As the UK is leaving the European Union on 31 January 2020, we examine what that means for mergers that are currently under the European Commission's review or that will be announced in the coming weeks or months.

'Brexit day' on 31 January does not fully separate the UK from the EU. Instead, it marks the start of a transition period that lasts until the end of 2020. During that period the UK remains in the single market and continues to follow EU rules.

I. Key Takeaways1

- Brexit will not affect merger

control jurisdiction until 31 December 2020

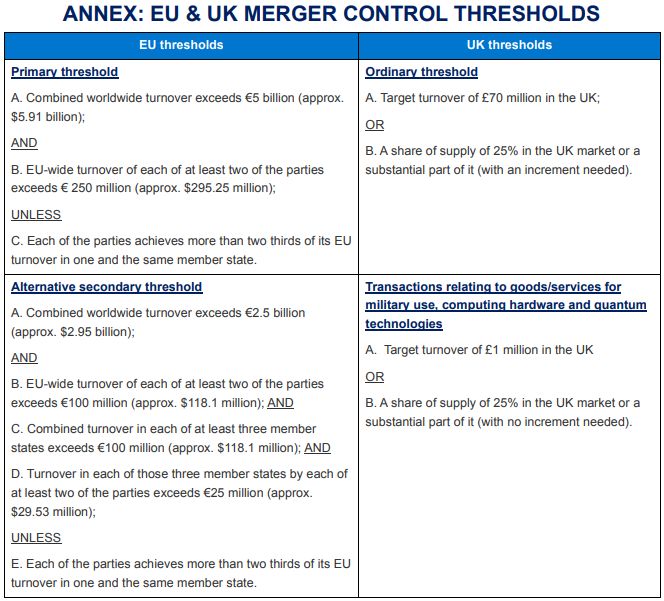

- The "one-stop-shop" principle continues to apply: mergers that satisfy the EU jurisdictional tests (see Annex) will continue to be reviewed exclusively by the European Commission, including the UK aspects of the deal.

- The merging companies' UK turnover continues to count towards the EU merger control thresholds and the European Commission will continue to analyse the effects of the merger on the UK market (and impose remedies if necessary).

- Transactions that do not exceed the EU jurisdictional thresholds but meet the UK jurisdictional thresholds (see Annex) can be reviewed by the UK Competition and Markets Authority (CMA). The UK regime for such mergers continues to be voluntary.

- As of 1 January 2021 there will be

potential parallel EU and UK merger reviews

- The "one-stop-shop" principle ceases to apply to the UK. The CMA will conduct its own review of the impact of any mergers in the UK and the European Commission's review will no longer cover the UK market(s).

- UK turnover will no longer count towards the EU jurisdictional thresholds, which means more mergers will potentially be reviewed by EU national competition authorities rather than the European Commission.

- The date of notification, rather than the date of announcement or signing of the agreement fixes jurisdiction to review.

- The CMA is more actively asserting jurisdiction. In the past months, with Brexit looming, we have seen the CMA assert jurisdiction in cases where the EU lacked jurisdiction to review and where there was only a very limited UK nexus. We expect this trend to continue during 2020 and beyond.

II. Jurisdiction: What Changes In Practice?

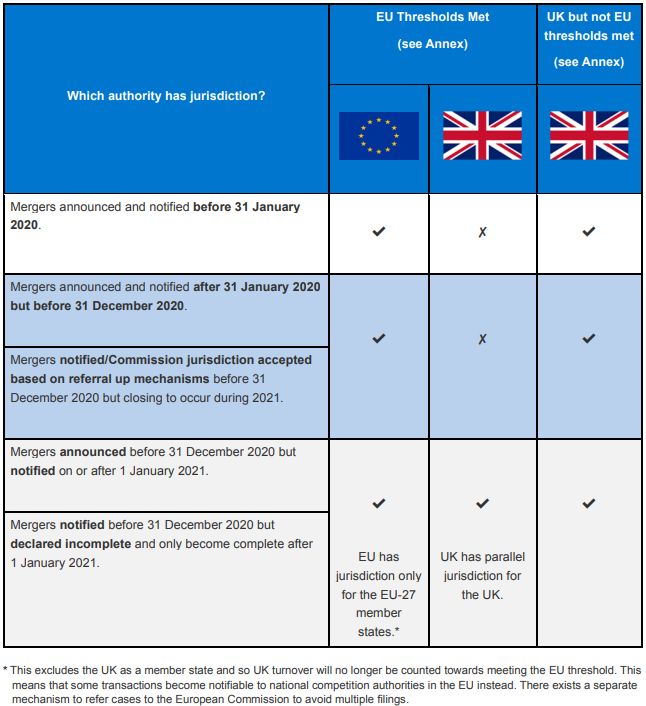

The EU will retain exclusive jurisdiction for all transactions notified before 31 December 2020 that satisfy the EU jurisdictional thresholds (see Annex), except for cases where a referral back to the CMA has been accepted by the European Commission before 31 December 2020. After that date the EU loses its jurisdiction over the UK aspects of the merger, which will instead be subject to the jurisdiction of the CMA if the UK jurisdictional thresholds (see Annex) are met. Moreover, UK revenue will no longer count towards the EU thresholds from that date, and for some mergers this could affect whether the EU or national competition authorities have jurisdiction in the post-Brexit EU.

The relevant date that fixes jurisdiction is generally the date of notification, not the agreement or announcement of the transaction. This means that there may be added pressure to file transactions before the end of the year in order to benefit from the EU one-stop-shop. For practical purposes, this means a notification must be made before 24 December 20202 (or earlier, if the parties wish to benefit from the referral mechanisms under the EU merger regulation) allowing for a period of pre-notification beforehand.

Jurisdiction could also change if the notification is declared incomplete or if the clearance (or prohibition) is quashed by the European court and the transaction needs to be re-notified. The latter means that the parties need to juggle conflicting pressures of seeking to benefit from the one-stop-shop against the danger of shifting jurisdiction if insufficient pre-notification discussions have taken place with the EU case team.

In cases falling below the EU jurisdictional thresholds and where the parties are considering a potential referral to the European Commission one has to consider whether the CMA could veto such a referral in order to retain jurisdiction for a case with significant UK implications.

This means that during the latter half of 2020, dealmakers need to take care in drafting the conditions precedent and in calculating long stop dates to take account of the potential jurisdictional changes. It may also be prudent in complex cases, and those where the likely notification date is unclear, to engage in parallel discussions with the CMA in a similar way to how the process was managed in 2019 when a no-deal Brexit was a possibility.

III. The UK CMA Is Already More Actively Asserting Jurisdiction

The UK merger control rules have always given the CMA wide discretion on establishing jurisdiction. In the course of 2019, the CMA has actively asserted jurisdiction in cases that did not meet the EU threshold and were not obvious candidates for the CMA's review, but where the CMA nevertheless perceived a need to review the merger.

Minority stakes. The CMA has treated the acquisition of minority stakes of as little as 16-17% as a merger situation in E.ON/RWE and in Amazon/Deliveroo. The CMA's power to do so is not new but in the past it has used this power sparingly and there seems to be more of a willingness to do so in the current climate.

Flexibility in applying the share of supply test. Similarly, the CMA has wide discretion on how it applies the share of supply test and its long established guidance sets this out clearly. In Roche/Spark, we understand that the share of supply test was applied to pipeline products, i.e. not products that were on the market in the UK even though the parties were active in the UK in non-overlap products. In Sabre/Farelogix, we understand that the CMA established jurisdiction based on the share of supply test despite the lack of substantial UK presence by US-based target Farelogix.

Pragmatic cooperation with other authorities. At the same time there are counter-examples to Sabre/Farelogix in which we have been involved, where in priority industries the CMA refrained from asserting jurisdiction despite a strong UK nexus, as other competition authorities were negotiating global remedies that also resolved potential UK issues. This means that the CMA is not just asserting jurisdiction for the sake of adding new cases but does so if it believes there could be an otherwise unresolved issue.

Finally, foreign investment review. In 2018, the UK merger control thresholds for transactions in certain sensitive sectors were lowered to allow for intervention in smaller transactions and to provide for political intervention in such cases. These sectors are: military goods and services, computing hardware, quantum technologies. The UK now envisages having a wider ranging, self-standing foreign investment review which is de-linked from the CMA merger review process (see our separate Advisory at https://www.arnoldporter.com/en/perspectives/publications/2018/07/ukmerger-control-a-new-regime-for-state); however, this requires new legislation to be approved by the UK Parliament.

The rise of foreign investment review is not purely a UK phenomenon. Other EU member states have put in place or expanded similar regimes and the EU has been assigned a coordinating role in such reviews (see our separate Advisory at https://www.arnoldporter.com/en/perspectives/publications/2019/02/foreign-direct-investment-control-in-europe).

Moreover, it would be wrong to assume that foreign investment review applies only to investments by companies linked to the Chinese or Russian state. Most recently, the UK served a European interest intervention notice in the acquisition by US private equity groups Advent and Blackstone of UK defence electronics company Cobham plc because of potential national security and public interest concerns. The case was ultimately cleared subject to commitments.3

Footnotes

1. The UK Competition and Markets Authority has also published guidance on how Brexit will affect its powers and processes during the transition period, towards the end of that period, and after the transition period ends - this is available at https://www.gov.uk/government/publications/uk-exit-from-the-eu-guidance-on-the-functions-of-the-cma-under-the-withdrawalagreement.

2. The start date of the Commission's holidays.

3. https://www.gov.uk/cma-cases/advent-international-cobham-merger-inquiry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.