Introduction

We have now seen the new restructuring plan under Part 26A Companies Act 2006 utilised twice to effect debt restructurings, mostly recently in the case of casual dining chain PizzaExpress, which used the procedure in order to restructure its financial obligations using a combination of debt-for-debt and debtfor-equity swaps, and which it completed on 7 November 2020. We consider below some of the key features of PizzaExpress's plan, including the emerging trend of using deeds of contribution in plans and schemes of arrangement in order to restructure debts incurred and guaranteed at multiple levels of a group's financing structure.

The restructuring plan

In our September briefing which can be found here as part of our UK Restructuring and Insolvency Law Reforms podcast series which can be found here, we outlined some of the key features of the new restructuring plan under Part 26A of the Companies Act 2006. These provisions came into force in June 2020 and were swiftly utilised by Virgin Atlantic Airways Limited ("Virgin"), which completed the first such plan in early September.

Hot on the heels of Virgin came the restructuring of popular restaurant chain PizzaExpress, which, even before the COVID-19 pandemic forced site closures, was already facing creditor calls to restructure its heavy debt burden as it struggled with the pressures facing the UK casual dining sector. The restructuring of PizzaExpress included some novel features which are the focus of our Insight.

Conditional company voluntary arrangement

In contrast to the single all-encompassing plan that was implemented in the case of Virgin, the proposal to restructure the PizzaExpress group needs to be seen as part of a wider effort comprising three parts: firstly, a disposal of the China group: secondly, the restructuring plan under Part 26A, which sought to restructure the groups debts: and, finally, a CVA by which the group is also seeking to reorganise its operations and, in a familiar trend, close sites and cut the rent payable to its landlords.

Although the use of CVAs in this manner is not unusual, this is the first instance in which both a CVA and a restructuring plan have been utilised alongside one another, with the successful implementation of the CVA being dependent on new monies being made available to the group under the terms of the restructuring plan.

The potential for uncertainty and the risk of the plan being rejected was heightened when, in a set-back for Pizza Express's plans, it was acknowledged during proceedings that at least one landlord was challenging the CVA. However, the court held that even though such a challenge created uncertainty as to whether the restructuring plan could achieve its aims, that factor alone need not prevent the court from sanctioning a plan even where two processes are inter-dependent, noting in particular that the court need only be interested in whether a restructuring plan has a commercially real prospect of success and should not be looking for a plan guaranteed to achieve success.

Multiple restructuring participants and deeds of contribution

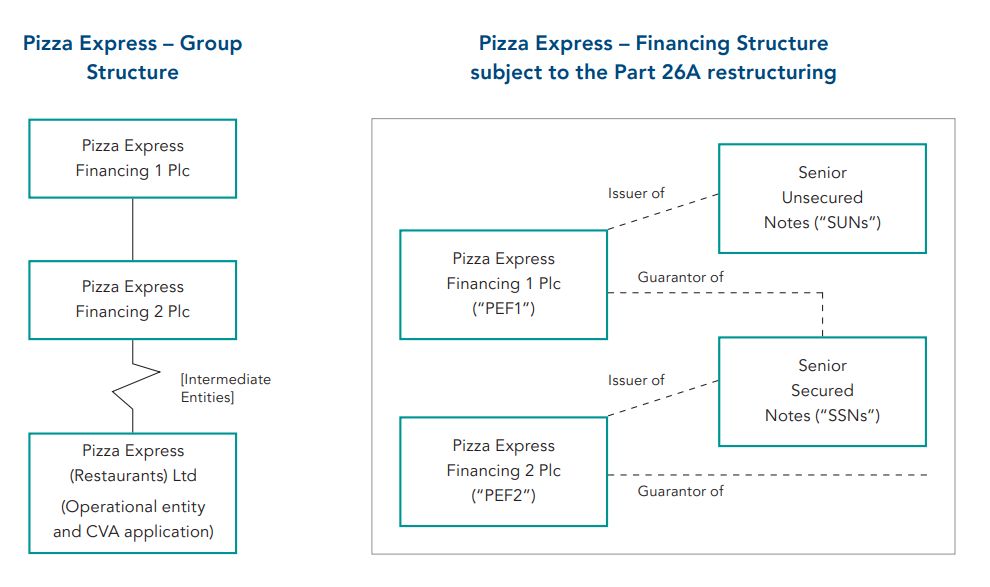

Another interesting feature of the restructuring plan was its use by a single entity to discharge all debts and liabilities at two different financing levels within the group. In the PizzaExpress structure, two series of notes were issued: (i) a series of senior secured notes (the "SSNs") issued by the applicant of the restructuring plan ("PEF2") and guaranteed by its parent ("PEF1"), and (ii) a series of senior unsecured notes (the "SUNs") issued by PEF1 and guaranteed by PEF2. In a first for restructuring plans, Part 26A was used by a single entity (PEF2) in order to discharge both the SUNs and the SSNs (and their associated guarantees) at both the PEF2 and PEF1 levels.

The rationale for discharging guarantees is to ensure that a debt owed by a restructured entity (in this case, the SSNs issued by PEF2) cannot be claimed from the guarantor (in this case, PEF1) who will in turn be entitled to make a claim against the restructured entity, resulting in a "merry-go-round" by which the restructured entity once again ultimately becomes responsible for a restructured debt.

Whilst this principle has been widely accepted since the fallout of the Lehman Brothers collapse in the case of a debt owed by a restructured entity, the same reasoning cannot automatically be applied to a debt that is only guaranteed by a restructured entity (in this case, the SUNs issued by PEF1) as the issuing entity does not have an automatic right to receive a contribution from the guarantor (i.e. PEF2).

In order to overcome this, PEF2 entered into a deed of contribution in favour of PEF1 under which it agreed to contribute to PEF1 any amount that PEF1 was required to pay in connection with the SUNs that PEF2 had guaranteed. The consequence of this is to create an automatic "link" between PEF2 and the debt owed by PEF1, thereby making the debt of PEF1 eligible for inclusion as part of the restructuring plan of PEF2.

This approach was also considered in the case of Virgin but the relevant creditors were ultimately omitted from the restructuring plan in order to avoid the need for such an approach. However, this path has been taken (and sanctioned by the courts) in recent cases involving the restructuring plan's sibling, the scheme of arrangement, having been accepted in Swissport Fueling and seems to be something of an emerging trend, having also appeared in the recent Irish case concerning Nordic Aviation.

Single shareholder cram-down

The third in the trio of features of the PizzaExpress financing was the use of a class that contained only one member: PEF1 as the sole shareholder of PEF2. Whilst class composition can be contested, and the use of a single-member class unusual, little was made of the point in submissions before the court and Norris J accepted both that (i) the rights of PEF1 as a shareholder are fundamentally different to those of the two groups of bondholders, and (ii) that the court has previously approved the principle of single-member classes.

Whilst the plan was devised in contemplation of the potential for cross class cram-down, the plan received resounding approval from all three classes meaning that, much like Virgin, we still await a judgment which may give insight into how the courts intend to apply this new power, although it is possible that the threat of cram-down alone may mean that creditors are more likely to approve plans and that it may be some time before a contested plan reaches the courts.

More to come?

At a broader level we anticipate seeing names in the casual dining sector look to restructure (quite possibly by means of the flexible tool that is Part 26A) given the ongoing impact of lockdowns and tier restrictions on a sector that relies heavily on social interaction and which had already been weakened in the years leading up to the pandemic.

Originally published 15 December, 2020

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.