March was a productive month for the Turkish Competition Authority, considering the publication of several expected regulations and reports as well as decisions by the Competition Board.

- The "Communiqué on Commitments" and the "de minimis Communiqué" both entered into force on 16 March 2021.

The Communiqué on Commitments shed light the details concerning the application of the commitment mechanism for competition law violations. It sets forth (i) the steps and procedures surrounding the commitment mechanism, (ii) the decisions to be taken by the Board regarding the submitted commitments, and (iii) hard-core restrictions where the commitment mechanism cannot be applied. We analyse each step of the Communiqué on Commitments here.

The de minimis Communiqué provides the procedures and principles to determine the agreements that do not significantly restrict competition and therefore may not be subject to investigation, excluding those that include hard-core violations. Our analysis of the draft version of the de minimis Communiqué is available here.

- The Authority presented for public consultation its draft Settlement Regulation, which sets forth the rules surrounding the settlement mechanism applicable to competition law violations. Here is our take on the draft.

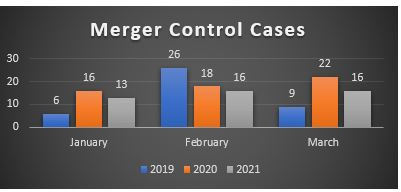

- The Authority published the annual M&A status report for 2020 in March, which includes statistics on the Board's merger control decisions. For further details please click here.

- The Authority also published the 2020 Annual Activity Report, which outlines (i) the basic policies of the Authority, (ii) statistics regarding the Board's activities and decisions in 2020, and (iii) an evaluation of institutional capability and capacity. You can find our summary here.

The Board gave Unilever a very Bitter Chocolate Ice-Cream

On 18 March, the Board concluded its investigation initiated against Unilever. In its decision, the Board ruled that Unilever had abused its dominant position in the ice-cream sector and imposed a total administrative monetary fine of approx. EUR 50 million(TRL 480 million) against the company.

In its decision, the Board indicated that Unilever had abused its dominant position and violated Article 6 of the Turkish Competition Law by creating de facto exclusivity by preventing the sale of competing products at final sales points and platforms through various practices.

It is estimated that the administrative monetary fine would be equal to approximately 6% of Unilever's overall annual turnover. Whether these high penalty rates are the new normal for the Authority is currently the subject of much discussion.

Merger control

The Board's "No-go" decision to the acquisition of Marport has been published

Following a Phase II review procedure, the Board has blocked the transaction concerning the acquisition of sole control over Marport Liman Isletmeleri by Terminal Investment Limited. The Board unanimously decided that as a result of the proposed transaction, effective competition in terms of port management services in relation to container handling in Turkey's north-western Marmara region would suffer a significant impediment.

This is only the fourth decision that the Competition Board has blocked in its history. Find our article on the decision here.

The Board initiated an in-depth Phase II investigation for the following transaction:

- The acquisition of sole control over Willis Towers Watson Public Limited Company by Aon plc.

The Board approved the following merger control filings in March at the Phase I stage:

The Board approved 16 merger control filings in March, the same number as in February 2020.

- Acquisition by CLA Süt ve Süt Ürünleri Gida Sanayi ve Ticaret A.S. of assets, including immovables defined machines and equipment, brands and other intellectual property rights, domain names, and social media accounts and stocks agreed by parties regarding factories producing milk and dairy products branded SEK belonging to Tat Gida Sanayi A.S.

- Acquisition of sole control of MTS Teknoloji Yatirimlari A.S. directly and Kartek Holding A.S. indirectly by International Fintech Solutions S.à.r.l., a subsidiary of Mediterra Capital Partners II, LP.

- Establishment of a joint venture between Ube Industries, Ltd. and Mitsubishi Materials Corporation to combine cement lines of business and other related lines of business.

- Acquisition of joint control of Watford Holdings Ltd. by funds and subsidiaries managed by Arch Capital Group Ltd., Kelso & Company L.P. and Warburg Pincus LLC and its affiliated funds.

- Acquisition by SMR Auomotive Mirrors Stuttgart GmbH of joint control of Plast Met Plastik Metal Sanayi Imalat ve Ticaret A.S. and Plast Met Kalip Sanayi Imalat ve Ticaret A.S. from Erol SENOL.

- Acquisition of sole control of Varian Medical Systems, Inc. by Siemens AG via Siemens Healthineers Holding I GmbH.

- Acquisition of joint control and shares of Chr. Hansen Natural Colors A/S, all shares of some of the subsidiaries of Chr. Hansen Holding A/S, and all of Chr. Hansen's assets related to the Natural Colorants line of business by EQT IX, controlled by EQT Fund Management S.à r.l.

- Acquisition of shares of Good Host Spaces Private Limited, jointly controlled by The Goldman Sachs Group, Inc. and Housing Development Finance Corporation Limited, by private equity funds managed by Warburg Pincus LLC from Housing Development Finance Corporation Limited.

- Acquisition of sole control of lines of business of development, production, restructuring and sales of polymethyl methacrylate and methyl methacrylate by Trinseo S.A.

- Acquisition of joint control of EPS Emobility S.r.l. controlled by ENGIE EPS Italia S.r.l by FCA Italy S.p.A.

- Acquisition of sole control of Elawan Energy, S.L. and its subsidiaries by ORIX Corporation Europe N.V.

- Acquisition of shares of AND Anadolu Gayrimenkul Yatirimlari A.S. by Quick Sigorta A.S. and Corpus Sigorta A.S.

- Acquisition of joint control of Whirlpool (China) Co., Ltd. by Guangdong Galanz Household Appliances Manufacturing Co., Ltd.

- Acquisition of sole control of defined lines of business of Walgreens Boots Alliance, Inc. including line of business of Pharmaceutical Wholesale in Turkey and other jurisdictions by AmerisourceBergen Corporation.

- Acquisition of sole control of subsidiaries of Kinesis Enerji Yatirimlari A.S. by Margün Enerji Üretim Sanayi ve Ticaret A.S., controlled by Naturel Yenilenebilir Enerji Ticaret A.S.

- Acquisition of sole control of Dogan ve Egmont Yayincilik ve Yapimcilik Ticaret A.S., jointly controlled by Dogan Sirketler Grubu Holding A.S. and Egmont International Holding A/S, by Dogan Sirketler Grubu Holding A.S.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.