News about Sonoda & Kobayashi

1. Sonoda & Kobayashi to visit the US and

Europe

With 2023 now well under way, Sonoda & Kobayashi is

happy to announce several important overseas business trips in this

year. From the 30th of January, we will be California, U.S.A,

followed be a trip through several states afterwards.

Furthermore, from the 13th of March, we will be in Germany for a

number of days and will then continue our journey to other European

clients.

We are looking forward to meeting with our clients and interested

parties. If you would like to book a meeting with us at these

events, don't hesitate to reach out at info@patents.jp

JPO and CNIPA News

1. Data on Business-Related Inventions presented by

JPO

In November, 2022, the JPO provided an update on the status of

business-related inventions

The JPO considers business-related inventions to be inventions by

which business methods are realized using Information and

Communication Technology (ICT). Specifically for the purposes of

this report, the JPO considered inventions classified with IPC or

FI1 G06Q as "Business-related inventions".

Business-related inventions are patentable subject matter in

Japan.

The number of domestic patent applications for business-related

inventions has been increasing in recent years. This was attributed

in the report to an increase in R&D following the industrial

structure change from "products" to "services".

Another reason is that new services using ICT are being created in

new fields such as finance, due to developments in AI and IoT

technologies in addition to the spread of smartphones and SNS to

the public.

As for the number of applications, the downward trend after the

application boom in 2000 turned into an increase around 2012 and

has been rising ever since For example, 11,747 applications were

filed in 2020.

The grant rate of business-related inventions was initially

sluggish, but has been rising year by year, reaching 74% (which is

roughly equivalent to other technical fields) in 2017. Specific

information on this topic can be found here.

(English)

1. File Index. JPO's own technology classification symbols, developed from IPC.

2. JPO Conducting Survey on Key Technical Fields

In December 2022, the JPO announced that it is conducting a

survey focused on technical fields that are expected to create new

markets, as well as technical fields that should be promoted as a

matter of national policy.

In this survey, based on patent information, the JPO is

investigating areas in which Japanese industries are leading, as

well as areas where Japanese industry does not play a leading role.

Information from this survey is to be used in research and

development strategies.

In financial year 2023, the following technical areas are scheduled

to be investigated.

-passive ZEH and ZEB

-drones

-all-solid state batteries

-healthcare informatics

-quantum computer related technology

Specific information on this topic can be found here.

(Japanese)

3. China's Intellectual Property Progress in 2022:

Insights from State Council Press Conference

On January 16th, 2023, the Information Office of the State Council

of China held a press conference where CNIPA officials introduced

the work related to intellectual property conducted in 2022 and

answered questions from reporters. The following are four key

points discussed at the press conference:

1) Main data on patents and trademarks: 798,000 invention patents,

2,804,000 utility model patents, and 721,000 design patents were

granted throughout the year. Furthermore, 74,000 PCT international

patent applications were accepted by CNIPA, and 63,000 patent

reexamination and 7,900 invalidation cases were closed.

Additionally, 1,286 applications for international registration of

designs were submitted by Chinese applicants through the Hague

Agreement. In terms of trademarks, 6,177,000 million cases were

registered throughout the year, and 169,000 trademark oppositions

were reviewed. What is more, 412,000 trials of various trademark

reviews and adjudications were completed. Finally, 5,827

international registration applications from domestic applicants

were received through the Madrid System.

In 2022, the number of foreign intellectual property rights in

China has been steadily increasing. By the end of 2022, the number

of valid foreign invention patents in China had reached 861,000,

showing a 4.5% year-on-year increase, and involved 58,000 foreign

companies, which is an increase of 2,000 from the previous year.

Additionally, 2,030,000 million foreign trademarks were registered

in China, showing a 5.9% year-on-year increase

2) Examination cycle of patents and trademarks: The target of

reducing the time for examination cycle of patents and trademarks

was successfully reached in 2022. The examination cycle of

high-value invention patents was reduced to 13 months, ahead of

schedule by one year. The average examination cycle of invention

patents was reduced to 16.5 months, ahead of schedule by 3 months,

and the average examination cycle of trademark registration was

reduced to less than 4 months, ahead of schedule by 2 years.

3) Continuous improvement of examination policy: CNIPA officially

introduced the examination for obvious inventiveness to improve the

quality of authorization when it comes to utility model

applications.

4) New Management System of Patent Affairs: CNIPA officially

launched a new Management System of Patent Affairs on January 11th,

2023.

Specific information on this topic can be found here.

(Chinese)

Latest IP News in Japan

1. Japan and Europe leading in hydrogen

technologies

Nikkei Asia, January 10th, 2022

On the 10th of January, Nikkei Asia reported on innovation in

hydrogen technologies worldwide, and published particularly

interesting information regarding Japan and Europe.

Citing a recently released joint study by the European Patent

Office and the International Energy Agency, it reported trends in

the area of hydrogen technologies.

Notably, in the 10 years from 2011 to 2020, Japan was the country

with the most hydrogen patent families in the world, with 24% of

the total amount of patents filed in this period . European Union

countries combined to account for 28%, with Germany and France

filing 11% and 8% respectively. The trend regarding the United

States was also interesting, as while it has 20% of total patent

families filed, the patenting activity of US companies in this area

decreased strongly after 2015.

On the other hand, South Korea and China took off in this decade,

with average annual growth rates of 12% and 15%. Despite that, at

present they hold 7% and 4% of the hydrogen patents in this

period.

In terms of the actual companies holding the patents, Japan's

Toyota stood at the top of the list, while both Honda and Panasonic

were in the top 5.

However, Japanese research centres were not present on the list of

most filing companies at all, while for South Korea and France,

research institutions focusing on hydrogen were particularly

important.

Hydrogen technologies have many end-use applications, and the use

in the automotive sector is chief among them. The study reveals

that patenting in this sector continues to grow, mainly led by

Japan. However, such momentum does not seem to exist for other

end-use applications.

When it came to other aspects of hydrogen technologies, such as

production or storage, distribution and transmission EU countries

had the highest share of patenting activity, followed by Japan and

the US.

More information can be found here and here in the original PDF summary.

(English)

2. Japanese expert committee positive

about allowing trademarks based on personal names

Yomiuri Shimbun, December 24th, 2022

On the 24th of December, the Yomiuri Shimbun reported

that the Japan Patent Office's Expert Committee had released a

report recommending that trademarks that include a person's

name should be allowed to be registered. Up until now, registering

a person's name as a trademark was not allowed in principle,

but the idea is that, in the future, certain well-known names

should now be permitted to be registered as trademarks. The JPO

plans to submit a draft amendment to the Trademark Law to the Diet

session in 2023 at the earliest.

The report also emphasized that in order to prevent third parties

from registering trademarks for the purpose of harming or damaging

others, it is necessary to examine the relationship between the

applicant and the brand name, as well as the purpose of the

application.

Currently, in order to register a trademark that includes a

person's name, one needs to obtain consent from all individuals

with the same name in the country, as far as this can be confirmed

by a phone book or other such means. This system is in place is to

protect personal rights such as an individual's name and

likeness, but it has made registration virtually impossible.

Yet, if a trademark cannot be recognized, it will also be difficult

for a company to file a claim for injunction or damages against a

counterfeit product. The Japanese business community has pointed

out that, in this respect, the JPO has been too strict in its

application of the law, and that this has been a hindrance to

business.

The JPO's decision to study the issue was prompted by a court

ruling last year. In a trial in which Matsumotokiyoshi Holdings

(now MatsukiyoCocokara & Co.), a major drugstore chain, sought

to register a phrase from a commercial song as a sound trademark,

the Intellectual Property High Court ruled that the trademark

"Matsumotokiyoshi," which is also the founder's name,

was recognized.

More information can be found here.

(Japanese)

Latest IP News in China

1. Chinese enterprises of Huawei, BOE

and OPPO are listed in the list of the top 50 of US patents

authorization in 2022

ChinaIPER, January 10th, 2023

On January 10th, 2023, IFI Claims, a well-known patent service

agency, released a report on the number of patents granted in the

United States in 2022, and published a top 50 list. Samsung topped

the list, overtaking IBM, who had held the number one spot since

1993. The companies ranked from 3rd to 10th were TSMC, Huawei,

Canon, LG, Qualcomm, Intel, Apple and Toyota.

According to the data released by IFI Claims, Asian companies

generally performed very well. In 2022, the number of patents

granted to Asian companies was 14% higher than that of Western

companies (41055 vs. 35365), representing a significant increase

from the 1% difference in 2021. Japan, China, and South Korea alone

obtained 40,114 granted patents, while American companies were

granted 32,130.

In the top 50 list, the Chinese companies Huawei (4th), BOE (11th),

and OPPO (43rd) ranked very high. The report also noted that in

2022, American companies were granted 142,703 patents, accounting

for 44% of all patents granted in the country. Japan came in second

with 46,504 patents, China third with 24,538, and South Korea and

Germany followed in fourth and fifth place with 22,359 and 14,746

patents granted respectively. The data showed that China was the

only country to achieve double-digit growth in 2022 with a nearly

19% increase from 2021.

More information can be found here.

(Chinese)

2. Novartis vs Suzhou Thery, the first

instance judgment of the drug patent linkage dispute case of

'Nilotinib Capsule'

IPLEAD MED+, January 2023

On the 6th of January 2023, IPLEAD MED+

published an article on the case of Novartis vs Suzhou

Thery for the drug 'Nilotinib Capsule'. This has been a

highly-publicized case since the implementation of China's

patient linkage system, and it has now been judged in the first

instance by the Beijing Intellectual Property Court.

As a background to the case, Nilotinib Capsule is a popular drug by

Novartis used to treat chronic myeloid leukemia and reportedly had

annual sales in China of 900 million yuan (about 132 million USD).

The compound patent for the drug in China is set to expire in

2023.

Currently, two companies, Qilu Pharmaceutical and Suzhou Thery,

have submitted patent declarations for Nilotinib Capsule. Qilu

Pharmaceutical's patent declaration is relatively conservative,

stating that their patent does not fall under the scope of patent

protection for imitation drugs. Suzhou Thery, on the other hand, is

challenging the patent and aiming for the exclusive period of the

first generic drug. For the patents ZL200680026444.6 and

ZL201080051819.0, Suzhou Thery made a category 4.1 declaration,

meaning that the patent for the imitation drug should be declared

invalid, and it subsequently filed a request for invalidation of

these two patents. Currently, the patent for ZL200680026444.6 has

been declared invalid, while the patent for ZL201080051819.0 is

still valid. Suzhou Thery has filed an administrative lawsuit in

response. Novartis has also filed a lawsuit with the Beijing

Intellectual Property Court to determine if the applications for

the listing license of the generic drug 'Nilotinib

Capsule', with the specifications of 150mg and 200mg as applied

for by Suzhou Thery, fall under the scope of patent protection. On

November 10th, 2022, the Beijing Intellectual Property Court made

two rulings to reject Novartis' application on the grounds that

the plaintiff had no right to file a lawsuit in this case.

According to the latest reports from December 30th 2022,

Suzhou Thery's generic Nilotinib Capsule was officially

approved by China's State Drug Administration. This makes it

the first product to challenge a patent and gain official approval

since the implementation of China's drug-patent linkage

system.

More information can be found here.

(Chinese)

IP Law Updates in China: Insights from Sonoda & Kobayashi

International filing activity in China: a 5 year

overview

If there is one country that has seen incredible growth of

its intellectual property landscape and legislation, it is China.

The total number of filings of IP was already very significant 10

years ago, and it has since nearly tripled to more than 1.5 million

patents being filed in 2021. There are also millions of utility

models, trademarks and designs filed each year.

While China's status as a giant in IP is mainly due to the fast

pace of filing activities by Chinese companies, there appears to be

a growing stream of foreign filings into China.

This article will shed light on this trend, showing the origin of

this foreign IP and detailing the ups-and-downs of filing

numbers.

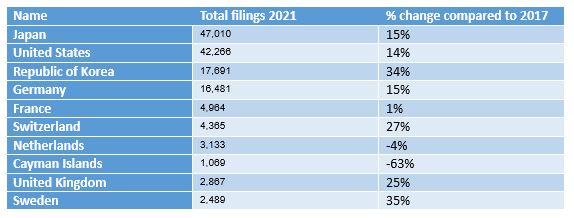

General country-level trends

Data from the annual reports from CNIPA allows us to create a

country-by-country breakdown of foreign filings, yet it does come

with some limitations. Before 2017, the data was reported without

distinguishing between patent filings, utility model filings and

design filings, resulting in one large, aggregated

number1. Taking this number as a starting point, the 10

year trend from 2012 to 2021 is one of about 42% growth in filing

of foreign of IP in China.

As of 2017, the reports allow us to study different types of IP

separately, and we can now start to look at just the trends for

patents. One thing that stands out immediately is that in the 5

years from 2017 to 2021, patent applications accounted for some

84%-86% of the IP (i.e.patents, utility models, designs) filed each

year, with the remaining 15% or so consisting of utility models and

design patents. Patents, then, are by far the most popular IP type

among foreign applicants. This contrasts starkly with domestic

Chinese filings where utility models outnumber patent in a roughly

2:1 ratio.

Growth of foreign patent filings in the 5 year period was some 16%,

with noticeable differences between countries. The table below

shows these differences and reveals the percentage by which filing

has changed from 2017 to 2021 in the top 10 biggest filers. The

numbers include both PCT and Paris route filings.

1. Data was retrieved from CNIPA's annual report 2016 to 2021. Subsequently the data was aggregated and analysed by Sonoda&Kobayashi. The reports can be found here: http://english.cnipa.gov.cn/col/col1587/index.html

While this table may not feature all details, it does show

several relevant trends:

1) The overwhelming majority of countries increased their filing

from 2017 to 2022, often marking double digit growth.

2) Japan is the number 1 filer (followed by the U.S.) and they have

been for over 5 years, leaving other countries' companies far

behind.

3) South Korea and Germany form the next group, far from Japan and

the U.S. but also still significantly ahead of number 5.

4) Cayman islands' filing dropped steeply than that of any

other country.

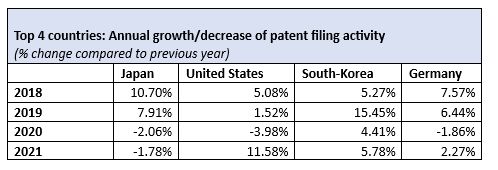

Detailed analysis of country-level

tendencies

By having a look at the data at the country level, we can shed

further light on the trends above.

For example, by examining the filing numbers of Japanese companies

over the 5-year period, we see that filing grew strongly in 2018

and 2019, by 10.7% and 7.9% respectively. However in 2020 and 2021

we see a decrease of around 2% each year.

For US companies, we see a 5.1% growth from 2017 to 2018, a small

growth of 1.5% in 2019 and a decrease of 4% annual filing in 2020.

Yet, in contrast to Japan, we see U.S. numbers go back up in 2021

with a strong 11.6% growth. So while, on the 5 years basis,

companies from both countries have filed more in China, it appears

that during the global COVID-19 pandemic, U.S. companies have

increased their filing activity quicker than Japan.

If we look at the second pair of South Korea and Germany, we find

that South Korea has taken the number 3 spot from Germany as of

2020. In 2020, Korean companies filed a total of 16725 applications

in China, while German companies filed 16115.

Growth of German filings in China was certainly observed, but there

was a slight decrease during the year of 2020, which was a year in

which Korean companies still filed more applications.

A further look into the numbers from Switzerland, the U.K. and

Sweden reveals strong double digit growth in 1 or 2 years, followed

by more modest growth. Without exception though, the yearly filed

applications decreased in 2020.

France and the Netherlands, then, are countries where filing did

not grow much over the 5 year period, or indeed even fell, as in

the case of the Netherlands. Interestingly, France's filing

actually grew by 1.3% in 2020 and is one of the few exceptions to

the general pattern observed.

However, what is clear is that filing from companies in these

countries already declined somewhat in 2018 or 2019, when companies

from most other countries are rapidly expanding their IP portfolio

in China.

Finally, there is the case of the Cayman islands, which filed 63%

less in 2021 than in 2017.

The inclusion of this country of the list of otherwise much larger

countries may already be a bit puzzling. It appears that these

applications are due to Chinese Tech Giant Alibaba having a holding

company in the Cayman islands. The fluctuations in the filing

numbers from this country are most likely due to changes within

this company.

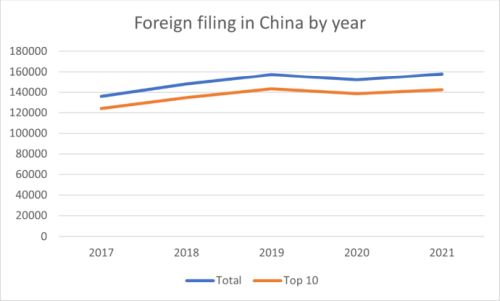

Over yearly growth patterns

Finally, it is worth looking at the overall filing data again, this

time focusing on the year-by-year changes. As mentioned earlier,

from 2017 to 2021, the total growth in foreign patent filing in

China was about 6%.

As can be seen from the graph below, the total year-on-year growth

for total foreign patent filings was reasonably high: About 9.1%

from 2017 to 2018, 6% from 2018 to 2019, -3% from 2019 to 2020 and

3.6% from 2020 to 2021.

Similar to what happened to many individual countries, the outbreak

of the COVID-19 pandemic in 2020 reduced filings in China somewhat,

though they have modestly recovered in 2021.

Figure 1: Filing in China by foreign organisations

Data retrieved from CNIPA reports and analyzed internally:

http://english.cnipa.gov.cn/col/col1587/index.html

What is notable from the graph above is how dominant the top 10

largest filing countries are in the overall picture. A little over

90% of all foreign patent filing is done by companies from one of

the 10 countries above, making them largely responsible for foreign

patent filing in China.

Overall, it is clear that China, as a destination for foreign IP,

has gathered a lot of momentum over the years, and according to the

present data shows little signs of slowing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.