Investor appetite for alternatives remains strong as the sustained low interest rate environment since the financial crisis, coupled with global growth concerns, trade war tensions, dovish central bank polices, and political uncertainty to name but a few, continue to drive the search for yield and interest in less liquid strategies, such as real estate.

In the first three quarters of 2019, $121bn was committed to real estate funds1 including the record closing of the two largest ever funds, a $20.5bn fund from Blackstone which closed in Q3, and Brookfield's $15bn vehicle that closed in early January.

In this article, we will discuss general market trends within real estate investing, how managers are positioning their funds to capture the best opportunities and key sector highlights.

Real Estate Investing Overview

Real estate strategies, like infrastructure, are grouped on the core, core-plus, value-add and opportunistic spectrum in terms of risk/return profile with satellite groupings for real estate debt and fund of funds. While the underlying investments are different (for example a toll road versus a shopping mall), it is interesting to note that real estate investment shares many commonalities with infrastructure investment given the long duration, real asset and income yielding nature of the assets and portfolio diversification attributes. Please contact us at investmentresearch@mjhudson.com if you would like access to our white paper for further information on infrastructure investing.

There are several different ways of gaining exposure to real estate, dependent on investors' risk- return appetite, liquidity and other constraints. Investors could buy assets directly, but this requires substantial capital commitment and knowledge of the sector. The most common approach by institutional investors is to invest in pooled open- or close-ended funds run by a manager. Close-ended funds have a fixed term of several years whilst open-ended have monthly/quarterly liquidity. To meet this liquidity, open-ended funds hold substantially more cash and even then, this liquidity is not guaranteed, as evidenced by some UK real estate funds suspending redemptions following the Brexit vote in 2016 and again more recently in December 2019 due to mass withdrawals. Opportunistic and value-add funds are almost always closed-ended because they seek to acquire and realise assets at the optimum time and valuation; core and core-plus strategies are offered through both fund types.

Alternatively, an investor could purchase shares in a real estate investment trust (REIT) as they would any other listed equity. These are the most liquid, can provide access to what is traditionally a highly illiquid asset class, can be freely bought and sold, but generate exposure to equity markets as well as to real estate, so are less of a diversifier.

Real Estate Investment Trends

The large supply of dry powder (which has doubled since 2007 to reach $333bn at September 20192), the long bull market supporting asset values, and the low interest rates that have facilitated cheap leverage when acquiring properties have led to high valuations in the sector. With so much capital chasing these returns, margins have become compressed. This has now led to many investors and managers targeting the top end of the spectrum, with value-add and opportunistic strategies having the largest proportion of current AUM and committed dry powder as well as the greatest number of funds in fundraising mode.

Value-add/opportunistic strategies seek to unlock an asset's true intrinsic value and higher yields through active investment management and have gained momentum in the last few years, as opposed to core strategies which focus on fully operational, yielding assets. Real estate debt has also become more popular as a way of gaining exposure to the sector; debt funds of course benefit from capital seniority versus equity holders as well as security against the asset; furthermore, real estate debt typically has a higher recovery rate (75%) compared to corporate bonds (40%)3.

Managers seek to access value-add/opportunistic assets through a variety of methods. For instance, they may target forced/distressed sellers which provide attractive acquisition values compared to going market rates. Such assets normally need extensive time and investment to improve the building and extend or acquire tenancies, followed by subsequent realisation to a core buyer at a higher value. Alternatively, they may target locations which they believe have an untapped market opportunity for future growth. IRRs in these strategies tend to be higher, at around 12-15% net of manager fees, with most of the returns coming through appreciation rather than income yield. Some specialist managers report net returns of over 20% for their opportunistic strategies.

That is not to say core assets are unpopular; some investors and managers specialise in acquiring fully built and operational assets in prime locations to provide a stable yield with little additional investment. IRRs are consequently lower (around 6-7% net of manager fees) with most returns coming from rental income. An example of a core real estate asset might be a fully let office building with long-term tenants and only needing day to day maintenance as opposed to a value-add asset which could be an office building which a developer believes can be converted into a residential building and let to private tenants. Broadly, we note that target and actual IRRs have declined in recent years as competition in the asset class has intensified.

Key Real Estate Sector Trends

Compressed margins and ambitious investors mean that managers are turning to newer sectors such as student housing and less popular markets (Southern and Eastern Europe) to find the best returns. Additionally, some managers are offering country- or sector-specific real estate funds, arguing that they have the necessary expertise to execute and risk-manage a more concentrated strategy.

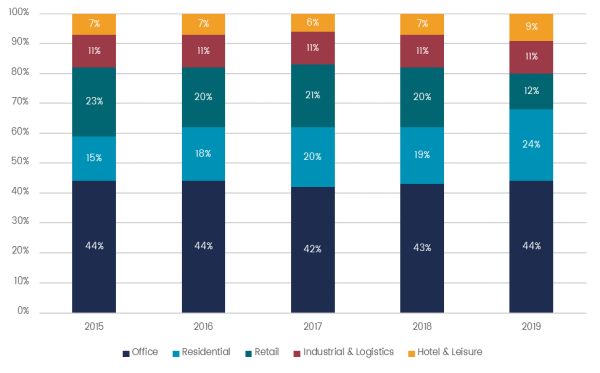

Commercial real estate now accounts for around 80% of all real estate investment in Europe and residential the remaining 20%. Within commercial real estate, the largest sector by investment volumes continues to be offices, accounting for roughly 44% in the last five years. The most significant changes have been in the retail sector, discussed below, which has halved, and now accounts for 12% only, while residential has grown by 60% since 2015. Industrial and logistics has remained broadly unchanged, while hotels and leisure have increased slightly in the last year after remaining the same since 2015. Within this aggregate data, there are sub-sector trends accounting for the changes and the highlights are discussed below.

Real Estate Investment in Europe Breakdown over the Last Five Years

Source: Real Capital Analytics

The significant growth of e-commerce is primarily responsible for the decline in the physical retail sector. Currently the average European yield is around 3%4 but certain markets like the UK have been particularly affected (the yield is around 2.5% in prime Central London) given it was one of the earliest adopters of online shopping. Other European markets are starting to catch up with the UK adding to the woes on the horizon for the sector5.

As a result of the former's decline, logistics demand remains strong. In Europe, vacancy levels are at a record low around 4.1%6. However, investors should be aware of declining average yields due to intense competition in the sector; the current average yield for the sector across Europe is just below 6%7.

Office investment remains the most popular sector due to strong employment figures and moderate economic growth necessitating a continual desire for new properties and leases. There is some divergence at country level: the main North-Western European cities have seen a flattening or slight decline of yields and therefore a fall in volumes. The average yield in Europe is currently approximately 4.5%. However, there is increased investment in higher yielding cities, particularly those in Southern and Eastern Europe, where the average yield can be closer to 7 or 8%8. despite the additional risks they bring.

Finally, the residential sector is growing due to continued global population growth. Several sub-sectors like student housing and senior living have increased in popularity due to their perceived "recession-proofness" (the argument being that a growing elderly population and continual student population will always provide a base level of supply despite any economic downturn). However, some cities are reporting oversupplies of student accommodation9 resulting in compressing yields. Average yields for the student housing sector are around 4.5% and senior housing slightly lower at 4%.

Conclusion

Like all illiquid strategies, there are many factors to consider when investing in real estate such as the risk/reward appetite and fund type, whether to choose an equity or debt strategy, a generalist or specialist fund, or a global or region-focused offering. Due to these many aspects, dispersion of both targeted and actual returns is high within this asset class and as such, fund due diligence and manager selection remains an important part of the process of allocating successfully to the asset class.

Footnotes

1. Quarterly Update: Real Estate Q3 2019, Preqin, October 2019

2. Real-Estate Funds Have a Problem: Too Much Cash, Wall Street Journal, March 2019

3. Moody's Default and Recovery Database

4. Prime High Street Retail Yields, Q2 2019, Statista

5. Spotlight: European Investment, Savills, October 2019

6. European Real Estate Outlook Still Positive Despite Increasing Risk, DWS, April 2019

7. European Logistics Yield Falls Below 6% for the First Time on Record, Cushman Wakefield, August 2019

8. European Yields Q2 2019, Savills, September 2019.

9. Higher Education: Is Britain's Student Housing Bubble set to Burst?, Financial Times, September 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.