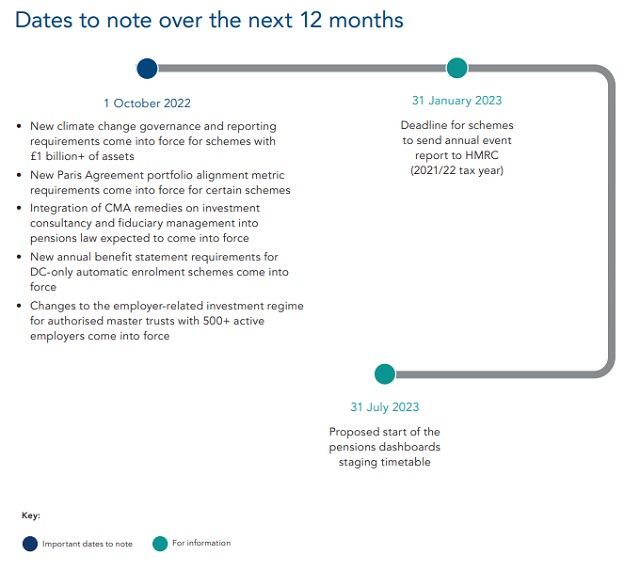

Issues affecting all schemes

Investment consultancy and fiduciary management – guidance

The Pensions Regulator has updated its guidance for trustees on their obligations in relation to:

The guidance has been updated to reflect the integration of the Competition and Markets Authority (CMA)'s remedies on investment consultancy and fiduciary management into pensions law. The Regulator has also added two new appendices to the fiduciary management guidance that set out how trustees can assess the performance of fiduciary managers using Global Investment Performance Standards developed specifically for pension schemes and approved by the CMA.

Action

No action required, but trustees may find the updated guidance helpful when tendering for fiduciary management services and when setting objectives for their investment consultants (and when reviewing their investment consultants' performance against those objectives).

Pensions dashboards – industry guidance

The Pensions Administration Standards Association has published:

- Guidance on returning pension values for pension dashboards. This includes a checklist and guidance on understanding value data requirements and scheme readiness to meet those requirements and creating an action plan.

- Updated guidance on data matching conventions. The guidance has been updated to include a call to action, to detail the next steps being worked on and to provide links to other industry guidance.

Action

No action required, but trustees and administrators may find the guidance helpful when preparing for compliance with the pensions dashboards requirements.

Forfeiture provisions – interpretation

The High Court has decided that:

- A scheme rule providing for benefits or instalments of benefits not claimed within six years of the date of payment to be retained by the trustees for the purposes of the scheme was a forfeiture provision. It was not limited to missing beneficiaries, but applied to all unclaimed benefits once the six year period had expired.

- The forfeiture of a shortfall in a lump sum has no effect on future instalments of a member's pension and does not either increase or decrease them.

- A benefit or instalment has been "claimed" when the member has expressly or impliedly asserted a right or entitlement to the specific benefit or instalment or has asserted a general right or entitlement to receive all unpaid benefits or instalments.

- If trustees wish to recover an overpayment by equitable recoupment, and the member disputes the amount to be recouped either in total or from each pension instalment, the trustees must obtain an order of a competent court to enforce the recoupment. The Pensions Ombudsman is not a competent court for these purposes.

Action

No action required.

Issues affecting DB schemes

Indexation – alignment of RPI with CPIH

The High Court has rejected a claim by the trustees of the BT, Marks and Spencer and Ford pension schemes for judicial review of the government's decisions:

- To align the Retail Prices Index (RPI) with the Consumer Prices Index including housing costs (CPIH) from 2030.

- Not to pay compensation to the holders of UK index-linked gilts because of the decision to align RPI with CPIH from 2030.

Action

No action required.

Refinancing – employer covenant impact

The Pensions Regulator has published a blog post looking at the risks of refinancing to the employer covenant and outlining the actions that trustees and employers should take to ensure that member benefits are protected. The Regulator's key expectation is that trustees and employers:

- Understand the implications of any refinancing on the pension scheme and the employer covenant.

- To the extent possible, mitigate any detriment caused

Action

No action required, but employers and trustees may find the post helpful when a refinancing affecting the employer is contemplated.

Investment strategies – appropriateness

The Pensions Regulator has published a blog post about the importance of trustees continuing to ask questions about whether their scheme's investment strategy remains appropriate. The post underlines the importance of trustees:

- Considering both operational and strategic investment risks.

- Getting good investment advice.

- Implementing effective investment risk management processes.

Action

No action required, but trustees may find the post helpful when reviewing their investment strategy.

Mayer Brown news

Upcoming events

All events will take place as online webinars. For more information or to book a place, please contact Katherine Carter.

- Trustee Foundation Course

7 December 2022 - Trustee Building Blocks Classes

9 November 2022 – trustee discretions and decision-making - Quarterly webinars

27 September 2022 – To go or not to go: dealing with pension transfers 13 December 2022 – TBC

Recent Mayer Brown work

- Beverly Cox and Tim Shepherd, partner in our professional risks and insurance team, advised the trustee of the WH Smith Pension Trust on its £1 billion buy-in, including residual risk cover, with Standard Life (part of Phoenix Group). The buy-in covers the Trust's liability to pay the benefits of all of its 13,000 members.

Pro bono and CSR

- Giles Bywater and Liam Kellett (and other Mayer Brown colleagues) won an internal award for their work on the Afghan Pro Bono Initiative, an ambitious collaborative project with 13 other law firms and the NGOs Safe Passage and Refugee Legal Support. The Initiative provides pro bono legal advice and representation to Afghans who want to resettle in the UK, focusing on family reunion applications and Afghan Relocation and Assistance Policy (ARAP) scheme applications and appeals.

Originally Published August 2022

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2021. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.