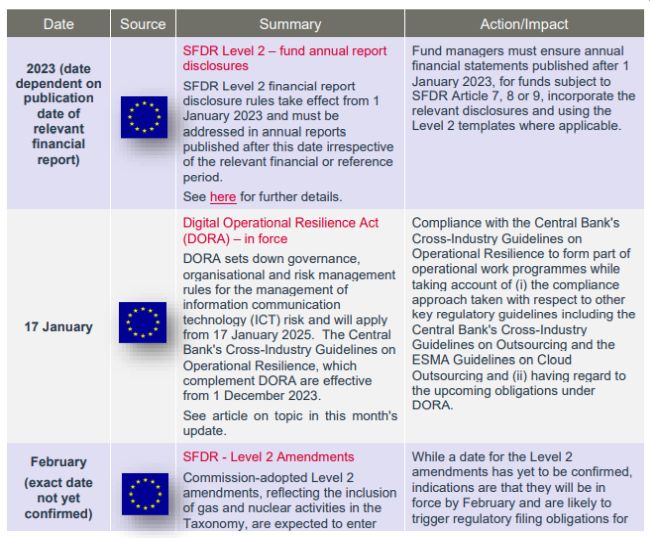

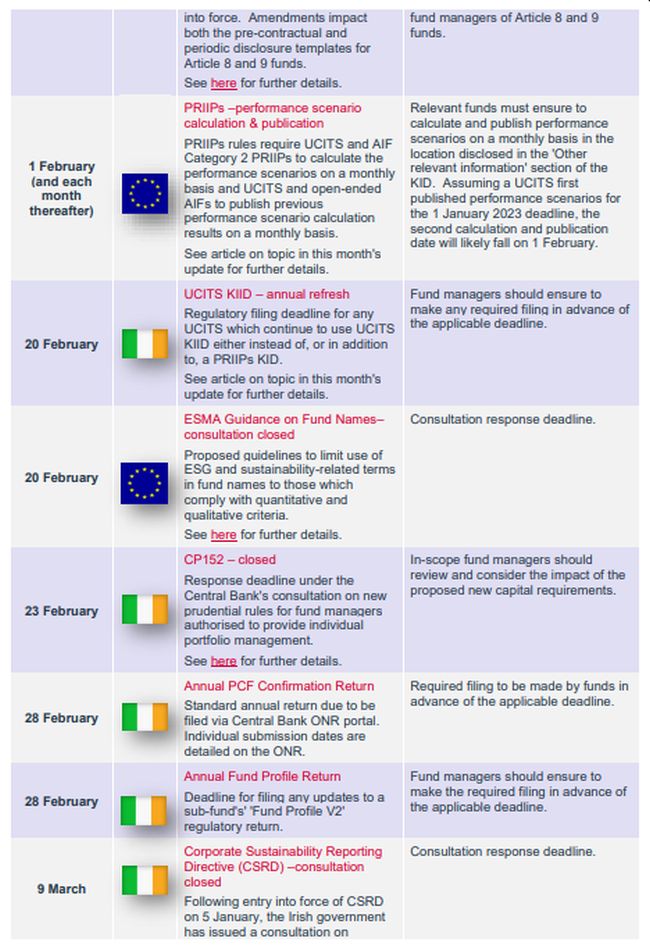

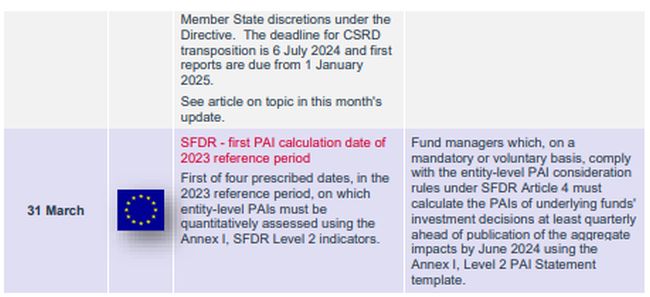

Key Dates & Deadlines: Q1 2023

Corporate Sustainability Reporting Rules Enter into Force

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force with an 18- month period for transposition by Member States. See here for further details on the scope and reporting obligations of CSRD.

On 30 January 2023, the Irish government launched a consultation on Member State options under CSRD which is open until 9 March 2023. Member State options include those in respect of the exclusion of commercially sensitive information from sustainability reporting; the translation of reports; website publication of reports; the introduction of the new category of Independent Assurance Services Providers; requirements for third country entities reporting of net turnover; and various matters in respect of the assurance of sustainability reports.

Next steps

Fund managers should consider the impact of coming in scope of CSRD which automatically results in being subject to the Article 8 Taxonomy disclosure rules, the combination of which would represent a significant sustainability reporting burden in addition to any created by SFDR.

Commission Guidance on Regulatory Filings of PRIIPs KIDs

In Q&A guidance dated 17 January 2023, the Commission set out its view that UCITS which produce PRIIPs KIDs continue to be subject to the UCITS KIID regulatory filing obligation (Article 82, UCITS Directive). As such, Article 82 should be read as requiring the filing of PRIIPs KIDs (instead of UCITS KIIDs) with home NCAs where UCITS produce PRIIPs KIDs in satisfaction of the UCITS KIID rules.

The Commission Q&A follows publication by the Central Bank of its filing requirements for UCITS' PRIIPs KIDs on 21 December 2022 (see here for further details). Under the Central Bank's requirements, the authorisation/approval of new UCITS umbrellas/sub-funds/share classes is subject to:

- where the UCITS produces only a PRIIPs KID, the

submission to the Central Bank of the PRIIPs KID along with written

confirmation of the KID's compliance with the PRIIPs regime and

that it does not conflict with the UCITS prospectus.

The PRIIPs KID and accompanying confirmations should be submitted with the authorisation/approval documents either via email (in the case of a new umbrella UCITS), via ORION (in the case of a new UCITS sub-fund) or via Portal (in the case of a new share class of an existing UCITS). Any updates to such PRIIPs KIDs must also be submitted to the Central Bank using the same ex-post process currently in place for filing UCITS KIIDs.

- where the UCITS produces both a PRIIPs KID and a UCITS KIID, the submission to the Central Bank of the UCITS KIID along with the necessary confirmations in accordance with the current UCITS KIID filing process.

Commission v Central Bank Guidance

It should be noted that the Guidance (at (ii) above) appears to conflict with the Commission Q&A issued earlier this month i.e., the Central Bank requires the filing of the UCITS KIIDs where both a PRIIPs KID and a UCITS KIID are simultaneously produced for a particular product whereas the Commission requires the filing of the PRIIPs KID. It is also unclear from the Guidance as to its application at share class level, a key point given that is the level at which KIDs/KIIDs are generally produced. William Fry has sought clarification directly from the Central Bank and hope to be able to provide an update on both matters shortly.

BMR Updates: Non-EU Benchmarks & FCA MoU

Use of Non-EU Benchmarks in the EU

In Q2 2023, the Commission intends to extend the transitional period under the Benchmarks Regulation (BMR) during which BMR rules for non-EU/third country (TC) benchmarks are suspended. The TC transitional period is currently scheduled to end at the end of 2023 and the proposal is to extend the end-date to December 2025. Proposals are expected to be published for feedback before the two-year extension is finalised next quarter.

While the BMR also includes grandfathering rules for TC benchmarks in use prior to the end of the transition period, any new use of TC benchmarks after the end of the transition is subject to EU equivalence, recognition of the administrator or endorsement of the benchmark under the BMR TC regime. And as the BMR TC regime is widely regarded, including by ESMA, as needing fundamental changes to be fit for purpose, a longer period of suspension would likely be very welcome by a majority of stakeholders.

While the BMR also includes grandfathering rules for TC benchmarks in use prior to the end of the transition period, any new use of TC benchmarks after the end of the transition is subject to EU equivalence, recognition of the administrator or endorsement of the benchmark under the BMR TC regime. And as the BMR TC regime is widely regarded, including by ESMA, as needing fundamental changes to be fit for purpose, a longer period of suspension would likely be very welcome by a majority of stakeholders.

Draft amendments to the BMR TC regime rules, following a review of consultation feedback, were scheduled to be published by the Commission in Q4 last year, but remain outstanding.

FCA MoU

On 25 January 2023, ESMA confirmed agreement of an MoU with the FCA for cooperation and information exchange on UK benchmark administrators. The MoU is one of the pre-conditions for the inclusion/re-insertion of UK benchmarks and administrators on the ESMA register, as is the elusive EU equivalence decision. In the absence of EU equivalence, UK benchmark administrators have until the end of the BMR transitional period to apply for recognition or endorsement. These being the two methods under the BMR TC regime by which administrators can ensure the availability of their benchmarks for new use in the EU after the end of the transitional period (benchmarks in use before the end of the transition period are grandfathered under the BMR). As set out above, however, UK benchmarks are likely to benefit from an extension of the transition period to end-2025, during which time it seems increasingly likely that the BMR TC regime will be overhauled, hopefully for the better.

Next Steps

Subject to the terms of the proposed amendments, an extension of the transition period would allow use of non-BMR compliant, third country benchmarks until end-2025. liquidity scenario (to better reflect redemption stress) and the macro scenario (to better capture macroprudential impact).

The consultation paper also includes the outcome of ESMA's assessment of a new climate risk scenario, which it has decided against proposing as the "exposure of MMFs to climate risk was lower than other entities". Final revised Guidelines are expected to be published in Q4 2023.

Revised liquidity scenario

Under the current liquidity scenario, MMF managers must apply a liquidity discount factor calibrated on bidask spreads by type of security.

ESMA is requesting feedback on two options for adjusting the liquidity scenario to include an additional factor, alongside the liquidity discount factor, which takes account of redemption pressures on liquidity.

For both options, the stress scenario is based on asset sales impacting asset prices (the price impact factor) as distinct from widening bid-ask spreads (the existing liquidity discount factor). To calculate the price impact factor, MMF managers must assume a level of net redemptions, simulate asset sales and assess the impact of those sales on asset prices.

Under option 1, the impact is by reference to the volume of sales - the greater the volume, the greater the impact on the price of the asset.

Under option 2, the impact depends on the MMFs' market footprint - the greater the footprint, the greater the impact on the asset price.

Neither option includes calibrations for the price impact factor, but the consultation sets out market data showing MMFs' large footprint in short term securities and confirms use of that data for future calibrations.

The consultation also proposes (under both options) an extension of the application of the liquidity discount factor to all assets and on a non-exhaustive basis to the list in the current Guidelines, plus certificates of deposit.

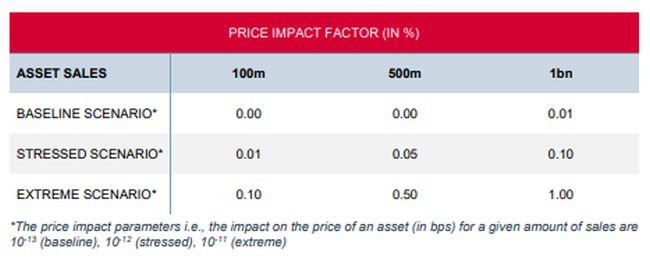

Option 1: Price impact factor increases with volume sold

Under this option the price impact factor is based on a specified price impact for a given level of asset sales in a specific category (the price impact parameter). The price impact parameter is used to estimate the impact of different volumes of asset sales, the result of assumed levels of net redemptions.

While price impact factor calibrations are not proposed for consultation, the following example (based on Central Bank research) is included for illustration. In this example, the price impact parameter for the baseline (normal liquidity) scenario is set at a 10bps price reduction for a sell off of €10bn of assets (10-13) in a specific category. This price impact parameter is then applied to the actual level of sales to determine the price impact factor, which then increases as the level of sales increases. The price impact parameter is also set for stressed conditions (10-12 being a 10bps price reduction for €1bn of asset sales) and extreme conditions (10bps reduction for €100mn of sales) and applied to the volume of sales due net redemptions to provide a price impact factor.

The impact of the liquidity scenario under this option would be the sum of the existing liquidity discount and the price impact. Once established, the MMF manager would estimate the impact on the NAV and report this in accordance with the MMFR and the Guidelines.

Option 2: Price impact factor increases with market footprint

This option also proposes a price impact factor. However, instead of asset sales impacting asset prices by reference to the absolute value of the sale as per option 1, the impact is based on the MMF's market footprint (size of holding compared to size of market) in an individual asset class:

- if the MMF's market footprint is below a specified % threshold, the asset sales would have no price impact, or

- if the MMF's market footprint is below a specified % threshold, the asset sales would have no price impact, or

To implement this option, ESMA would define the list of MMF eligible assets by currency, assess the size of the under underlying market, and define a % threshold reflecting the liquidity of the market for each asset.

The impact of the liquidity scenario under this option would be the sum of the existing liquidity discount and the price impact. Once established, the MMF manager would estimate the impact on the NAV and report this in accordance with the MMFR and the Guidelines.

Revised macro scenario.

The proposals for the macro scenario do not directly impact MMF managers as they do not involve any amendments to the Guidelines but rather provide for additional steps by ESMA to assess (i) the systemic impact on the money market and (ii) the spill overs to short-term issuers, based on the scenario results reported by MMF managers.

Next Steps

Consultation feedback is requested by 28 April 2023 and ESMA aims to finalise the Final Report by Q4 2023 which will include the calibration of the 2023 stress testing scenario for implementation.

Central Bank's Financial Regulation Priorities 2023

In a letter dated 17 January 2023, the Governor of the Central Bank set out the Central Bank's 2023 priorities for financial regulation for the Minister for Finance. Most have been signposted for some time but those regulatory priorities of relevance to funds and fund managers are set out below along with some commentary:

- consulting and engaging on the operationalisation of the

Individual Accountability Framework (IAF)

- notably, the legislation to underpin the IAF was passed by the Dáil on 1 February last. See here for further details

- continuing progress of actions on the systemic risks

generated by non-banks (in particular advancing the

development/operationalisation of a macro-prudential framework for

non-banks, improvements to our legislative frameworks and investor

protections in the investment fund sector)

- see here for further details of the macroprudential framework for property funds which the Central Bank recently noted to Irish Funds was the only such measure currently confirmed for investment funds

- enhancing the governance, oversight and investor

outcomes in the funds sector including the implementation

of new ESG requirements and measures to mitigate greenwashing risks

- the Central Bank is currently carrying out two

greenwashing-related reviews:

- a spot-check review of SFDR Level 2 fast-track filings; and

- an internal thematic review focussing on the alignment of

funds' SFDR classifications, investment strategies, and

portfolio holdings.

The spot-check review is similar to that carried out on Level 1 fast-track filings and the Central

Bank has agreed to meet with Irish Funds in due course to share its findings.

Findings from the thematic review are expected to be presented internally within the Central

Bank in the next two months but no fixed timeline, or set format, has been confirmed for their

dissemination to industry

- notably, the ESAs are also carrying out

greenwashing-related reviews:

- n response to the Commission's request for a report on the prevalence of greenwashing in the Union and the effectiveness of the EU supervisory framework to mitigate any risks identified. A progress report is due end-May 2023, with the final ESA report due to the Commission by end-May 2024; and

- in anticipation of the ESMA greenwashing CSA for funds, expected to launch this year and which may be on terms similar to that launched on 16 January 2023 for MiFID firms which is focussing on the compliance of marketing materials with MiFID disclosure rules and will be 'an opportunity to collect information about possible greenwashing practices observed in the marketing communications and advertisements'

- the Central Bank is currently carrying out two

greenwashing-related reviews:

- strengthening the resilience of the financial system to climate change risks and its ability to support the transition to a climate-neutral economy, along with implementing the EU's Sustainable Finance Disclosures Regulation

- mplementing new EU regulations on digital operational resilience (see article below on topic for further details) and markets in crypto assets (expected to be adopted shortly)

- the implications of the UK's Overseas Funds Regime (including the ongoing equivalence process) to ensure that Irish domiciled funds can continue to service UK investors

- ensuring that the EU's Anti-Money Laundering Action Plan, including the establishment of a single supervisory authority (the Anti-Money Laundering Authority), results in a consistent and robust EU wide framework

- supervisory priorities include the assessment and management of risks to financial and operational resilience).

Next Steps

Fund managers are advised to take account of the regulatory and supervisory priorities as part of work programmes and compliance planning for the coming year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.