CloseCross is the world's first truly decentralised derivatives platform driving democratic participation. By introducing simple 3-click-trading, eliminating unquantified risks, and making trading 90% cheaper, CloseCross gives everyone the opportunity to participate in the $1200 trillion financial derivatives market - without needing to be a financial genius with access to tons of money. Decentralized. Democratized. Transparent.

In this post we will be discussing the sequential innovations CloseCross plans to introduce beyond the Virtual Prediction Floors and 3-click trading. A general understanding of how VPFs work would be good to have and if you are new to CloseCross best to start with our previous blog-post.

At CloseCross we believe in simplifying things - and that goes not only for the user experience on the platform, but also the strategy involved in our innovation cycles.

We feel it is important to help users understand what new things we are introducing and to make them a natural progression for people who are trading with CloseCross.

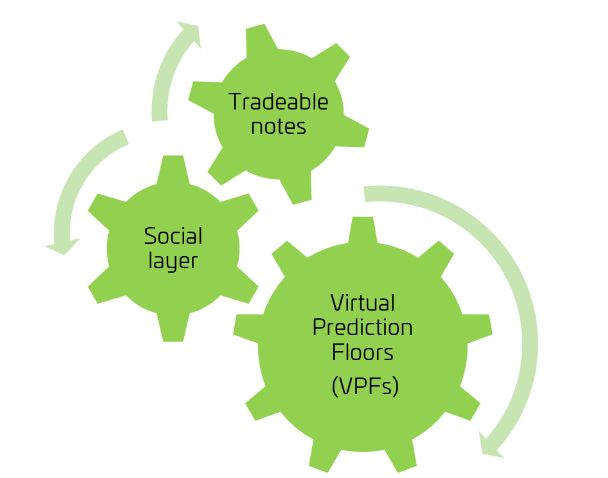

We have started with VPFs and 3-click trading and the next cycle of innovation and expansion will be white-labelling the platform together with tradeable receipts, private prediction floors (PPFs), social trading, long-term tradeable receipts and eventually a decentralised autonomous organisation (DAO).

Let's take these one at a time.

White labelling (resellers/affiliates of our platform, protocol and algorithms)

Once the technology platform is built we need to focus on getting as many users to the CloseCross decentralized derivatives world as possible. We do this through organic means of spreading the word ourselves, as well as, bringing in partners from across the globe that will become our resellers or white-label partners. CloseCross will be the core engine in all cases, but users in different jurisdictions may get aboard CloseCross through a local partner that can have their own logo, look and feel for users to have a more familiar experience.

Let's take the example of Luxottica. Heard of them?

They are the sole producers of sunglasses across a plethora of high-end sunglass brands. You probably wear sunglasses made by Luxottica without knowing it, as what you and others see is the brand the sunglasses carry.

You remain loyal to the brand you know, because they do their quality control and checks for you, but outsource the sunglasses from a common producer.

We will be implementing a white-labelling solution, wherein we engage a large number of resellers across the globe to ensure that the decentralized democratized derivatives are available to as many people as possible. We will scale up faster with resellers that hold the right regulatory licenses.

We will be able to generate economies of scale and increased trading volume/liquidity for all participants through this approach.

Our target markets are USA, EU, South Korea, Japan, Hong Kong and Singapore. With this we will be able to address a sizable portion of the financial derivatives market. If you want to become a reseller or know of someone who should, write to us (include hyperlink to email info@closecross.com)

Tradeable receipts - secondary market

Once we have a significantly large population using CloseCross derivatives we want to bridge the engagement gap that may occur in between the time the VPF closes and until the Outcome is known. We also want to simultaneously address early cashing-in opportunities for the VPF receipts. For both these purposes we will introduce the Tradeable receipts as a next innovation.

During the period of time in between the VPF Closing Time and the time at which the Bitcoin price at the end of the day is known, you will be able to trade the receipt you got issued. This becomes extremely interesting for market participants under multiple scenarios.

For example, continuing with the gold VPF trading example in the previous post, if you needed to cash-out the receipt before waiting for the actual settlement or wanted to hedge the risk of outcome you could sell the receipt to another trader who would buy it from you at a price between $10 and $63.

You cash-in some profits and the buyer takes the profit in between the purchase price and $63 - if you sold it for $30, you made a profit of $20 and the buyer of your receipt would make a profit of $33 ($63-$30).

Private Prediction Floors (PPFs)

The opposite of CloseCross being a cross reseller back-end platform that reaches the masses would be a restricted platform where participation is by invitation only.

We will allow for a limited amount of resellers to limit the participation to their own user-base rather than opening up their users for interactions with users from other jurisdictions or spaces.

This is interesting for institutions such as private banks where they would like to create a decentralized derivatives environment for their High Net Worth Individual (HNWI) clients. With a sub-licensed version of the CloseCross platform, any institution such as a Private Bank can now allow their clients to trade between themselves without them ever having to leave the comfort and privacy of their own Private Bank. The business model for us remains the same.

Long term tradeable receipts - secondary market

The new-age trading community prefers not to lock up liquidity for longer periods of time, but yet still wants to trade derivatives. In response to popular demand, CloseCross will initially be focusing on VPFs that run from a couple of hours to a few days. "Hyper Hedging" is a term we have coined for this approach.

This though leaves out a significant part of current derivatives market wherein the contracts are for durations of a few months to a couple of years. We will address this gap in our offering in Q1 2020. The innovative long-term tradeable receipts moreover will ensure that the market participants are not obliged to block their liquidity as their participating receipts will be freely tradeable and you can cash-in at any point in time without needing to wait for the derivative maturity date by simply selling the receipt.

Social layer

This is one of the most anticipated innovations in our community and we are looking forward to introducing the social layer on CloseCross.

The reason we will wait to introduce this feature is that we need to have critical mass of data on user participation, success rates and returns generated before we can turn on the social layer.

As part of the social layer you can become a visible participant in the CloseCross community and demonstrate your derivatives trading prowess on as high or as granular a level as you like. Your trading profile can now become your showcase. There may even be trophies and medals in there as we seek to gamify the user experience.

You will also be able to create your own sub-communities and followership and chat with them in real time while participating in multiple VPFs, exchange notes and discuss jointly on how and where to invest.

All the social layer functions are completely on an opt-in basis and will turn on only if you so wish.

Follow trades

The Social Layer innovations will form the basis for the next big thing we will introduce - Follow Trades.

Imagine a scenario where you have established yourself as a consistently good trader on CloseCross and that the community and followership around you seeks your advice and you have become an influencer.

They now can trust you to make money for them by simply following your trades. You would share in profits in a way similar to a money manager does from managing the clients funds - except that you will not need to manage their funds at all.

You can continue to trade as you do and, in the background, CloseCross will ensure that every trade you make is copied into the wallets, accounts and portfolios of all users that chose to follow you. There will be a standard value share agreement applied across the board, however, you may even be able to negotiate the profit sharing mechanisms between you and your followers (TBD) - and it could be differentiated based on individual agreements with the followers too.

As a market participant that is looking for ways to make your money to work by itself without having to actively engage and monitor the markets, the Follow Trades option frees up your time for things you want to do and lets the trading gurus make money for you.

All with a click of a button.

As with the social layer, your engagement here is limited only by your choices. You will also have the choice of accepting/rejecting anyone before they begin following your trades.

DAO - To Be Determined

The true decentralized autonomous organization (DAO) is the holy grail of all things crypto and blockchain. Our ultimate aim is to make CloseCross a DAO; and make the multi-party settlement mechanisms and algorithms we provide a part of the derivatives trading ethos - which can survive on their own.

To be a fully compliant financial operation CloseCross needs to fulfil an array of regulatory requirements and ensure that the platform is not misused in any manner whatsoever. KYC, AML and CTF requirements do not allow a completely unmonitored use of any trading platform.

We dream, though, of technology improvements and smart contract sophistication where perhaps one day we will be able to incorporate the KYC, AML, CTF and localized regulatory requirements and automate the entire exercise so that we as CloseCross team do not need to fulfil these functions.

This would allow anyone to setup a VPF and open it up to the world or limit it to a group of people. It would be a simple interface where users could select the underlying asset, the time horizon and chose who can enter. The rest would be automated and the revenues would be shared.

We do not know, though, when these technology advancements and smart contract sophistication could be realised. Until then, this ultimate step remains a TBD (to be decided).

Summary

By sharing the entire product roll-out and innovation outlook we hope to have demonstrated our commitment for the long term success of the project and its core principles. We will always stand on transparency as one of our core pillars beyond decentralization and democratization.

We are convinced that with the innovations outlined above we will go deeper and broader in delivering our promise of making the derivatives market a completely inclusive one, where no one is discriminated against.

Join us and support us - we will need all your help to drive the democratic (r)evolution. We are sure to be fought hard by the fat cat incumbents - but together we will prevail.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.