UK Summer Budget analysis

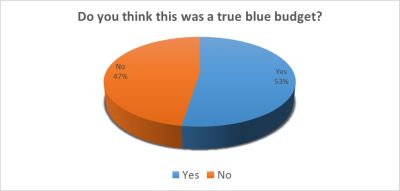

Given a free hand after 5 years of coalition economics, George Osborne was very much expected to announce a truly Conservative budget. Did he?

At our Budget Briefing on 9 July, we asked the audience of wealth planning professionals to vote on a number of key announcements in the Budget. The results of these questions are displayed below.

Remittance changes – seismic shift or a storm in a small teacup?

Undoubtedly there was caution, and a certain degree of reference to the salutary lessons of Greece's current problems. But the Chancellor then appears to have thrown caution to the wind with far reaching changes to the remittance basis, so that resident non domiciliaries ('RNDs') will be subject to taxation on the arising basis of tax after more than 15 out of 20 years of residence. The good news is that no one will have to bother paying the £90,000 remittance basis charge after 2017, which applies after 17 out of 20 years of residence, as of course by then RNDs will be deemed domiciled for all taxes.

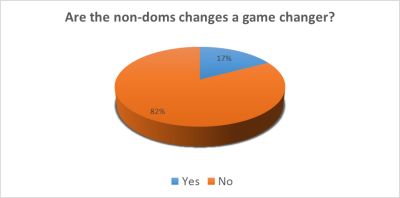

That's a good headline, but when one looks at the detail it becomes apparent that the changes are rather less seismic than they might first appear and that there are planning opportunities which will be available between now and April 2017, when the changes are due to come into operation.

Why?

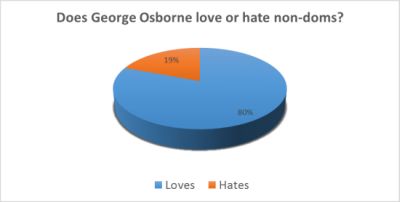

The first question is what is the rationale behind the change? We know that RNDs are major contributors to both tax receipts and the economy generally, with £8.2bn being the last estimate of their contribution. It seems rash when, as the Chancellor reminded us, 'the greatest mistake this country could make would be to think all our problems are solved', to then shake the foundations of a system that makes the UK incredibly attractive to international investors, entrepreneurs and job creators.

The move is expected to raise £385m by 2020-21 – hardly worth it, one would think. It can only be assumed that the answer lies in the political impact rather than economics and, one assumes, a desire to ensure that this is no longer a political hot potato. As we shall see though, the changes are not necessarily as dramatic as they seem.

As to why 15 years, that, we are afraid, appears to be anyone's guess.

What does it really mean?

HMRC has published a technical briefing to go alongside the announcement and the following key points stand out:

- Both existing and future excluded property trusts remain valid planning options; indeed

- Trusts established prior to having been resident for 15 out of 20 years will ensure income and gains realised and retained within the trust will not be taxed, even after the settlor and/or beneficiaries are deemed domiciled under the new test;

- Distributions and benefits received from such trusts will however be taxed, whether remitted or not;

- The recently increased £90,000 remittance basis charge is somewhat of a red herring – since it kicks in only after 17 out of 20 years of residence, clearly it will fall away (although it is possible that there will be a further increase in the remittance basis charges for shorter term residents by 2017);

- Domicile as a matter of general law remains unaffected;

- The children of longer term RNDs will not automatically become deemed domiciled when their parents do – their position will be tested on the length of their residence (bad news for UK schools maybe);

- Longer term deemed domiciled residents will have to remain non-resident for more than five complete tax years to break general deemed domicile – this aligns with the current requirements for capital gains and income tax residence;

- Longer term RNDs who have already established non-trust offshore structures – e.g. companies – will wish to review these prior to 2017.

The good news

The good news is that with planning in good time, offshore trusts will remain a good deferral and inheritance tax planning structure. The bad news is that accessing benefits will be rather unattractive. Trustees will wish to be especially mindful of the impact of the supplementary charge, which means distributions of gains which are within the structure for six or more years are charged at a 44.8% rate, as it will no longer be possible to address this by distributions offshore.

Hereditary non doms – no change

Despite much speculation that hereditary non domicile status would be removed or significantly amended, there has in fact been no change at all to this.

Instead, in the rather unusual scenario where a UK domiciliary acquires a domicile of choice elsewhere – e.g. through establishing a home elsewhere and deciding to settle there – and then returns for a short period to the UK, perhaps for a job posting, with the clear intention of returning to his new home, he will not be able to claim non-domicile status.

What next?

Perhaps the most heartening sentence in the Chancellor's speech in relation to RNDs was: "We will consult to get the detail right". The changes are set to take effect in April 2017, and a consultation paper is to be issued later this summer.

The first key point to take away is that these are not necessarily the dramatic changes that they first appear, and trusts do and will continue to offer very significant benefits for RNDs, provided they are established in advance of 15 out of 20 years of UK residence and properly run.

The second key point is that there is a transitional period of almost two years to get one's affairs properly structured in preparation for the changes announced today.

We would certainly urge anyone who is non-UK domiciled and who is close to having been UK resident for 15 out of 20 years to start planning in earnest and in particular:

- Making sure an excluded property trust is set up in good time;

- Making sure you are absolutely aware of exactly when 15 out of 20 years will arise – as with deemed domicile at present, we expect this can in practice be rather less than 15 years and could be as little as 13 years.

- For existing structures, it will be important to decide between stripping out income and gains offshore while the remittance basis applies and retaining assets within excluded property trusts;

- Reviewing existing non-trust deferral structures and making sure these are changed so as to be as efficient as possible in good time.

Above all else though, we recommend a non-panicked approach, which holds good in tax planning as in many other areas of life!

Companies

What George Osborne can give with one hand, he can take away with the other. To paraphrase the other George (Orwell), unearned income good, earned income better (and benefits worse...). Nowhere is this better exemplified than in the treatment of corporate earnings. When George Osborne became Chancellor the standard rate of Corporation tax was 28%; by the time he ceases to be Chancellor (presumably in his mind to move next door) in 2020, the rate will be 18%. Trading companies generating profits will be able to keep more of those profits.

However, the picture is not so rosy for the shareholders in those companies. In 1997, Gordon Brown was pilloried for a raid on pensions by preventing them from reclaiming the dividend tax credit. George Osborne, keeping with his mantra that earned income is better than unearned income, which should be penalised, has completed that job by taking away the dividend tax credit entirely. There is some amelioration in the introduction of a new tax-free dividend allowance for all taxpayers (even top rate payers who do not currently get a personal allowance!) and a change to the rates of income tax on dividends. However, the Treasury estimate that the benefit of these changes to the Exchequer (and therefore the cost to the taxpayer) will be in excess of £11 billion over the lifetime of the Parliament.

Inheritance tax

It has long been the objective of the Conservative party to increase the inheritance tax threshold to £1 million. While the Chancellor felt able to announce today that "You can pass up to £1 million on to your children free of inheritance tax" and "No more inheritance tax on family homes", the reality is somewhat more qualified. So, if: (i) you are married, or in a civil partnership; (ii) you have survived your spouse or civil partner; (iii) they didn't use their nil rate band; (iv) you have a home which is worth £1 million; (v) you have a total estate which is worth less than £2m and you want to leave your home to your children; and (vi) you die after 6 April 2020, then you will be able to pass on £1m to your children tax free. In the meantime the £325,000 nil rate band that applies to all estates is frozen for this Parliament.

Inheritance tax on UK residential property

One of the themes of the coalition government was to increase the tax paid by non-UK resident and non-UK domiciled owners of residential property. In 2011, the Annual Tax on Enveloped Dwellings was announced that introduced a charge for certain residential properties held by companies. In 2014, a new capital gains tax charge was announced that, for the first time, brought non-resident owners of residential properties within the charge to capital gains tax.

The Conservative government has continued with that theme and now proposes to introduce a change to the inheritance tax rules so that any indirect owner of UK residential property is subject to inheritance tax, regardless of how that property is owned. The intention is that broadly the same properties currently covered by the non-residents CGT legislation introduced in this year will be subject to IHT, so there will be no exemptions for let properties or property development as there are under ATED. The new rules will be subject to consultation and will come into effect from April 2017, raising an additional £285m over the course of the Parliament.

If a positive can be taken from this announcement, it is a recognition that some owners of residential property may be trapped in inefficient structures created prior to 2011 by the costs of restructuring. The Government has promised to consult on these costs and it may be possible that a limited exemption or deferral may be introduced for de-enveloping.

Pensions

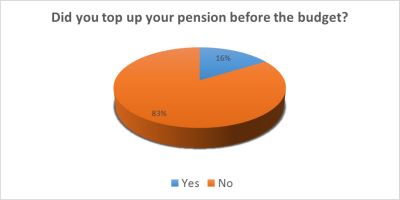

As widely leaked before the Budget, one of the key revenue raising measures, raising nearly £4 billion over the lifetime of this Parliament, is a restriction for the highest earners on funding their pensions. From April 2016, earners with earned income in excess of £110,000 will have the amount they can put into pensions reduced from £40,000 per year to a minimum of £10,000. Transitional measures will be introduced to prevent retrospective taxation and there is likely to be an opportunity for top earners to make significant contributions before the changes take full effect in 2016. Looking to the longer term, there will be a consultation on ISA style pensions, so higher earners can at least make contributions to pensions, even if they don't get tax relief.

Income tax

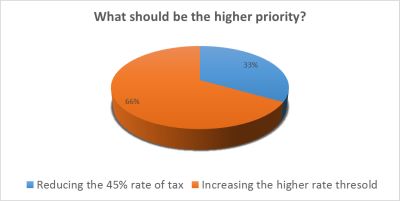

A reduction in the 45% rate of income tax was always going to be too much for top rate taxpayers to hope for, particularly from this Chancellor. Instead the focus was on raising thresholds and taking those at the bottom end of the earned income spectrum out of tax, with increases in the personal allowance and basic rate limit and higher rate threshold.

Capital gains tax

Despite not being included in the 'tax lock', no changes were announced to capital gains tax rates yesterday. Phew. Similarly entrepreneurs' relief, the cost of which was the subject of some speculation in the run-up to the Budget, also remains unchanged.

Buy-to-let properties

Individual landlords of residential property will also find themselves contributing an additional £1.3 billion to the Exchequer over the course of this Parliament, with a reduction of their ability to claim a deduction for finance costs (bank interest, etc.).

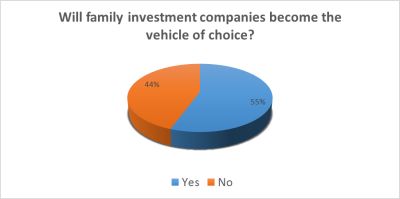

With these rules only applying to individual owners and the proposed reduction in corporation tax rates, limited companies are looking increasingly attractive as vehicles for holding buy-to-let properties.

Anti-avoidance

No Budget can pass without a crackdown on anti-avoidance and sure enough George Osborne found another "£5 billion from tackling tax evasion, avoidance, planning and imbalances in the tax system". However, other than the proposed consultation on penalties under the General Anti-Abuse Rule, which had already been announced, it is difficult to pinpoint any specific measures.

Overall, non-doms may be breathing something of a sigh of relief and thinking it could have been worse, but higher earners, particularly those looking to fund their retirements may be wondering exactly which party was elected on May 7th.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.