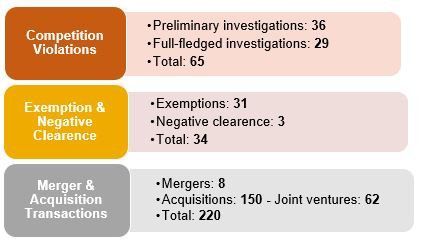

April 2021 – The Turkish Competition Authority has published its annual activity report for 2020. The Report provides an outline on the statistics of the Competition Board's decisions with regard to (i) competition violations, (ii) exemption and negative clearance applications, and (iii) merger & acquisition transactions as demonstrated below, as well as a sector-based distribution of the relevant decisions:

A. Breakdown of the decisions related to competition law violations

In 2020, the Board rendered a total of 65 decisions concerning competition violations, a decrease of approximately 6% compared to the previous year's figure, 69.

The majority of the decisions concerning competition law violations were related to Article 4 violations (agreements, concerted practices and decisions of undertaking associations) with 36 decisions, while 22 of the decisions were related to Article 6 violations (abuse of dominant position). The Board examined whether both of the relevant articles were violated in the remaining 7 decisions.

As a result of its 29 full-fledged investigations, the Board rejected the allegations in 10 decisions, imposed administrative monetary fines on undertakings in 16 decisions, and decided to terminate the investigation process based on commitments submitted by the undertakings in 3 decisions.

In 2020 the Board imposed administrative fines totalling approximately EUR 253,033,708. Of this amount, 93% of fines were imposed on undertakings active in the (i) chemistry and mining, (ii) information technologies, platform services and (iii) banking, capital markets, finance and insurance sectors.

B. Breakdown of the decisions concerning exemption & negative clearance applications

In 2020 the Board rendered a total of 34 exemption and negative clearance decisions, which is close to the previous year's figure, 35. The vast majority (31) of the relevant decisions were related to exemptions, while the Board granted negative clearance to 3 applications.

Concerning the exemption decisions, the Board granted unconditional individual exemption in 15 decisions, while it rejected exemption applications in 7 decisions and rendered 7 conditional exemption decisions. In one of the remaining two exemption decisions, the Board decided that block exemption would be applicable, while in the other decision it reviewed both block and individual exemption.

The top three sectors reviewed in the relevant decisions were (i) Banking, Capital Markets, Finance and Insurance Services, (ii) Health Care Services and (iii) Automotive and Vehicles.

C. Merger & Acquisition transactions

The Board reviewed a total of 220 M&A transactions in 2020, an increase of approximately 6% compared to the previous year's figure, 208.

In 2020, the Board decided to take 3 transactions to Phase II review while it resolved the other 217 decisions in its Phase I review. Furthermore, the Board rendered unconditional approval to 190 transactions, conditionally approved 1 transaction and rendered an "out-of-scope decision" to 28 transactions.

It is noteworthy that the Board blocked one transaction following a Phase II procedure in 2020. This was the fourth transaction that has ever been blocked by the Board.

The top three sectors reviewed by the Board in M&A transactions were: (i) chemistry and mining, (ii) automotive and vehicles, and (iii) the machinery industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.