The coming expiry of Private Finance Initiative (PFI) and Public Private Partnership (PPP) contracts looms ever larger as an issue for public and private sector alike. The UK Public Accounts Committee has launched an inquiry into management of the expiry of PFI contracts and major government initiatives have been launched including the UK Infrastructure & Projects Authority (IPA)'s "Private Finance Initiative (PFI) Contract Management Programme".

In this article, we look at some of the key issues and how a collaborative approach can contribute to successful outcomes for the next wave of PFIs to expire.

Even as the world pressed the 'pause' button at various times throughout the COVID-19 pandemic, an 'under the radar' issue has continued to move into focus – the coming expiry of Public Private Partnerships (PPPs).

PPPs saw their heyday in the UK in the 1990s and 2000s, when projects including those procured under the UK Government's Private Finance Initiative (PFI) saw a boom in the construction of public infrastructure. The principles behind PPPs were to enable the public sector to avoid having to fund the up-front capital cost of major projects whilst obtaining up-front visibility over 'whole life' costing. In practice, this meant concession terms of between 20 and 30 years, meaning that at the start of 2021 only a handful have reached their expiry date (with a number of others voluntarily terminated).

With the IPA now advocating that procuring authorities should start the process seven years out from the expiry date, this issue is particularly pertinent at the time of writing, as we are about to reach the hand-back period on a large number of PFI contracts.

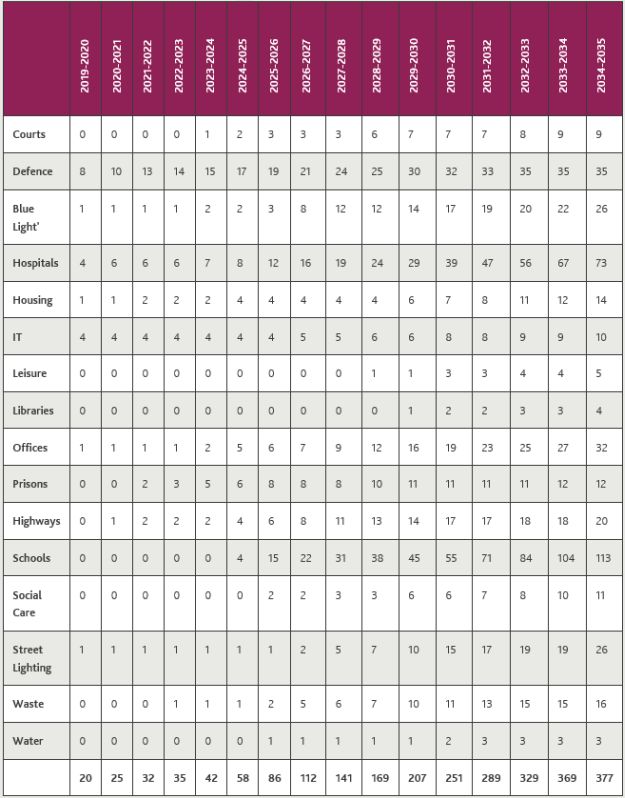

Figure 1: Cumulative totals

of PFI projects due to reach their expiry date 2020-2035 by

sector

The dynamics of a PFI project change substantially in its winter years, in particular after the point where senior debt has been repaid. The purpose of this alert is to identify some of the key drafting provisions in PFI contracts and provide food for thought about potential creative alternative approaches to the coming challenges for all parties involved in PFI and PPP projects.

The fate of PFI Assets

A good place to begin is to consider if a PFI asset has a future. This is a straightforward question in sectors such as highways, but a complex one for many accommodation-based schemes. These complexities are a result of both recent events and longer term trends. In addition to issues thrown into focus by the COVID-19 pandemic, such as changes to the nature of the workplace and future use of office accommodation, changes to design standards in the period since most PFIs were signed are likely to affect the future usability of some assets. Accordingly it is likely to be the case that many PFI assets will not form part of a procuring authority's medium or long term asset strategy.

Ownership of the asset on expiry differs from project to project: PFI assets normally transfer to public sector on expiry but this is not universally true. On certain early healthcare PPPs, NHS LIFT and waste PFI projects, the default position may be that the asset remains with the PFI Contractor. In such circumstances, there is sometimes a right or option for the public sector to re-purchase the asset and a formula to determine the price payable, which may or may not still be reflective of the value of the asset to the procuring authority.

Where the public sector wishes to vacate a PFI building at or before its expiry, this may mean they take a very different approach to requirements concerning condition at the expiry date and/or any option to purchase.

Linked to this is the potential requirement for capital expenditure at or after the expiry date. The requirements for PFI asset in many instances identified design-life requirements that tied in with the term of the concession (with exceptions, for example a minimum residual life is in some instances identified in the hand-back provisions). The handover of a PFI asset on expiry may present a significant challenge for the public sector if there are endemic requirements for material capital expenditure to enable the continued use of a PFI asset.

Required condition

Some regard is also needed for the way contractual hand-back requirements may be expressed. Wording along the lines of "in a consistent condition with the performance by the contractor of its obligations under this agreement" is in many contracts the full extent of the definition of the required condition at hand-back..

Possibly the most well-known example of this is "NHS estate code condition B". The required hand-back condition under the NHS Standard Form 3 Project Agreement "Estatecode condition B" is actually only expressed in very high-level terms in the (now superseded) NHS publication "Estatecode".

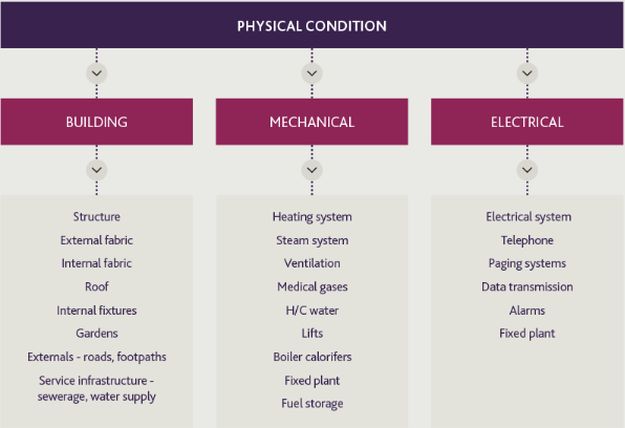

"4.15 If a more precise and detailed assessment is wanted, for example for inclusion in a new business case or for operational maintenance purposes, the three elements can be broken down into a list of components (see Figure 4.2). These can then be scored as shown in order to reach an A-D score.

4.16 Each component should be scored and the aggregate score used to rank the physical condition of your estate as follows:

A 190-240

B 150-189

C 110-149

D under 110"

Figure 2: Text of NHS Estatecode (2001) identifying the method to calculate 'Condition B'

This leaves open the scope for protracted negotiations about the extent to which a concession-holder has complied with its obligations.

A consensual approach to assessing condition

Drafting that envisaged significantly detailed surveys being performed was well intentioned, but some consideration is needed as to whether:

- the contractual timeline for surveys is far enough ahead of the expiry date to be useful (i.e. after surveys have been performed and reports delivered, will there be adequate time to deal with any issues identified?); and

- the cost, disruption (where surveys require temporary partial closure of a PFI Asset) and management time (for both public and private sector stakeholders) associated with condition surveys is proportionate to the value of the information that may be produced

as condition surveys may not be definitive and may not address either party's expectations concerning the condition of the PFI Asset.

With this in mind, we would suggest that the first question (for Authorities and PFI contractors and asset holders alike) should be 'how well do you know your PFI asset?' The potential to undertake early surveys or extract (from monitoring reports, maintenance plans, Lifecycle records, BMS data etc) information about the condition of the asset could provide a framework for early engagement about asset condition, or at the very least be used as a basis for decisions about how any formal survey of a PFI asset should be focussed. In addition, it may be desirable to identify a 'fast track' or alternative to the processes identified in the PFI Contract to deal with known issues about the condition of the asset or extent of the contractor's obligations / any shortfall in performance.

PFI contracts usually provide a mechanism for the public sector to be entitled to withhold all or part of the unitary payments in the final months of the contract. The exact nature of the entitlement varies. On some, this entitlement applies from a fixed date up to five years from expiry (and potentially before any 'shortfall' in the condition of the PFI Asset / value of the works required before the expiry date have been identified). On others, the entitlement may not crystallise until agreed or determined, and may only apply for a shorter period prior to expiry.

For the public sector, the issue is whether withholding this amount will enable it to build up a fund sufficient to cover the costs of remedying the condition of the PFI Asset in the event the PFI Contract does not undertake the works required. From the PFI Contractor's perspective, the possibility of the Authority withholding the unitary payment has the potential to affect its solvency/ability to make payments to either funders, service providers or sub-contractors it has continuing obligations to. This may potentially become an issue for the directors of the PFI Contractor and, depending upon how the risk of responsibility for life-cycle maintenance of a facility is provided for, an issue for the facilities' service provider and its guarantor.

Alternative solutions may be available in the form of bonds or other financial instruments. These provide the Authority with alternative security, potentially eliminating the requirement to withhold against the unitary charge. This would be at the discretion of the Authority and underlines further the need for collaboration and consensus to resolve the challenges that the expiry process presents.

What is clear is the need for both Authorities and PFI Contractors, equity holders and Service Providers to consider well ahead of the expiry date how the condition and past operation of a PFI asset, and what is known now about its expected future use, are likely to affect the approach they will take in the run- up to contract expiry.

As well as the potential for the contractual mechanisms designed at the turn of the millennium to be enhanced if the parties adopt a consensus-based approach to the expiry process, it may be that opportunities can be identified for solutions beyond those envisaged at the time of contract. For example where an Authority knows it will vacate or need to materially change the layout or use of a PFI asset, the possibility of a negotiated early termination may be attractive to both parties: avoiding the need to incur the time and cost of contract amendments and/or fulfilling contractual obligations relating to the expiry process when a different outcome might suit them both.

The 377 PFI projects due to expire by 2035 will doubtless take a range of different approaches to some of these challenges - we will watch closely to see how the market addresses these and, in particular, how initiatives such as the Infrastructure & Projects Authority's "Operational Contract Review" and "Contract Expiry Healthcheck" initiatives might set the direction for this.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.