Welcome to the Q2 2010 edition of Hotel Market Outlook by Deloitte – our quarterly publication for the UK hotel sector. The outlook is produced using data from an inconsistent sample of hotels collected by STR Global Limited. This data is input into an econometric model developed by the independent economic research firm, e-forecasting Inc, to produce hotel performance outlooks for London and Regional UK.

Hotel Market Outlook capitalises on Deloitte's extensive knowledge of the hospitality industry, enabling us to provide you with commentary and analysis on future trends, as predicted by the e-forecasting model, as well as historic ones.

As always, we hope you will find this publication of interest and we would be delighted to receive your feedback.

Marvin Rust Managing

Partner – Hospitality Deloitte

Overview

Q2 2010 saw hoteliers in London maintain the strong revenue per available room (revPAR) growth achieved during Q1, rising 8.5% to £102.27. Although occupancy saw marginal increases, up 0.7%, average room rates remained robust, growing 7.7%. There was good news for hotels in Regional UK too. After six consecutive quarters of revPAR decline, Q2 saw a 4.5% increase in revPAR to £45.91. This growth was driven by a 4.9% rise in occupancy, which now stands at just over 70%.

Since the last issue of Hotel Market Outlook, the UK economy continues on the road to recovery. GDP grew 1.2% during Q2 – more than the 1.1% initially thought – buoyed by strong performance in the construction sector. As a result, this was the fastest rate of quarterly expansion reported since Q1 2001. Unemployment is also recovering well. According to the Office of National Statistics, the number of people unemployed fell by 49,000 to 2.46 million in the three months to June, the biggest drop in three years. The UK inflation rate eased in July to 3.1%, although it remains well above the Bank of England's (BOE) 2% target rate. The main reasons behind the continued strength of inflation includes the return of VAT in January to 17.5% following its reduction to 15% during the recession, together with increases in oil prices generally and higher import prices as a result of a depreciating pound since the middle of 2007. The BOE now expects inflation to remain higher than forecast for the foreseeable future, primarily due to the rise in VAT to 20% in January 2011. The BOE expects the economy to grow by less than 3% next year; down from the previous forecast of 3.5% (the model uses a consensus forecast of 1.9% GDP growth in 2011 however). Interest rates were kept on hold in September for the 18th consecutive month at 0.5%.

Elsewhere in the world, US economic growth has started to show signs of deceleration, with Q2 reporting 1.6% annualised growth – considerably less than many European economies and lower than the first estimate of 2.4%. Although the US economy has grown for the last four straight quarters, it is thought by experts that it needs to grow at about 3% to keep the unemployment rate from rising.

In August, another 54,000 jobs were lost according to the Labor Department, resulting in the unemployment rate rising to 9.6%. Home sales also slowed following the expiration of the homebuyer tax credit at the end of June.

In Europe, the Euro zone grew 1% in Q2 primarily due to strong exports that were boosted by a weaker euro. The German economy, which grew 2.2%, boosted the zone's overall growth. On the flip side, the Greek economy shrank by 1.5% during Q2 – the only economy in the euro zone to contract during the period. Unemployment remains high across the zone, with Spain remaining the highest at 20%. However, the rest of the euro zone is also suffering with a record high of 10% – slightly higher than the US.

London

Average room rates in Q2 were spot on in terms of what the model predicted in the last edition of Hotel Market Outlook, however occupancy was slightly behind resulting in more muted revPAR growth than initially predicted. According to the Visit London Attraction Monitor, the number of visitors to London's attractions in June saw the highest percentage growth since September 2009, up 6.3%. This followed an upward trend that started in May following the disruption due to the ash cloud a month earlier. As a result, Q2 saw 1% growth compared to Q2 2009.

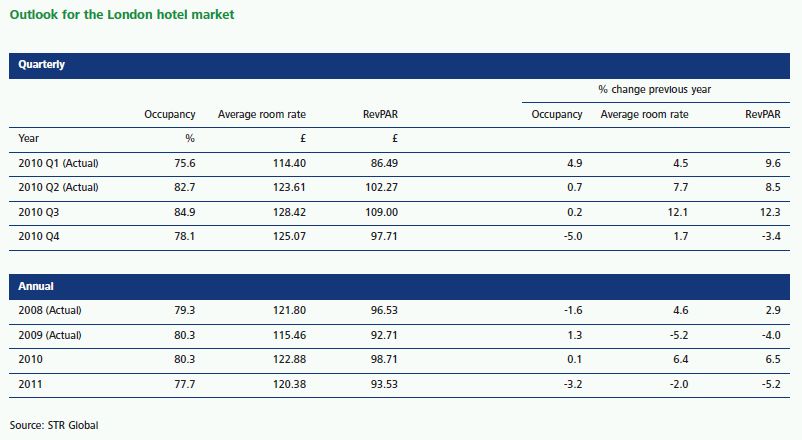

The immediate outlook for hotels in the capital looks assured, with strong revPAR growth expected in Q3. The model is currently forecasting a 12.3% increase in revPAR, however, this is almost a six percentage point downward revision on the last outlook. A double-digit increase for Q3 looks to be 'in the bag' as July was a very strong month for hoteliers in London with revPAR jumping a staggering 24.6% due to the Farnborough Air Show taking place in the UK this year. August also saw good growth, up 5.2% according to daily results from STR Global and with September results expected to follow this trend; we expect the risk to be on the upside. London also saw a huge influx in travellers from the Middle East over the summer months as many sought to escape the scorching heat at home leading up to the Muslim religious festival of Ramadan which took place during the month of August and beginning of September which no doubt attributed to the strong revPAR performance during the period.

The outlook for Q4 has changed considerably since the last report however, with revPAR expecting to decline 3.4%, driven by a dip in occupancy and limited growth in average room rates. This is a very different outlook to three months ago, when the model was predicting a 6.0% increase in average room rates, leading to a 4.1% rise in revPAR.

Looking towards the end of the year and further ahead, the 2010 outlook has also been revised downwards since the last edition of Hotel Market Outlook. It was thought that hotels in the capital would see revPAR rise 10.4%; however it is now only expected to rise 6.5%. Occupancy is set to rise only marginally by 0.1% to just over 80% for the year, while average room rates will be the main driver of growth, up 6.4% to £122.88. The Upper Upscale segment (four-star deluxe properties) are expected to see the strongest growth during 2010, reporting double-digit revPAR growth of 10.2%, closely followed by the Luxury segment, up 9.9%. Growth in both these segments will be led by a rise in average room rates.

For 2011, the outlook has also been revised downwards and all three indicators are expected to dip into negative territory for the year. Occupancy is predicted to take the hardest hit, falling 3.2%, resulting in an overall revPAR decline of 5.2% to £93.53 for the year.

Future prospects

Hoteliers across the UK will be pleased with the results they achieved during Q2 as they continued to build on the growth reported in Q1. The most noteworthy news in terms of performance to date is that hotels in Regional UK are now growing average room rates as well as occupancy.

Regional UK

Occupancy in Regional UK hotels grew for the second quarter running in Q2, up 4.9% to 70.4% following two years of decline which will also please hoteliers around the country. Although Regional UK hotels are yet to report any average room rate growth, they are almost there, declining a marginal 0.4% in Q2 to £65.23. As a result revPAR for Q2 grew 4.5% to £45.91.

Like the capital, the outlook for the remainder of 2010 for hotels in Regional UK has also been revised downwards since the last issue of Hotel Market Outlook. In Q3, revPAR is expected to rise just short of 5% with occupancy continuing to lead the recovery process and reaching 74%. However, average room rates are due to make a turning point in Q3 and forecast to rise 1.1% to £65.91. Occupancy and average room rates are to be strong in Q4 (against weak comparables) resulting in revPAR growth of 7.8% to £45.09. As a result, revPAR will end 2010 up a modest 4.1% driven by occupancy.

When analysing hotel performance in terms of weekend versus weekday split, weekday revPAR continues to lead growth in Regional UK. Weekend revPAR is still growing, albeit at a slower pace than weekday business. The latter reflects an uptick in corporate demand whereas leisure was stronger in 2009 through the downturn.

Looking further ahead to 2011, the model predicts that occupancy will fall back slightly in terms of growth and average room rates will be the main driver, resulting in revPAR growth of 4.5% - a slight downward revision on the last outlook but still stronger than the capital. Occupancy will rise 1.4% to just short of 70% while 3% will be added to average room rates to end the year at £67.16.

Authors comment

Most readers are probably somewhat shocked by the models predictions for London. Whilst there are clearly a number of negative factors for 2011 including it being a non Farnborough year, the year before the Olympics, the year when the supply of luxury hotel product expands with the reopening of The Savoy and The Four Seasons as well as the new Battersea Von Essen property and of course a relative appreciation of sterling against both the Euro and Dollar the pessimism looks to be overstated. In particular the predictions of occupancy declines starting in August 2010 are wide off the mark. For the first time the author's views have probably crossed with many hoteliers.

For 2010 we have led the bulls and still expect the year to end with close to 10% gains in revPAR. For hoteliers expecting much of the same for 2011, disappointment may be in prospect.

For Regional hoteliers the headwinds of job cuts in the public sector and the increase in the rate of VAT will have an effect on suppressing demand and margins particularly in the early part of the year. Although the model has revised downwards expectations for 2011 and 2011 the risk in the short term probably lies on the upside and 2011 looks to be a fair target.

To keep you up-to-date, Hotel Market Outlook will be available each quarter with the latest monthly indicators that shape the future of the industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.