty will only hold them back." ( 'SMMT statement on government and net zero commitments'). For industry, the policy change aggravates the existing uncertain investment climate around the much-needed development of EV charging facilities. This appears to have been somewhat recognised by the Government in its Autumn Statement, delivered on 22 November, where specific measures have been announced including the prioritization of EV charging infrastructure development, including EV charging hubs.

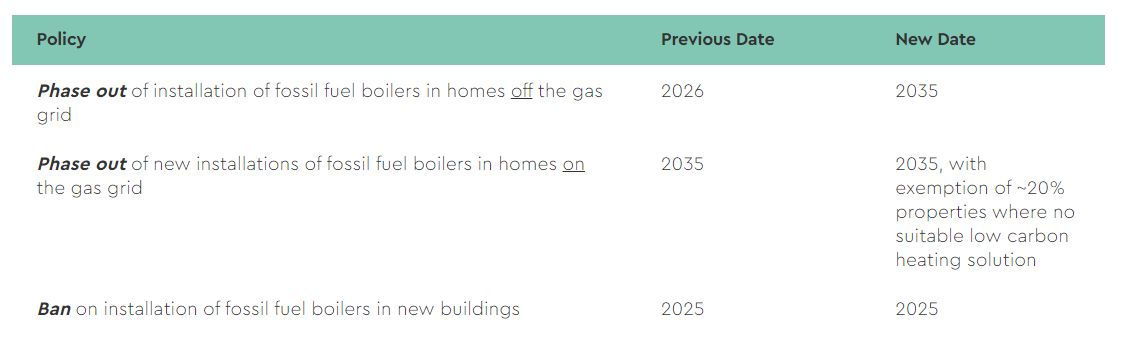

3. Phasing out new fossil fuel boilers – delay and additional grant funds

The Government's original proposal was to phase out the installation of high carbon oil or liquid petroleum gas (LPG) boilers in homes off the gas grid from 2026. This has been pushed back to 2035, bringing it in line with the proposed date for phasing out new installations of gas or LPG boilers in homes on the grid. For the latter, the Government has proposed an exemption for an estimated 20% of properties where there is not currently a suitable low carbon heating solution. Further guidance will reportedly be developed with industry, to explain how to determine whether a property is suitable for a heat pump or other low carbon heating technology – in light of factors such as heat loss, potential to upgrade, space and legal constraints. Ahead of that guidance, the Autumn Statement confirms the Government's plans to consult on the introduction of new permitted development rights to end the blanket restriction on heat pumps one metre from a property boundary in England.

Increase in one off grants (but no extra budget)

At the same time the Government has increased the value of some grants available under its existing Boiler Upgrade Scheme ("BUS") for switching to biomass boilers or heat pumps. The one-off grants for heat pumps have increased from £5,000 to £7,500, but the overall budget remains the same.

Take-up to date has been low - in its first BUS annual report (published 31 July 2023) Ofgem (who administers the scheme) noted that 9,983 grants had been paid. The CCC warned in February 2023 that if the current take-up continues, only half of the allocated budget will be used to help households make the switch, meaning the Government's target of 600,000 installations per year is unlikely to be met. Baroness Parminter, Chair of the Environment and CCC has suggested that if the Government were to "look at issues around raising consumer awareness around the lack of installers, around mixed messages, around hydrogen and some of the smaller things in terms of restrictive planning laws and the facts that EPCs aren't really incentivising heat pumps we think this boiler upgrade scheme could be put back on track."

No change to ban on installing gas boilers in new homes from 2025

The proposed ban, as part of the wider Future Homes Standard, on installing gas boilers in new buildings from 2025 appears to still remain part of current policy.

4. Requirements for landlords to upgrade residential properties dropped

The Government's decision to drop proposals to require improved energy efficiency in rented homes has been more widely criticised. While this will remove upfront costs for landlords (and so potentially avoid related rent rises and help landlords facing pressure from increasing interest costs and other pressures in the buy-to-rent sector), it is likely to leave renters paying higher energy bills for longer. Note, however, that the current energy efficiency rules relating to commercial (as opposed to residential) premises remain in place.

5. Pledge not to introduce car sharing or new taxes on meat and dairy

The Government also recently confirmed it would not be introducing any car sharing requirements or implementing any taxes on meat and dairy. Whilst it is not clear whether such policy positions had previously been adopted, this underlines the Government's non-interventionist leanings on emissions cutting measures which involve direct consumer cost or lifestyle changes. The CCC argued in response that it may be unhelpful to rule out demand side measures in a wide range of areas such as transport choices and diet, as this restricts the available options to reduce emissions.

But debate is likely to continue...

This is an area which is likely to come under increasing scrutiny in coming years, given the meat and dairy industry are relatively land intensive. With the pressure on land in the UK likely to grow – and continued efforts to on-shore the food supply chain whilst also needing to use more land to achieve positive biodiversity contribution in developments (through the biodiversity net gain regime introduced by the Environment Act 2021) – we expect this to come back into the national debate.

6. Renewable energy, same old challenges

Oil and gas exploration

The Government separately announced various measures to strengthen the domestic licensing regime for oil and gas exploration, including introducing annual licensing rounds. This had long been signalled following events in Ukraine, leading to political motivation to reduce reliance on imports from Russia and other sensitive (and/or expensive) regions, and was confirmed in the Kings Speech on 7 November. Once again it is not clear how impactful this will be in real carbon terms – the shift to annual licensing rounds will not necessarily attract investment; and some commentators believe a clearer more transparent process can enable a more orderly long-term transition away from hydrocarbons. Again, though, it feels emblematic of a change in emphasis.

Renewable energy

Whilst renewable energy also remains high up the agenda – with the Kings Speech stating that: "My ministers will seek to attract record levels of investment in renewable energy sources and reform grid connections, building on the United Kingdom's track record of decarbonising faster than other G7 economies" - it is not yet clear how this will be achieved in policy terms. Whilst the Government has been seeking to streamline planning processes, particularly for larger projects that can take some years to get consent, the plan for smaller embedded renewable projects, which are key to a stable and renewable grid, is less evident.

Wind power, tidal stream and geothermal projects

In addition, the debate around on-shore wind continues – with recent changes to planning requirements by the government purporting to remove the de-facto ban on them in truth doing very little. And the position towards larger onshore solar developments appears to, if anything, be becoming more hostile. There was also the high-profile failure to attract bids for offshore wind (previously held out as a key plank to the UK's Net Zero future) under the Contract for Difference regime – although less attention was given the range of contracts awarded for a number of innovative projects, including remote island wind, tidal stream and geothermal projects.

Progress on more fundamental market-related matters (including the pricing of energy and its tie to gas prices, and the ever more complex position on windfall levies) and on-grid reforms to bring much sought technical stability and commercial flexibility has been slower than many would wish. Funding and support from the government for research and development projects in carbon capture and storage and hydrogen is continuing to be made available, but there are those who think the viability and scalability of these technologies is unproven, and there should be more focus on ensuring support for tried and tested sources of low carbon energy. Once again there is a need for stability in policy and regulation for an uncertain market. Some good news for the renewables sector is provided in the Autumn Statement where there is a discussion of measures aimed at reforming the UK's outdated planning system and speeding up the time it takes for new developments to connect to the electricity grid from 5 years to 6 months and proposals. There are also plans to legislate for a new investment exemption for the Electricity Generator Levy. Designed to support investment in the UK's renewable generation capacity this will allow projects (for which the substantive decision to proceed is made on or after 22 November 2023) to be exempt from paying the EGL.

7. Plugging the gap – sustainable investments

In addition to what we could call 'operational' policy and regulation (i.e. laws concerning infrastructure, homes and cars) the Government is also focusing on "greening the financial system". Here there is perhaps more evidence of a progressive policy intent. Keen not to be left behind the EU with its sustainable finance plan (which the UK fed into before it left the EU), the Government continues to emphasise the role the financial sector has to play in driving a green transition by funding sustainable investments and innovative technologies. Indeed, the Government's proposed measures to encourage such investments by reforming the planning system and EGL relief (see Section 6 above) has been explained as being part of a wider plan to remove barriers to investment in critical infrastructure.

Sustainability reporting

To encourage this funding, the Government has introduced and proposed a number of regulatory developments. These include the introduction of mandatory climate-related financial disclosures for certain public companies and large private companies, as well as certain UK asset managers. By requiring this information, it is hoped that it will assist consumers in making more informed, and greener, investment decisions. Further UK sustainable finance drivers include proposals to require firms to disclose their sustainability risks, opportunities and impacts, building on their existing climate-reporting. It will also introduce sustainable investment labels to reflect the sustainable characteristics of investment products. Finally, a new UK Green Taxonomy is proposed to allow the measurement and comparison of how 'green' investments are (more on this below).

Transition planning

One of the disclosure requirements for companies captured by the legislation described above includes details as to a company's transition planning. With published transition plans varying in detail and approach they are not easily comparable and run the risk of misleading consumers and investors (so-called "greenwashing"). To limit this risk the Government's newly established Transition Plan Taskforce ("TPT") launched a disclosure framework on 9 October 2023. The TPT has since released sector guidance outlining sector-specific decarbonisation levers, metrics and targets for seven sectors, including certain financial sectors and 'Electric Utilities & Power Generators', 'Metals & Mining', and 'Oil & Gas' sectors. The framework and supporting guidance set out good practice for companies to help them make high quality, consistent and comparable transition plan disclosures. While the framework remains voluntary for now, the FCA has welcomed its publication and has hinted at plans to incorporate it into its own guidance for the companies it regulates.

Does it all hang together?

To be effective, ideally the green finance initiatives will dovetail with 'operational' aimed regulation to facilitate and attract investment. So, for example, the Zero Emission Vehicle mandate (see above) will help ensure a stable regulatory framework for the development of charging infrastructure, and the UK's Green Taxonomy could ensure that investors with a sustainable mandate are encouraged to raise funds for it. To be effective, both sides of the coin (sustainable investment and the operational regulatory environment) do need be aligned, and it's not always clear this is the case. The GTAG (the Government's Green Technical Advisory Group appointed to provide advice on the design and implementation of the UK Green Taxonomy) continues to urge the Government to prioritise delivery of a credible, robust and usable green taxonomy. Since the announcement in 2021 of the Government's plan to introduce a UK green taxonomy, an additional 21 taxonomies have been announced or come into force globally. While the UK's delay provides the opportunity to learn from efforts of those implementing taxonomies elsewhere, it risks putting UK industry behind the curve in terms of certainty and the potential to plan.

Divergence from the EU

It has already been acknowledged that divergence from the standards within the EU Green Taxonomy will likely be included in the UK's own version. This provides a number of opportunities for the UK to design the Taxonomy for the UK market and to include technology or assets that the EU has overlooked. For example, the EU's Green Taxonomy has been criticised for only recognising assets and activities that are already "green" with limited recognition of transitioning assets and activities. In diverging the UK may also be able to avoid the delays and intense debate faced in the EU over highly politicised industries, such as that faced over the inclusion of nuclear and natural gas – although intense national debate over what activities may be considered "green" will no doubt arise once the UK version is published.

The challenge of divergent standards within the growing number of taxonomies has been acknowledged by both GTAG and the EU, but a solution to the same not yet offered. While divergent standards may allow activities to qualify under some taxonomies and not others, it remains to be seen whether this will benefit companies where investors recognise the relevant standards, or whether the more stringent criteria (widely accepted as existing in the EU Taxonomy at present) will be used as a high-water mark and undermine investments in what would otherwise be considered transitional or impact investments elsewhere. With the recent failure of the latest UK auction for offshore wind contracts to attract sufficient interest, investor confidence will indeed be crucial in the UK. The ongoing delay in implementing UK sustainable investment legislation that meets the challenge levelled by the EU's own sustainable finance package means it is not yet clear whether the UK's proposed green investment labels and more flexible taxonomy of "green" business activities will facilitate investment in assets where legal requirements are potentially less stringent than those in the EU.

8. What's Next?

The Government's announcements delaying or scrapping various consumer-impacting environmental measures have come under significant debate and scrutiny. In truth their actual impact in carbon terms may prove relatively limited. Their greater significance is in demonstrating the current policy mindset in a highly politicised landscape. The UK's decarbonisation strategy seems increasingly predicated on private markets and ESG regimes aimed at ensuring that the deployment of finance is aligned with net zero.

Sending the wrong signals?

However, as we are seeing with the renewables sector, creating a stable investment environment is in many ways linked to stable and predictable legislation at an operational level. The response by many businesses to the Government's announcement was telling in this respect. There was a general concern that, whatever the rights or wrongs of carbon budgets and financial costs, the wrong signals were being sent to consumers and markets and this is making investment in the green agenda riskier. And the short term doesn't look to be any more stable. The upcoming election could see a Government with a very different, and likely more interventionist, approach coming (albeit Labour have kept their cards close to their chest in terms of which policies they would actually change and/or restore). Meanwhile the NGO community has shown itself increasingly willing and creative (in the UK and abroad) at finding ways to test the rationale of the Government's decarbonisation strategies before the courts.

Alongside all this, the EU (with its supply chain and other more operationally focused measures) and in some respects the US (with the inflation reduction act) are moving to more structural reform of their Net Zero strategy. The UK is rapidly reaching decision point. Investors are looking for a clear direction of travel.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.