Introduction

Global businesses are increasingly centralising their financing functions, looking to increase efficiency by running their finance and reporting functions from shared service centres instead of replicating the entire structure of the function in every country. The change is driven by the need to streamline, standardise, and control data from the hub instead of at the rim. The cost efficiency and greater degree of control given by centralised business models makes them unquestionably attractive. But they are not without risks.

Operating in a multiplicity of countries inevitably also means having to comply with many local regulations- for tax returns, statutory filing, payroll, and many more. Compliance regimes can be simple or complex, but more than anything they are varied. Furthermore, many territories change their filing regulations frequently, and without a contact in the country, it can be difficult to keep abreast of these changes. Therefore, the highest barriers to a truly centralised finance function are the problem of scalability, and the continued need to rely on local expertise. Without that key local knowledge, businesses can run foul of laws entirely unintentionally - but the consequences could still be strict.

"Late filing in Denmark can lead to the company being dissolved within a span of months. It's possible to restart the business after this, but there are significant administrative barriers to overcome"

BDO has conducted a study to examine the penalties and regimes that are in place the world over, asking partners from throughout our global accounting network to give us a snapshot of the state of play in their country, and the penalties for failing to comply with the regulations. In this report we summarise the responses of 67 of those countries and examine the key findings.

"In Serbia, many companies misunderstand tax regulation and pay penalties as a result. Some taxpayers have taken to paying extra tax where they have no liability just to insure against possible liability."

Geographic breakdown of countries in the study:

Our sample spanned the world, and ranged from very small countries to major international business centres.

"In Argentina, audited financial statements have to be filed annually regardless of the size or activity of the trading entity."

Notes: Quotes in this report are from BDO partners in the responding countries and from company executives in our previous study "Local Compliance in Global Business"

INTRODUCTION

The exact countries were as follows:

"I don't lie awake at night worrying about our local regulatory requirements, but there is always a nagging doubt at the back of my mind that we could fall foul of some requirement of which we may not even be aware."

SUMMARY OF FINDINGS

Compliance is not just a local risk. Many countries can and do apply penalties for failing to comply with local procedures to the global parent, in some cases even personally to the parent company directors.

Filing administration is widely varied. Despite the global convergence on IFRS, the expectations (and consequences for non-compliance) are still very different and tied in to the forms of the local legal systems, and there is no expectation for this to change.

Many countries require that filings are made in their local language, or are always made at a set date regardless of the company's internal reporting date.

The most common penalties for late or incorrect filing, or similar non-compliance, are fines. These may be levied against the company or against individual directors.

However, in some cases, non-compliance can result in mandatory closure of operations within that country, or even imprisonment of the directors.

"In Venezuela, companies must keep their accounts in the Spanish language and it is obligatory to keep them up to date. There are sanctions if the books are more than one month behind."

The consequences of non-compliance are not limited to statutory or legal penalties- the indirect costs to a company are often more significant. These include the inconvenience and cost of righting a mistake, damage to the company's reputation or credit rating, and even possible loss of contracts.

"In Estonia, all companies are automatically credit-rated by the organisation Krediidiinfo. The results are used by banks and other organisations. Late filing automatically reduces the company's credit rating with Krediidiinfo."

Summary of BDO risk category by region:

The risk levels in the above diagram were based on the worst-case scenario that could occur in the event of non-compliance, and the ease of that scenario occurring.

THE WORST-CASE SCENARIO

One of the key measures we used when looking at our classifications of countries by risk was that of the worst-case scenario. We asked our partners two questions - what was the worst that could happen in cases of non-compliance, and how would those consequences come about?

The exact behaviour required to merit these penalties was varied across the responding countries, but a broad classification shows that it's not just gross misconduct and fraud that can lead to strict penalisation.

"The Egyptian tax authorities will impose a fine if a letter informing you of a tax inspection arrives before a proper tax return has been filed."

Here, the size of each bubble represents the number of countries that would consider a specific penalty for a specific infraction. So if you read along the 'fraud' line, you can see that imprisonment is a likely consequence, or closure of the local company. But going along the line for 'non-compliance', you can see that most countries would just fine the company- although in some, even that could be enough to warrant the more severe penalties.

"You wouldn't want to be late filing in Libya."

Severity of penalty by degree of infraction

So it is clear that, although in general the most severe penalties are reserved for the most severe breaches of regulation, nevertheless there is a risk at all levels for a significant penalty to be assessed.

CENTRAL AND PERSONAL LIABILITY

We also asked our partners to report on the specific personal liabilities of directors, both local ones and those of global companies with a presence in that locale. 47 of our countries reported on their situation.

- Some countries count branches as separate legal entities, and others treat them merely as a shell for the parent, who is ultimately responsible.

- Over half of the countries in the study can hold directors personally responsible for non-compliance, even where there is no evidence of criminal conduct.

"If a company in the Netherlands with a history of late filings should face bankruptcy, the liquidator is allowed to assume that the statutory directors are personally liable for the bankruptcy unless proven otherwise."

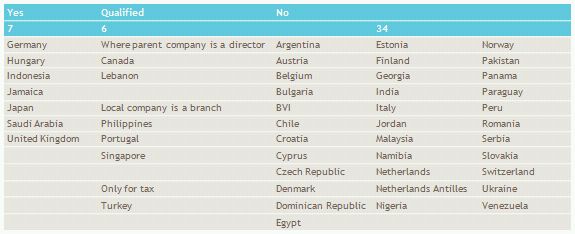

Furthermore, we asked our partners whether or not their local authorities had the power to attach penalties to a foreign parent of the local operation. Their responses were as follows:

Of these same 47 countries, penalties are pursued as civil matters in 25 of them, as criminal in 6, and as a mixture or both in the remaining 16.

SOLUTIONS TO THE PROBLEM OF NON-COMPLIANCE

In our in-depth study, "Local compliance in global business", we approached 23 global businesses with a combined sales volume of US$550bn to ask them how they dealt with the challenges presented by local compliance in their business. Each of the companies we spoke to was present in at least 25 countries and in many cases over 100. A full copy of the study is available from the BDO Outsourcing team in Reading, whose contact details appear at the rear of the report.

In summary, four key models were identified, whose features are briefly covered below:

Model one: In-house, in-country

Companies using this model keep their local compliance functions in-house, even after transactional functions have been moved to the SSC.

Advantages:

- Suitable where the presence in a country is significant.

- Builds good local knowledge of the local business.

Disadvantages:

- Works less well in conjunction with a shared services model where most of the finance roles have moved out of country.

- Lose visibility at the centre.

- People issue in smaller countries - limited career progression, ability to cover absence.

- Risk of losing knowledge when key individuals leave.

"I worry that I don't know what I don't know. We no longer have the in-country resources to tell us when the regulations change."

Model two: Local outsourcing

In this model, each country or region is required to find a local accounting firm to take over their bookkeeping and/or compliance work – either a local firm or a major firm approached locally.

Advantages:

- Potentially low cost outsourcing solution.

- Reduces dependency on individual in-house 'experts' who may leave

- Assists continuity

Disadvantages:

- No central coordination.

- Multiple and complex points of contact.

- Low central visibility.

- Nowhere to escalate matters if a local outsourcer is not delivering.

"I'm left with one good guy in Finland- and not sure how we'll cope when he leaves."

SOLUTIONS TO THE PROBLEM OF NON-COMPLIANCE

Model three: Centralised outsourcing, central delivery

There are two sub-models here. In the first approach, foreign national experts are employed in an in-house or outsourced compliance centre to prepare local returns for their specialist country.

Advantages:

- Cost effective for larger countries.

Disadvantages:

- Hard to find suitable people for smaller countries, and who are willing to relocate.

- Reliant on an expert, who may leave the company.

In the second approach, technology is used to automate the transition between the central accounting data and a version in local GAAP.

Advantages:

- Efficiency and scalability.

- Low cost once systems are installed.

Disadvantages:

- Risk of not keeping up to date with changes in local regulation.

- Rubbish in, rubbish out- no sense checks by a local person to make sure process is working as designed

"One drawback of using SSCs is the loss of intricate local knowledge of the accounts."

Model four: Centralised outsourcing, local delivery

The fourth and final model we saw in our study is the model offered by BDO - central outsourcing with local delivery. This model provides the best of both worlds, allowing for central control and visibility without the loss of on-the-ground expertise and knowledge.

In this model, services in each country are delivered by local accounting and tax professionals who know the local regulations and speak the language. Operations are centrally managed at a designated point of contact between the parent headquarters and a chosen branch of the global accounting firm.

Advantages:

- Local service delivery and local presence.

- Global visibility for local compliance issues when it's needed.

- Central coordination, allowing reduced demands on management time.

- Defined escalation path and well-established service level agreements.

- A single contract gives flexibility and scalability.

Disadvantages:

- Few firms offer full service combined with global cover.

"We're looking to outsource local compliance – it's the last mile in the journey."

SOLUTIONS TO THE PROBLEM OF NON-COMPLIANCE

What to look for when selecting a global provider for local compliance:

"It's hard to find Peruvian GAAP knowledge in Bangalore."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.