1. Introduction

The UK's new Qualifying Asset Holding Company Regime (the "QAHC Regime") comes into effect on 1 April 2022. The main objective of the regime is to make the UK a more desirable jurisdiction from which funds (which may already have substance in the UK) can efficiently operate through the use of qualifying asset holding companies. For asset holding companies that meet the qualifying criteria and elect into the regime, there are numerous tax advantages that seek to reduce the potential tax leakage, which may otherwise arise from the use of a corporate investment entity.

2. Background

A review of the direct and indirect tax treatment of funds was a topic of focus in the UK Government's Spring 2020 Budget. In particular, the Government's stated objective was to make the UK "a more attractive location for companies used by funds to hold assets". For context, key jurisdictions in which Qualifying Asset Holding Companies ("QAHCs") have been established have included Luxembourg, Ireland and the Netherlands.

Following consultations, the Government decided to create a bespoke tax regime for asset holding companies. A draft of the legislation instituting the QAHC Regime was published for inclusion in the Finance Bill 2022 in July of last year, and the QAHC Regime is due to come into effect from 1 April of this year.

3. Summary of the QAHC Regime

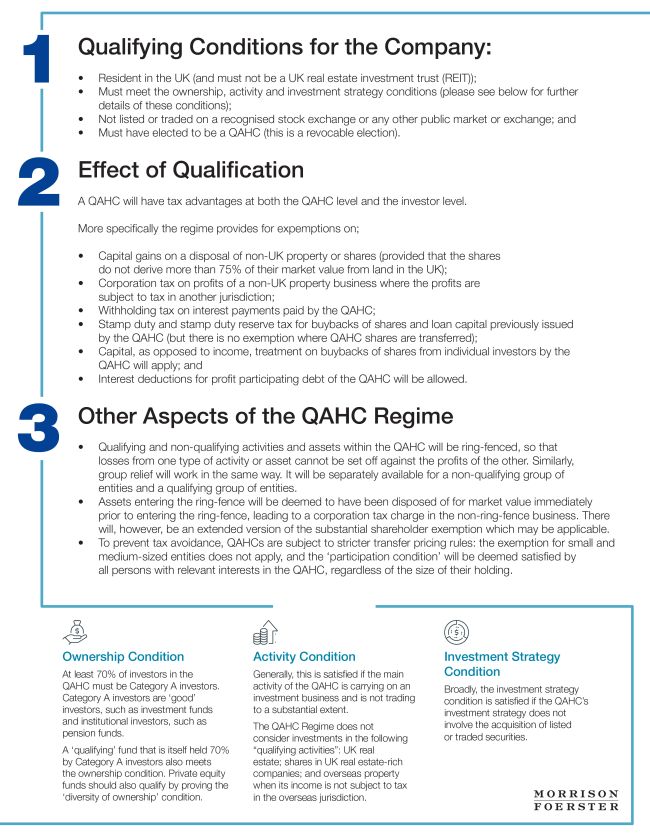

The infographic below provides a summary of the key aspects of the new QAHC Regime.

View infographic in full size.

4. The Change the QAHC Regime May Bring and Its Relevance

The QAHC Regime is expected to bring the UK's position on how holding companies of alternative investment funds are taxed more in line with the rules in jurisdictions that are commonly used for establishing QAHCs (e.g., Luxembourg). The regime also promises the simplification of compliance requirements and potential savings for funds, institutional investors and asset managers who will now be able to align their corporate holding structures with their UK economic substance. The introduction of the QAHC Regime is therefore a solid step toward increasing the popularity of the UK as a favourable funds and private equity jurisdiction.

To take advantage and ensure appropriate consideration of the new QAHC Regime, (i) funds, institutional investors and asset managers that have holding structures with economic substance in the UK may wish to conduct a cost-benefit analysis on relocating holding companies to the UK, and (ii) new funds are advised to analyse the benefits of establishing a holding company in the UK versus in an offshore jurisdiction.

Julia Kotamäki, London trainee solicitor, contributed to the drafting of this alert.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved