The Pensions Brief is a monthly update for trustees and employers of occupational pension schemes in the UK. It provides headline summaries of developments over the previous month and associated action points. It also includes a timeline of forthcoming developments over the next 12 months.

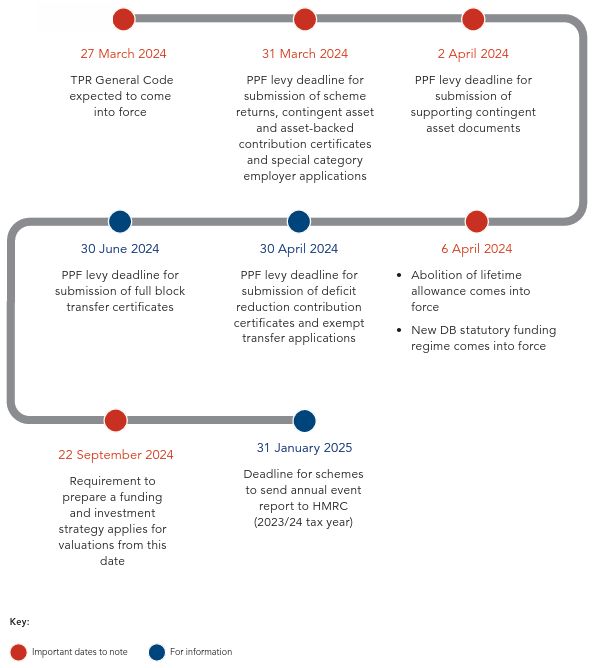

Dates to note over the next 12 months

ISSUES AFFECTING ALL SCHEMES

General Code – final version published

The Pensions Regulator (TPR) has published the final version of its new General Code and an accompanying consultation response. The Code consolidates ten of TPR's existing codes of practice and sets out the requirements that schemes need to meet in order to have an effective system of governance (ESOG) in place. The Code has been laid before Parliament for approval and is expected to come into force on 27 March 2024.

A wide range of changes have been made to the Code. However, in the main these are clarificatory in nature, involve the adding of additional detail and/or involve the renaming or restructuring of modules. The module numbers have also been removed.

Other key changes include:

- Clarification that the remuneration policy should only cover costs for which the trustees are directly responsible and does not have to set out the levels of remuneration paid. The requirement to publish the policy online has also been removed.

- Relaxation of the own risk assessment (ORA) timetable so that schemes will be able to complete the ORA on their own timetable and to complete different sections of the ORA at different times, provided the ORA is carried out in its entirety at least every three years. In addition, the requirement to complete the first ORA within 12 months of the Code coming into force has been removed. Instead, the first ORA must be completed by the deadline specified in regulations (which at its earliest will be within 12 months of the end of the first scheme year that begins after the Code comes into force).

For more information, please see our legal update.

Action

Trustees should review the Code and consider what steps they need to take to comply with the ESOG requirements and the other matters in the Code.

Abolition of the lifetime allowance – further guidance

HMRC has published a newsletter which includes responses to a number of queries that have been raised about the abolition of the lifetime allowance (LTA) and the new lump sum regime. These cover topics including small and trivial commutation lump sums and transitional tax-free amount certificates. The newsletter also confirms that HMRC will aim to issue further guidance every two weeks.

Action

No action required, but trustees and administrators may find the newsletter helpful in their preparations for the abolition of the LTA.

Private markets investment – TPR guidance

TPR has published guidance for trustees on investing in private markets. The guidance covers:

- A general overview of the classes of private market assets.

- The opportunities and risks that private market assets can present.

- The legal duties of trustees when investing.

- Key considerations and specific matters to consider as trustees of DB and/or DC schemes.

For more information, please see our legal update.

Action

No action required, but trustees may find the guidance helpful when considering private markets investment opportunities.

Pensions dashboards – FAQs

The Pensions Dashboards Programme has published FAQs on the dashboards ecosystem and on "find" data. The FAQs cover:

- The central digital architecture.

- The different components of the ecosystem.

- How dashboard users interact with the central digital architecture.

- What find data is.

- How find data is used for data matching.

- What the find data journey is.

In addition, the statutory prohibition on trustees being indemnified out of scheme assets in respect of civil penalties imposed under the pensions dashboards legislation came into force on 1 January 2024.

Action

No action required.

Invalid amendments – severability

The High Court has decided that, when considering whether a partially invalid amendment that infringes the scheme's amendment power can be severed to save a partially valid amendment:

- The court must be satisfied that the parties to the amendment would not have entered into it had they known the true scope of the amendment power.

- This involves an objective rather than a subjective investigation.

Action

No action required.

To read this article in full, please click here.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.