Introduction

Overall, this paper presents a FinTech guide by describing the design and implementation of FinTech norms applicable in Turkey. Turkey offers business-friendly policies through a deep talent pool and low marketing costs at the border of Europe, Asia and Africa. Markedly, Turkey's FinTech legal ecosystem is of great importance in addressing the scope and nature of entrepreneurship and every single start-up investment.

For our work and all legal services on the matter of investment, please click our "Practice Areas", titled "Investment Advice".

What is the meaning of FinTech?

The term "FinTech" describes emerging digital systems based on the modification, advancement, automation and facilitation of payment systems. The word FinTech covers a broad form of payment models including electronic money institutions, payment institutions, digital banks, online insurance agencies, and crowdfunding platforms.

What is the main purpose of FinTech?

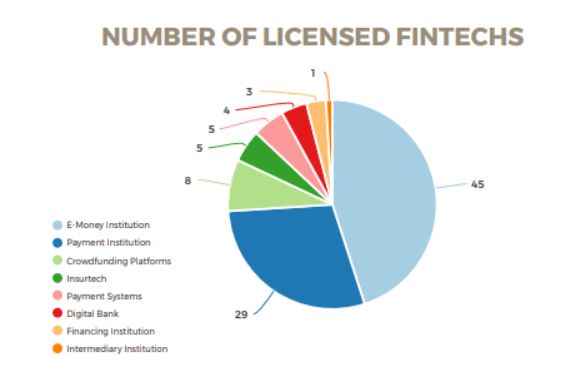

The main objective of FinTech is to facilitate and accelerate shopping and trade. There are several advantages of alternative virtual payment methods. There is a growing agreement that FinTech will play a substantial role in the payment ecosystems across the world. By virtue of those benefits, as of February 2023, 739 FinTech-led companies have been formed in Turkey according to recent studies by the Presidency of Republic of Turkey.

What are the leading FinTech business models in Turkey?

FinTech-centric corporations engage in a wide range of sectors. Taking into account ever increasing growth in digital innovations, the provision of a limited list is far beyond easy. However, particularly following fields are quite attractive for FinTech-backed corporations:

- payment systems

- electronic money service

- payment service

- money remittance systems

- mobile payment service

- digital banking

- intermediary institution including securities

- crowdfunding

- insurance service

What are the related FinTech regulations in Turkey?

Despite the advantages of FinTech systems, security breaches and data privacy infringements present serious challenges within the context of the digital world. Nonetheless, legal framework may play a pivotal role in guaranteeing the rights and interests of users and consumers. It is possible to make a reference to a certain legal framework within the context of FinTech. Particularly, following regulations provide significant principles within the scope of alternative digital payment systems:

- Banking Law (Numbered 5411),

- Bank Cards and Credit Cards Law (Numbered 5464),

- Payment and Securities Settlement Systems, Payment Services and Electronic Money Institutions Law (Numbered 6493),

- Financial Leasing, Factoring, Financing and Saving Financing Institutions Law (Numbered 636),

- Regulation on the Operations of Payment and Securities Settlement Systems,

- Regulation on Oversight of Payment and Securities Settlement Systems,

- Regulation on the Generation and Use of TR QR Code in Payment Services,

- Regulation on the Disuse of Crypto Assets in Payments,

- Regulation on Check Clearing Activities,

- Regulation on Information Systems and Electronic Banking Services of Banks,

- Communiqué on Information Systems Used in Payment and Securities Settlement Systems

How is the outlook of the FinTech-based regulatory regime in Turkey?

The first thing capturing our attention is that customers, end-users and tech-driven companies face substantial challenges because of the fragmentation of FinTech norms. The applicable regulations are, thus, very confusing and complicated.

Which authorities are competent for the implementation of FinTech laws and regulations?

Particularly, the Banking Regulation and Supervision Agency has a core mission to ensure the compliance of the banking activities in line with the Banking Law and other applicable regulations. According to Article 93 of the Banking Law, the Agency is granted certain powers and duties for the implementation of the Banking Law.

Secondly, the Turkish Revenue Administration performs certain duties dedicated to regulating payment systems.

Thirdly, in terms of data privacy, the Personal Data Protection Authority, engaging in the protection of personal data processing in line with internationally recognized human rights standards.

Besides, the Payment and Electronic Money Institutions Association carries out a broad range of duties in Turkey under Article 1 of the Law Numbered 6493.

Conclusion

In the light of the foregoing, this article is intended to make observations about the FinTech ecosystem in Turkey. Speed, easy and cheap accessibility have a dramatic influence upon increasing types and financial transactions of FinTech. Nonetheless, there is also an urgent need to address the importance of regulatory structure aiming at tolerating disadvantages of virtual payment systems. A comprehensive legal support is needed for the protection of civil rights [including the right to privacy] as well as the maintenance of interests of FinTech-centric corporations, and the facilitation of an effectively functioning market economy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.