The Turkish Competition Authority (the "TCA") published its annual "Mergers and Acquisitions Overview Report" (the "Report") on 5 January 2024. The Report presents data related to mergers and acquisitions examined by the Competition Board ("Board") during 2023 and helps to observe the trends in TCA's merger control enforcement.

M&A Transactions in Numbers:

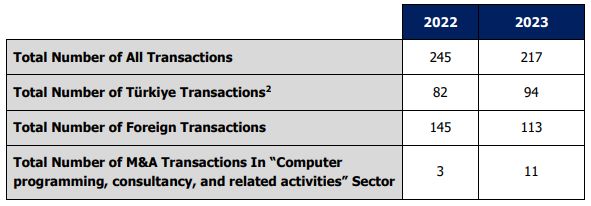

In 2023, the TCA reviewed 217 transactions with a total value of approximately TRY 57.525 trillion (approx. USD 2.4 trillion)1 . 48 of these transactions involved only Turkish parties, while 118 transactions involved solely foreign parties. Three of these transactions were privatizations.

- Compared to 2022, the total number of notified transactions has decreased from 245 to 217, which constitutes a 12% decrease. The total number of transactions reviewed in 2023 is also shortly below the ten-year average of 219.

- In 2023, the TCA reviewed 94 mergers and acquisitions where the target was a Turkish company (i.e., Türkiye Transactions) and the total transaction value of these transactions was approximately TRY 162.555 billion (USD 6.85 billion). In 2022, transactions between Turkish companies had a total value of approximately TRY 25.073 billion (approx. USD 1.55 billion). On the other hand, transactions involving only foreign companies had a total transaction value of approximately TRY 5.58 trillion (approx. USD 366 billion) in 2022.

- In 2023, a total of 113 foreign transactions, where the target is not a Turkish undertaking, were realized. The total reported transaction value of these is approximately TRY 57.362 trillion (USD 2.41 trillion). As it can be seen, in 2023, the majority of the TCA's workload regarding M&A review consisted of transactions that took place abroad.

- A majority of transactions involving a Turkish target company in 2023 occurred in the sectors of "electricity generation, transmission, and distribution" and "computer programming, consultancy, and related activities." In 2023, the Board reviewed 11 transactions within the "computer programming, consultancy, and related activities" sector, marking a significant increase from the three transactions recorded in 2022.

- Foreign investors, mostly German and Dutch, were engaged in 35 separate transactions involving Turkish target companies in 2023. The total value of expected investment by foreign investors in 2023 is approximately TRY 68 billion (USD 2.86 billion).

- Within the transactions realized by foreign investors in 2023, the noteworthy sectors based on transaction value include "computer programming, consultancy, and related activities", "broadcasting activities", "manufacture of food products" and "manufacture of chemical products".

- In 2023, the Board rendered its final decisions in approximately 13 days on average following the latest submission to the file.

- Lastly, among 217 transactions in 2023, the TCA launched only one Phase-II review concerning a transaction in the automotive sector.

Conclusion

The Report outlines the critical trends and insights into the merger control enforcement in Türkiye. Notably, 2023 witnessed a decline in the total number of transactions reviewed by the TCA when compared to 2022, however, the total transaction value increased due to the recent acceleration of inflation rate in Türkiye. Further, due to the recent legislative amendment decreasing specific turnover thresholds for transactions involving acquisition of technology undertakings, the TCA's workload concerning technology undertakings significantly increased. This trend is evident in the escalating number of reviewed transactions regarding sectors such as "computer programming, consulting, and related activities", "data processing, hosting, web portals" and "software programming" in 2023.

Footnotes

1 The USD equivalents of the monetary figures provided in this Report are calculated based on the applicable exchange rate of USD 1 / TRY 23.74.

2 Only mergers and acquisitions are included.

© Kolcuoğlu Demirkan Koçaklı Attorneys at Law 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.