Türkiye has emerged as a significant player in the global cryptocurrency scene, with a rapidly growing number of adopters and investors. According to the Crypto Currency Research Report published by the Information Technologies and Communication Authority ("ICTA") of Turkey in May 2020, the country boasts over 5 million cryptocurrency owners, solidifying its position as one of the largest and fastest crypto adopters worldwide1. This number increased drastically and by the end of 2023 more than half of the population invest money on cryptocurrencies2. However, despite this surge in adoption, the regulatory framework for crypto assets remains in flux, with the government currently working on a draft legislation to address this evolving landscape. As Turkey works towards formalizing its approach to cryptocurrencies, Anti-Money Laundering ("AML") measures are becoming increasingly crucial to ensure financial integrity.

In addition, developments in the crypto market should be examined, considering that the new Minister of Economy, Mehmet Şimşek, who abandoned the unorthodox economic policies employed before the latest election, personally follows the issue of Turkey's exit from the FATF grey list.

In this regard, this article delves into the evolving regulatory framework surrounding cryptocurrencies in Turkey, with a focus on AML compliance and the forthcoming legislative developments.

Regulatory Background

As discussed in more detail in our previous article3, Turkey's regulatory framework for AML/CTF is primarily governed by Act No. 5549 which provides the legal standards for combating money laundering and terrorist financing activities, overseen by the Financial Crimes Investigation Board ("FCIB", "MASAK") which acts as a law enforcement agency under the Ministry of Treasury and Finance. In recent years, Turkey has taken significant steps to strengthen its AML framework, aligning with international standards set forth by organizations like the Financial Action Task Force ("FATF").

It's important to note that, under the current regulatory landscape, crypto assets are not classified as "capital markets instruments." Instead, the Central Bank Regulation issued by the Central Bank of the Republic of Türkiye defines crypto assets as "intangible assets representing a value or right that can be created and stored virtually through distributed ledger technology or any other similar technology and that can be distributed over digital networks." This distinct classification subject crypto assets to a separate legal regime, further highlighting the need for tailored regulatory measures.

Pressure Points and Regulatory Responses

The exponential growth of Turkey's cryptocurrency market has raised concerns regarding potential AML risks. In response, Presidential Decree No. 3941, issued in May 2021, expanded the scope of the Regulation on Measures to include crypto asset service providers ("CASPs") as "obliged parties." This amendment underscores CASPs' responsibility to prevent money laundering and terrorist financing through crypto assets such as Bitcoin, Ethereum, etc., subjecting them to rigorous AML requirements and MASAK supervision4.

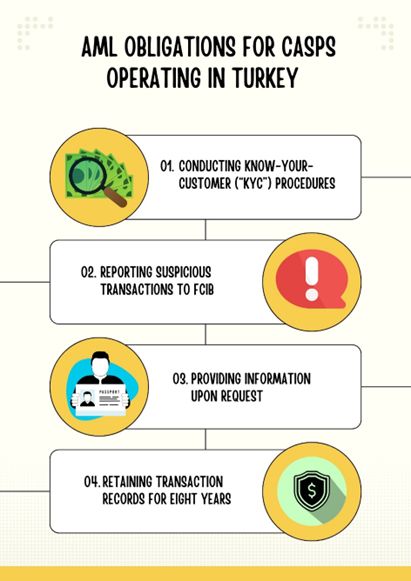

CASPs operating in Turkey are mandated to adhere to AML obligations outlined in the Regulation on Measures and FCIB's guidelines. These obligations include:

- Conducting know-your-customer ("KYC") procedures

- Reporting suspicious transactions to FCIB

- Providing information upon request

- Retaining transaction records for eight years

MASAK has published detailed guides outlining these obligations and procedures for CASPs.

Furthermore, Guideline for Suspicious Transaction Reports of Crypto Asset Service Providers ("Suspicious Transactions Guideline"), introduced in April 2022, outlines the reporting process for suspicious transactions, emphasizing timely reporting and confidentiality.

In alignment with the AML Guideline, the Suspicious Transactions Guide mandates CASPs to report such transactions to MASAK within maximum 10 days or immediately in urgent cases. Additionally, if new information surfaces after the initial report, CASPs must promptly file an additional Suspicious Transaction Report, clearly indicating it as supplementary. The guideline furnishes comprehensive details on the procedure for submitting a customer's suspicious transaction to FCIB.

Per the guideline, the legal representative of the obligated entity must report suspicious transactions using the designated Suspicious Transaction Reporting Form. These reports can be submitted electronically via MASAK's online platform, EMIS.ONLINE, if authorized. Otherwise, submission is via ink-signed papers or registered email addresses. To access the EMIS.ONLINE system, legal representatives must complete the Suspicious Transaction Reporting Commitment Form and submit it along with specified documents to MASAK. Regardless of the submission method, CASPs must retain copies of suspicious transaction notifications for eight years.

CASPs may request a postponement from MASAK when they believe serious indications support suspicion, provided adequate justification accompanies the request.

Given the FATF's updated guidance5 on a risk-based approach and the international standards regarding the "travel rule" for virtual assets, it is expected that Türkiye will adopt regulations in line with recent developments6. Alignment with the EU's stricter approach on AML/CTF standards, including traceability and verification requirements for "un-hosted wallets," is anticipated for regulatory harmonization.

Simplified KYC procedures for CASP customers, as per the Regulation on Measures, allow for streamlined measures as it is a simplified due diligence verification process which is applied to customers who have a low risk of money laundering. These measures, outlined in MASAK General Communiqué No. 5, permit CASPs exclusively operating in electronic environments to benefit from simplified KYC principles, provided they meet specific conditions.

Verification through the Ministry of Internal Affairs' identity sharing system database obviates the need for signature samples. However, many CASPs still collect additional documents, potentially raising liability concerns under Personal Data Protection Law No. 6698. Obtaining explicit consent from customers may be necessary to comply with data protection principles. It's worth noting that simplified KYC procedures may not apply to non-resident customers.

Additionally, the government is drafting legislation, known as the "Unofficial Draft Legislation", to regulate crypto assets and service providers under the existing Capital Markets Law ("CML"). The Draft Legislation is expected to introduce licensing requirements and additional AML obligations for crypto asset service providers ("CASPs") with an omnibus law.

Future Considerations

We expect that the cryptocurrency matter is currently under scrutiny by Financial Intelligence Units due to its impact on the payments system. MASAK is closely monitoring these developments, and based on our experience in public policies, we foresee the possibility of stricter regulations being implemented in this regard.

As international AML standards evolve, Turkey is expected to align its regulations with global best practices as it is also included in the FATF system. Furthermore, technological advancements in blockchain analytics and transaction monitoring are providing new tools for AML compliance in the cryptocurrency sector. Turkish regulators may leverage these technologies to enhance their surveillance capabilities and detect suspicious activity more effectively. By harnessing the power of data analytics and artificial intelligence, authorities can identify patterns of illicit behaviour and take proactive measures to mitigate AML risks in the cryptocurrency market.

While the rapid growth of Turkey's cryptocurrency market presents challenges in terms of AML compliance, it also offers opportunities for innovation and collaboration. By implementing robust AML regulations, leveraging technological solutions, and fostering international cooperation, Turkey can strengthen its defenses against money laundering and terrorist financing activities involving cryptocurrencies. As the regulatory landscape continues to evolve, proactive measures will be essential to ensure the integrity and stability of Turkey's financial system in the digital age. The actors in cryptocurrency market, please do not forget that MASAK follows you!

Footnotes

1. Crypto Currency Research Report 2020, p. 21

2. https://www.bloomberght.com/turkiyedeki-yetiskinlerin-yarisi-kripto-yatirimcisi-2337462 (last accessed on 26.03.2024).

3. Dark Side Of The Globalization: An Overview Of The Turkish Regulation Against Money Laundering (AML), https://www.mondaq.com/turkey/money-laundering/1198190/dark-side-of-the-globalization-an-overview-of-the-turkish-regulation-against-money-laundering-aml (last accessed on 26.03.2024).

4. "Türkiye adds crypto firms to money laundering, terror financing rules", https://www.reuters.com/technology/turkey-adds-crypto-firms-money-laundering-terror-financing-rules-2021-05-01/ (last accessed on 07.03.2024).

5. Updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers, https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Guidance-rba-virtual-assets-2021.html (last accessed on 26.03.2024).

6. "Crypto assets: deal on new rules to stop illicit flows in the EU", https://www.europarl.europa.eu/news/en/press-room/20220627IPR33919/crypto-assets-deal-on-new-rules-to-stop-illicit-flows-in-the-eu (last accessed on 07.03.2024).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.