The authors write that it is essential for companies to have comprehensive climate action plans to ensure they are able to mitigate both physical and regulatory risks and to take advantage of the opportunities presented by climate change

Many factors are putting pressure on corporates and financial institutions to address climate change. The UK is currently rolling out mandatory economywide disclosure in accordance with the Task Force on Climate-Related Financial Disclosures ("TCFD") Recommendations. Beyond this lies immense investor and stakeholder pressure, including by way of shareholder resolutions, and increased media, non-governmental organization ("NGO") and ratings agency attention on those who are perceived to not be doing enough. We are now living in an environmental, social and governance ("ESG") world, and it is all but impossible to address the "E" without a sound climate action plan of some kind.

During COP26, national governments agreed to revise and strengthen their Nationally Determined Contribution ("NDC") goals under the Paris Agreement by the end of 2022, given that NDCs submitted to date are not ambitious enough to be consistent with climate science. It is essential for companies to have comprehensive climate action plans to ensure they are able to mitigate the risks (both physical and regulatory) and to take advantage of the opportunities, presented by climate change.

WHY DO COMPANIES NEED CLIMATE ACTION PLANS?

Stakeholder Pressure

Companies are increasingly realizing that in addition to devastating socioenvironmental costs, failure to mitigate the risks presented by climate change can cause significant reputational and financial losses. Consequently, companies are under pressure from stakeholders to have climate action plans. Earlier this year, a British consumer goods giant announced that the overwhelming majority of its shareholders voted in favor of its plan to reduce greenhouse gas ("GHG") emissions across its supply chain to net zero by 2039, while well over three quarters of the shareholders of the listed British subsidiary of a multinational mining, metals and petroleum company endorsed a plan targeting net zero by 2050.

These developments reflect an uptick in investors responding to climate change with their own climate action plans, which often involve significant climate-related stewardship components. Investor groups like "The Investor Agenda" have already developed best practices around climate action plans that prioritize active engagement with portfolio companies.1 Investors adhering to these guidelines will encourage their portfolio companies to implement business strategies in line with the goals of the Paris Agreement.

Legislative Developments

Governments are increasingly implementing legislation aimed at reducing GHG emissions. The UK's target is to cut emissions by 78 percent by 2035, compared with 1990 levels in advance of a 2050 net zero target.2 As this target is passed down, companies will be forced to make significant changes. The EU has announced proposals to include maritime, building and road transport emissions in or alongside the existing EU Emissions Trading scheme.3 The UK will need to determine how to meet similar objectives.

Disclosure will also be an important part of this. Eighteen jurisdictions have now adopted, or are planning to adopt, mandatory frameworks aligned with the TCFD Recommendations.4 For example, the UK has introduced the Listing Rules (Disclosure of Climate-Related Financial Information) Instrument 2020,5 which requires companies with a UK premium listing to disclose, on a comply or explain basis, against the TCFD recommendations in their annual reports. The UK government has also published its draft Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2021,6 which, if implemented in its current form, will extend TCFD-aligned disclosure requirements to over 1,300 standard listed companies, UK registered companies, and Limited Liability Partnerships from April 6, 2022. The introduction of such legislative measures will require companies to disclose the impacts of climate-related risks and opportunities on their businesses, strategies and financial planning.

In addition to implementing TCFD-aligned disclosure requirements, governments are beginning to mandate the disclosure of transition plans which set out how companies will adapt to the transition to a low carbon economy.

For instance, in its October 2021 policy paper, "Greening Finance: A Roadmap to Sustainable Investing,"7 and subsequent guidance note,8 the UK government confirmed that from 2023, asset managers, regulated asset owners and listed companies will be required to publish net zero transition plans that detail how they will adapt and decarbonize as the UK moves towards a net zero economy by 2050.

Developing a comprehensive climate action plan will, therefore, ensure companies are well-positioned to comply with such disclosure requirements.

Climate Litigation Risk

Climate change litigation is becoming more prevalent. The global cumulative number of climate change-related cases is reported to have more than doubled since 2015.9 This is a concern for companies, given that litigation can have significant consequences, not just in terms of any award or finding made, but also in terms of adverse publicity and the draw on internal time and resources. For example, following an international NGO's success in its case against a multinational energy company, the multinational energy company was ordered to increase its GHG emissions reduction target.

Moreover, a German NGO has recently filed lawsuits against three German automotive companies, with the aim of forcing the German automakers to limit production of internal combustion engine cars and adopt more stringent GHG emissions reduction targets.

There is also potential for litigation surrounding the development and communication of a climate action plan. For example, an Australian environmental group has filed a lawsuit against Santos, an Australian natural gas producer, alleging that its public commitment to reach net zero by 2040 was not based on sound assumptions and therefore misled investors in violation of Australian law.10 Many businesses already have a well-developed climate action plan and it has not prevented them being subject to litigation. However, it will be even more challenging for businesses to defend themselves in the absence of a well-developed climate action plan.

UNDERSTANDING THE TERMINOLOGY

Climate Disclosures

An initial step in developing a climate action plan is for businesses to identify and report on their emissions.

Emissions are categorized into Scope 1, 2 and 3. Scope 1 emissions are companies' direct emissions from their owned/controlled operations. This includes emissions from running boilers and vehicles, as well as from fuel combustion.

Scope 2 emissions are companies' indirect emissions from the generation of acquired energy, such as from electricity, steam, heating and cooling for their own use.

Finally, Scope 3 emissions are companies' indirect emissions that are not included in Scope 2 and for which they are responsible across their value chain. This includes emissions from products purchased from suppliers, from companies' own products when customers use them, and from employees commuting.11 Scope 3 emissions are potentially of significant importance, since they can account for over 70 percent of companies' carbon footprint. Reducing Scope 3 emissions can therefore have a larger impact than reducing Scope 1 and Scope 2 emissions.

Working out what Scope 3 emissions are can be challenging. However, reporting on Scope 3 emissions can potentially have wider benefits. For instance, it can enable companies to assess where emission "hotspots" reside in their supply chain, thereby allowing companies to identify and potentially manage and mitigate resource and energy risks.

Interestingly, the case against the multinational energy company and the claim against the three German automotive companies both demand reductions in Scope 3 emissions. As the majority of the energy company's and automotive companies' GHG emissions come from their manufactured products, this is a challenging area. Accordingly, it is important for companies to assess their Scope 3 emissions. Companies that do not assess, report on and set targets in respect of their Scope 3 emissions are vulnerable to accusations that they are not doing enough.

GHG Emissions Reduction Targets

When it comes to setting emissions reduction targets, there is often confusion between some of the terminology used.

Carbon Neutral

If a company aims to become "carbon neutral," it is generally committed to not increasing carbon emissions and achieving carbon reduction through "offsets" (for example, through voluntary emissions reduction projects). Becoming "carbon neutral" does not necessarily require a commitment to reduce overall GHG emissions.

Although many companies aim to become "carbon neutral," approaches to climate neutrality often differ in respect of the time frames of the target, the scope of the activities included in the target, the climate impacts from those targets and the climate mitigation approaches used to meet targets.

Net Zero

If a company aims to become "Net Zero," this means the company concerned aims to reduce GHG emissions and will only offset "residual" emissions as a last resort.

Science-based

Science-based targets are targets consistent with the scale of reductions required to keep global warming to 1.5oC/2oC above pre-industrial levels. Companies often set science-based targets via the Science Based Targets Initiative ("SBTi"). SBTi requires companies to set targets based on emission reductions through direct action in their own operations and/or value chains.

Paris-aligned

A target is "Paris-aligned" if it is in line with the science to achieve the Paris Agreement goal of keeping global warming to 1.5oC above pre-industrial levels and reducing GHG emissions to net zero by around 2050. The dual temperature and emission reduction element is a key distinguishing factor.

WHAT SHOULD COMPANIES INCLUDE IN THEIR CLIMATE ACTION PLANS?

Summary

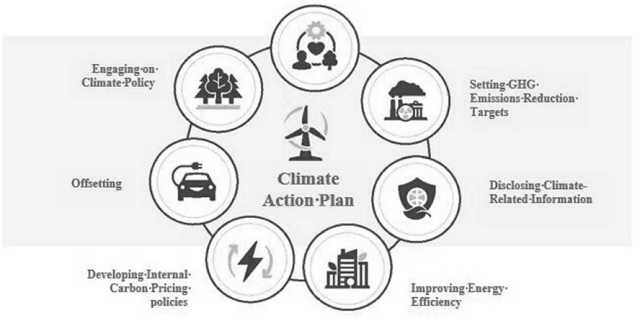

Figure 1 illustrates the key elements to a comprehensive climate action plan. The rest of this section explores each of these elements in more detail.

Figure 1 Measuring, Reporting and Monitoring GHG Emissions

Measuring, Reporting and Monitoring GHG Emissions

As discussed above, a foundational element to any climate action plan is for companies to measure and report (and subsequently monitor) their Scope 1, Scope 2 and Scope 3 emissions, since this enables them to more fully understand their climate impacts and allows them to take effective and targeted responsive action.

There are various standardized approaches for measuring, reporting and monitoring GHG emissions available to companies, including the Greenhouse Gas Protocol ("GHGP")12 and Carbon Footprint Registry.13 The GHGP, for example, provides standardized frameworks which aim to help companies prepare GHG inventories that represent a true and fair account of their emissions. These frameworks have been widely adopted by companies, as demonstrated by the fact that at least 92 percent of Fortune 500 companies responding to the Carbon Disclosure Project's 2016 survey stated that they use the GHGP frameworks.

For many companies and investors, it is important to fit GHG emissions data into a broader "ESG" context that captures a range of environmental, social and governance elements of non-financial risk. The leading ESG disclosure standards and frameworks, including GRI,14 SASB15 and IIRC,16 provide systems for disclosing GHG emissions and other ESG data in a manner that is consistent and comparable, leading to higher quality disclosures that are favored by investors. Yet the fact that there are multiple disclosure standards and frameworks can be confusing for companies. The IFRS Foundation Trustees has, therefore, recently announced the creation of the ISSB17 to consolidate many of the leading disclosure standards and frameworks, thereby establishing a consistent global reporting system.

By using the consistent methodologies provided by frameworks like the GHGP and the ISSB reporting standard, companies can accurately and effectively monitor, report and compare GHG emissions over time.

Setting GHG Emissions Reduction Targets

Once companies have implemented a framework for reporting GHG emissions, they should set emissions reduction targets. Companies can, for example, develop science-based targets via the SBTi. The SBTi sets out a five-stage process to setting targets,18 which includes mandatory criteria for such targets to be recognized as science-based. If companies follow this process, they will have science-based targets that are aligned with the Paris Agreement's goal of limiting global warming to below 1.5oC above pre-industrial levels. This process has been adopted by a variety of companies, from energy and industrial companies to retailers, the majority of whom have committed to becoming net-zero emissions energy businesses by 2050.

Disclosing Climate-Related Information

After companies have set GHG emissions reductions targets, they will be able to disclose their climate-related information. Many companies now go beyond simply disclosing the amount of GHG emissions they produce and comply with the more complex TCFD recommendations. For instance, companies are required to undertake scenario analysis to inform their disclosure of climaterelated risks and opportunities. This will necessitate quantitative analyses of the physical, transitional, acute and chronic risks presented by climate change, as well as the use of heat-mapping to identify areas of particular vulnerability.

To comply with the TCFD recommendations, companies should disclose the actual and potential impacts of climate change on their business, as well as their processes for identifying and managing climate-related risks and opportunities.

Improving Energy Efficiency

Companies should also consider committing to improve their energy efficiency by setting energy efficiency goals. C2ES has developed a system of "SMART energy efficiency goals,"19 which encourage companies to take a systems-based approach to energy efficiency that is enabled through the networking of efficient devices to facilitate more dynamic energy management. To set such goals, companies must firstly ensure they have robust tracking and measurement systems, allowing them to more accurately identify and record their energy usage.

Companies should subsequently implement measures to increase the efficiency of their energy usage. The exact measures used will vary from company to company.

Companies in the real estate sector, for example, can reduce the heating demand of their buildings through limiting the exposed surface area of buildings and improving the insulation of buildings' fabrics, whilst also reducing the consumption of appliances by fitting energy efficient plant and machinery

Companies may also wish to support customers in improving their own energy efficiency by encouraging the use of smart technologies. For instance, demand side response ("DSR"), the incentivized time-shifting of energy use by consumers away from peak times, is becoming increasingly important as energy systems become more reliant on less predictable renewable energy sources, which have a high share of non-dispatchable power. By using smart metering systems, utility companies can communicate with consumers regarding their energy use.

Developing Internal Carbon Pricing Policies

Companies can place monetary values on carbon emissions by developing Internal Carbon Pricing ("ICP") policies. This can be beneficial for companies, since it enables them to assess the carbon footprint of investments and so estimate potential carbon costs and investment return. ICPs can also be used to assess exposure to carbon risk throughout supply chains, which can help companies accelerate emissions reduction and find new revenue opportunities.

There is not currently a uniform global carbon price. For example, European Union Allowances ("EUA") under the EU Emissions Trading System ("EU ETS") are currently trading at just below €60/tonne, while UK Allowances under the UK Emissions Trading System ("UK ETS") are trading at just above £60/tonne.20 Both of these prices are significantly higher than in the "voluntary" carbon offset market. They are also different to the price under the California cap and trade system, for example. The closer ICP levels are to a realistic cost that reflects the cost to the business of being consistent with the achievement of the Paris Agreement targets, for example, the more useful they will be as a guide to a company decarbonizing its activities.

Companies can develop ICPs by undertaking steps discussed below.

Measuring Their Direct and Indirect GHG Emissions

This can be achieved by following the approaches outlined herein.

Examining Their Exposure to External Carbon Prices

To do this, companies can start by gathering current carbon prices by assessing current climate policies in the jurisdictions in which they operate. If the jurisdictions have cap and trade policies, the price on carbon is often made explicit in the marketplace for emissions allowances. In other jurisdictions, the price on carbon can be identified from carbon tax rates, which are usually located in national tax laws. If the price on carbon cannot be identified from these sources, companies can review the World Bank's21 and the OECD's22 published carbon price data.

Once companies have assessed current carbon prices, they should then try to predict future carbon prices. Determining the timescales of such predictions can be difficult, given that there can be considerable variation in profiles over different time series. Consequently, it can be difficult to reliably project value for the carbon futures' forward curve into the longer-term future. Companies are likely to need external help. For instance, the Carbon Pricing Corridors Initiative23 helps companies identify industry-specific carbon price levels necessary to achieve the Paris Agreement goals.

Setting Internal Carbon Prices

Companies should then be in a position to set Internal Carbon Prices. In doing so, companies should consider the time period the ICP is expected to cover. For short-term to medium-term goals, it may be adequate to set ICPs in line with current carbon prices. Yet for longer term goals, companies should set ICPs in line with predicted future carbon prices.

The ICP levels companies should adopt will vary according to their exposure to enduring carbon risk. For instance, British Land has adopted an ICP of £60/tonne to cover projects up to 2030.24 On the other hand, Microsoft has self-levied an ICP of $15/tonne, given its comparatively low exposure to enduring carbon risk.25 This highlights that the exercise of setting ICPs is an art rather than a science, but there are plenty of organizations that are willing to support companies in this area.

Offsetting

Companies may also wish to explore carbon offsetting. Companies can offset GHG emissions by purchasing carbon credits generated from environmental schemes. These environmental schemes generally fall into two categories: reduction schemes, which cut GHG emissions by improving processes, and removal schemes, which absorb or eliminate GHG emissions from the atmosphere. In selecting carbon credits to purchase, companies should consider if the carbon credit is of verifiable quality, if the environmental scheme fits with its responsible business priorities, and if the cost is suitable.

There is not a central marketplace for purchasing carbon credits, which means there are several ways for companies to purchase carbon credits, including purchasing directly from project developers, and relying on brokers and/or retailers. The lack of a central marketplace and uniform standards has meant that the voluntary carbon credits market is particularly fragmented and companies can have difficulties with assessing the quality of carbon credits.

Accordingly, the Taskforce on Scaling Voluntary Carbon Markets ("TSVCM") has been established, which aims to help address these issues by establishing a governance body with an oversight function that will host the infrastructure for a scaled and high-integrity carbon market.26

In particular, the TSVCM intends to create standardized commodity-like contracts that allow companies to trade voluntary carbon offsets at a large scale.

Engaging on Climate Policy

Finally, it is important for companies to engage responsibly in climate policy. This can be achieved by companies identifying the influences of government policies on their own internal climate policies, as well as aligning their internal practices and external messages with such policies.

Companies also can publicly support government adoption of new policies, as demonstrated by multinationals in the energy sector supporting government adoption of carbon pricing in recent years.

Footnotes

1 https://theinvestoragenda.org/icaps/.

2 The United Kingdom's Nationally Determined Contributions (publishing.service.gov.uk).

3 2030 climate target plan: extension of ETS to transport emissions | ENVI Workshop Proceedings (europa.eu).

4 Report on Promoting Climate-related Disclosures (fsb.org).

5 https://www.handbook.fca.org.uk/instrument/2020/FCA_2020_75.pdf.

6 https://www.legislation.gov.uk/ukdsi/2021/9780348228519/pdfs/ukdsi_9780348228519_en.pdf.

10 Australasian Centre for Corporate Responsibility files landmark case against Santos in Federal Court—ACCR.

11 Explained: What are Scopes 1, 2 and 3 | Deloitte UK.

12 https://ghgprotocol.org/corporate-standard.

13 https://www.theclimateregistry.org/programs-services/voluntary-reporting/how-to-join/.

14 https://www.globalreporting.org/.

16 https://www.integratedreporting.org/.

17 https://www.ifrs.org/groups/international-sustainability-standards-board/.

18 https://sciencebasedtargets.org/step-by-step-process.

19 https://www.c2es.org/content/business-strategies-to-address-climate-change/.

20 Carbon Price Viewer—Ember (ember-climate.org).

21 https://carbonpricingdashboard.worldbank.org/.

22 https://www.oecd.org/tax/tax-policy/effective-carbon-rates-2021-0e8e24f5-en.htm.

23 https://www.cdp.net/en/climate/carbon-pricing/corridors.

24 British Land confirms approved science-based targets on journey to net-zero (edie.net).

25 Microsoft will be carbon negative by 2030—The Official Microsoft Blog.

26 Taskforce on Scaling Voluntary Carbon Markets > Homepage (iif.com).

Originally Published February 2022

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2021. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.