Over a year since the European Sustainable Finance Disclosure Regulation (the "SFDR") came into effect, the FCA recently published a Consultation Paper on Sustainability Disclosure Requirements. This is a significant step in the UK's development of a regime on sustainability related disclosure and labels for funds and other financial products. Whilst the FCA's draft rules have some parallels to the SFDR, the FCA has taken a different approach, notably introducing a retail consumer facing product "labelling" regime alongside separate product level disclosures.

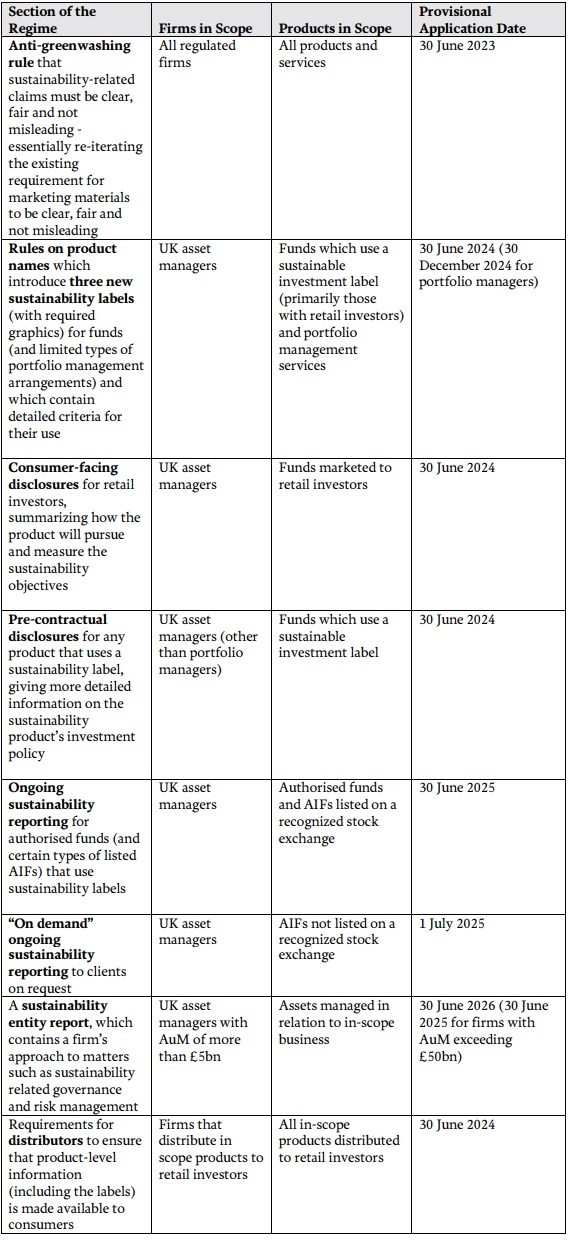

The FCA will publish its final rules on this subject by 30 June 2023, with the rules substantially applying in mid-2024. The rules will form new chapters of the FCA's ESG sourcebook, which currently contains (as chapter 2) the FCA's application of climate change related disclosure ("TCFD") to UK firms. In line with the application of chapter 2 of the FCA's ESG sourcebook, the draft rules apply to UK "asset managers", which comprise full scope and small authorised UK AIFMs, UK UCITS management companies and "portfolio managers", in relation to their funds and portfolio management services.

Firms with assets under management of less than £5 billion are currently exempt from the FCA's climate related disclosures. Under the proposed rules, they will also be exempt from a requirement to produce an entity level sustainability disclosure, but not from the new consumer-facing and product-level disclosure requirements. The draft rules will only apply to UK firms. UK firms that also market in the European Union will have to comply with both sets of standards.

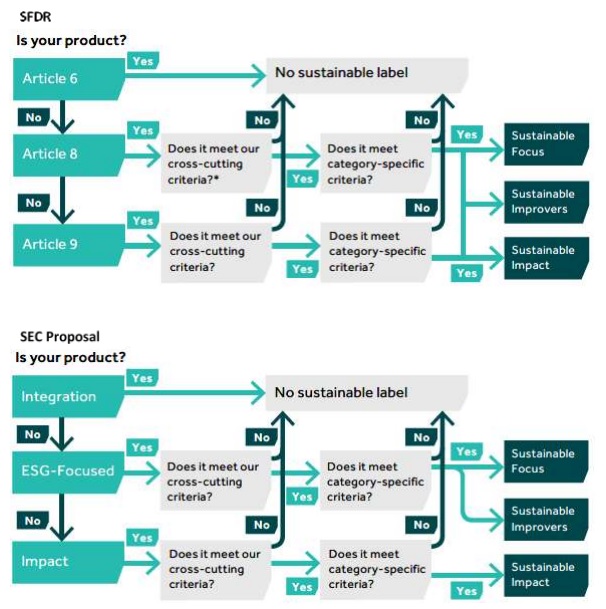

The FCA provides charts of how its proposed sustainability labels map to EU SFDR requirements and the SEC's proposals on disclosure requirements—copied below. However, given the detailed criteria that is applied to use the sustainability labels, there will not be any direct correlation between, for instance an Article 8 EU SFDR product and the type of product the FCA conceives under the label "Sustainable Focus".

There are different levels of rules proposed by the FCA, summarized as follows:

Sustainability Labels

The Concept behind Sustainability Labels

The most novel element of the FCA's proposal is the sustainability "labels" for products. Where a product (a fund or a portfolio management mandate that invests in funds) meets specific qualifying criteria, firms may make use of new sustainability "labels" for products. In practice, a firm will use the sustainability labels when marketing to retail investors, because if it does not, it may not use the term ESG or common related names (such as "green" and "impact") in the naming and marketing of the product. Funds with institutional investors may be interested in adopting the labels, but are not required to do so, and it is an open question whether institutional investors will favour funds with the FCA's labels.

Firms that use the labels must, as a general principle, ensure that the product's sustainability objective (its intention to pursue ESG characteristics) has a "plausible and credible" link to an environmental and/or social outcome, with an investment policy aligned to the sustainability objective, relevant key performance indicators in place, and an investor stewardship strategy consistent with the sustainability objective

In a perceptive statement, the FCA encourages firms to better define the link between a product's investment policy and the positive environmental or social outcomes promoted, either through active investor stewardship and engagement, by directing capital to assets in order to influence their asset prices and the reduce their cost of capital, or by allocating capital to assets that offer solutions to environmental or social problems.

The Three Available Labels—a Correlation to SFDR?

"Sustainable focus" means that at least 70% of the product's assets either meet a credible standard of environmental and/or social sustainability or align with a specified environmental and/or social sustainability theme. This is directed at funds that have broad sustainability objectives alongside giving a financial return, with the fund achieving its aims either through influencing asset prices or investor stewardship activities. Independent assessment of the manner in which the product meets its sustainability themes will be required. The FCA refers to such a product as likely to have a "highly screened" portfolio and suggests that the fund's investment policy will be aligned to the sustainability objective, differentiating funds that more generally integrate environmental or social considerations under Article 8 of SFDR.

"Sustainable improvers" means the product invests in assets with potential to become more sustainable over time, in environmental or social terms, such as companies with clear de-carbonisation plans. The FCA states that it expects this type of product to invest broadly, with the firm playing a role in improving the sustainability of the assets, primarily through investor stewardship. Performance will be assessed by reference to clear and measurable targets over the long term.

It is likely that some, but by no means all, SFDR Article 8 funds (the criteria for which is more flexible since they are not labelled funds) will meet the FCA's criteria for "sustainable focus" and "sustainable improvers".

"Sustainable impact" means an objective to achieve pre-defined, positive and measurable "real-world" outcomes, such as climate change mitigation through renewable energy generation and distribution. The FCA's criteria for the "sustainable impact" include a requirement for the firm to develop a "theory of change" to show how and why a particular change is expected to occur; a robust method for measuring the "real-world" impact and an escalation plan, should the anticipated impact not occur, including potential divestment of the asset. There is no explicit reference to the principle of "do no significant harm" in the FCA's rules, although the FCA does state in its related commentary that it expects products "to avoid unintended negative environmental or social impacts". There is a clear correlation here to SFDR Article 9 funds.

Sustainability Disclosure Requirements in Detail

Consumer-Facing Disclosure

The FCA intends there to be a set of consumer-facing disclosures for retail investors, summarizing how the product will pursue and measure the sustainability objectives. These disclosures are obligatory for all in-scope products for retail investors, regardless of whether the product qualifies for or opts to use a sustainable investment label, and the FCA acknowledges that the disclosure will be limited for products that do not have any sustainability related strategies. The consumer-facing disclosure is a standalone document (similar to the PRIIPs KID) that provides a summary of the key elements of the product's sustainable investment strategy (including any "unexpected investments" that the consumer might find inconsistent with the sustainability objective) and sustainability metrics.

Pre-Contractual Disclosures

The second layer of product level disclosures, pre-contractual disclosures, provide institutional investors and retail investors with more information than in the label and the consumer-facing disclosures. Pre-contractual disclosures are required where a product uses a sustainability label, and will be part of the fund prospectus or similar point of sale information document. If the product does not use a label, but has sustainability-related features central to the firm's investment policy and strategy, the FCA's expectation is that they will also be included in pre-contractual disclosures. These disclosures contain information on the product's investment policy, investible universe (its scope of investments) and target asset composition, with specific information required to support the sustainability label.

Sustainability Product Reports

Sustainability product reports will contain ongoing sustainability-related performance information for FCA authorised funds that use sustainability labels. The reports build on the existing requirement for a TCFD public product-level sustainability report as currently required by the FCA's ESG sourcebook, with similar guidance by the FCA on how firms should approach data gaps in those reports. "Part A" of the product report contains the pre-contractual information summarized above and applies where the product does not have a fund prospectus or other pre-contractual disclosure requirements.

"Part B" of the sustainability product report will only be required for FCA authorised funds that use a sustainable investment label. This provides information on the firm's progress in meeting the product's sustainability objective and details of metrics that a client or consumer might find useful. The FCA does not include a baseline of required sustainability-related metrics in the sustainability product report.

In parallel to the "on demand reporting" provisions of the FCA's TCFD rules, UK AIFMs of unauthorized AIFs, which opt to use a sustainability label for these products, will provide the report on demand to investors on an annual basis, where the investor needs the information to satisfy their own sustainability disclosure obligations.

Entity-Level Disclosures

Similar to the requirement to produce a TCFD entity report, all asset managers with assets under management of £5 billion or more will be required to produce a sustainability entity report. The entity level report covers the firm's approach to governance of sustainability risks and opportunities, how the firm manages sustainability related risks and the sustainability related metrics and targets adopted by the firm overall. This requirement will be phased-in, with asset managers with assets under management of more than £50 billion making their first entity-level disclosures provisionally by 30 June 2025 and firms with more than £5 billion AUM making their first disclosures by 30 June 2026.

Impact on Private Fund Managers and Adviser-Arrangers

It is clear that the FCA's focus is on retail products—UCITS funds and UK listed AIFs. UK AIFMs of private funds may use the FCA's sustainability labels, if they wish, and would be required to do so if they admit any retail investors. As above, UK portfolio managers are in scope, although the FCA's rules are primarily directed at those which manage individual mandates comprising underlying funds which are within scope of the rules.

As for the FCA's TCFD related rules, portfolio managers (as a definition) includes private equity and other private market advisers (including those providing advice to US and other non-UK fund sponsors), as well as discretionary portfolio managers. There is, however, no commentary by the FCA on how the rules apply to private equity adviser-arrangers, with the FCA stating that it will consider rules for financial advisers (and how they should take sustainability matters into account in their investment advice) at a later date. Unlike the EU SFDR, it appears that the FCA does not intend the regime to apply to non-UK firms marketing funds in the UK. In addition, the FCA excludes overseas products from the scope of the rules, intending to consult separately on this. In excluding overseas products, the FCA is clearly thinking of overseas retail schemes, and there is at present some lack of clarity as to the treatment of non-UK AIFs managed by UK AIFMs.

The FCA's rules are subject to industry feedback in the next few months, with the FCA publishing final rules during the first half of 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.