- News about Sonoda & Kobayashi -

1. Sonoda & Kobayashi participated in INTA 2023

Earlier this month, Sonoda & Kobayashi participated in the 2023 edition of INTA in Singapore.

We would like to extend our thanks to all those colleagues present there. It was a pleasure to meet again with old friends and acquaintances as well as to have a chance to meet many new faces. We would be happy to meet again during our travels in the coming year.

- JPO and CNIPA News -

1. JPO released its 2023 Status Report

In March, 2023, the JPO released its 2023 Status Report. The report states that the JPO is proceeding with Green Transformation (GX) initiatives, as well as adapting to ever-increasing digitalization and globalization to realize a sustainable society. The JPO released the Green Transformation Technologies Inventory (GXTI) in June 2022, showing how to search for patent documents related to GX technologies.

Furthermore, throughout the year, the JPO held discussions on revising IP systems to encourage SMEs and startups, as well as large enterprises, to develop new businesses using IP. With regard to patents, the Patent System Subcommittee discussed measures for adapting to digitalization and improving user convenience, such as revising the delivery system and digitalizing written procedures.

The number of patent applications filed in Japan rose very slightly in 2022, from 289,200 applications in 2021 to 289,530 in 2022, led by an increase in international application filings (from 72,782 in 2021 to 75,892 in 2022).

Specific information on this topic can be found here.

2. JPO announces end of flexible measures for deadline relief based on circumstances impacted by covid-19

In our previous newsletter, we reported the JPO's decision to continue to provide flexible measures for deadline relief based on circumstances impacted by Covid-19.

However, on April 7th, 2023, the JPO announced that these flexible measures would be discontinued. Specifically, these procedures will no longer apply for deadlines on or after May 9th, 2023. Instead, the JPO will return to the operation of conventional relief measures.

Specific information on this topic can be found here. (Japanese)

3. CNIPA announces the furtherance of the "Blue Sky" IP agency rectification campaign

CNIPA issued a notice on April 10, 2023, announcing their intention to continue enacting the "Blue Sky" special rectification campaign to regulate and strengthen the intellectual property agency industry. The campaign has been implemented to curb illegal agency behavior in China, such as abnormal patent applications and malicious trademark applications. The notice outlines specific actions to be taken.

- Strict implementation of new regulations on trademark agency to combat violations: The Regulations on the Supervision and Administration of Trademark Agents will be enforced to standardize trademark agency behavior. Local authorities are instructed to increase supervision, provide training, and improve efficiency. Key targets for rectification include preemptive registration of hot-word trademarks, acting as agents for trademarks with adverse social impact, cross-border e-commerce business, and trademark agents involved in illegal activities. Record management and source governance will be strengthened.

- Continuing rectification of patent agencies to maintain industry order: Abnormal patent application agency behavior will be addressed by notifying regions and conducting investigations. Acting as a patent agent while unqualified will be cracked down on through data analysis, investigation, and punishment. Submission of false materials will be rectified, and institutions not meeting practice license conditions will be urged to make corrections. A comprehensive supervision system will be established, including credit evaluation management, social supervision, industry self-regulation, and promoting autonomy of institutions.

- Accelerating the establishment of a comprehensive supervision system: Collaborative credit supervision will be implemented, and credit evaluation results will be publicized. Social supervision will be strengthened through information disclosure and risk warnings. Industry self-regulation will be promoted by enhancing self-discipline norms, business training, and the role of industry organizations. Institutions will be encouraged to improve their level of autonomy through capacity building and standardized operations.

The State Intellectual Property Office emphasizes cross-regional collaborative supervision, encourages publishing of the rectification campaign's results, and requests detailed plans and annual summaries from localities. They aim to continuously improve supervision capabilities and share experiences and practices.

Specific information on this topic can be found here. (Chinese)

- Latest IP News in Japan -

1. Landmark case on territoriality of patent rights in Japan: Japanese video distribution company Dwango wins infringement suit against US' FC2

NHK, May 26th, 2023

On the 26th of May, NHK reported on the outcome of a patent infringement suit between Dwango, the operator of the video site "Nico Nico Douga," and FC2 Video based in the US.

Dwango holds a patent for displaying comments on videos while the video is playing, and it claimed that FC2 infringed on their patent.

In the trial of second instance, Japan's Intellectual Property High Court recognized the infringement of the patent and ordered the suspension of the comment function by FC2 and compensation of over 11 million yen to be paid to Dwango.

Earlier, in the first instance, the lawsuit had been dismissed on the grounds that FC2's servers are located in the United States, and thus it did not constitute an infringement of Japanese patents. Dwango appealed the decision.

The Intellectual Property High Court had already overturned this decision and recognized the infringement in July of 2022. However, the highlight of the new ruling this year was made by a panel of 5 judges.

Chief Judge of the panel, Mr. Ichiro Otaka, expressed the view that even if the server is located overseas, it is necessary to comprehensively consider the role played by the components of the system in Japan as well as places where they can effectively be used. Following this perspective, the judge concluded that if it is considered to have taken place within Japan, the Japanese patent law would extend to this case.

Based on the fact that "FC2's service requires user terminals in Japan," the court subsequently determined that the jurisdiction of Japanese law applies, and recognized the infringement of the patent. It ordered FC2 to suspend the use of the comment function in question and pay over 11 million yen in compensation.

Further adding to the exceptionality of this case, this trial employed a procedure to solicit, for the first time, opinions on the issues involved from parties other than the litigants. According to the Tokyo High Court, 52 opinions were received from companies and individuals, and 44 of them were used as evidence in the trial.

Further information can be found here.

2. Patents filed for storage battery technologies on the increase worldwide, Japanese companies in the lead

Nihon Keizai Shimbun, May 29th, 2023

On the 29th of May, the Nihon Keizai Shimbun reported on the patents in the field of storage batteries and the role of Japanese companies in this technological field.

According to the Japanese Patent Office (JPO), the number of patent applications filed worldwide in the field of storage batteries increased to over 8,000 in 2020. This is about 1.7 times more than in the year 2010.

Looking at the total number of patent applications by country from 2010 to 2020, Japan led the way with the highest number of patents at 26,000. The active research and development of Japanese companies in the electric vehicle sector is a driver of this growth.

The JPO collected data from various countries and areas including Japan, the United States, Europe, and China on granted patents. The number of patents originating from Japan in the field of storage batteries was around 2,300 in 2020, showing an increase of about 200 patents compared to ten years earlier. Particularly in recent years, the numbers have been rapidly increasing.

With the exception of 2014, Japanese companies have consistently obtained over 2,000 patents annually in the field of storage batteries. After Japan, it is South Korea, ranked second, and China, ranked third, which obtain the most patents each year.

Looking at the company-specific data for patent applications until 2021, South Korea's LG Group had the highest number with 5,355 filings, followed by Samsung Group with 4,976 filings. When looking at the top 20, 12 companies were from Japan, including Toyota Motor Corporation coming in at 3rd place.

Further information can be found here (Japanese) and here.

- Latest IP News in China -

1. Huawei leads patent filings in China despite recent decline

IAM Media, May 26th, 2023

On May 26th, IAM Media, in conjunction with data provided by IP Pilot, reported that Huawei has consistently been the top filer of patents in China over a span of five years, despite a decline in the number of applications in the past two years. Other companies that led the way in patent filings were state-owned utility company State Grid, home appliances maker Gree Electric, components provider BOE Technology, and Oppo.

According to data from April 2023, Huawei filed 8,440 applications in 2022, closely followed by State Grid Corp with 8,385 applications. Both companies have experienced a decline in patent applications over the last five years, with a significant drop-off in 2022.

Huawei's primary focus in terms of patent filings was the electronic communications industry, accounting for 56,637 applications between 2018 and 2022, which represents just over 54% of its total filings. State Grid's main area of activity was in electrical machinery, apparatus, and energy, with 24,375 patent applications, comprising 37% of its overall filings.

Further information can be found here.

2. BOE Technology files patent-infringement lawsuit against Samsung: escalating IP dispute among the 2 Apple suppliers

South China Morning Post, May 10th,2023

Chinese display panel manufacturer BOE Technology Group has filed a series of patent- infringement lawsuits against Samsung Electronics, intensifying the intellectual property dispute between the two major Apple suppliers. BOE and its subsidiaries have filed six lawsuits against Samsung and its five Chinese entities, as well as two lawsuits against JD.com subsidiary Chongqing Jingdong Jiapin Trading Co. The lawsuits, related to "dispute over infringement of patent rights of inventions", are expected to be heard by the Chongqing court in the coming months.

Founded in 1993, BOE started supplying displays for Apple ahead of the release of the iPhone 12 in 2020. In 2021, BOE produced 10 percent of all organic light-emitting diode displays for iPhones, shipping 16 million units to Apple, according to Chinese market intelligence firm Runto Technology. Samsung Electronics has also long been a display supplier to Apple, previously providing over 80 million OLED displays for the iPhone 14 in 2022.

Early last year, Samsung had suggested that Apple should not use BOE's display technology because it only made a "slight change" to Samsung's "Diamond Pixel" technology that places red, blue and green dots in the shape of diamonds to maximise visual clarity on display panels, according to a report by OFweek. Later in August, BOE unveiled its self-developed "Blue Diamond" pixel arrangement system that optimises display clarity.

In December, Samsung initiated a trade dispute by filing a complaint with the United States International Trade Commission against 17 smartphone repair shops in the country, claiming these shops sourced certain "illegal" display panels to fix Samsung's Galaxy smartphones and Apple's iPhones. Samsung claimed that those products violated its intellectual property rights, including its screen system.

The ITC - a quasi-judicial entity that investigates the impact of imports on US industries, and directs action against unfair trade practices - began investigating BOE in April despite Samsung's complaint not naming any specific screen supplier, according to a report by monthly magazine BusinessKorea.

The dispute between BOE and Samsung has large implications for their positions as Apple's screen suppliers, with BOE predicted to overtake Samsung by 2024.

Further information can be found here.

- IP Law Updates in Japan: Insights from Sonoda & Kobayashi -

1. Foreign filing trends in the 2023 JPO Status Report

With the arrival of spring each year, so too arrives the JPO's Annual Status Report at the very end of march. In the past we have reflected on trends in JPO filing over a 10 year period over here.

When it came to filing of patents, a long term trend was that while filings in general are decreasing in Japan, filings from international companies are rising.

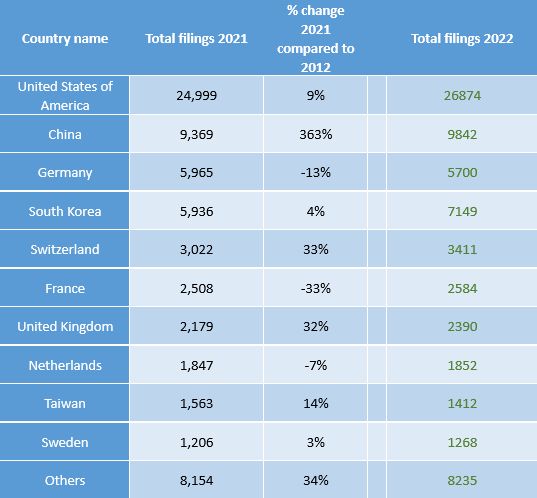

Furthermore, several country-level trends from 2012 to 2021 were:

- Chinese companies have dramatically increased their filing in Japan

- The United States has been, and is by far, the largest filer during this decade

- There is a split among European countries: those that file clearly less in Japan like France, Germany and the Netherlands, and those that have increased their activity like Switzerland, the UK and Sweden.

- Filing from countries other than these 10 has seen a significant increase too. With this in mind, the below sections will reflect on this year's status report, which incorporates the data of 2022.

General international filing trends

Knowing that from 2012 to 2021, international companies took an ever-increasing share of patent filing in Japan, what can be seen in 2022?

First, we see that PCT applications entering the Japanese national phase continue to rise. In 2022, a total of 75,892 PCT applications were filed, an increase of over 4% from the 72,782 applications the year before.

At the same time, we see that the number of other applications drops again: now standing at 213,638 which down from 216,418 in 2021.

In total, slightly more patents were filed in 2022 than in 2021, marking the second yearly increase since the all-time low of 2020, an increase which was due to larger number of international applications.

That said, PCT applications do not necessary come from foreign companies only and could be filed by Japanese companies too. For example, in 2022 28,264 PCT applications came from Japanese applicants.

Moreover, international companies also regularly file patent applications into Japan via the Paris-route. To get a better picture of the trends, we should consider the number of applications per country/region.

In the previous article on filing activity by international applicants, we found that from 2012 to 2021, the total number of applications increased by nearly 20%, reaching over 66,000 applications.

Looking at the number in this year's status report, we find that 70,717 applicants were filed by international companies1. This is nearly 6% higher than the 2021 figure and the highest number to date.

Country-level trends

Further, it is worth examining the country-level trends that took place this year.

The date on the left side of the table was show previously in November and is partially the basis of the 4 trends observed during the 10 year period.

On the right side, the new data from 2022 is shown.

It confirms the first two trends: the ongoing rise in applications from Chinese companies and the continued dominance of US companies among foreign applicants.

Regarding the 3rd trend, among European countries, we see that from 2021 to 2022 growth from Swiss (12.9%), UK (9.7%) and Swedish (5.1%) companies contrasts clearly with filing numbers from companies from France (3%), the Netherlands (0.3%) and Germany (-4.4%). The 4th trend continues modestly, with countries out of the top 10 increasing their total number of patent filings into Japan from 8145 in 2021 to 8235 in 2022.

Perhaps the most surprising discovery of this chart is the total filings from South Korea, which grew by a rather spectacular 20.4%. The country now surpasses Germany and is the 3rd largest foreign filer in Japan after the US and China.

Study of past data reveals that total filing activity by Korean companies in Japan has fluctuated rather strongly over the years, contracting year-by-year from 2013 to 2017, while seeing a strong uptick in 2018 and 2019, and even increasing their filing activity throughout 2020 and 2021.

The current increase is however the largest both in absolute numbers and percentage since at least 2012.

Table 1: filing in Japan per country2

In summary, this year's JPO Status Report reveals to us that the latest data regarding foreign filing in Japan align quite well with the long-term trends from 2012 to 2021. It shows us that international companies continue to file more and more in Japan, lead by the USA, China and, since this year, South-Korea.

Footnotes

1. JPO Status Report 2023, p.15, retrieved from https://www.jpo.go.jp/e/resources/report/statusreport/2023/document/index/all.pdf

2. Data was retrieved from the JPO's annual report 2013, and 2014 and the JPO's status report 2015 to 2023. Subsequently the data was aggregated and analysed by Sonoda&Kobayashi. The reports can be found here: https://www.jpo.go.jp/e/resources/report/index.html

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.