We are living at a time when national economies should keep their guard high because global customs policies are being shaped by the impact of trade wars and the demand shocks caused by the COVID-19 crisis. However, the way to remain optimistic is through the adoption of strong and stable energy policies. More than ever, energy is one of the most important factors in maintaining a country's independence. In Turkey, policymakers and technocrats have been united in adopting "domestic and national" energy policies.

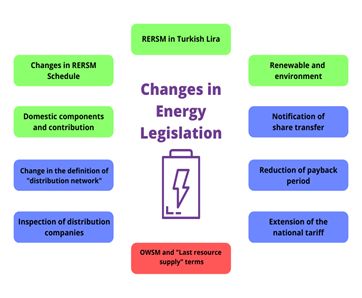

Dizzying developments on both the technological and structural side signal that we are on the verge of a paradigm shift in the global energy industry. Electrification of transportation vehicles, significant decreases in costs, developments in storage and information systems, structural changes in networks and developments in distributed electricity generation are examples of this. Thus, we are witnessing many changes in energy legislation, including the Law on the Amendment of the Electricity Market Act and Some Laws.

Although each of the amendments made is important, we will limit this article to the amendments to the Renewable Energy (RES) Act, Electricity Market Act and Natural Gas Market Act.

The reasons for amendments in the Renewable Energy Act (The RES Act)

Electricity generation from renewable energy sources is encouraged in many countries in order to reduce foreign dependency and promote efficient use of local sources. Moreover, generation from renewable energy sources is much more environmentally friendly than electricity generation from conventional carbon-based primary energy sources. In Turkey, the RES Act determines the main framework of the incentive system for electricity generation from renewable energy sources. However in recent years, due to economic developments and in particular fluctuations in the exchange rate, the RES Act ? especially the renewable energy sources support mechanism (RESSM") (YEKDEM) which guarantees the purchase through foreign exchange ? has been one of the most controversial legal arrangements. The investment incentives after 2020 were attractive for investors but some legal problems encountered in practice made it inevitable to amend the RES Act. Moreover, environmental activists have been criticizing some of the promoted electricity generation methods. Let's take a look at the notable amendments in the RES Act.

Biomass-based generation

The definition of "biomass" in the RES Act has been a target of environmental criticisms. Before the amendment, "biomass" was defined in the RES Act as follows:

"..resources obtained from agricultural and forestry products, including agricultural harvest wastes, vegetable oil wastes as well as urban wastes, and by-products resulting from the processing of these products and waste tires, as well as industrial waste sludge and treatment sludge."

The RES Act provides a purchase guarantee for electricity generated from biomass-based generation facilities of 13.3 (USD cents/kWh), which is the highest price in the RES Act. Many people, especially environmentalists, have criticized the promotion of electricity generation from agricultural and forestry products and by-products from the processing of waste tires. In the amendment of the "biomass" definition, we see that municipal waste (including landfill gas) is added in place of urban waste; agricultural waste is limited to "that with no food and feed value"; and forestry products are defined as "those other than industrial wood". We can foresee that environmentalists will continue to criticize the RES Act because the production of electricity from landfill gas and waste tires are still supported. We believe it is necessary to re-evaluate this issue and consider at least giving lower incentives to electricity produced from biomass sources with a relatively low contribution to the environment.

Eliminating uncertainty regarding unlicensed electricity generation after 10 years of production

One of the most frequently asked questions regarding the RES Act was how to utilize the surplus electricity generated by unlicensed electricity generation facilities at the end of 10 years. Indeed, there was a legal gap here before the amendment. The gap was mainly due to the dynamic nature of the market, and the legislator's deliberate refraining from making regulations, considering that it would be more appropriate to make the relevant regulation towards the end of the 10-year period. With the amendment, it has been made possible for those who produce unlicensed electricity to switch to licensed generation activities at the end of 10 years, provided that 15 percent of the hourly market clearing price formed in the electricity market is paid as a contribution fee to the RESSM. On the other hand, for the surplus electricity generated within the scope of unlicensed generation activity, the price to be applied should not exceed the market clearing price in the electricity market, and the procedures and principles will be determined by the president. The amendment has two important results. First, it is obvious that the purchase guarantee continues after 10 years for the surplus electricity generation of these facilities. The second point is that at the end of 10 years, the incentive price will no longer apply, but they can sell their electricity at market price.

RESSM incentives in foreign currency or in Turkish lira?

Everyone was curious about how the renewable energy sources support mechanism (RESSM) under the RES Act would be like after 2020. As we approach the end of 2020, Presidential Decree No. 2949 has extended the commissioning deadline to benefit from RESSM from December 31, 2020, until June 30, 2021. The Presidential Decree also stated that the price support for production facilities that are subject to RESSM will be applied until December 31, 2030.

According to the amendment, the president will determine the procedures, principles and price updates regarding the RESSM to be applied in Turkish lira for electricity generation facilities that will be operational after June 30, 2021. We note that the legislator has abandoned the system of granting incentives in foreign currency for facilities that will start operating after June 30, 2021. With the regulation we understand that two different incentive systems will be applying in Turkey at the same time. The first of these is the foreign currency-based incentive system to be used by facilities that were already operating before June 30, 2021, and the other is the Turkish lira-based incentive system to be applied to facilities that will start operating after June 30, 2021. This dual situation creates uncertainty over which incentive mechanism will be applied to units that will start operating after June 30, 2021, but which are part of facilities that have already started partially operating before June 30, 2021. In our opinion, the fact that these facilities are partially activated means that they are already included in the system, and that therefore the new units should also benefit from the foreign exchange-based RESSM. On the other hand, it is possible that the Energy Market Regulatory Authority (EMRA) will adopt the opposite point of view and in that case it is predictable that legal disputes may arise.

On the other hand, determining the incentives in Turkish lira may not trigger investments due to high inflation. However, this situation will not pose a problem unless a shortage of supply. Still, it should be emphasized that the necessary arrangements should be made at the right time, taking into account the supply-demand balance.

Before the amendment, EMRA had to publish the list of companies that would be subject to RESSM before November 30. After the amendment, this date was changed to the "end of the year". This change is extremely positive in terms of preventing some problems that may be encountered in practice by facilities that enter into operation between November 30 and December 31.

Domestic components and contribution

In parallel with the above-mentioned incentive system, it has been ruled that for facilities that will start operating after June 30, 2021, the domestic contribution prices to be paid to the users of domestic components will be determined in Turkish lira and the relevant procedures and principles will be determined by the president. Another important regulation on domestic components is that the procedures and principles regarding the definition, standards, certification and inspection of domestic components will be determined by a regulation to be issued by the Ministry of Energy and Natural Resources. In this regard, serious problems have been encountered in practice and new regulations are needed as well.

In addition, one of the striking changes in the RES Act is the regulation brought by provisional article 7, stating that the legal entities allocated capacity with zero or less than zero price offers in the competitions held before the effective date of the article cannot benefit from the domestic contribution prices. This arrangement is interesting as it is a retroactive regulation. When we look at the preamble of the regulation, it is stated that this regulation was made in order not to change the conditions for competitions, since it is stated that giving zero or less than zero price offers in the competitions means that the facilities will not benefit from RESSM and if RESSM does not benefit, the domestic contribution prices will not apply in accordance with the legislation on the date of the competitions. It is clear that the justification is contradictory in itself. Because, if giving a zero or less than zero price offer in competitions means that they will not benefit from RESSM, and if domestic contribution prices will not apply if RESSM does not benefit in accordance with the legislation on the date of the competitions, then what is the need for a retroactive regulation on the subject?

On the other hand, this is not the first time we encounter a retroactive regulation in energy law. In this regard, we immediately think of the "leakage loss" issue in electricity. Going back to the provisional article 7 of the RES Act, if the legal disputes arising from the mentioned article go before the Constitutional Court, the Supreme Court may act with practical considerations and may hold the said regulation lawful in accordance with the Constitution, despite the "principle of non-retroactivity" as it did so, in the leakage loss case.

Provisions on inspection in RES Act have been repealed

The provisions on inspection in the RES Act have been repealed with the amendment. Inspection of the aforementioned generation facilities is carried out in accordance with the Electricity Market Act rather than the RES Act.

Amendments in Annex 1

Another change made in the field of renewable energy is the inclusion of a "generation facility based on renewable energy resources, limited by the contractual power in the connection agreement" in Article 14, entitled "activities that can be carried out without license" of the Electricity Market Act No.6446. With this regulation, we see that the obligation to obtain licenses for such generation facilities based on renewable energy resources is removed.

In addition to that, "facilities within the scope of unlicensed electricity generation activity based on renewable energy sources that are entitled to receive a letter of invitation to the connection agreement as of 10.5.2019" have been added to Annex 1 of RES Act, which indicates the type of generation facility based on renewable energy sources and the prices to be applied. In the same Annex, the price to be applied for these facilities is regulated as "the retail one-time active energy price of its own subscriber group, declared by EMRA as Turkish lira kurus/kWh". Although at first glance it appears that these facilities cannot benefit from the price of 13.3 USD cents/kWh, in our opinion, if these facilities enter into operation before June 30, 2021, they should benefit from the price of 13.3 USD cents/kWh. The aforementioned regulation may also cause legal disputes.

Important amendments in the Electricity Market Act

The change in the definition of "distribution network"

The definition of "distribution network" in Article 3 the Electricity Market Act has been amended. With this amendment, the connection lines installed for individual generators to connect the producers' switchyard to the distribution system are excluded from the definition of a distribution network. Essentially, "distribution network" was already defined as a "distribution facility excluding the connection lines established to connect the internal installation of the consumers to the distribution system" in Article 3 p.1 (y) of the Regulation on Electricity Market Connection and System Usage. Although we welcome the amendment, the regulations must comply with the laws, but in practice the opposite is the case here and the definition of "distribution network" in the RES Act is harmonized with the definition in the Regulation. The motive behind this change is to ensure that the costs of transmission lines established for individual interests remain on the generation facilities, which is how it is supposed to be.

Is share transfer no longer subject to EMRA's permission?

Pursuant to paragraph 3 of Article 5 of the Electricity Market Act, changes in capital shares of 5 percent in public companies and 10 percent or more in others were subject to the permission of EMRA. With the amendment, only legal entities with the regulated tariff will need the permission of EMRA for such changes in the share capital. Others can now transfer shares without obtaining permission from EMRA; except of course for the transactions that result in a change of ownership or right of use of the facilities. Therefore, generation license holders and supply license holders other than the incumbent companies are now freed from a process that caused them loss of time and cash. It is worth remembering that making a similar regulation for companies in the pre-license process will make it easier to include investors in projects, and of course, it is assumed that EMRA will grant pre-licenses to real investors.

Good news about repayment of transmission lines costs

In Article 8 of the Electricity Market Act, if companies make necessary transmission facility investments for the connection of their own facilities, the Turkish Electricity Transmission Corporation ("TEIAS") will repay that investment within a maximum of 10 years. As you will appreciate, the 10-year period for payback was quite a long period under the conditions in our country. The repayment period has been reduced to five years with the amendment. A 10-year period for repayment increased the burden on companies investing in transmission facilities. In this respect, the reduction of the payback period to five years is undoubtedly a positive development.

Inspections in the electricity market

In accordance with Article 15 of the Electricity Market Act, inspections and supervision of the electricity market activities and the persons operating without a license, excluding the distribution companies, are carried out by EMRA. On the other hand, the Ministry of Energy and Natural Resources is authorized to inspect and supervise distribution companies. However, the same Article says that the Ministry can delegate this authority for inspection and supervision of distribution companies to public institutions and organizations specialized in this field. With the amendments, it has been clarified that the Ministry may transfer this authority partially or completely to specialized public institutions and organizations, including EMRA. We know that the reason behind this amendment is judicial process. However, when we examine the Electricity Market Act, we are of the opinion that EMRA already has the authority to inspect the distribution companies. To illustrate, in subparagraph (d) of paragraph 2 of Article 5 of the Law, it is stated that, "License holder legal entities; they have to keep their facilities, legal books and records ready for the inspection of the Authority, open them for inspection when requested by the Authority, and submit all kinds of information and documents that the Authority may need in order to carry out its activities in a timely, complete and accurate manner". Again, in Law No. 4628 on the Organization and Duties of the Energy Market Regulatory Authority, the duty of "inspecting the audited financial statements of the legal entities operating in the market or having them inspected" is included. EMRA has been given the authority for inspection in Article 4 of the same Law. Therefore, even if the said amendment were not made, EMRA has supervisory power over the entire sector, including distribution companies, as it is the sectoral regulatory authority.

How long will the national tariff continue?

Besides all the good news we mentioned above, there is also bad news. With the amendment in the Electricity Market Act, the national tariff implementation was unfortunately extended until December 31, 2025. Actually, this was not a surprising development. The main purpose of the price equalization mechanism and the national tariff implementation is to eliminate the regional effects of the costs that need to be reflected for the regulated consumers in accordance with the relevant legislation during the transition period of the market or, more accurately, to spread those costs to the consumers throughout the country. When we say that, "The implementation of the national tariff has been extended in order to provide sufficient, high quality and continuous electricity to consumers in all regions because the transition period implementations do not come to an end in terms of inter-regional cost differences and cross subsidies between subscribers", it does not actually sound unattractive, right? As the veterans of the sector will admit, the extension of the national tariff implementation is, in fact, an implicit acknowledgment that a number of longstanding structural problems in the market could not be solved.

Is the jurisdiction of the administrative courts expanding?

With the provisional Article 3 added to the Electricity Market Act, disputes arising from the implementation of subparagraph (d) of the second paragraph of Article 8 will be heard in the administrative courts. The article in question is as follows:

".to operate the transmission system under normal operating conditions and to monitor the system usage violations regulated in the connection and system usage agreements in relation to the situations that pose a risk to operational safety and integrity, to apply the penal terms set out in the system usage agreement and other sanctions to the legal entities whose violation status is detected."

We knew that there were different opinions in both the doctrine and the judiciary regarding the legal nature of the system usage agreements and which jurisdiction would resolve the disputes arising from these agreements. Under the amendment, disputes arising from the system use agreements made with TEIAS regarding the penal terms and sanctions by TEIAS will be heard in the administrative courts. We understand that, with this amendment, the legislator has ended the discussions on this matter. Based on the stated regulation, we would like to underline that EMRA can no longer impose sanctions on the violations in question. In addition, when we interpret the amendment in full, it is worth noting that the disputes arising from the distribution companies' system usage agreements and the system usage agreements to which TEIAS is a party, other than the above-mentioned issue, should be heard in the civil courts.

So what has been amended in the Natural Gas Market Act?

The terms of "Organized Wholesale Natural Gas Sales Market" (OWSM) and "last resort supply" and other changes

In order to define the OWSM at the legal level and determine its scope, the following definition of OWSM has been added to Article 3 of the Natural Gas Market Act: "Markets where natural gas purchase and sale and balancing transactions are carried out by license holders benefiting from the natural gas system, natural gas markets that require post-dated physical delivery, and the market regulated by the board where other natural gas market transactions determined by the board are carried out".

Although the winds of liberalization started to blow in the electricity market and natural gas sectors in the same years, the liberalization in the natural gas market progresses much more slowly. In this respect, the establishment of OWSM can be described as a game changer. Of course, we know that we are at the very beginning of the road and it will take time for the market to reach the desired depth.

In parallel with the establishment of the OWSM, we see that the term of "last resort supply", which we are familiar with from the electricity market, has entered the Natural Gas Market Act. Accordingly, in the case of license holders who fail to fulfill their obligations, the term of "last resort supply" was added to the Law in order to prevent disruption of the operation of the system, with the following definition: "Providing gas supply by license holders authorized within the framework of the method determined by the board, to consumers who cannot supply natural gas due to reasons such as the bankruptcy of companies supplying natural gas to consumers within the contract period, their licenses being canceled and/or defaulting as a result of failing to fulfill their obligations within the framework of the organized wholesale natural gas sales market, or their gas supply cannot be provided even though they have the right to be free consumers".

As can be seen from the definition, EMRA is authorized to determine the company that will be responsible for the last resort supply. In addition, with the new regulation, EMRA has been given the authority to impose obligations on some companies to make transactions in OWSM. In a sense, the legislator says, "Transaction volume will increase in OWSM; if not, we will find a way to increase it!" In our opinion, the regulations regarding the purchase of natural gas within the context of last resort is on the way. Although many other amendments have been made in the natural gas law, the key ones are the ones mentioned here. It seems that important developments may occur in the natural gas market in the upcoming days!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.