Almost no part of the business world has escaped the impact of the COVID-19 pandemic. The lockdowns that sought to control the spread of the virus had the side effect of sucking demand out of the world economy. That led to a need for liquidity: business plans were simply not designed to cope with the write-off of an entire financial quarter.

In some cases, the response was straightforward. Existing liquidity lines with relationship banks were increased, or new ones put in place. But other cases have been more complex, requiring different approaches by portfolio companies and their private equity backers.

1. Ask the Sponsor

The existing private equity sponsor is often the most obvious source of new capital for a portfolio company, and lenders will frequently call for the injection of additional equity to provide working capital. The maxim 'last money in, first money out' usually guides private equity expectations. Rescue financing – either as equity or subordinated debt – which ranks behind everybody else in the capital structure is rarely attractive. At a minimum, sponsors will want any additional funding to rank ahead of the existing equity and shareholder debt.

The trouble is that many leveraged loan documents, especially those of earlier vintages, make it difficult for shareholders to provide further funds to the company in any form other than equity or subordinated debt. It may be possible for sponsors to provide new financing via incremental facilities (see below), but in doing so they would likely be subject to provisions that disadvantage them versus other lenders. For example, they would probably be disenfranchised in any lender vote on all but the most basic matters.

Another problem in some jurisdictions is the doctrine of 'equitable subordination'. This is a legal principle that overrides the contractual documentation to ensure that any financing provided by a direct or indirect shareholder of the borrower is subordinated to third-party creditors in a bankruptcy situation. The sponsor option is often more complex than it looks.

2. Use the Accordion

Borrowers can ask the existing lenders or other third-party debt providers to lend new money under the existing debt documentation. Most recent leveraged loan agreements will allow an additional facility on a pari passu basis with the existing term loans. If a lender willing to provide the new facility, the documentation is usually very simple.1

The amount is likely to be capped, however. While most facilities provide for a basket that can be tapped regardless of the financial condition of the borrower, where more liquidity is needed, the company would usually have to satisfy a leverage test, which may be difficult in a distressed situation.

The other issue is ranking. Similar to the sponsor option, a new debt provider will often want to rank ahead of the 'old' money. However, an incremental facility, while sharing in the existing guarantee and security package, still ranks pari passu with the existing lenders.

New covenant packages may also present a challenge. Some clauses allow an incremental facility to be documented as a 'sidecar' financing outside the existing loan agreement, yet they may require the covenants to be 'no more onerous' than those in the existing loan. That could be an issue where rescue financing providers need additional covenant protection or reporting obligations.

3. Use the Baskets

A borrower may be able to use existing baskets in its loan agreement to incur further debt. In addition to any specifically negotiated baskets, a borrower may also have:

- a 'ratio' basket, allowing an unlimited amount of debt to be incurred so long as a leverage or fixed-charge coverage ratio is satisfied;

- a 'general' basket, which will be capped at the higher of either a set figure or a percentage of EBITDA for the most recent four-quarter period;

- a 'local' debt basket to allow for bilateral facilities, often in specific jurisdictions (again capped);

- a 'non-guarantor' basket (which may be a sub-cap of each of the above baskets); or

- a general carve-out for "securitisation" transactions.

These baskets may enable the borrower to take on a meaningful amount of debt, although the key issue will be the ranking.

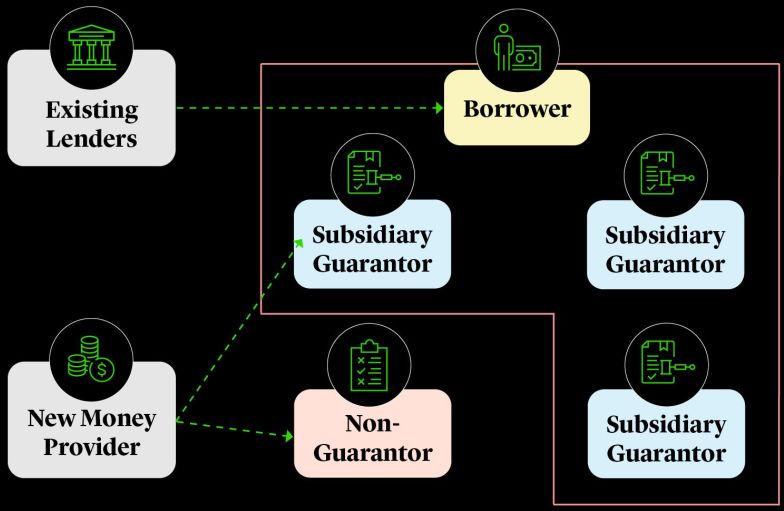

If most of the borrower's assets are already pledged to the existing banks, there may not be much security left for a new financing provider. In European companies, however, there are often entities with valuable assets that provide only a very limited guarantee and security package for the existing leveraged financing. That could be due to financial assistance or corporate benefit issues associated with upstream guarantees. If it is possible to lend to those entities, the new funding provider may be able to establish a senior position even if the new loan is required to remain legally unsecured under the existing negative pledge provisions.

On the downside, the lending amount available to non-guarantors tends to be low, and non-guarantors often do not possess enough assets to make them attractive counterparties.

Lending to unrestricted subsidiaries can usually be done without reference to a capped basket, but unrestricted subsidiaries also tend to have fewer assets. To counter this, companies can contribute valuable assets to an unrestricted subsidiary, and then have the new financing provided to that subsidiary – the so-called 'J.Crew Trapdoor'. Borrowers should check permitted investment baskets carefully to determine if this approach is possible. At the same time, new lenders should analyse whether they will need to accede to the intercreditor agreement, as this could adversely affect the ranking of their money.

4. Amend

If basket headroom is not available, it is usually straightforward to add further flexibility under a credit agreement or bond indenture. Altering the ranking is not so easy, however.

In most European deals, all of the collateral granted by the borrower and guarantors is held by a single security trustee, with ranking and rights of all debt tranches of debt detailed in the intercreditor agreement. Some provisions of that agreement can be amended with simple majority consent. But others require consent from a much broader group; ranking and subordination provisions typically require unanimity under LMA-style documentation. Creative approaches to avoid those requirements are possible. But as recent transactions have shown, they can also lead to tension among creditors. We expect those tensions to rise as capital structures remain under stress.

Footnote

1. If the loan agreement does not have an

incremental facility clause, it may be possible to add an

additional facility using a 'structural adjustment', which

typically requires only majority lender consent.

Source: Cleary Gottlieb.

To view original article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.