On 24 September 2020, the Chancellor, Rishi Sunak, set out the Government's new Job Support Scheme (JSS) in a statement to the House of Commons.

The JSS will begin on 1 November 2020 following the closure of the Coronavirus Job Retention Scheme (CJRS) on 31 October and subsidises the wages of employees working at least a third of their normal hours.

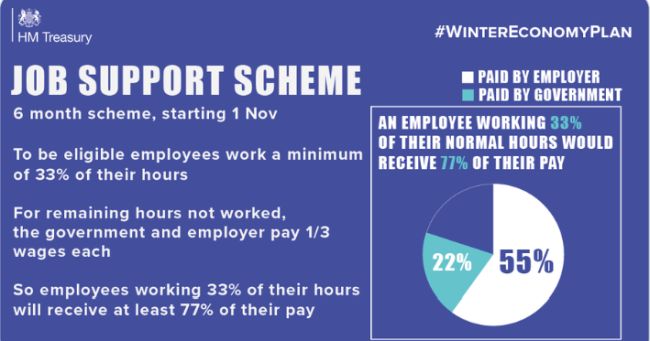

The new JSS is focused on preserving 'viable jobs'. For employers the JSS is less generous than the CJRS. In October employers may claim a CJRS grant for up to 60% of an employee's normal wages, but under the JSS, grants will only be up to 22% of an employee's normal wages. As for employees, they will receive 77% of their gross salary for doing a third of their normal hours. For many that will translate into well over 80% of their net pay.

In the hours that followed the announcement, more details of the new scheme have emerged following HM Treasury's publication of its Winter Economy Plan Policy Paper covering a number of new or revised Government initiatives, including the JSS and the Job Support Scheme Factsheet.

While we await further promised guidance, here we take a look of what we know about the JSS so far and what we have yet to learn.

The New Job Support Scheme Q&A

1. What is the aim of the JSS?

The JSS is designed to protect viable jobs in businesses who are facing lower demand over the winter months due to COVID-19. It focuses support on businesses "that are being impacted by Coronavirus and who can support their employees doing some work, but that need more time for demand to recover.

2. When will the JSS run?

The JSS will open on 1 November 2020 and run for 6 months, until April 2021.

3. What does the JSS provide?

Basically, the JSS can be used to bolster the pay of employees working reduced hours:

- Where eligible employees work at least one third* of their normal hours and are paid by their employer for those hours then,

- The Government and employer together will make up the pay to two-thirds of normal hours, with the Government and the employer each paying one third of the remaining unworked hours (subject to a cap on the Government contribution - see below).

According to the HM Treasury infographic this means the employee works 33% of normal hours and receives 77% of pay, 55% funded directly by the employer (33% + 22%) and 22% funded by the Government (via the employer) - those mathematically inclined will note HM Treasury has done some selective rounding down.

*The JSS Factsheet includes an important caveat. While the JSS is to run for 6 months, the requirement that the employee must work at least 33% of their usual hours will be reviewed by Government who may increase this minimum hours threshold 3 months into the running of the JSS.

4. Is there a cap on the Government's contribution

Yes. As set out in the headlines, employees will need to work a minimum of 33% of their usual hours. For every hour not worked the employer and the Government will each pay one third of the employee's unworked hours. However the Government's contribution will be capped at £697.92 per month. Accordingly, where the Government contribution has been capped the employee may receive less than 77% of their normal pay.

5. Can employees work more than a third of their normal hours?

Yes. If employees work more than a third of their normal hours the JSS grant amount will be reduced as the unworked hours to which the grant can be claimed will be reduced. The Treasury Factsheet provides the illustrative example of:

| Hours Employee Worked | 33% | 40% | 50% | 60% | 70% |

| Hours Employee Not Working | 67% | 60% | 50% | 40% | 30% |

| Employee Earnings (% of normal) | 78% | 80% | 83% | 87% | 90% |

| Gov't Grant (% of normal wages) | 22% | 20% | 17% | 13% | 10% |

| Employer Cost (% normal wages) | 55% | 60% | 67% | 73% | 80% |

6. Is use of the JSS linked in any way to the CJRS?

No. Eligibility for employers is not dependent upon having previously used the CJRS.

If the employer has used the CJRS, they can still use the new JSS and will still be able to claim the Jobs Retention Bonus in respect of those previously furloughed employees who are retained until at least 31 January 2021.

7. Which employers are eligible?

All employers with a UK bank account and UK PAYE schemes can claim the JSS grant.

All small and medium employers will be eligible without any financial assessment test.

Large employers will only be eligible where their turnover has fallen through the COVID-19 crisis. Large businesses will have to meet a financial assessment test, so the scheme is only available to those whose turnover is lower now than before experiencing difficulties from COVID-19.

Further guidance is promised on what the financial assessment test will entail for large employers. However, the JSS Factsheet states that the Government expects that large employers will not be making capital distributions, such as dividends or share buybacks if using the JSS.

We also await detail of how small, medium and large employers will be defined for the purposes of the JSS.

8. Which employees are eligible?

Employees must be on an employer's PAYE payroll on or before 23 September 2020. This means a Real Time Information (RTI) submission notifying payment to that employee to HMRC must have been made on or before 23 September 2020.

Employees must be on reduced hours (see below).

Employees will be able to cycle on and off the scheme and do not have to be working the same pattern each month, but each short-time working arrangement must cover a minimum period of seven days.

Employees cannot be made redundant or put on notice of redundancy during the period within which their employer is claiming the grant for that employee. This is an important difference to the CJRS.

Note: the Treasury Factsheet uses the term 'employees'. At this stage it is unclear whether 'employees' is used as defined in the Employment Rights Act 1996 or whether it is intended to include the wider class of 'workers'. It is highly likely to be the latter which is used under the CJRS.

9. What does it mean to be on reduced hours?

The employee must be working at least 33% of their usual hours - to be reviewed by Government who may increase this minimum hours threshold 3 months into the running of the JSS.

Note: HM Treasury use the terms 'normal hours' and 'usual hours' interchangeably.

10. What does the grant cover?

For every hour not worked by the employee, both the Government and employer will pay a third each of the 'usual hourly wage' for that employee, subject to the Government contribution cap of £697.92 a month.

The JSS grant will not cover Class 1 employer NICs or pension contributions, although these contributions will remain payable by the employer

11. What are 'usual wages'

The JSS Factsheet states the 'usual wages' calculations will follow a similar methodology as for the CJRS. Full details to be provided in future guidance. Employees who have previously been furloughed, will have their underlying usual pay and/or hours used to calculate usual wages, not the amount they were paid whilst on furlough.

What remains unclear at this time, is what will be the reference point for 'usual wages'. The CJRS used pay based on a 19 March 2020 reference date. But the eligibility date for the JSS is 23 September 2020. What is the position where the employer and employee have agreed a more permanent contractual change in working hours since 19 March, intended to endure beyond the employee's furlough arrangements or where an employer did not utilise the CJRS? Presumably it will be the contractual hours/wage in effect at the time the grant is claimed in that scenario rather than contractual wages/hours which applied back in March. Hopefully further guidance will address this issue.

12. Can employers claiming the JSS grant top-up employee wages?

No. Unlike the CJRS, the JSS Factsheet states the Government "expectation is that employers cannot top up their employees' wages above the two-thirds contribution to hours not worked at their own expense".

13. What about those on leave?

Will and if so how the JSS will apply in relation to those on maternity and other forms of family related leave or sick leave/self-isolating is simply unanswered.

14. Can the JSS grant be claimed before paying over the employees' wages?

No. The employer will be reimbursed in arrears for the Government contribution.

This a key difference to the CJRS and will be an important cash flow concern for employers.

15. How can an employer claim?

Employers will be able to make a claim online through Gov.uk from December 2020.

Grants will be paid on a monthly basis. Grants will be payable in arrears meaning that a claim can only be submitted in respect of a given pay period, after payment to the employee has been made and that payment has been reported to HMRC via an RTI return.

16. Will HMRC run checks?

Yes. Payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information. Grants can only be used as reimbursement for wage costs actually incurred.

As was required under the CJRS, employers must agree the new short-time working arrangements with their staff, make any changes to the employment contract by agreement, and notify the employee in writing. This agreement must be made available to HMRC on request.

Unlike the CJRS

We will provide a further update once more detail is available.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.