Shortly after the UK government announced its Future Fund, we received several enquiries about the scheme.

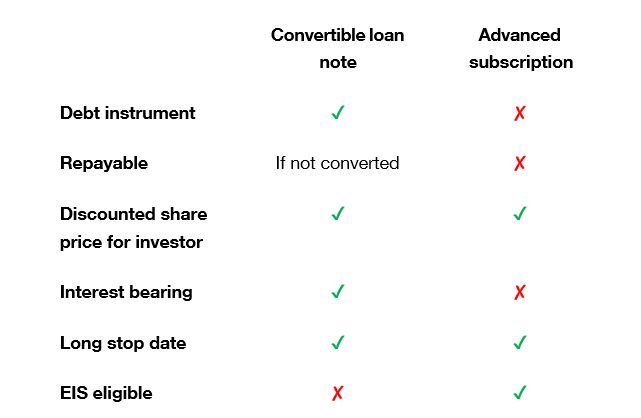

One of the questions frequently asked by Founders related to the difference between a Convertible Loan Note (the instrument the government proposes to use to deliver Future Fund support) and an Advance Subscription Agreement. This brief summary explains the key features of each instrument.

Convertible loan notes

As 'loan' suggests, this is a type of debt instrument. Convertible Loan Notes (CLN) are commonplace in the US and are increasingly popular with investors in the UK. They are often used when it may be difficult to place a value on the company, due to anything from the early stage of the company or the wider economic climate.

Monies are advanced to companies as a short-term loan and provide the option to either: (i) repay the principal amount of the loan (plus interest, if applicable) in a given timeframe; or (ii) convert it into shares at a trigger event, such as a future funding round.

In a conversion scenario, the noteholders receive shares at an agreed discount which can depend on the valuation of the round and amount of the raise. These instruments do not attract EIS relief, making them unattractive for a number of business angels and investment funds.

Advance Subscription Agreements

An Advance Subscription Agreement (ASA) is not a debt instrument and instead requires an upfront payment to the company for future shares. As it is not a loan, it doesn't attract interest and the money isn't repayable by the company.

In exchange, the investor will be issued with shares in the company at a discounted price in the future. When structured and drafted correctly, the investment can be eligible for EIS, making it an appealing structure for business angels and EIS investment funds.

Key CLN and ASA features compared

Avoiding problems

When considering whether to issue single or multiple CLNs or ASAs, a company should understand how these instruments work alongside each other, and with any previously issued notes, ASAs, warrants or options. It's very easy to inadvertently end up with conflicting terms and rights, which often only come to light in the throes of a future funding round.

Future funding rounds are sufficiently time-consuming for management without having distracting, and potentially fractious, discussions over the order and price of share issues. Taking appropriate legal advice at the outset can avoid these problems in the future, whilst helping to secure a welcome source of funding in these challenging times.

Read the articles in the series

- Future Fund - further advice to companies seeking to participate

- The new Future Fund - key unanswered questions

- The Government's new Future Fund for innovative companies - a first assessment

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.