To read Part One of this article please click here

AIRLINES AND HOTELS: JOINED AT THE HIP

No strategic overview of the future of the hospitality industry would be complete without a look at air travel. Analysis confirms that any disaster that hits airlines – such as a terrorist attack, or the outbreak of war – also impacts hotel businesses dramatically. Likewise, positive events, such as major sporting events and conferences – gives both airlines and hotels a boost.

As many people reach the hotel reception desk via an airline, we need to look at air transport predictions for 2010. If the air travel industry is changing, how will this influence tourism, which is both a major customer and supplier?

A Shift In Traffic

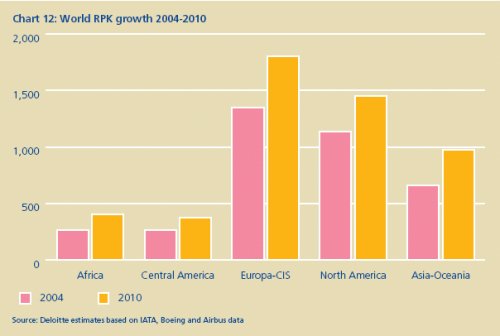

More than 1.6 billion35 passengers a year use the world's airlines for business and leisure travel today. By 2010, we expect that to soar to around 2.3 billion, with Revenue Passenger Kilometers (RPKs) reaching 5 trillion. As you can see in the chart 12, some regions will experience even stronger growth.

Last year, more than 50% of total passenger traffic was generated within North America and Europe, with Japan accounting for an additional 4% from domestic or international flights35. These three regions equate to more than 70% of the US$ 400 billion of airline revenues35.

However, this picture will change dramatically in the next five years, due mainly to the emergence of China and India as economic superpowers, set to capture around 15% of the expected growth in global traffic. Business travel will dominate, but inbound and outbound leisure tourism will account for a significant slice of the traffic. Importantly, this signals the opening of an entirely new market, since much of the growth will come from people who have never flown before.

To date, air travel has been mainly a privilege for the western, industrialised mass market, but it will increasingly become an option for all. While liberalisation of domestic and international traffic, fuel prices and political stability will impact the speed of growth, there is no doubt that there will be sizeable shift in air traffic from North to South, and from West to East.

Business, Pleasure – Or Both

People choose to fly for both business and leisure reasons, but will the distinction between the two continue to matter? Across America and Europe, product differentiation is changing.

Some airlines, such as Aer Lingus, have abolished business class on short and medium-haul flights, while Low Cost Carriers (LCCs) have introduced features such as in-flight entertainment and departures from first tier, business friendly airports to attract more business clients. Recently, several companies have brought in business class "low cost" options on long-haul routes.

Fierce competition between LCCs and the traditional carriers, plus cost-cutting by both airlines and corporate travel managers, have triggered this trend. But as the airline industry stabilises and the corporate market recovers, there will be space for more product differentiation, including business and luxury services. This can already be seen on intercontinental traffic, where some airlines, such as Air France, British Airways, KLM, Lufthansa and Virgin are now offering all-business class flights, and most major network carriers are investing heavily to improve their products. This upward market segmentation is illustrated by marketing campaigns featuring:

- Increased on-board comfort levels, with possible shower facilities, gym and massages.

- Seamless and pervasive technology, with broadband as the bare minimum, and possibly video conferencing.

- Mood lighting to aid jetlag and assist sleep.

- On-board entertainment to move into 'home-from-home,' with online gaming and the option to challenge fellow passengers.

- Amenities that focus on customers' personal needs. Using CRM technologies and data capture, airlines can offer a passenger's preferred reading materials, menu items, wines, and other services.

- Segmentation of the physical space to allow interaction or solitude.

- Door-to-door rather than gate-to-gate service.

Despite the intrusive, though vital, security at airports, these additional personal touches and luxury facilities will make the flight an enticing prospect again – for some. It would seem that, although air travel has generally become a commodity product, airlines will continue to find ways to differentiate between the value conscious and those seeking luxury.

The Future Of Low Cost Travel

If the way forward for many airlines is more luxury, does that mean that LCCs have reached the end of the road? Not quite. The continuous expansion of low cost travel in the US, where it first took hold in the 1970s, proves the business model foundations are sound and still meet the needs of a major chunk of the market.

However, we do expect significant changes in the segment across Europe and Asia, where LCCs are still youthful and facing some unprecedented challenges. The market is reaching saturation in Northern Europe. There is also tough competition from network carriers, which are in better shape in Europe and Asia than they are in the US, as well as charter airlines. It follows that consolidation is on the cards, either among the LCCs themselves, through acquisition or market exit by start-ups.

Survivors, however, will continue to be among the world's most profitable airlines, generating less than 50% of revenue through ticket sales, with the bulk of their revenue and all of their profit coming from related activities, including on-board sales, car rentals and hotels, ground transportation tickets fees, and other services.

In the Middle East region, where the low cost revolution has just begun, we can expect the same kind of pattern. Low cost mania, as witnessed in South-East Asia and Europe in the past decade, will last for around three years, followed by consolidation.

Moving From A To B

Will LCC consolidation mean the end to the point-to-point network promoted by budget airlines? Probably not. Although this model is less economically efficient overall, it meets the passengers' needs of moving from A to B better. All things being equal – especially the price – it will always be preferred over any network link that requires a connection. Additionally, recent economic benefits of the hub & spoke model – essentially asset allocation and slots utilisation – have been eroded by the cost of complexity built in by airlines running huge network operations. There is evidence that major network carriers are already slimming down their hub operations, either by reducing the number of waves or withdrawing from certain airports where they had established 'secondary hubs.'

There are noticeable exceptions to this trend. Emirates, for instance, with no domestic market, is building its future business success on its Dubai hub. By around 2010, it intends to be the biggest long-haul carrier in the world. But as Emirates has built its strategy on market liberalisation (the UAE has 'open skies' agreements with all the major countries, making it possible for Emirates to link to secondary airports in Europe, Asia, Africa and the Pacific Region and leverage its natural hub position), international air traffic liberalisation could contribute to the success of point-to-point.

If the recently agreed open sky deal between the EU and the US is ratified, similar agreements around the world will follow. It will then be possible to fly from any city to any other city of the country or region that adopts the agreement, making connection stops at super-hubs (such as London Heathrow) redundant.

Obviously, this will only be possible if the airport infrastructure can accommodate long-haul aircraft and the extra passengers from intercontinental traffic.

It's therefore likely that public policies, local community support for huge infrastructure investments – including runways, ground transportation, logistics platforms, retail and commercial activities – will determine the future of air transport as much as product innovation and customer preferences.

Supersize Me

Airlines currently seem divided on future business model options, and this is reflected in current investment decisions. Hub & spoke supporters are ordering the so-called 'Super Jumbo,' such as the double deck Airbus A380 with 550-800 seats, and its Boeing archrival, the stretched B747-800 or smaller B777 or A340.

Those who favour point-to-point travel are ordering the new 'Sub Jumbos,' which have 250 seats, such as the Boeing 787 and the renewed Airbus 350.

Other factors are influencing their buying decisions, including:

- Oil prices;

- Environmental concern and relative regulation;

- Cost of capital/access to financial resources;

- Investment decisions of airports to accommodate super jumbos;

- Final customer preference; and

- Traffic congestion and Air Traffic Control regulation and technology.

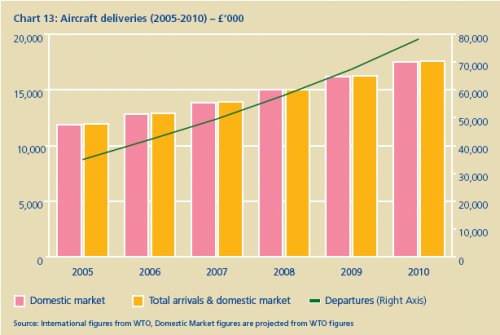

We believe there is sufficient demand for both types of aircraft and the current boom in orders has been stretching Boeing and Airbus' production plans to the limit. Interestingly, orders placed last year were about a quarter higher than the total number in 1989.

Safe And Secure

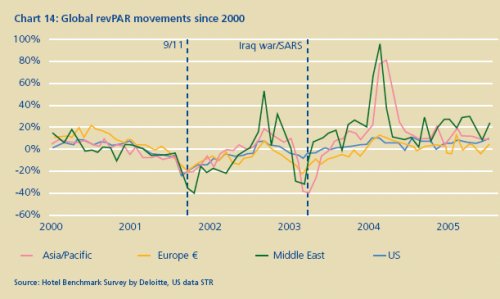

When news of terrorist attacks, hurricanes or other natural disasters strikes, the initial reaction around the world is profound shock and outrage, then sympathy with the tragic loss of life and destruction of property. Next, everyone on the travel and hospitality industry begins the painful task of calculating the cost and rebuilding, where possible.

But, as our research shows in chart 14, travellers appear to have become more resilient. Despite the disasters that swept the world in recent years, visitor numbers and hotel performance, as measured by revenue per available room, has remained buoyant and the industry is now enjoying unprecedented levels of growth. We expect that tomorrow's travellers will take more ownership of their security by using the internet to check safety issues prior to travel.

Governments worldwide are responding to terrorism threats with a diverse range of traveller identification initiatives, such as biometric passports and extremely rigorous entry visa procedures. These will increase border security, but may also slow the growth in travel, particularly for countries where security investment and internet take up lags behind.

Achieving Success In 2010

- Air transport will remain hugely influential within the larger tourism industry. Flying will become part of everyday life for millions of people, who, until a few years ago, never moved from their villages.

- Technology – both IT and avionics – will improve market segmentation and direct sales. Airlines, especially charters who already offer up-to 35% of their seats online, and airports will compete with tour operators and hotels for customer spending. After all, the more that's spent at the airport and on-board, the less there is to spend at the destination.

- Government policies, international co-operation and public concerns will dictate the pace of transformation.

- Travellers will continue to become more resilient to political, terrorist and natural disasters, and will increasingly use the internet to assess safety & security levels prior, during and after their travels.

- Substantial investment in biometrics and other technologies will continue – at the cost of individual privacy. In the short-term, a country's ability to invest in safeguarding their national borders may impact the growth in travel.

ACTIONS TO CONSIDER

- Customer loyalty will depend on the hotel operator's ability to deliver the brand promise consistently at every touch point – from reservation to post-stay. Getting it right will deliver sustained returns and brand premium. Action is needed to review the customer relationship on a holistic basis and operationalise the brand response to the customer – at every touch point. Among other things, this will require:

- A virtual, as well as a physical CRM strategy. An eCRM strategy will become even more important as broadband and next generation mobile communications become pervasive.

- Investment in loyalty programmes that recognise customer needs. Points may not always be the answer, but hotels must find innovative ways to recognise and reward customers if they want to increase loyalty.

- Innovation in both products and market segmentation must meet the diverse needs of the four generations. The 'one size fits all' approach will no longer work. Work is needed to define the brand persona which should reflect the expectations of the target generation. These will vary across different regions. Operations, sales and marketing, and service delivery must be adapted to the different needs of each generational segment.

- As product and software platforms converge, IT investments must be rigorously evaluated to ensure spending is matched by greater efficiency and/or increased RevPAR. Investment in short term IT 'fads' should be avoided.

- The talent agenda, aimed at attracting and retaining employees, will require investment in new dimensions – focused more on generational values and less on traditional compensation structures. Performance metrics will need to reflect the transition from asset manager to brand owner. HR will need to reflect 2010 values – including flexible working, onsite and work-from-home arrangements, and ethnic and religious integration. Enterprise-wide HR processes and training, traditionally an area of under-investment by the industry, will be essential.

- The emerging markets of China, India and the Gulf States offer massive opportunities for development. Entry and growth strategies should be developed that reflect the unique business, real estate and tax environments of each market. Given that China and India present huge potential markets for domestic tourism, investment in product innovation and adaptation to local preferences will be necessary.

- Recruitment of trained talent is a challenge in the emerging markets of China, India and the Gulf States and action is required to develop local and international training to meet the demand. With the number of Chinese tourists rising rapidly, Mandarin language skills will be in strong demand worldwide. Hotels will need to make sure their F&B and entertainment offerings cater for these new travellers. Are your hotels ready to receive Chinese visitors?

Footnotes

35. IATA.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.