Turkish competition law practice once again has the beer market on its agenda following the annulment of Turkish Competition Authority's ("TCA") approval of the acquisition of SABMiller plc ("SABMiller") by Anheuser-Busch InBev ("ABI"). In June 2016, SABMiller's worldwide acquisition by ABI has been subject to final examination before the TCA, along with many other competition authorities. The transaction covered the acquisition of all shares and sole control of SABMiller by ABI. TCA rendered its decision in favour of the transaction and approved the acquisition without any commitments.

In its decision, the TCA evaluated the market shares of both undertakings resulting from their operations in Turkey and stated that the acquisition posed no competitive concerns in relation to the concentration in the market.

Afterwards, the TCA pointed out the shareholding structure of Anadolu Efes. SABMiller is one of the joint controllers of the Turkish beer producer along with Yazıcılar Holding A.Ş. and Özilhan Sınai Yatırım A.Ş. Yet after the transaction, as recurrently stated by the representatives of ABI, SABMiller will come down to a position where it can exercise no veto power or have any say at the decision making process, but only act as a passive minority shareholder. Considering this, the TCA approved the transaction without asserting any conditions.

However, the decision was challenged before the administrative court by Tuborg and yesterday, the TCA faced an annulment decision by 6th Administrative Court of Ankara on the grounds that its decision was not based on neither sufficient analysis of the market conditions nor any legal and technical arguments that might allow unconditional approval of the acquisition.

Briefly, Turkish beer market can be summed up as a duopoly where Anadolu Efes and Türk Tuborg lead the market, followed by small-scale importers. Even though Anadolu Efes has been losing market share in the past couple of years, it is still going strong as the market leader and statistics show that Türk Tuborg has obtained the market shares lost by Anadolu Efes. These enterprises seem to be two balancing competitors whose strength are each vital for avoiding one-brand dominance in the market.

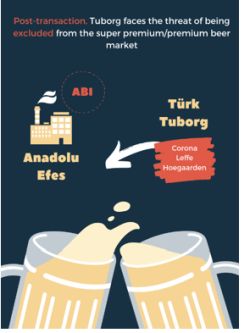

Prior to the transaction, SAB Miller was active in Turkish beer market selling beer to Anadolu Efes, whereas ABI did not have any subsidiaries in Turkey but carried out activities in Turkey through three channels:

- Licensing agreement entered with Anadolu Efes for production and distribution of Beck's brands;

- Distribution agreement entered with Türk Tuborg for distribution of Corona, Leffe and Hoegaarden brands; and

- Sales of Budweiser, Stella, Artois and Corona brands by Pamsa or other third parties.

The Court decision and the dissenting opinion of President

Ömer Torlak show resemblance in their criticism of the TCA

decision. In scope of this acquisition, they are of the opinion

that the TCA failed to examine ABI-Türk Tuborg relations

mentioned above sufficiently before granting approval to the

transaction. The transaction results in a mutual interest between

ABI and  Anadolu Efes due to the minority

shares indirectly acquired by ABI. From this point onwards, profits

and/or losses of Anadolu Efes will be of interest of ABI, and ABI

might choose to conduct all its agreements with Anadolu Efes

instead of other players, Türk Tuborg in particular. While

Anadolu Efes holds the brands Corona, Leffe and Hoegaarden at hand,

it will almost become a monopoly in the super premium/premium beer

market; a risk the TCA failed to consider in its decision according

to the administrative court.

Anadolu Efes due to the minority

shares indirectly acquired by ABI. From this point onwards, profits

and/or losses of Anadolu Efes will be of interest of ABI, and ABI

might choose to conduct all its agreements with Anadolu Efes

instead of other players, Türk Tuborg in particular. While

Anadolu Efes holds the brands Corona, Leffe and Hoegaarden at hand,

it will almost become a monopoly in the super premium/premium beer

market; a risk the TCA failed to consider in its decision according

to the administrative court.

One other argument proposed by the Administrative Court is that Türk Tuborg has made significant investment in brands Corona, Leffe and Hoegaarden 3 years prior to the advertisement ban in Turkey. After the transaction, Anadolu Efes will be benefiting from the recognition level of these brands without breaking a sweat. Türk Tuborg's investment in brand promotion, marketing and sales will only become a tool for strengthening Anadolu Efes' dominant position in the market.

Even though the TCA once again stated that Anadolu Efes shares acquired by ABI do not include any veto power and therefore any control over the undertaking, the Administrative Court is of the opinion that no legal or technical evidence was presented to support these arguments. Seeing that the worldwide acquisition was subject to many conditions in other jurisdictions, the Court rendered the TCA to review its now-annulled decision.

It is unclear how the TCA will shape its reassessment with regards to the SABMiller-ABI acquisition. However, it is for certain that the beer market will stay as a hot topic in the competition circles for a while.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.