In the broadest sense, sustainable finance is a financing process sensitive to the principles of environmental, social and corporate governance. Navigating the challenges and opportunities presented by this rapidlygrowing and evolving financing philosophy can be a daunting undertaking for companies. This newsletter presents the recent developments in sustainable finance in Turkey and ten tips based on our experience as Esin Attorney Partnership.

- Sustainable finance requires immediate action: All market participants urgently need to develop their own sustainable financing expertise. Not only are there altruistic reasons to undertake these initiatives, but stakeholders, foreign investors, foreign financiers as well as governmental authorities, among many others, increasingly demand action.

- Sustainable finance is here to stay: Urgent environmental, social and governance drivers across all industries and jurisdictions will ensure that sustainable finance remains an important topic for the foreseeable future.

- Sustainable finance is still in its early days: While it gains more and more importance every day, sustainable finance is a relatively young phenomenon. Consequently, its rules and protocols are voluminous and confusing; its benefits are (currently) primarily non-economic; and its risks remain uncertain.

Sustainable Finance in Turkey

Recent Developments from Turkey

Sustainable finance has also gained momentum in Turkey. The International Finance Corporation and Amundi's 2019 report on sustainable finance in emerging markets provides that Turkey's green funding potential is expected to increase along with its green infrastructure investments.1 The National Energy Efficiency Plan, approved in January 2018, calls for a 14% reduction in primary energy consumption until 2023, by means of USD 10.9 billion worth of investments.

Accordingly, as stated in the International Finance Corporation and Amundi's report, while pursuing its economic goals, Turkey will have to give weight to sustainable finance projects in order to meet its environmental commitments, and the volume of sustainable finance investments will increase in the medium-term.2

In 2016, Türkiye Sınai Kalkınma Bankası issued the first ever green bond out of Turkey. In 2020, Akbank issued USD 50 million green bond, which will be used for financing renewable energy projects, after the COVID-19 pandemic began. The transaction is of significant value in Turkish banking sector for being the first green bond issuance since the start of the COVID-19 pandemic.

Legislative Innovations

On 2 September 2020, the Capital Markets Board ("CMB") amended the Corporate Governance Communiqué ("Communiqué") to ensure that public companies take concrete steps to ensure sustainability and to finance themselves in a sustainable manner ("Amendment"). The CMB has also published the "Sustainability Principles Compliance Framework" ("Compliance Framework"), outlining the sustainability principles that public companies should follow. According to the Amendment, public companies that are subject to the Corporate Governance Principles in the Communiqué will now also be subject to the principles set out in the Sustainability Principles Compliance Framework. While there is no obligation for companies to follow these principles, they will still be obliged to report whether they comply with these principles, or their reasons for failing to do so, to the public through their annual reports on a "Comply or Explain" basis, starting from the year 2021 (and including information for the year 2020). Considering the progression of Corporate Governance Principles in Turkey, this development injects optimism that these principles will become mandatory to comply with over time. You can read more about this topic in our Legal Alert dated 6 October 2020.

Top 10 Tips To Be Considered in Sustainable Financing

Tip 1: Select Your Shade of Green

Terms that are often connected to sustainable finance, such as environmental, social and corporate governance principles, have different meanings across different markets, which makes it difficult to have a common understanding of what sustainable finance is.

Expected economic benefits of a sustainable finance investment may not always be as apparent as its social or environmental benefit. In this respect, the regulatory and legal frameworks established to facilitate the development of sustainable finance may actually be slowing its growth in certain circumstances. Based solely on a finance costbenefit analysis, the additional cost and effort to issue and maintain sustainable financing may act as a deterrent, regardless of the importance of the social impact.

Nevertheless, the definition of sustainable finance is being crystallized with the CMB's Compliance Framework and the increasing number of sustainable finance initiatives in the market. Moreover, a broad understanding of the term that is not strictly limited to environmental issues makes sustainable finance more accessible by companies, and creates new sustainable finance instruments, which also generates direct economic benefits. These instruments are widely known as key performance indicator (KPI) linked bonds/loans, which is good news for debtors and investors, as it provides them with a more diverse range of options to benefit from sustainable finance initiatives.

Tip 2: Choose the Right ESG Product

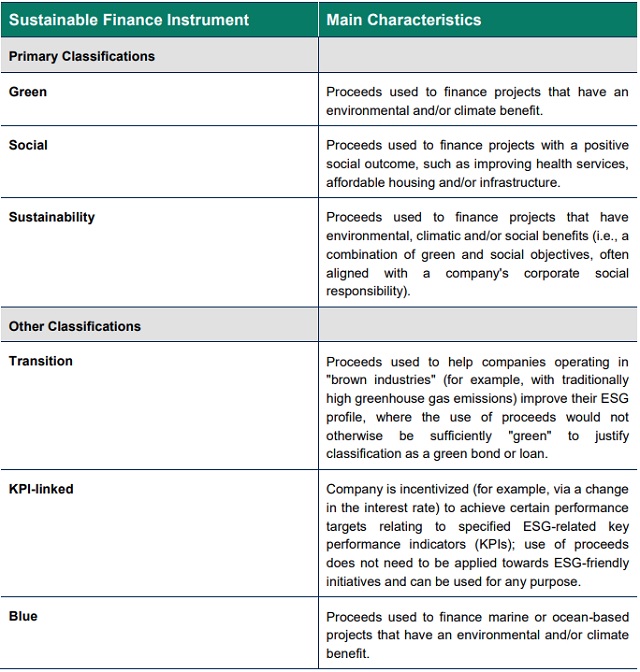

As the sustainable finance market develops, market participants continue to look for different ways to address global environmental, social and governance ("ESG") concerns. While the market is still developing, there is still a wide range of financing alternatives for any company as indicated by the table below.

Footnotes

1 Amundi Asset Management (Amundi) and International Finance Corporation (2019), Emerging Market Green Bond Report 2019: Momentum Builds as Nascent Markets Grow. Available at: https://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/climate+business/resources/em-gb-report2019.

2 Amundi and International Finance Corporation (2019) p. 29.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.